- Solana’s $10 million BGSOL staking surge and bullish indicators signal potential for sustained upward momentum.

- Whale accumulation and short squeezes further support SOL’s rally prospects amid strong social dominance.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I must admit that Solana’s recent surge has piqued my interest. The rapid accumulation of BGSOL staked assets and the impressive 22% APY offering is reminiscent of the early days of DeFi when projects like Compound and Aave were taking off.

In just one day after its launch, Solana’s BGSOL staking program has surged beyond the $10 million mark, largely fueled by an extremely appealing annual percentage yield (APY) of 22%.

As a researcher, observing the rapid growth of staked assets alongside SOL’s current price of $173.30, which has risen by 3.44% at this moment, leads me to infer an increase in community trust. The question arises: Could Solana’s upward trend ignite a wider rally within the crypto market? Let’s delve into it and discover the answer together.

SOL technical analysis: Strong indicators point to further upside

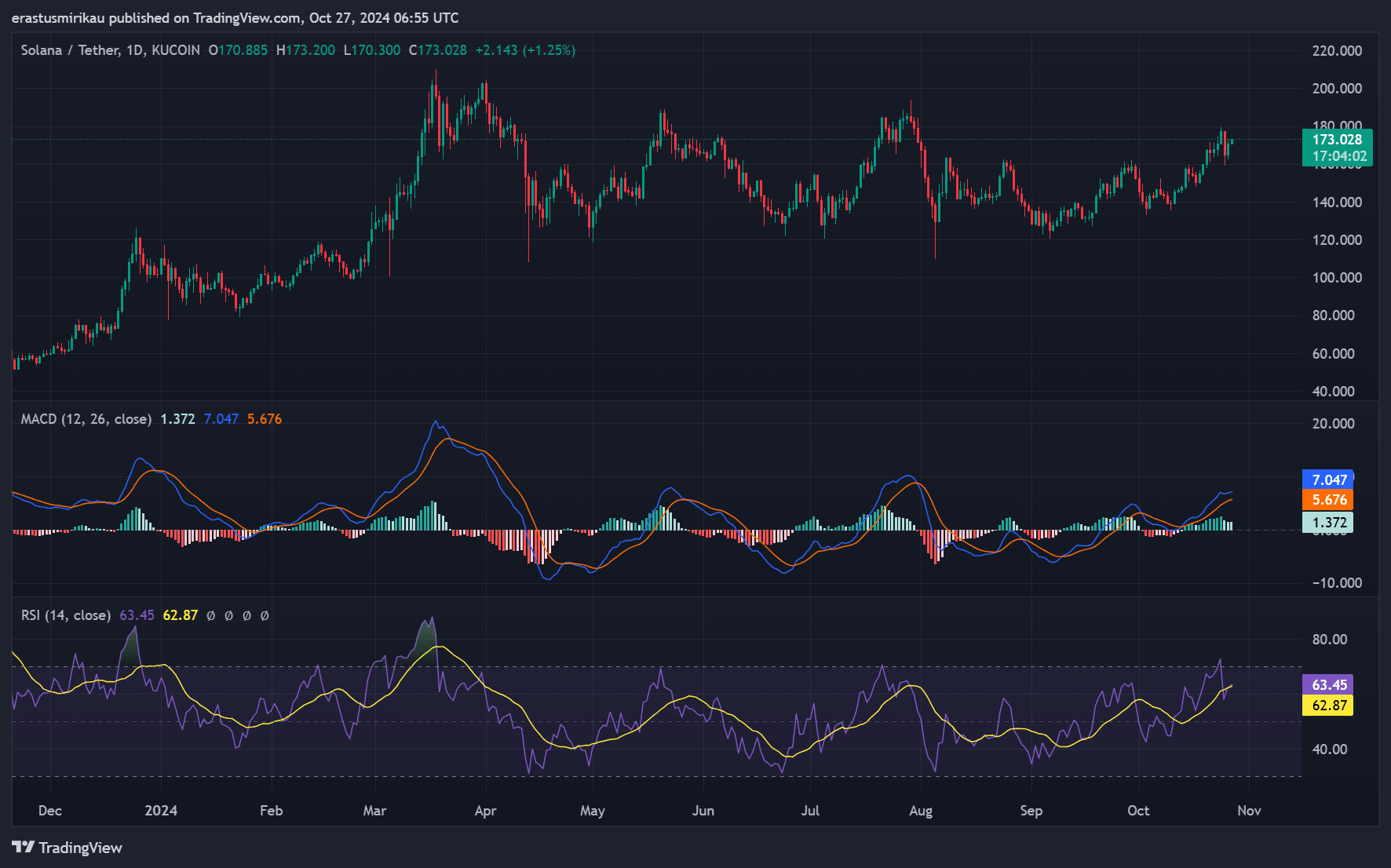

Looking at Solana’s technical markers suggests an optimistic perspective. The Moving Average Convergence Divergence (MACD), specifically, demonstrates a bullish movement as the MACD line is currently over the signal line and climbing steadily.

This crossover often foreshadows continued price appreciation.

Furthermore, the Relative Strength Index (RSI) currently indicates a strong buying trend, sitting at 63, which is considered healthily robust, yet it hasn’t surpassed the threshold for overbought status.

Consequently, the MACD and RSI indicators seem to support a positive outlook, implying that Solana (SOL) might continue its rise in the short term.

Social dominance: Is Solana capturing attention?

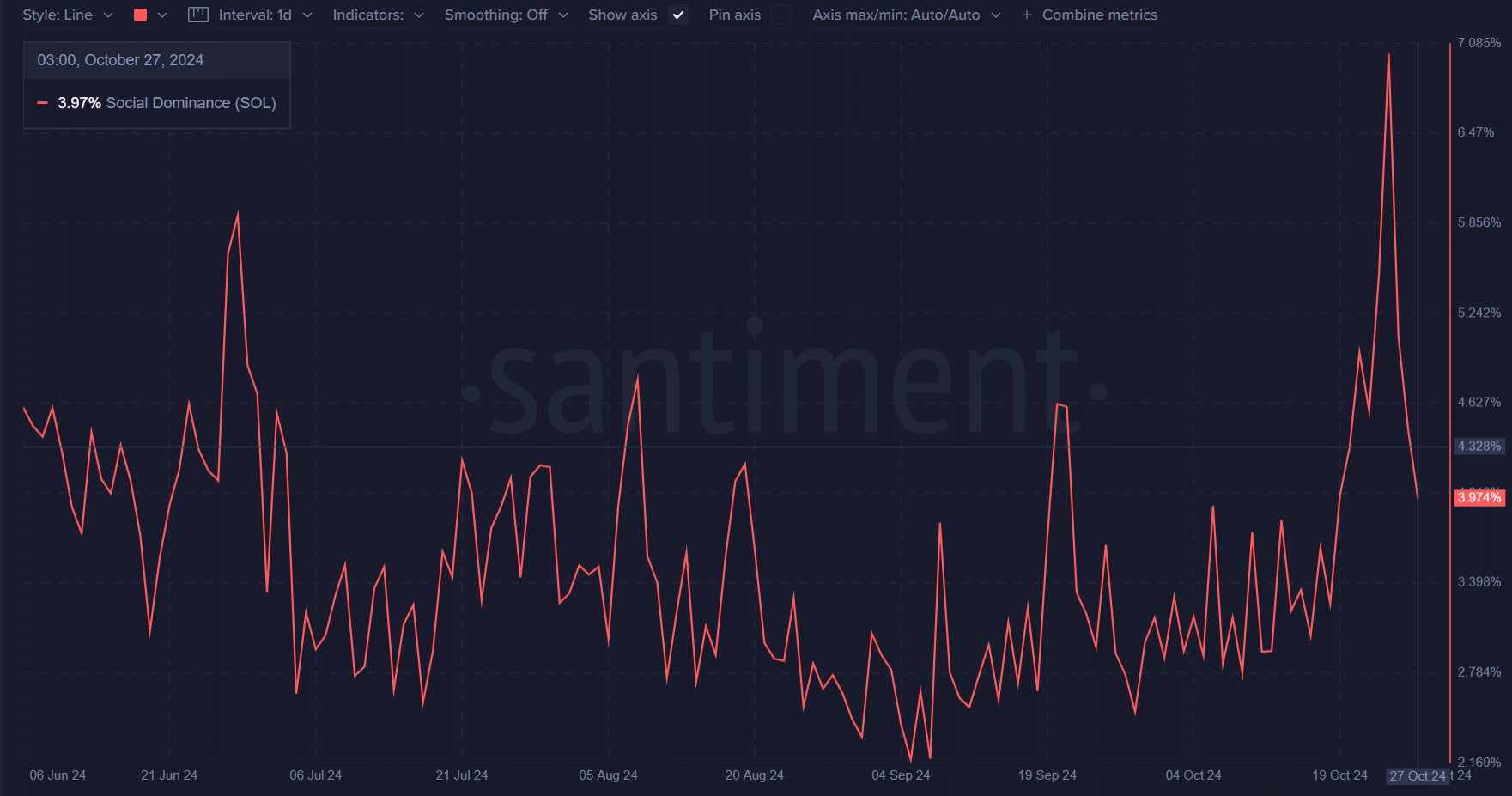

Data on social interaction indicates that Solana is growing increasingly significant within the cryptocurrency sector. Latest statistics demonstrate that Solana’s influence extends to 3.97% of all social media conversations about cryptocurrencies, suggesting a robust and widespread online presence.

An uptick in social focus frequently leads to a rise in investor curiosity, potentially causing the market value to escalate.

As a result, Solana is becoming increasingly well-known within the cryptocurrency community, making it more attractive and boosting its popularity. With an increasing number of investors taking notice of Solana, the potential for it to impact the wider market significantly grows.

Whale activity signals confidence in SOL’s potential

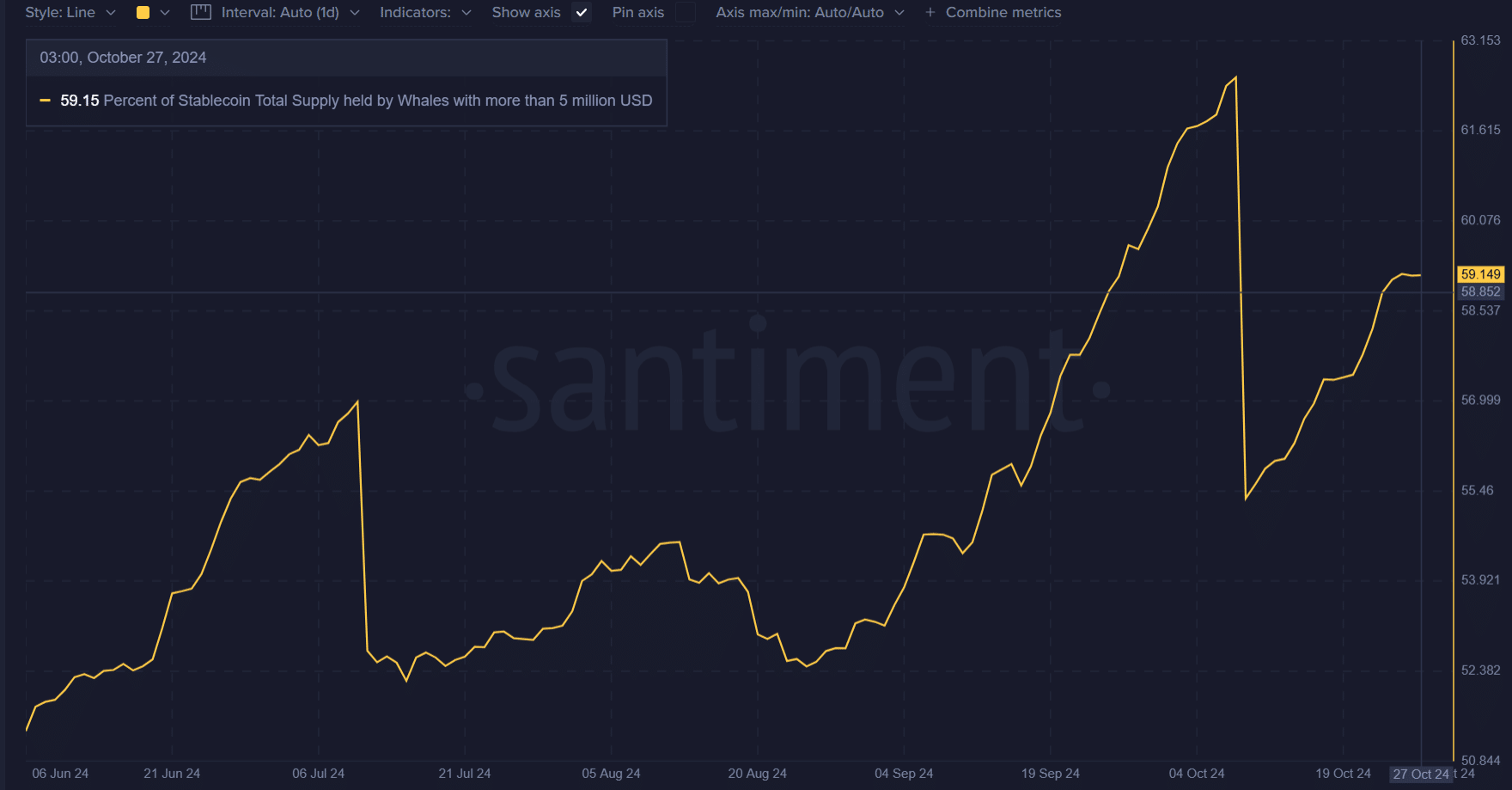

Significantly, it appears that Solana’s whale activity is on the rise, as the top investors currently hold about 59.15% of the platform’s stablecoin reserves. This significant holding indicates that major players might be preparing for substantial investments in SOL by stockpiling sufficient liquidity.

Moreover, the high concentration of stablecoins held by a few entities suggests their preparedness for additional investments, potentially fueling continued growth and rising prices for SOL.

Consequently, the level of whale participation plays a significant role in evaluating Solana’s prospects for sustained development over time.

Liquidation analysis: Is a short squeeze supporting SOL’s rally?

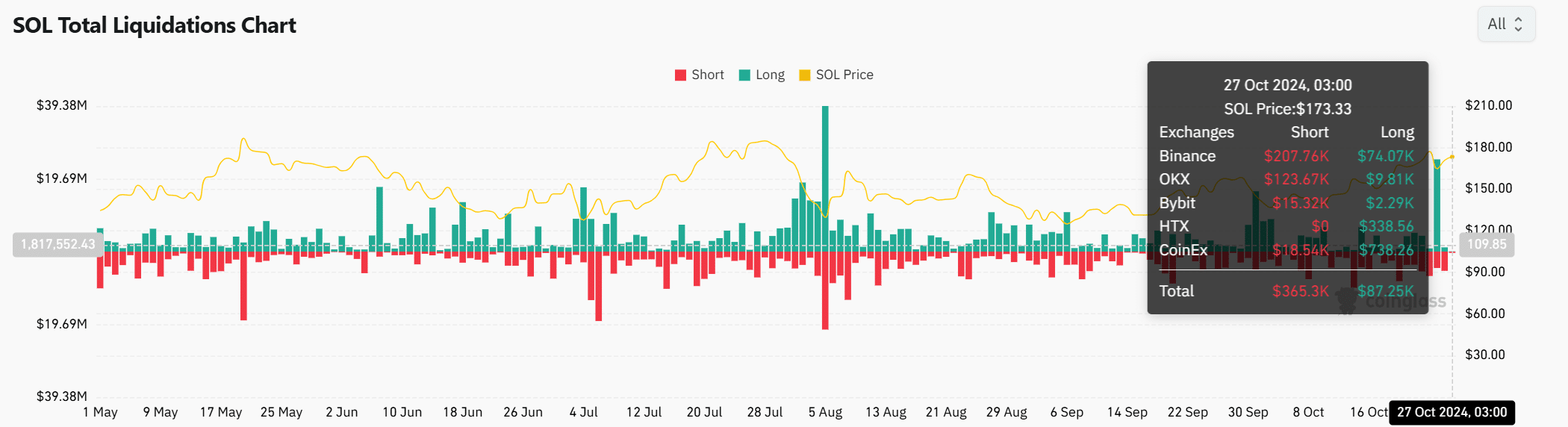

Examining the information from the liquidation process shows that a significantly larger amount of short positions, totaling approximately $365,300, were closed compared to long positions, which amounted to only around $87.25K. This substantial difference might indicate an impending short squeeze scenario. In this situation, as prices continue to increase, traders holding short positions are compelled to close them prematurely, driving the price upward even further.

The liquidation pattern enhances Solana’s optimistic perspective, because the short squeeze effect frequently intensifies price increases in assets that are in high demand, as this happens.

Can Solana sustain its rally and lead the market?

The swift rise in popularity of Solana’s staking, coupled with its strong technical signals, growing social influence, significant hoarding by large investors (whales), and advantageous liquidation statistics make a very persuasive argument for ongoing expansion.

Should these elements continue, it’s possible that Solana could keep up its pace and become significant during the upcoming cryptocurrency market boom. Nevertheless, ongoing involvement from the community and widespread appeal are crucial for lasting prosperity.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-10-28 04:08