-

Network activity could be the key to SOL’s short-term price action

Positive demand dynamics may shield it from more downside

As a seasoned researcher with extensive experience in analyzing cryptocurrencies and blockchain technology, I have closely followed Solana’s (SOL) progress throughout 2024. The network’s robust ecosystem growth, particularly in memecoin and DeFi sectors, has caught my attention due to its positive implications for SOL’s short-term price action.

As a crypto investor, I’ve observed an impressive expansion of Solana’s ecosystem this year, primarily fueled by the surge in memecoin and DeFi projects. This growth is evident in the network’s expanding stablecoin market capitalization and total value locked (TVL) in various DeFi protocols. While these observations don’t guarantee future price movements for SOL, they do suggest that the underlying infrastructure of Solana is gaining traction and attracting more users and projects. As a result, it’s reasonable to expect continued growth and potential price appreciation for SOL as the ecosystem develops further.

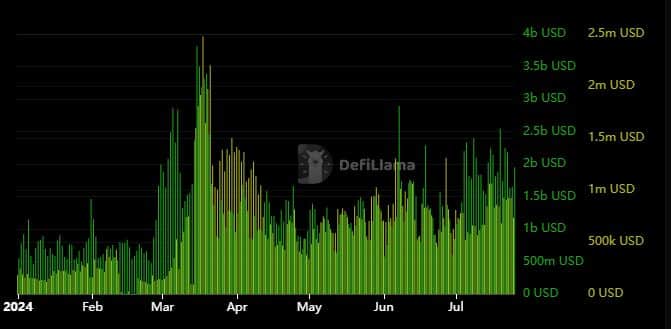

Based on DeFiLlama’s data, Solana’s total value locked (TVL) and stablecoin market capitalization have experienced significant growth in the first part of this year. To put things into context, the TVL reached its minimum of $1.396 billion around early 2024, while the stablecoin market capitalization had a low point of $1.83 billion during the same period.

Based on our recent evaluation, the market capitalization of Solana’s stablecoins amounted to $3.22 billion, whereas its total value locked (TVL) stood at $5.29 billion. This implies that these metrics have reached the midpoint between their all-time highs. However, there’s more to it than just that.

The market capitalization of Solana’s stablecoin experienced a recent surge, reaching an peak of $$.4 billion on July 12. Concurrently, the total value locked (TVL) in the system continued to increase, even amidst a broader downturn. This trend suggests that liquidity might have been shifting from stablecoins towards DeFi platforms.

Why rising TVL could signal more demand for SOL

As a crypto investor observing the market trends, I’ve noticed an intriguing development: Total Value Locked (TVL) in Solana’s DeFi ecosystem has continued to grow despite a decline in stablecoin marketcap. This could imply that holders are increasingly confident in shifting their funds towards Solana’s DeFi offerings.

Has Solana (SOL) been showing signs of another strong price surge recently? SOL experienced a brief dip into overbought territory a few days ago, but our analysis indicates that the bulls are likely to remain in control. Following a correction period, SOL has bounced back and nearly reached its current year-to-date high.

An important second discovery was made: the price surpassed a previous resistance line not long ago. This could indicate growing optimism among buyers, potentially leading to further upward momentum.

Strong demand for SOL from its DeFi ecosystem could support the probability of a bullish breakout.

As an analyst, I’ve noticed a decrease in both on-chain volume and revenue for Solana between March and April. But, the data from May up until now indicates that these metrics have been rebounding.

The data on volume and revenue reinforces the earlier indications of increasing network engagement.

Read More

2024-07-27 10:42