- Solana demonstrates solid recovery as the market finds the bottom of the latest crash.

- Robust on-chain activity makes a comeback, painting a clear picture of market confidence.

After closely observing the crypto market and Solana’s (SOL) performance over the past few months, I have to say that I am quite optimistic about its future prospects. As a seasoned analyst who has witnessed numerous crypto bull runs and bear markets, I can confidently say that SOL’s resilience during this latest crash is impressive.

Among the leading cryptocurrencies by market capitalization, Solana’s SOL can be seen as a prolific contributor, perhaps symbolizing a golden goose. This asset has experienced an impressive surge in value since October of the previous year, catching the attention of numerous investors and traders alike.

Consequently, each dip that came along since then was followed up by a rapid recovery.

Is it possible for Solana (SOL) to maintain its current standing following the recent downturn? This might hinge on a single factor: focus. Solana exhibited a surge reminiscent of past market upswings, which suggests that attention may be crucial in determining its future performance.

A significant factor behind SOL‘s achievements stemmed from its ability to dominate the meme coin conversation on the Solana blockchain. This positive momentum, which has favored the network in 2021, has boosted interest and demand for SOL tokens.

As a researcher, I’ve been closely observing the current market scenario, and it appears that the recent market crash could potentially alter the demand patterns. This potential change might necessitate a more prudent stance, thereby possibly leading to a transition away from the emphasis on memecoins.

Should you sell your SOL?

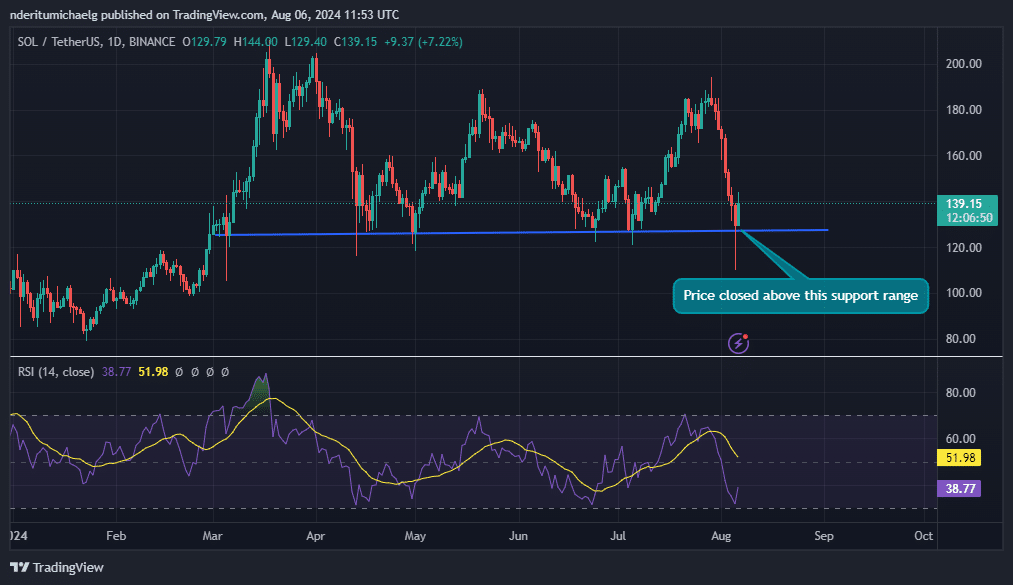

Despite the decline in popularity for many meme coins, Solana’s price movements might be telling a different story. In fact, this cryptocurrency dropped by up to 42% from its July lows, reaching the lower end of the current panic-induced pullback range.

However, it also bounced back just as sharply as it fell.

On the 5th of August, the dip drove Solana’s price down to approximately $110. However, at the moment of reporting, it was trading at $139.87, thanks to a 26% price increase.

It is also worth noting that despite the sell pressure, price still closed above a key support level at the $126 price range. A bold statement that signals what the market currently perceives as SOL’s bottom range.

The state of investor confidence in Solana

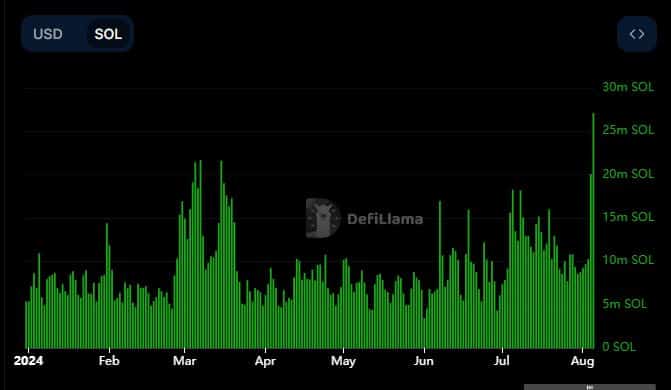

On August 5th, our recent evaluation of the Solana system revealed a significant surge in its daily on-chain transaction volume, marking a new high.

On the very same day, it dipped to its lowest point in the lower range before rebounding. The trading volume reached an all-time high of $27.11 for Solana (SOL), which was only surpassed by two other daily volumes recorded over the past two years.

Although a portion of the volume could suggest demand for SOL, it might also be connected to network activity related to the demand for other assets within the system.

A lower SOL value offers an opportunity to acquire other assets using SOL at reduced prices, as suggested by recent updates from the Solana network.

As someone who has closely followed the crypto market for several years now, I can confidently say that this latest announcement is a significant step towards revitalizing demand within the Solana ecosystem. Based on my observations, I believe that this move could reignite strong demand driven by the ecosystem itself, much like what we saw earlier that played a crucial role in SOL‘s impressive recoveries. In fact, I remember vividly how such ecosystem-driven surges have consistently propelled the growth of various blockchain projects, ultimately leading to their success. This time around, I am optimistic that Solana will follow suit and continue to thrive in the rapidly evolving crypto landscape.

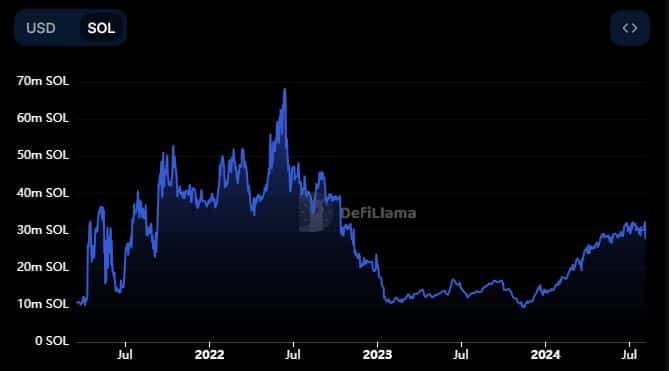

Furthermore, even during confidence-related situations, Solana’s Total Value Locked (TVL) appears to be relatively resilient. However, there was a decrease of approximately 4.76 million SOL in its TVL on the 5th of August.

Approximately equivalent to about $614.7 million – a noticeable, but still relatively modest decrease compared to the multi-billion dollar outflows from Ethereum‘s TVL (Total Value Locked) that we’ve seen recently.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Based on these accumulated pieces of information, it seems clear that the Solana system has proven resilient during challenging times. Investor confidence remains strong for now, suggesting that SOL could potentially regain its allure among investors once more.

Nevertheless, it could still be prone to a possible support break if more sell pressure emerges.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-08-07 10:18