- Solana could decline by 12% to reach the $200 level if it breaches the neckline at the $230 level.

- SOL’s Spot Inflow/Outflow data indicated that whales are dumping their holdings from wallets to exchanges.

As a seasoned researcher with years of experience in cryptocurrency markets, I find myself cautiously bearish on Solana (SOL) at present. The technical indicators and on-chain data paint a grim picture for the fourth-largest crypto asset.

Looking ahead, it’s anticipated that the value of Solana (SOL), currently ranking as the world’s fourth-largest cryptocurrency, may experience a decrease in its price over the next few days.

Over the past period, Solana (SOL) has been shaping a bearish chart configuration on shorter time scales, indicating it might soon experience a price drop.

Solana’s bearish price patterns

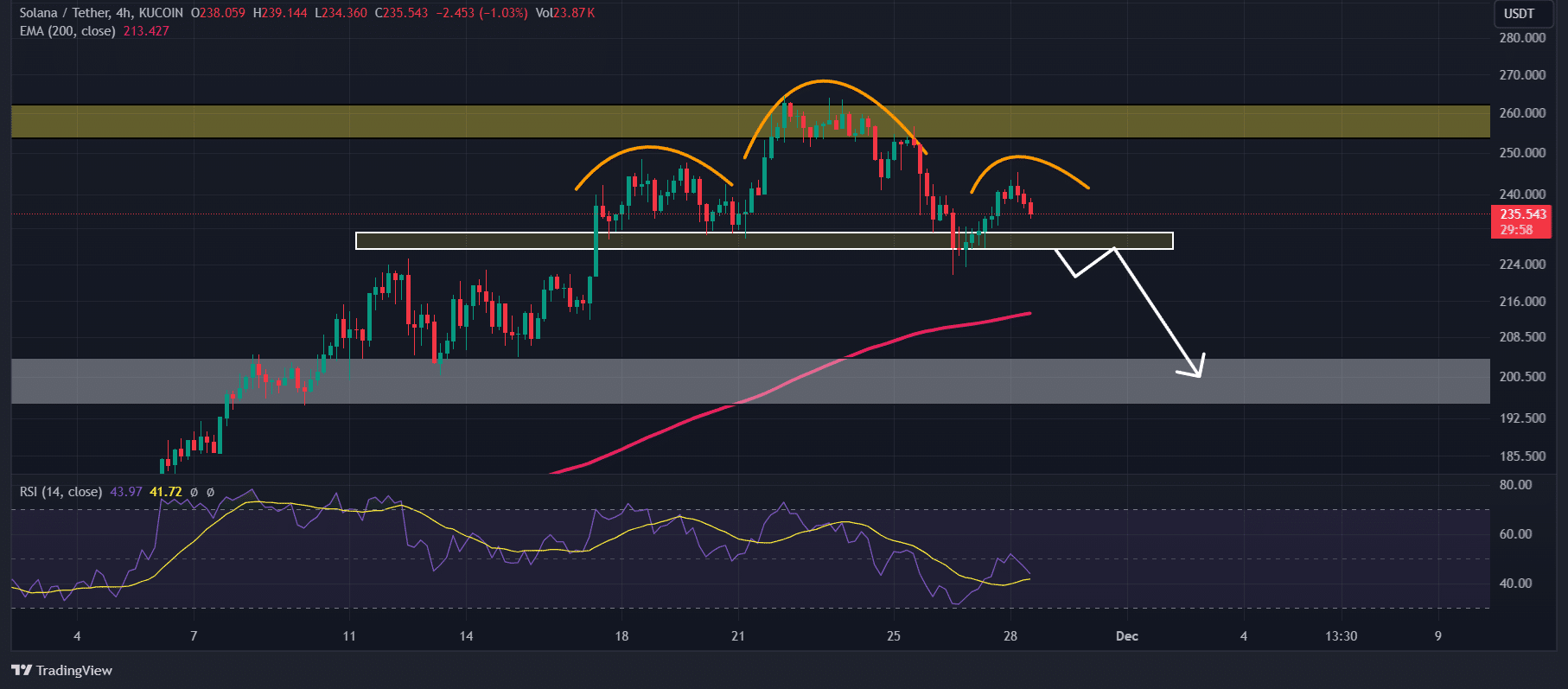

Based on AMBCrypto’s technical assessment, Solana (SOL) seems to be developing a potentially bearish ‘head-and-shoulders’ formation over a four-hour time period. This pattern isn’t yet fully shaped, as we have one head and one shoulder formed so far, with the second shoulder still in progress.

Based on the involvement of traders and investors, as well as the current market setup, it seems quite likely that this pattern may be fully developed within the next few hours.

Key technical levels to watch

Should SOL follow through with its current bearish structure and drop below the $230 neckline, we might witness a potential 12% decrease, bringing the price down to approximately $200 within the next few days.

Looking on the optimistic front, SOL’s Relative Strength Index (RSI) hinted at a possible upward surge. At present, SOL’s RSI is around 45, which is close to the oversold zone, implying that there’s still potential for SOL to increase further.

Bearish on-chain metrics

Beyond the regular technical assessment, on-chain indicators also reinforce this pessimistic perspective. As per the data from Coinglass, a leading on-chain analytics company, it seems that enthusiasm among traders and investors for SOL may be dwindling.

According to Coinglass, Solana’s Open Interest decreased by 5.4% over the last day, suggesting either that existing positions were closed or that traders are being cautious about establishing new ones.

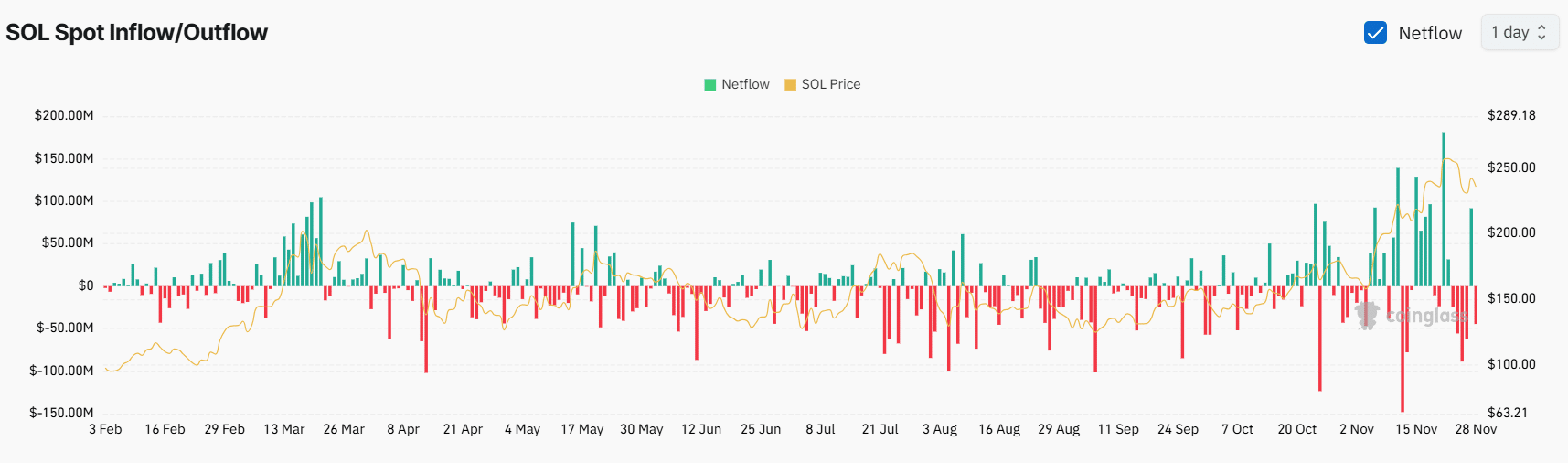

Apart from the minimal engagement by traders, Solana’s Spot Inflow/Outflow data shows a relatively higher influx into exchanges. This implies that large holders or investors might be transferring their assets from wallets to exchanges, which often results in increased selling pressure and potentially causes a drop in price.

Read Solana’s [SOL] Price Prediction 2024–2025

Currently, Solana (SOL) is being exchanged around $235 and has maintained its position, showing a small decrease of 0.10% over the past day.

Over that specific timeframe, there was a decrease in trading activity by 17%, suggesting less involvement from both traders and investors, potentially due to a pessimistic market forecast.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-28 16:39