- Solana was down by more than 5% in the last 24 hours alone.

- A few of the metrics and indicators hinted at a trend reversal.

As a seasoned crypto investor with years of experience under my belt, I’m keeping a close eye on Solana (SOL) as it approaches a critical support level. The recent decline in SOL’s price, which saw it lose more than 5% over the last 24 hours alone, has left many investors feeling uneasy.

In simple terms, the market situation led most cryptocurrencies, including Solana (SOL), to experience price drops. This downward trend forced SOL’s price to reach a significant low point, potentially shaping its future direction.

Solana approaches support

In the past 24 hours, the bears have had complete control, as evidenced by a drop of over 5% for Solana (SOL) based on data from CoinMarketCap.

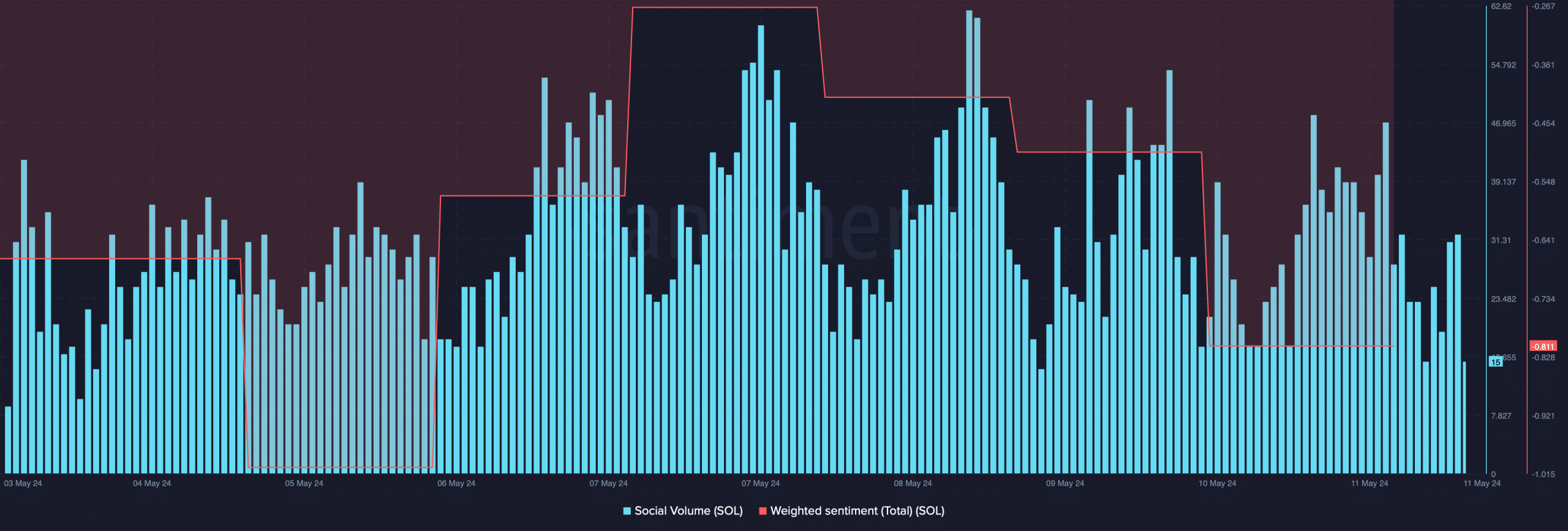

Currently, the value of SOL is being exchanged for $144.80 in markets, and its total market worth exceeds $64 billion, ranking it as the fifth largest cryptocurrency. However, the downward trend in prices has negatively influenced the token’s Weighted Sentiment score.

In the cryptocurrency market, there was a prevailing pessimistic outlook towards Solana (SOL). The Social Volume associated with SOL took a nosedive, implying that its popularity among traders and investors had waned.

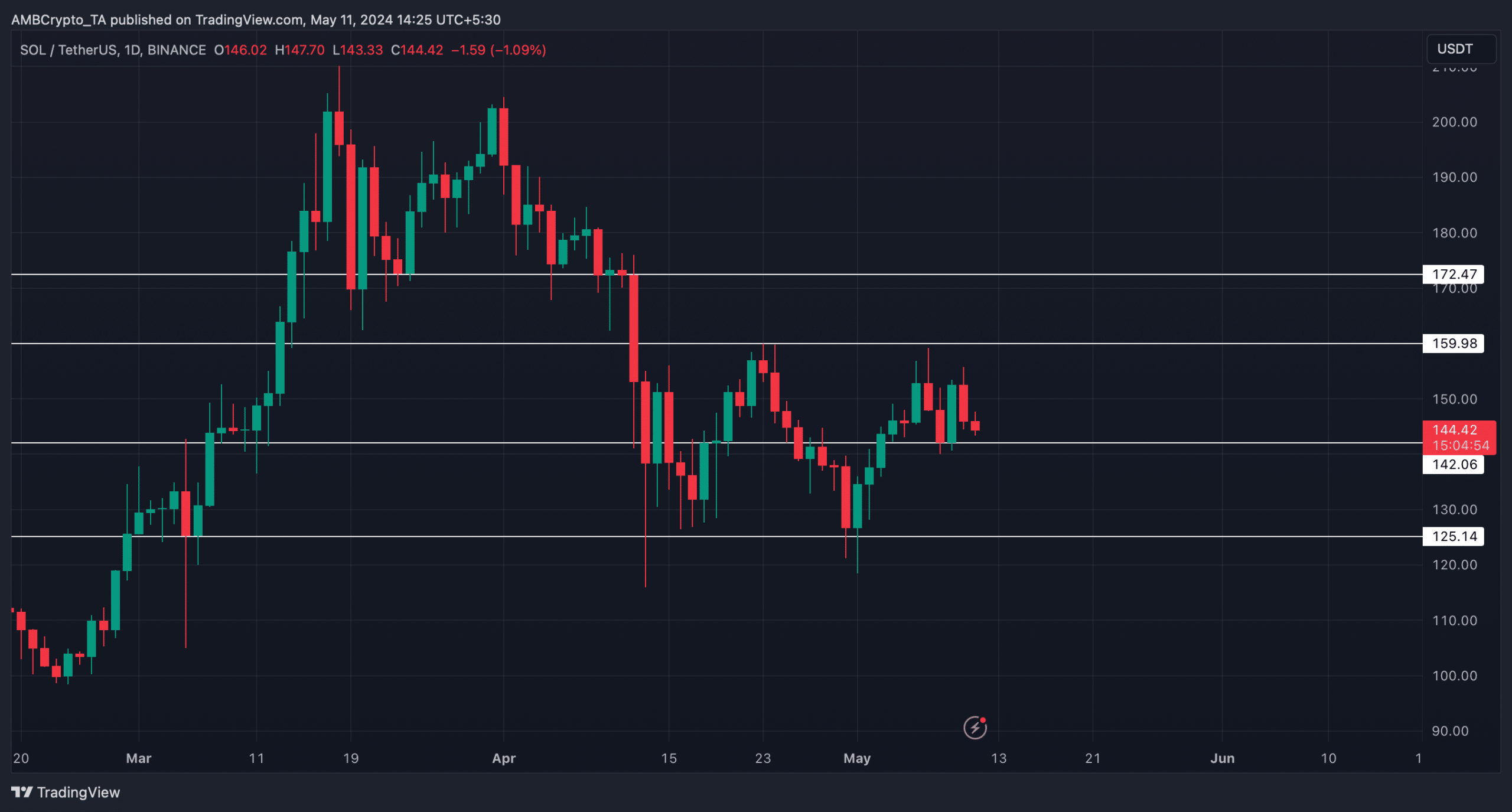

As a researcher studying the price action of Solana (SOL) based on AMBCrypto’s analysis, I’ve identified a significant support level at around $142. Should SOL encounter a test at this price point, investors could potentially witness a bounce-back in its value.

But a drop under that could be disastrous.

Which way is Solana headed?

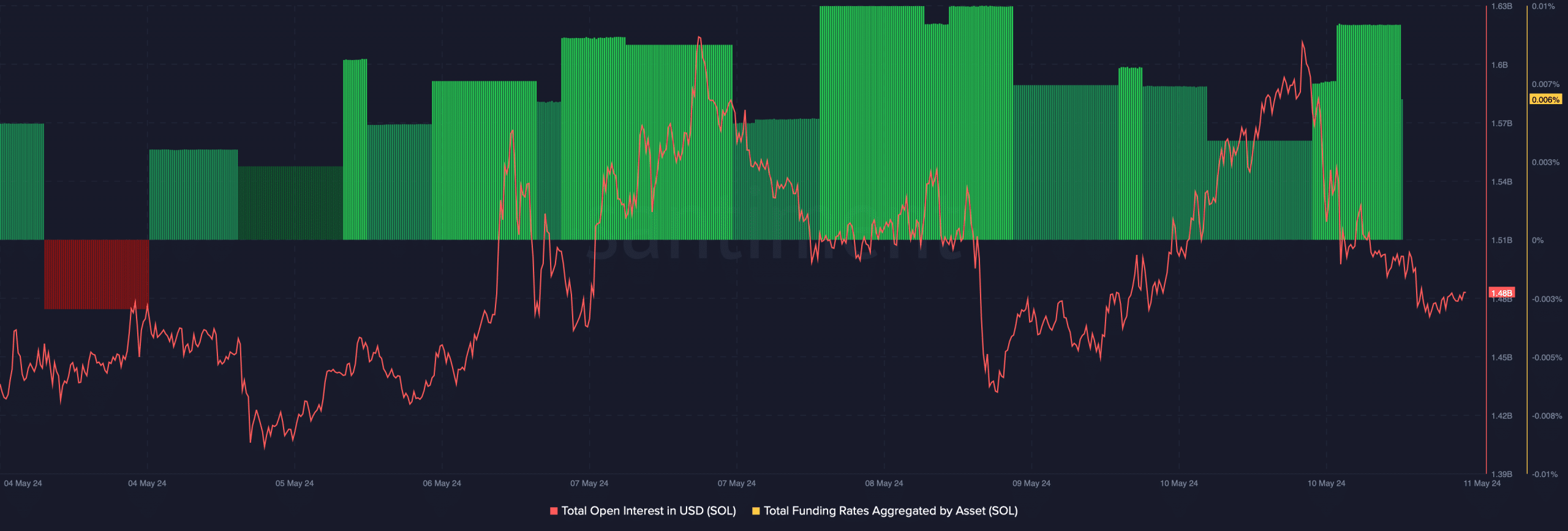

To gain insight into the short-term prospects of Solana (SOL), as reported by AMBCrypto, we examined the data provided by Santiment. The findings revealed a correlation between the decrease in SOL’s Open Interest and its falling price.

As an analyst, I would interpret a sinking metric as a sign that the probability of the current price trend persisting is diminishing, potentially suggesting an impending trend reversal.

The high Funding Rate for SOL at Hubspot was cause for concern, as it suggested strong selling pressure for the token. Furthermore, Solana’s Long-Short Ratio took a downturn, implying that bears held an edge in the market.

If these metrics are to be believed, then SOL’s price might plummet under the $142 support.

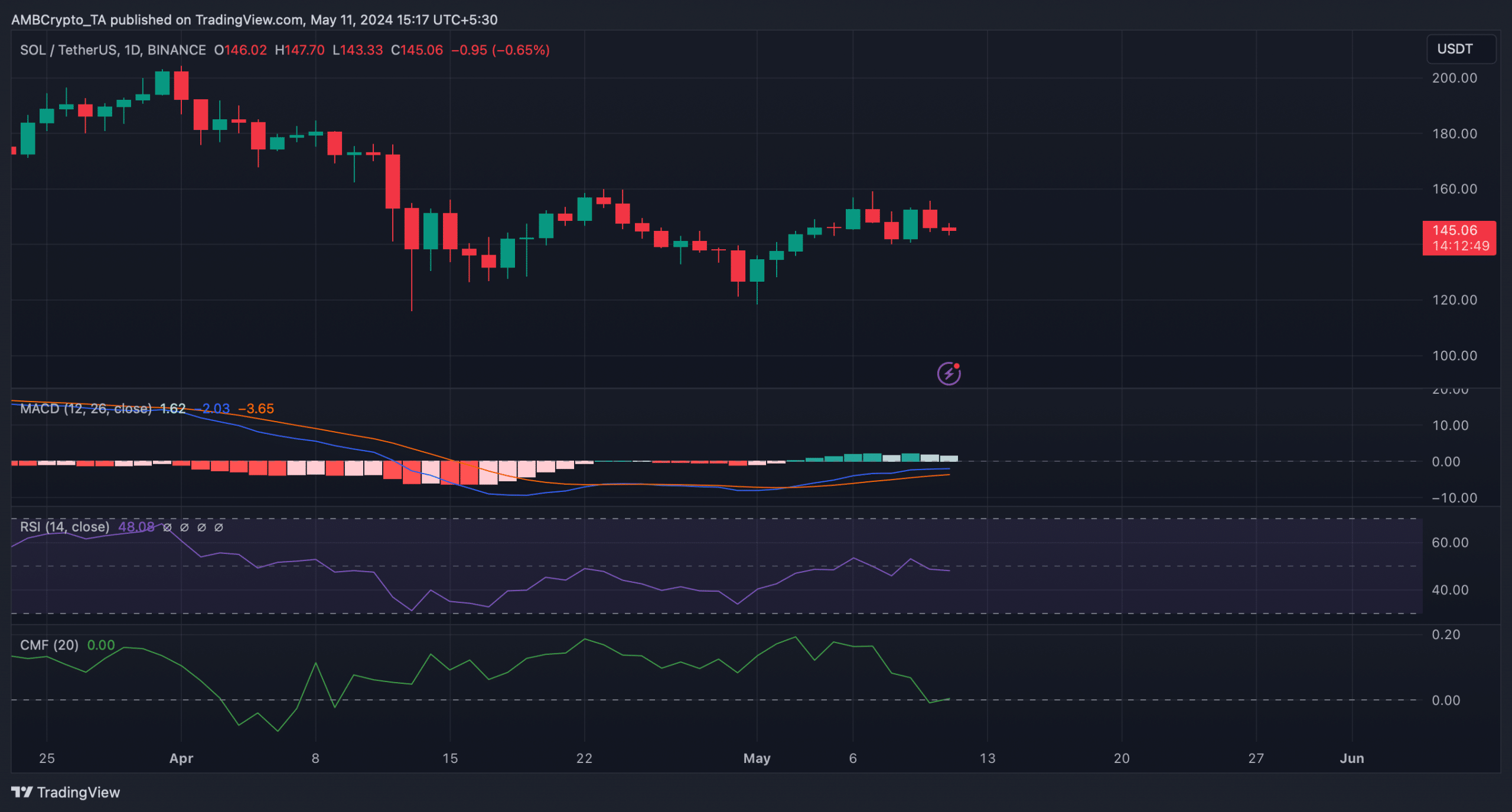

The RSI continued to indicate bearish conditions, with a decrease in its value. However, some other indicators offered encouraging signs.

In simple terms, the MACD indicator signaled a bullish trend in the market for Solana, while its Chaikin Money Flow (CMF) subsequently showed a surge, implying a potential price rise after a significant drop.

Should SOL successfully test its support around $142 on the price chart, there’s a possibility that the cryptocurrency could make another attempt at reaching its resistance level hovering around $160.

Realistic or not, here’s SOL’s market cap in BTC’s terms

As a researcher, I’ve come across an intriguing piece of information from AMBCrypto. They mentioned previously that the token in question had nearly reached a significant threshold on two occasions last week, only to encounter setbacks and fail to break through.

In the event that SOL does not pass the test of its current support, there’s a possibility that its price may drop significantly, potentially reaching the range of $120-$125 within a short time frame.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-12 11:03