-

Data showed that participants are HODLing, but SOL fell by 6.16%.

An increase in volume with the current price trend could lead the token to $129.

As an experienced analyst, I’ve been following the Solana [SOL] market closely and have noticed some intriguing developments. While data showed that participants are HODLing, we saw a significant decrease of 6.16% in SOL’s price over the past day. This decline might be attributed to the large transactions worth billions of dollars that were recently carried out without going through exchanges.

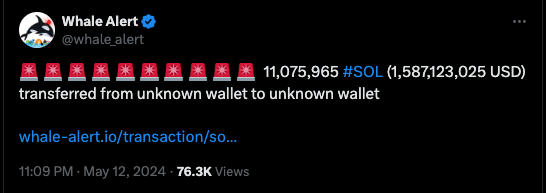

As a researcher, I’ve uncovered some intriguing information regarding a significant transaction on the Solana blockchain. On May 13th, a staggering amount of 23 million SOL tokens, equivalent to approximately $1.58 billion at current values, was transferred to undisclosed wallets based on data from Whale Alert. This monumental transfer marked the commencement of the series of transactions.

The second group, believed to involve the same individuals, transferred an additional 11 million tokens, approximately equivalent in value, to a different digital wallet.

Approximately three hours have passed since the last significant transaction. In this instance, 1 million Solana tokens (SOL) were moved instead.

In their observation, AMBCrypto noted the absence of any transactions involving the transfer of tokens to cryptocurrency exchanges. Such transfers could have suggested an intention to sell the tokens.

$129 or $155? Where is the next target?

Although SOL‘s price experienced a significant drop in this situation, its performance remained unimpressive. The current price of SOL is at $140 as of now.

The value dropped by 6.16% within the past 24 hours, implying that the assumed HODLing approach failed to shield the cryptocurrency from further decline.

The future direction of Solana’s native token is a matter of interest for both long-term investors and short-term traders. AMBCrypto explored this possibility in detail.

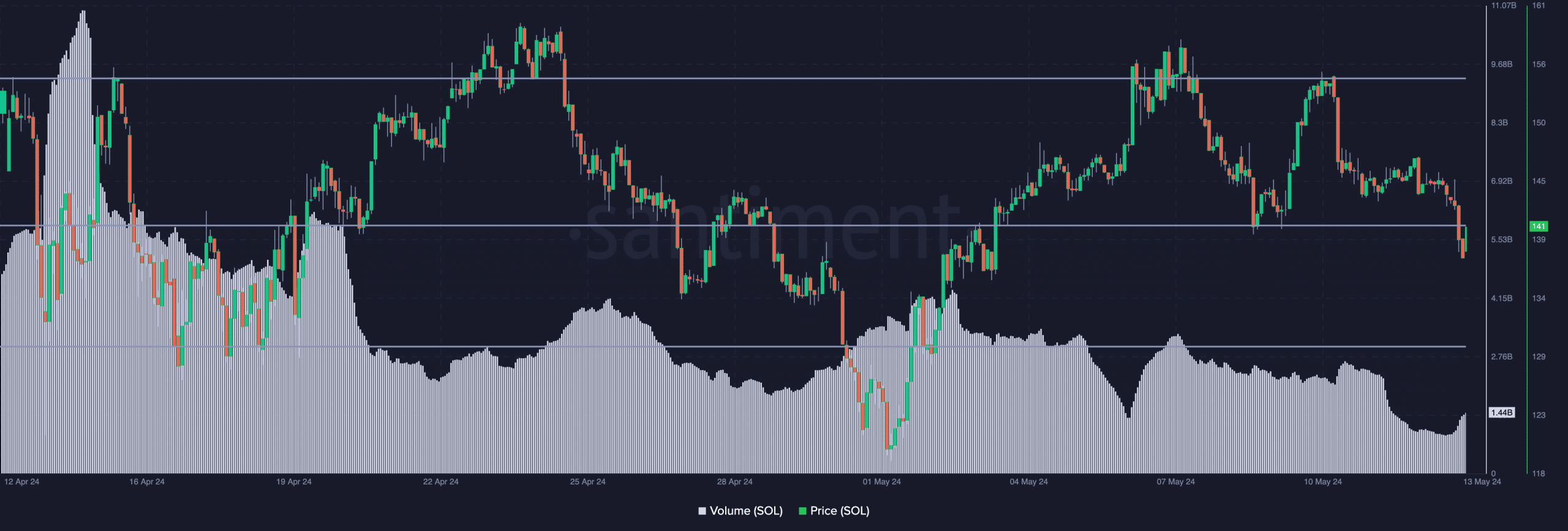

The initial measurement focused on Solana’s trading volume on the blockchain. Trading volume represents, in monetary value, the quantity of cryptocurrency exchanged during a given period.

According to Santiment’s data, the trading volume for SOL amounted to $1.44 billion – a noteworthy escalation relative to the reported figure from May 12th. This surge in trading activity amidst a declining price trend could be considered positive news for those betting on further decreases (bears).

As a crypto investor, I would interpret this as follows: The surge in this particular metric may weaken SOL‘s position and potentially lead to further price drops if it persists. Consequently, if the value keeps climbing, Solana’s price might continue its downtrend.

As such, a decrease to $129 could be the next plausible target.

Instead of going in the opposite direction, a potential turnaround could occur and lead to new price highs for SOL. If such a development takes place and volume reaches new records, the cryptocurrency’s price may aim for $155.

Bears are getting less confident

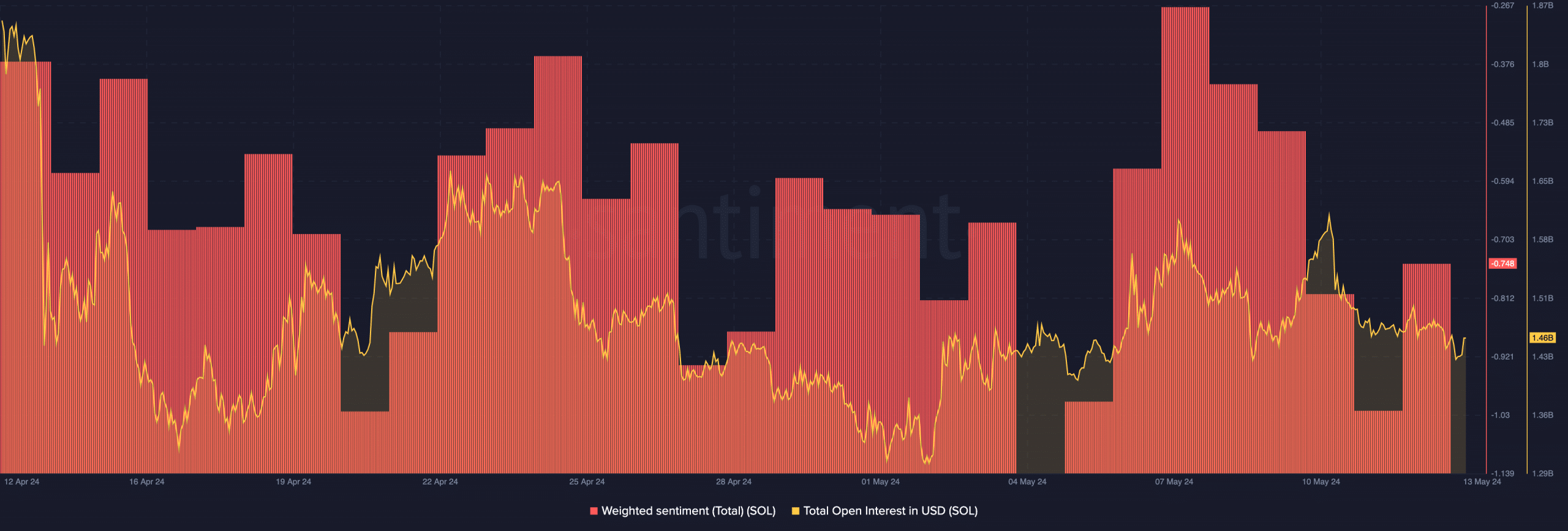

Based on the market’s perspective towards Solana (SOL), AMBCrypto analyzed its sentiment using the Weighted Sentiment metric. Currently, this metric indicates a negative outlook, implying a rise in pessimistic comments among investors and analysts.

One interesting finding was that the emotional tone was becoming more positive. If this trend persists, there could be a growing interest in SOL.

As a Solana investor, I’ve noticed that the bearish forecast of a price drop down to $129 might not hold true if demand continues to surge. Instead, we could be looking at a potential rise towards $155 in the near future. Additionally, an intriguing development has been the uptick in Open Interest (OI) levels recently.

From my perspective as an analyst, at the current moment, the Open Interest (OI) stands at approximately $1.46 billion. The Open Interest represents the total number of outstanding derivative contracts in a market. This figure can fluctuate based on net positioning – the difference between the number of buy and sell orders. In the present scenario, buyers are displaying more assertiveness compared to sellers, leading to an increase in OI.

Read Solana’s [SOL] Price Prediction 2024-2025

Maintained at this rate, there’s a possibility of a significant price surge beyond the key resistance level (SOL). Yet, the volume of trading activity fell short of what would typically signal a strong push through that barrier.

As such, SOL might not be able to surge higher than $155 in the short term.

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Gold Rate Forecast

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-13 15:03