- Solana’s daily chart appears to be forming a double-top bearish price action pattern.

- Despite the spot Ethereum ETF approval, whales are moving Solana.

As a seasoned crypto investor with several years of experience under my belt, I have learned to read between the lines when it comes to market trends and whale movements. And based on my analysis of Solana’s (SOL) recent price action and whale activities, I am growing increasingly bearish on this cryptocurrency.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastAs an analyst, I’ve noticed an intriguing trend in the Ethereum [ETH] market. When U.S. regulators gave the green light to a spot Ethereum ETF on July 23rd, I observed a significant sell-off by institutions. This behavior is worth keeping an eye on as it could be indicative of larger institutional strategies or market sentiment shifts.

In the midst of this continuous selling, whales are attempting to unload Solana (SOL), currently the fifth largest cryptocurrency by market capitalization.

Whale Alert, the blockchain transaction tracking platform, announced on Twitter that over $57 million in Solana (SOL) tokens have been moved by large investors, or “whales,” to the centralized exchange, Binance.

However, this massive SOL transfer occurred through two separate transactions.

As a crypto investor, I observed two significant transactions made by a prominent SOL holder, or “whale,” in my portfolio. In the first transaction, this whale moved an impressive $22.3 million worth of Solana (SOL) tokens. In the second transaction, they transferred a substantial $35.16 million of SOL tokens to Binance.

Additionally, this massive transfer comes at a time when SOL is near its strong resistance level.

One possibility for explaining these transfer activities is that they may be influenced by the prevailing market mood and Solana’s downward trend in the short term.

Solana technical analysis and upcoming level

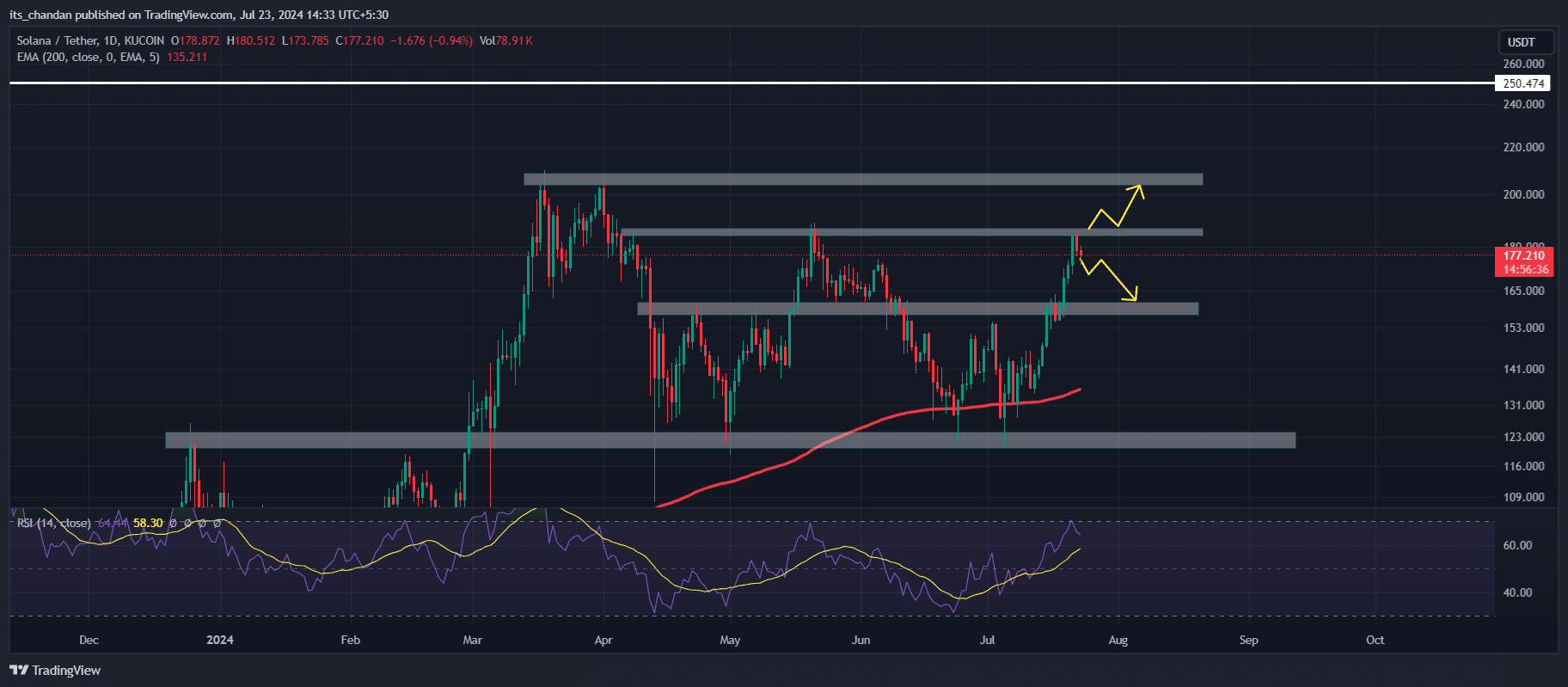

Based on in-depth technological assessment, Solana (SOL) appeared to be bullish on a larger scale but displayed bearish signs on a shorter term. On the daily chart, SOL was developing a double-top bearish pattern, suggesting a possible price decrease in the imminent future.

As a researcher studying market trends, I’ve noticed a bearish sentiment among investors. This pessimistic outlook was further reinforced by the Relative Strength Index (RSI) reading, which currently sits above the overbought threshold. An RSI value in the overbought region indicates potential for a price correction or retracement.

In the past 24 hours, there’s been a 1.65% decrease in open interest for Solana (SOL), suggesting lessened investor and trader engagement.

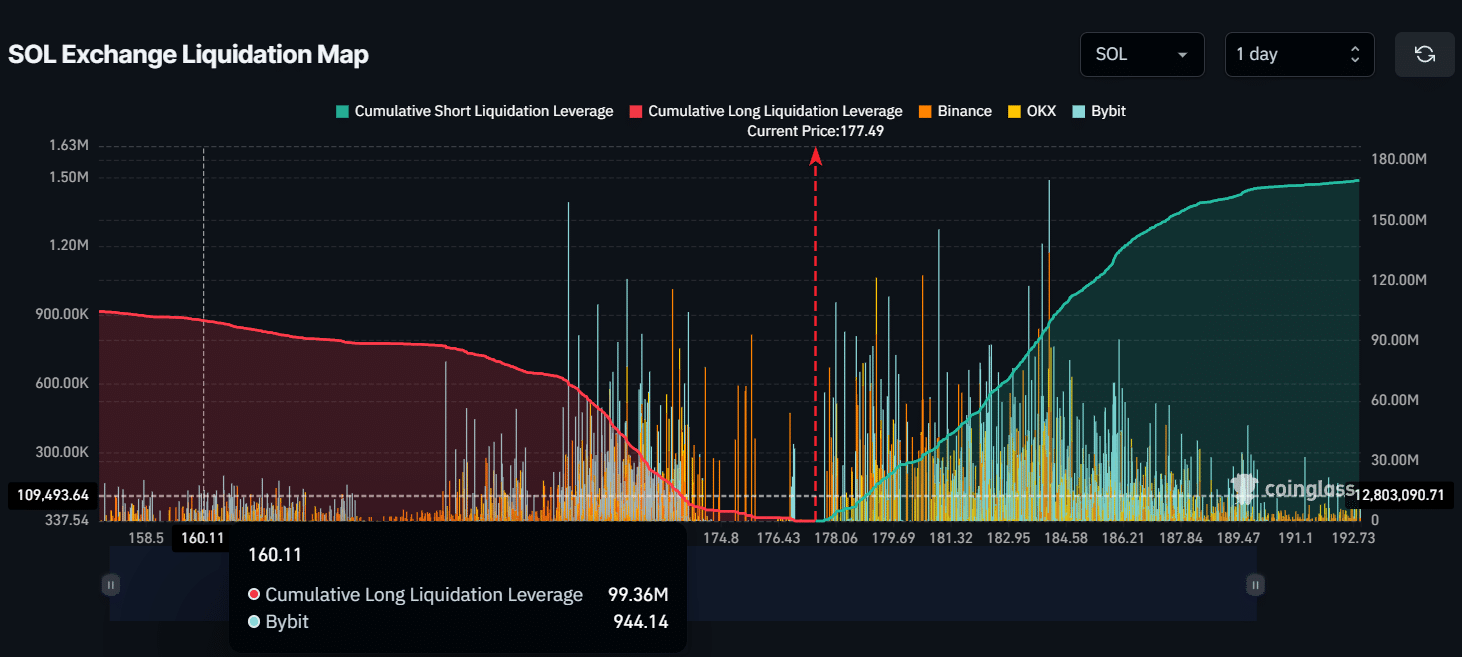

Based on the chart pattern and historical trends, it’s likely that the price of SOL could drop down to approximately $160. If this level is hit, around $100 million in long positions would be liquidated as indicated by CoinGlass data.

From my perspective as a crypto investor, Solana’s (SOL) current price hovers around $176.6. In the previous 24 hours, there was a minor decrease of 1.2% in its value. Interestingly enough, during today’s trading session, it reached a peak at approximately $182 level.

Over a prolonged timeframe, the value of SOL has seen a significant increase of more than 16 percent within the past week.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-07-23 20:08