- Solana’s transaction count has increased recently, but market activity suggested that sellers dominated.

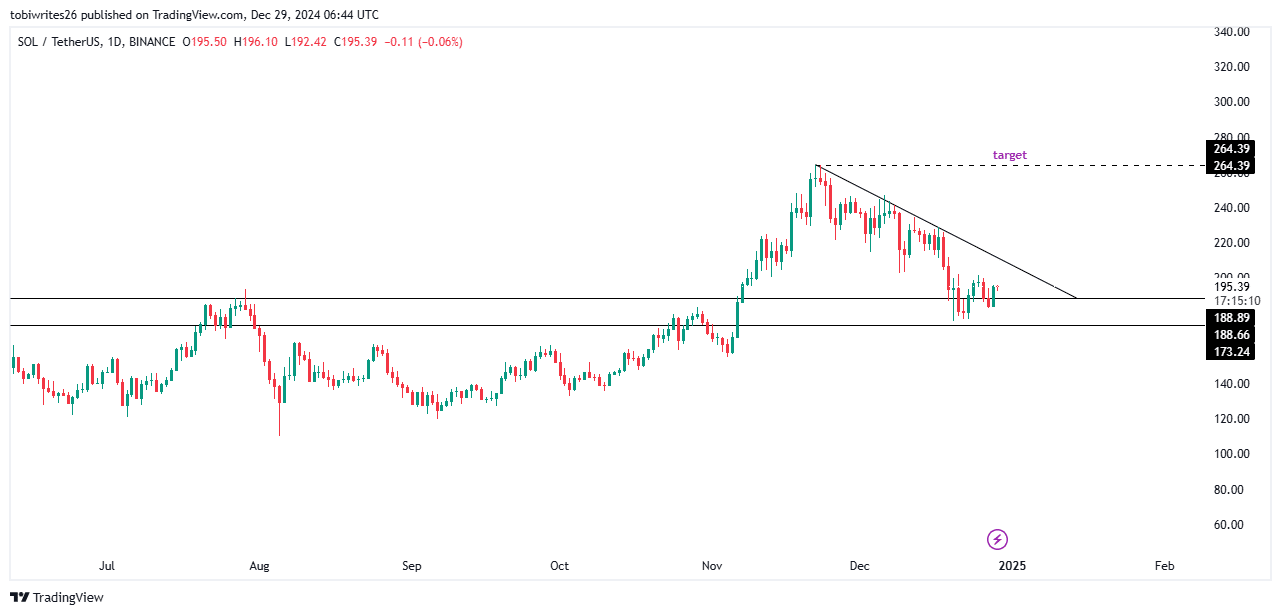

- On the chart, SOL remained within a bullish pattern that could propel it back to its previous all-time high.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by Solana’s recent performance. While the transaction count has surged, it seems that sellers have been dominating the scene, as evidenced by the negative Exchange Netflow and the fragile price surge.

However, I am not too concerned about the current selling pressure. After all, even a rising tide lifts all boats – and in this case, it just might be that the bullish sentiment is yet to fully materialize. The asset’s position within a bullish triangle structure on the chart gives me reason to believe that Solana could rebound back to its previous all-time high if the support level holds strong.

That being said, I would advise caution to those considering investing in SOL at this time. As the saying goes, “Buy low, sell high” – and right now, we are not exactly at the lowest point yet. But who knows? With a bit of luck (and maybe some market magic), Solana might just surprise us all.

On a lighter note, remember: investing in cryptocurrencies is like trying to predict the weather – you can never be completely certain! So always do your research and stay informed, but don’t forget to have fun along the way!

Over the past month, I’ve observed a 18.18% dip in Solana’s [SOL] value following its record-breaking high in December. This recent downturn is a deviation from its previous upward trajectory.

On the other hand, it seems that the story is evolving since the asset experienced a growth of 7.09% over the past week and an increase of 5.42% within the last day.

Even though there seems to be a strong upward trend, doubts linger due to uncertainties. While the general outlook remains optimistic, the recent surge in sell-offs casts a shadow on the longevity of this trajectory.

Transaction counts surge, but sellers dominate

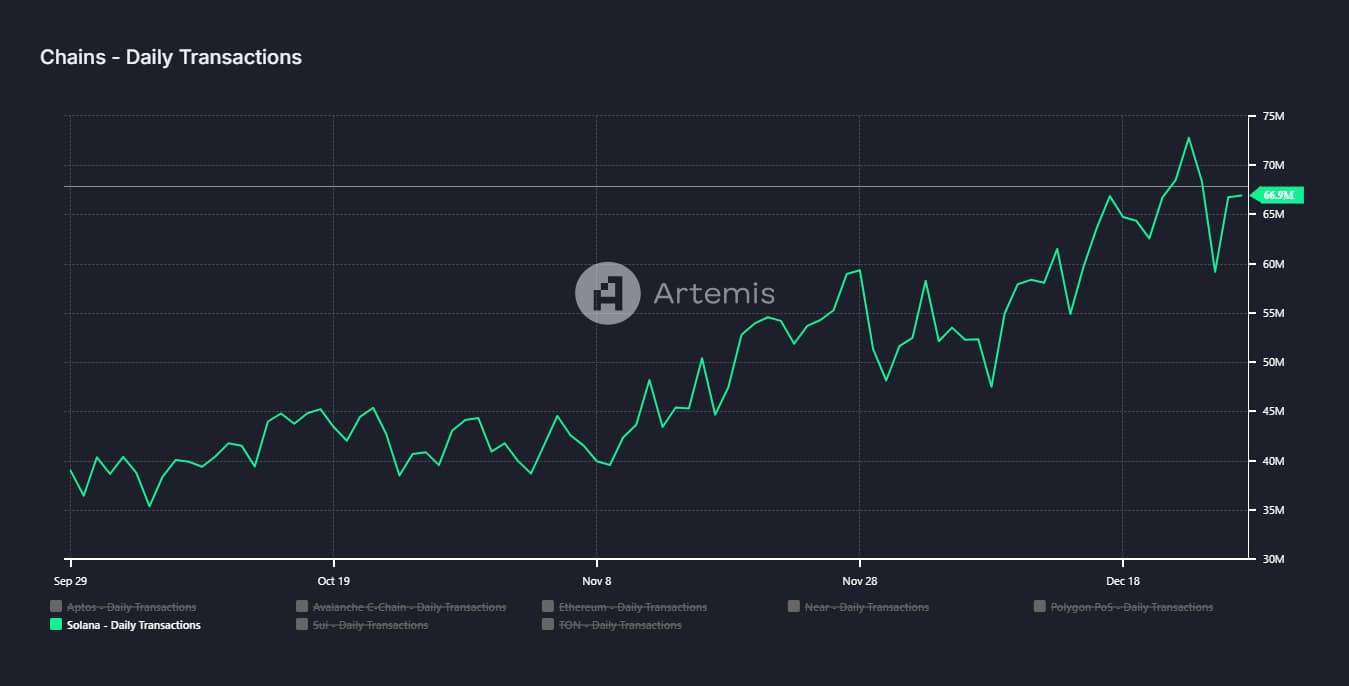

As a seasoned crypto investor with years of experience in this dynamic market, I’ve witnessed numerous ups and downs. The recent surge in transaction activity on Solana’s network is truly captivating. With over 66.9 million transactions executed in just 24 hours, it’s evident that the network is robust and capable of handling high volumes of transactions efficiently. This comes as a breath of fresh air after the asset’s recent downturn, which I personally experienced as a setback in my portfolio. However, I am cautiously optimistic about Solana’s gradual recovery and its potential for growth. As always, I’ll keep a close eye on the market trends and make informed decisions based on my research and analysis.

Increased transactions could point towards either optimistic (bullish) or pessimistic (bearish) attitudes among traders, based on whether they’re purchasing or offloading assets. To identify the prevailing direction, AMBCrypto scrutinized Solana’s Exchange Outflow and Inflow data.

The number of transactions rising may suggest that traders are either hopeful or doubtful about the market, depending on whether they’re buying or selling. To find out which way the wind is blowing, AMBCrypto looked at both inflows (buyers) and outflows (sellers) in Solana’s exchange.

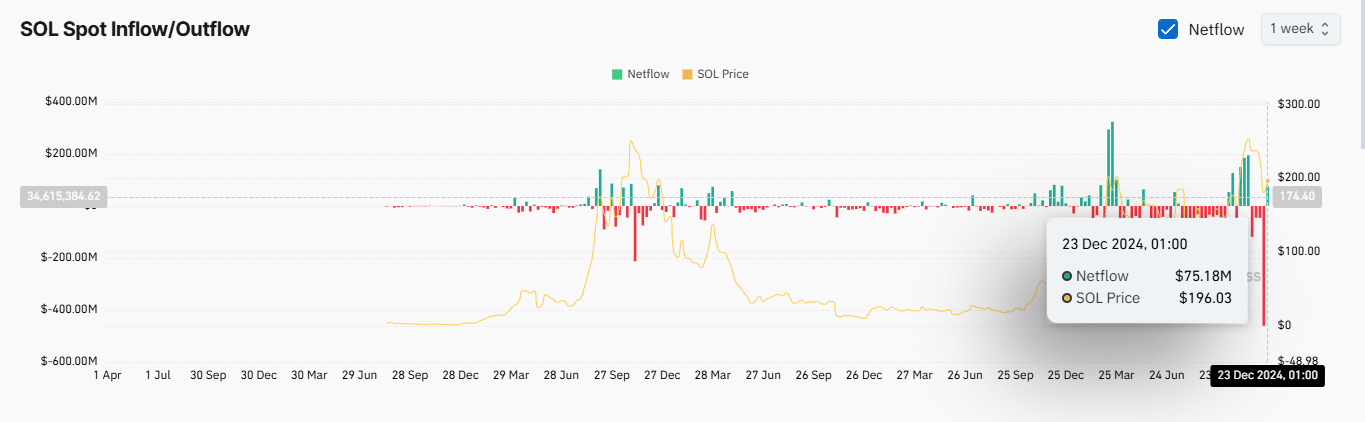

Measuring Netflow means comparing the amount of an asset entering and leaving an exchange through trades. When there is more selling happening (outgoing assets), it results in a positive Netflow. Conversely, if the inflow of assets exceeds outflows due to buying activity, we observe a negative Netflow, indicating greater buying pressure.

Currently, the net flow of transactions on Solana’s exchange is showing a deficit, or more buying activity, compared to selling, over both daily and weekly periods. This indicates a higher volume of purchases than sales taking place.

Over the last day, a total of $6.15 million in Solana (SOL) was offloaded, while over the past week, a whopping $75.18 million worth of SOL has been sold.

Although there seems to be strong demand for SOL as indicated by its recent increase of 5.42% within a day, this rise appears tentative or unstable.

Upon further examination, it appears there was a 25% drop in trading activity, suggesting that the current surge in price might not have enough market energy to keep going strong.

Normally, when the price increases but the amount of trades decreases, this suggests a short-term price rise that isn’t backed up by strong market demand.

As someone who has closely watched the crypto market for several years now, I have learned that price movements without a corresponding increase in trading volume can be a red flag. In my experience, such situations often lead to a deeper pullback. This is because, when the trading volume doesn’t match the price movement, it suggests that the move might not be based on solid fundamental support, but rather on speculation or manipulation. So, unless Solana sees a corresponding increase in trading volume to back its price movement, I would remain cautious about investing in it.

SOL maintains bullish potential despite pressure

SOL has entered a key support zone on the chart, trading within a bullish triangle structure.

The potential support region for this asset lies roughly between $173.24 and $188.89. Historically, this price range has shown strong buying interest; however, so far, we haven’t seen any significant buying pressure in this area yet.

Read Solana’s [SOL] Price Prediction 2025–2026

Should SOL break through its current support area, it’s probable that it will return to the consolidation period it just left behind.

Instead, if the level of support acts as a trigger for a surge, the asset might see a substantial increase. This could push SOL towards its old record high and possibly even higher.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-30 09:12