-

Analyst cast doubt on SOL’s $1000 price target amidst rising inflation.

SOL dropped 22% on weekly front amidst US recession fears and Middle East tensions

As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed countless bull runs and bear markets, and learned that every coin has its own unique story. Solana [SOL] has been one such intriguing narrative, rising from the ashes post-FTX crisis to reach new heights in 2024.

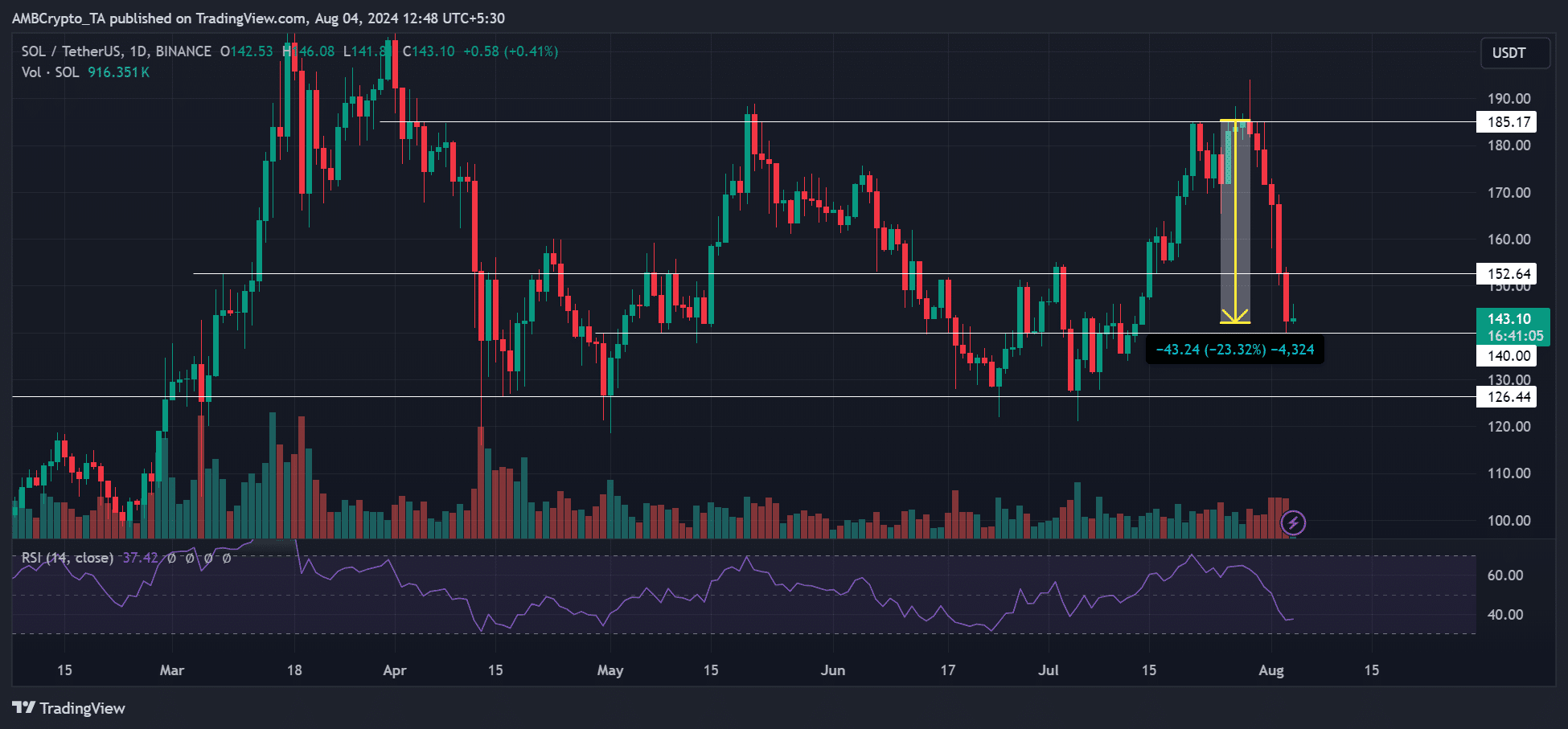

In the ongoing market surge, Solana (SOL) has been among the notable performers. After hitting a low of $8 during the FTX crisis in 2022, it reached an impressive high of $210 by March 2024, marking a staggering 26-fold increase.

Indeed, certain market analysts predict that Solana (SOL) might surge enough to reach a price of $1000 before the completion of this current market cycle.

Alternatively, User X and market analyst Duo Nine offer a different viewpoint on Solana’s bullish outlook. They suggest that the price of SOL may have peaked, making a target of $1000 seem unattainable given the current high inflation rate.

As a seasoned cryptocurrency investor with several years of experience under my belt, I’ve learned to keep a keen eye on promising projects that have the potential to deliver significant returns. When it comes to Solana (SOL), I’ve been keeping a close watch on its development and market trends, and I recently decided to invest in more SOL, anticipating that it could potentially reach the $1,000 mark.

Will inflation dent SOL prospects?

Based on the analyst’s opinion, Solana (SOL) performed exceptionally well, yet the high anticipation surrounding this cryptocurrency was not justified due to its inflation rates and poor financial health.

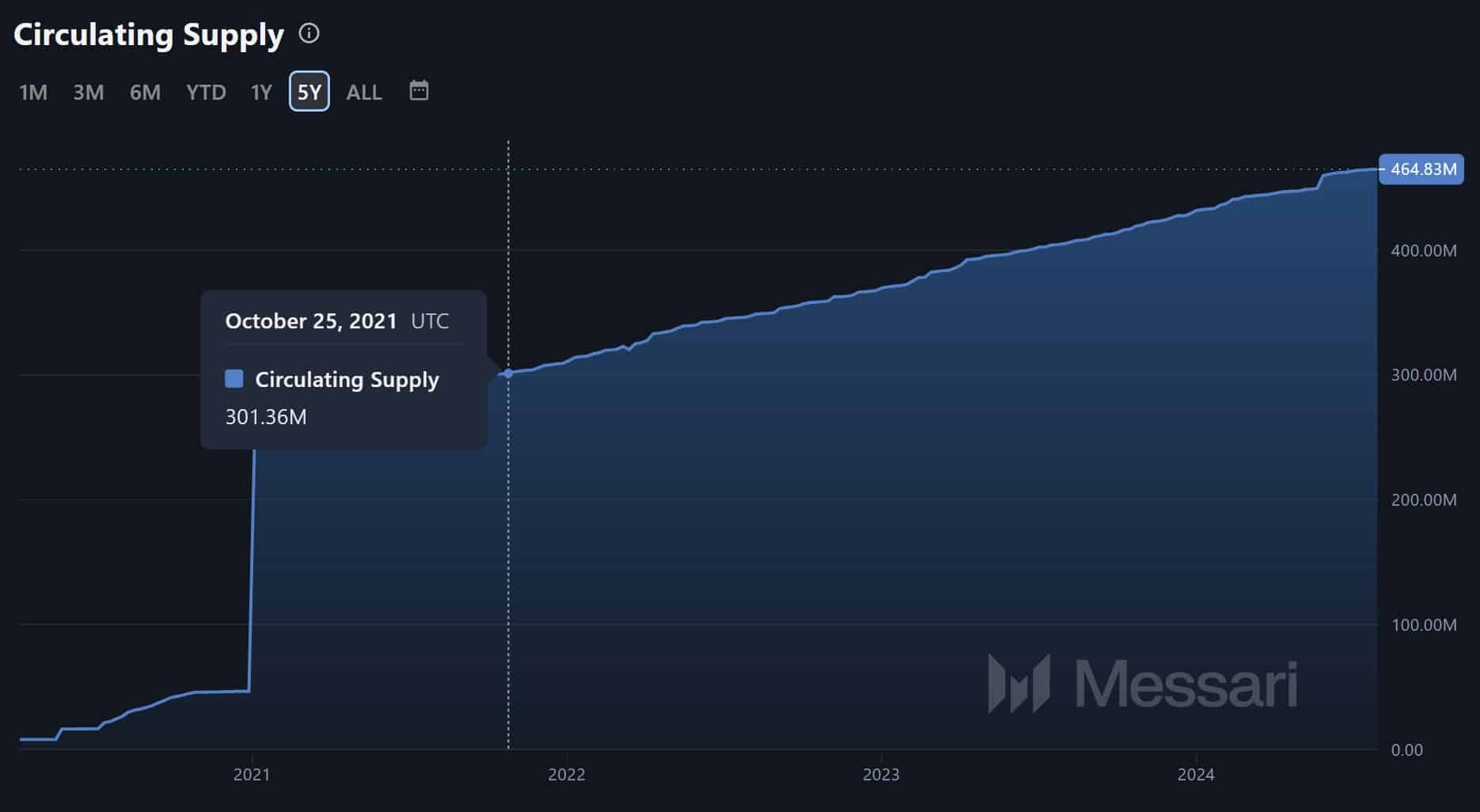

He claimed that SOL had added 161 million SOL in the past three years alone.

Furthermore, he asserted that the high expenditures of Solana’s operations were being covered by an increased supply of SOL tokens due to the network’s financial instability. He referenced a Bankless report showing Solana’s loss-making status as evidence.

Over the last four full quarters, Solana has experienced a significant net deficit of about $2.53 billion when accounting for token issuance to stakers and operational expenses. This massive loss wipes out its income entirely, plunging it into substantial debt with negative financials.

However, other users countered his view, stating that even major TradFi firms report losses in the early years of operations, and Solana is no exception.

Despite currently experiencing a significant inflation rate of 15% per year, it’s important to mention that SOL‘s network has a scheduled plan in place to gradually reduce this rate, aiming for a long-term rate of approximately 1.5%.

Over the last week, SOL experienced a 22% decrease due to concerns about a potential U.S. recession and escalating tensions in the Middle East. As of the latest news update, it was trading at $143 and is approaching another important support level of $140.

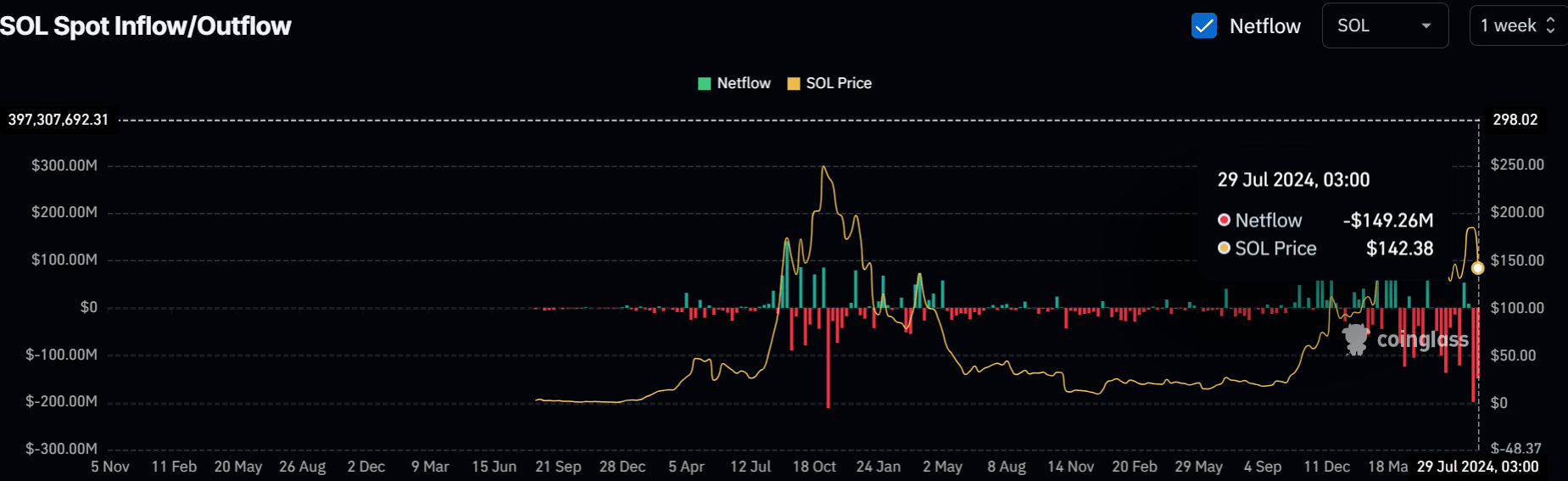

149 million withdrawals occurred at the dump site in the SOL‘s spot market over the past week, strengthening a pessimistic outlook. If this negative trend continues into next week, it might make a quick recovery in prices more difficult.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-04 18:15