- SOL’s Futures Open Interest has dropped to its lowest level in two months.

Key technical indicators suggest that the coin’s price decline may continue.

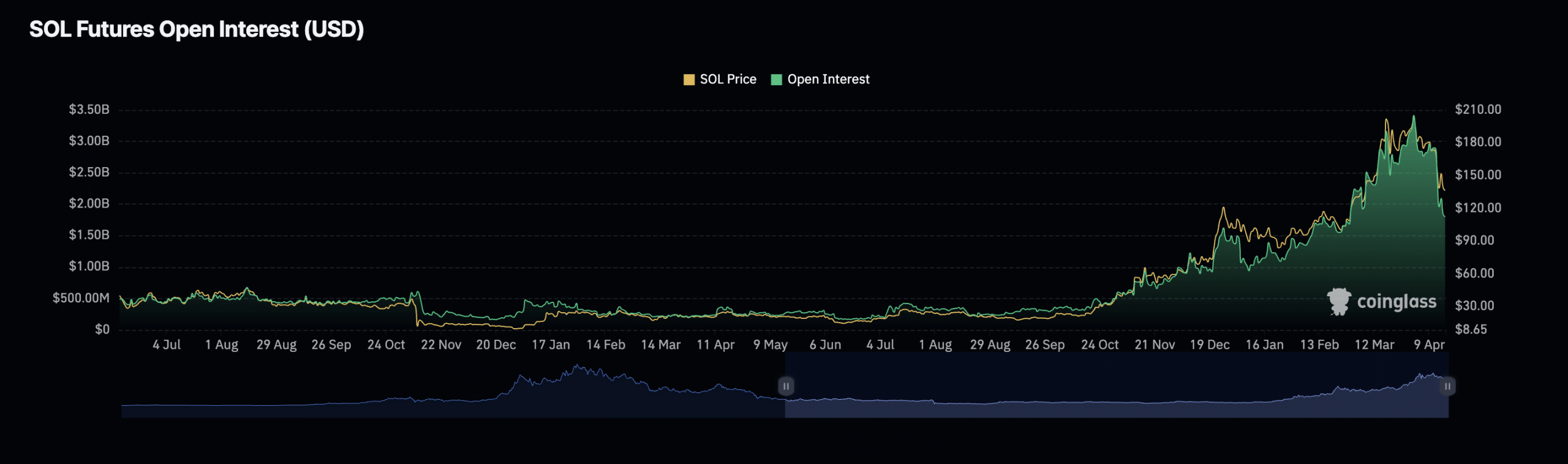

The open interest for Solana’s [SOL] futures contracts has dropped to its lowest point in the past two months, as reported by Coinglass, due to the overall market decline.

The term “Futures Open Interest” denotes the current count of unfilled or unsettled contracts for a particular coin’s futures market.

When it decreases, this indicates that traders are liquidating their holdings without making any new purchases.

According to Coinglass data, the open interest for SOL‘s futures contracts reached a peak of $3.41 billion this year, only to drop significantly. Currently, it stands at approximately $1.8 billion, representing a decrease of around 47% from its highest point.

Long traders have it rough

Currently, one SOL coin is being traded for around $140.44 in the markets. However, its value has dropped by approximately 19% over the past week based on data from CoinMarketCap.

The recent decrease in price for this cryptocurrency is similar to the downward trend experienced by the larger crypto market over the last few weeks.

Based on the data from CoinGecko, the total value of all cryptocurrencies has decreased by 8% over the last two weeks.

Because the cost of SOL has gone down significantly, there’s been a large increase in the number of long positions being closed out forcibly in the futures market.

In simple terms, liquidation occurs in the derivatives market when a trader’s position is forcibly terminated because they don’t have enough money to keep up with the required funds.

When the value of an asset unexpectedly plummets, long-held positions must be sold by traders hoping for a price increase, resulting in prolonged selling processes.

Based on CoinGecko data from April 12th, SOL experienced a peak in long liquidations amounting to $41.49 million, representing its highest yield-to-date in 2023.

Possibility of a rebound in the short term?

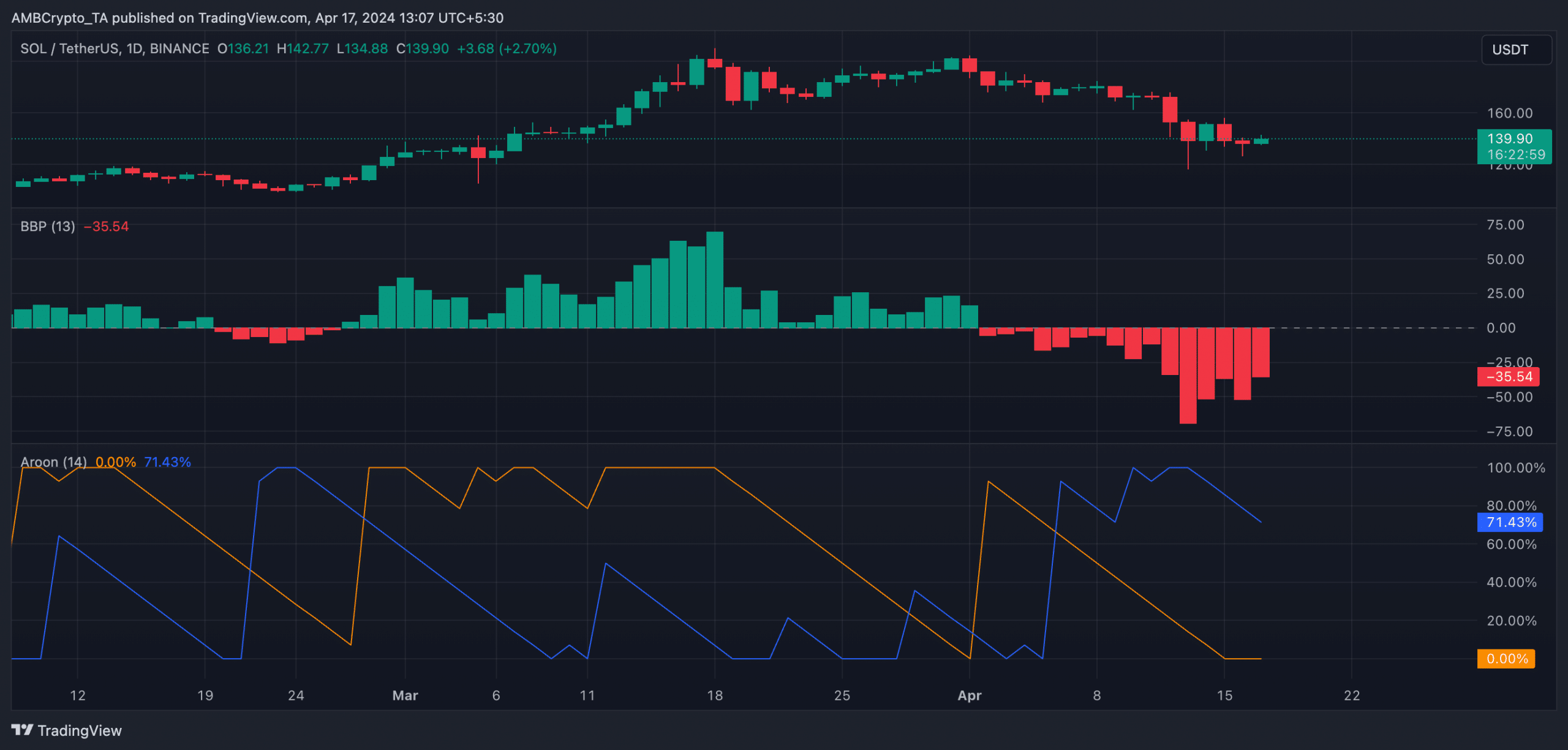

Based on my analysis of SOL‘s essential tech indicators, displayed on a daily graph, there seemed to be a likelihood of its price dropping even more.

At present, the Elder-Ray Index shows a negative value, signifying that the buying power is currently weaker than the selling power in the market.

When its value is negative, it means that bear power is dominant in the market.

Currently, SOL‘s Elder-Ray Index stands at -35.17 upon press. Throughout this month, it has yielded only negative returns.

In a similar fashion, the Aroon Down Line, represented by the blue line, amounted to 71.43%, whereas the Aroon Up Line, signified by the orange line, was observed at the zero mark.

An asset’s Aroon indicator measures its trend strength and potential reversal points.

Read Solana’s [SOL] Price Prediction 2024-25

When the Down Line nears 100, this signifies a powerful downward trend, meaning the latest low point was attained not too long ago.

In other words, when the Up Line is nearly at zero, the uptrend is not strong, and the latest peak was achieved quite some time ago.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- THETA PREDICTION. THETA cryptocurrency

- Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

2024-04-18 02:15