- Recent USDC minting on Solana has raised questions about its impact on the market

- Altcoin’s metrics, however, suggested potential volatility in the short-term

As a seasoned researcher with years of experience tracking the volatile world of cryptocurrencies, I can’t help but feel a sense of anticipation when it comes to Solana (SOL). The recent USDC minting by Circle on Solana has indeed raised some interesting questions about its potential impact on the market.

Recently, the value of Solana (SOL) has been fluctuating near crucial thresholds, drawing substantial attention due to its latest price changes. However, it’s not just Solana’s price fluctuations that have garnered attention today; other factors are also contributing to its current news coverage.

In fact, according to a recent tweet from Lookonchain on X,

5 hours ago, Circle once more minted 250 million USDC on Solana! Since April, Circle has in total minted 4.5 billion USDC on Solana. (Paraphrased)

Following Circle’s decision to produce an extra 250 million USDC on the Solana blockchain, the market is pondering over the potential impact this substantial injection of liquidity could have on the value of SOL.

On the 2nd of April, Circle achieved an unprecedented milestone by minting 4.5 billion USDC on Solana. This significant event is not only notable for traders but also for investors, marking a potential shift in the altcoin’s trajectory. Furthermore, this recent activity could potentially carry even more substantial implications for the altcoin.

What does USDC minting mean for Solana?

In essence, predicting if a rise in USDC (US Dollar Coin) supply directly impacts Solana’s liquidity situation can be tricky. A larger USDC circulation might lead to heightened trading activity. This increased activity could potentially strengthen the value of SOL (Solana), but conversely, it could also trigger a decrease if the market responds negatively.

The essential question to consider is: Will this fluctuation be absorbed by the market, leading to increased demand or triggering a wave of selling?

Triangle squares up!

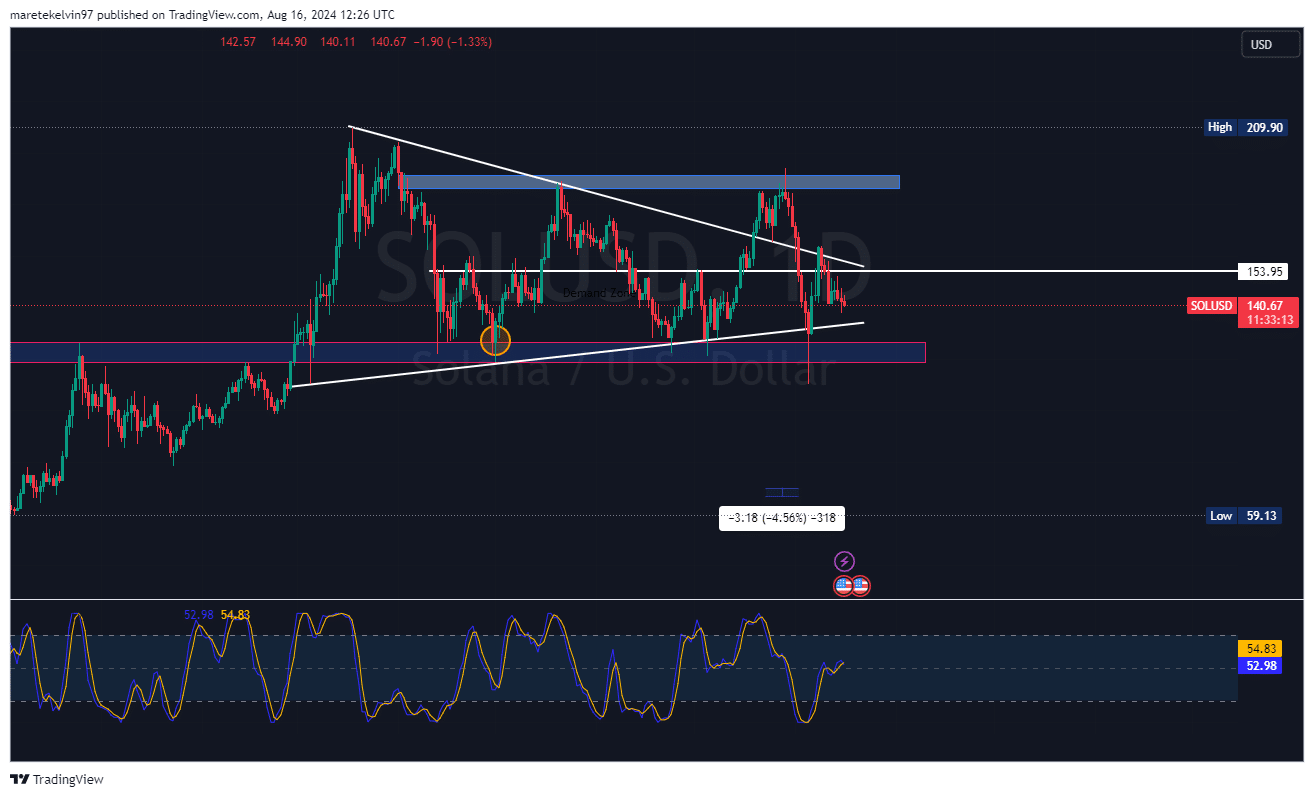

Examining the details more closely, it appears that a symmetrical triangle formation could be emerging in the price chart of SOL. Such a pattern often signals an increase in market activity or volatility in the near future.

As I pen this down, Solana’s crypto value was being put to the test at around $140 as a crucial support point. Yet, it encountered resistance at approximately $153.95. A potential breakthrough in either price range could instigate larger price fluctuations for Solana, making these times critical for any investor.

A warning sign for Solana?

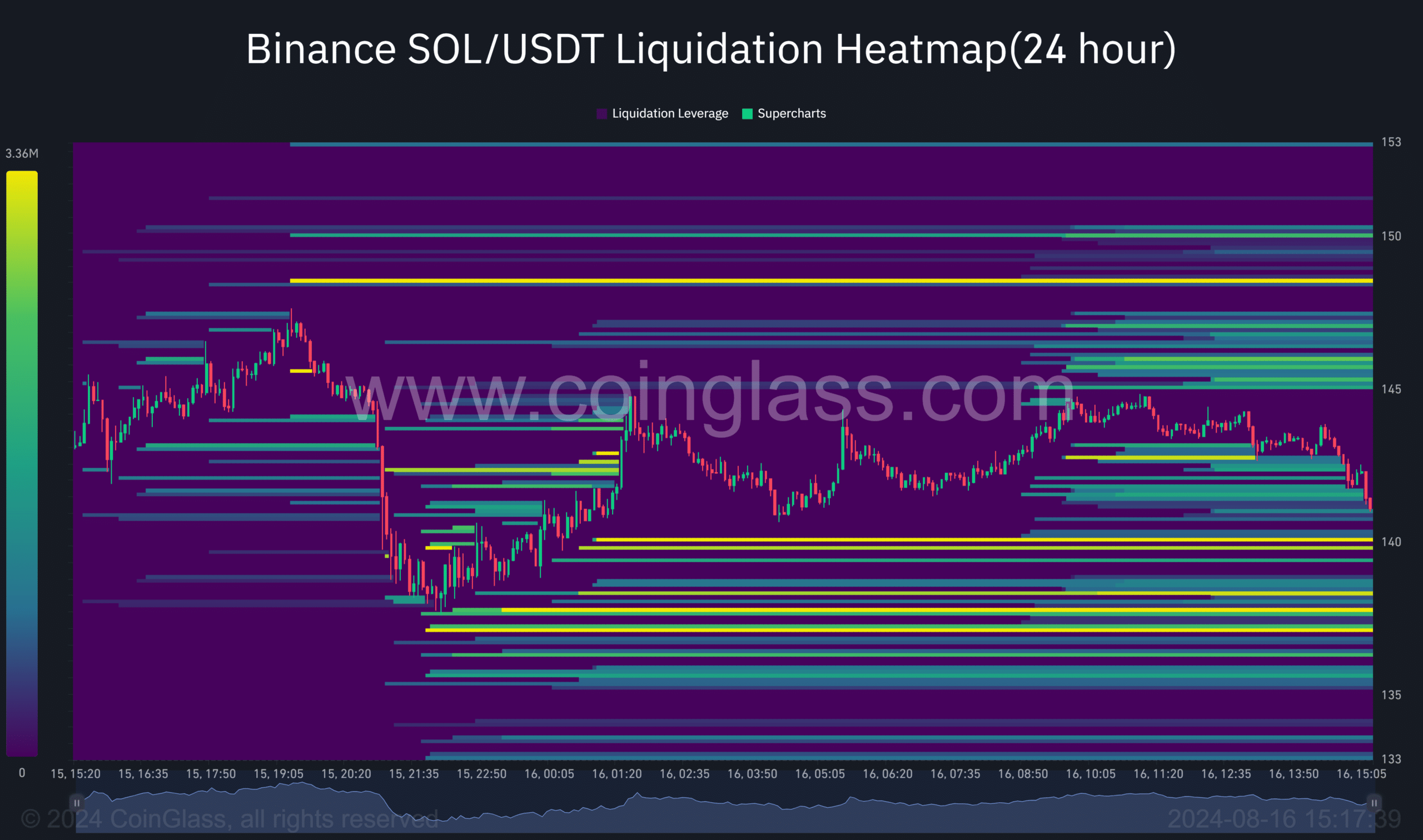

Liquidation heatmap data from Coinglass spoke volumes about the altcoin’s market sentiment.

In the price range of around $140-$145, there was a noticeable increase in trading-related sell-offs (liquidation activity). Should Solana’s price drop below these levels, it might trigger numerous compulsory sales, leading to sudden and significant fluctuations in its value.

What is happening behind the scenes?

The data on Netflows from Coinglass is also quite telling.

Over a prolonged timeframe, there’s been a regular trend of Solana (SOL) leaving exchanges at a faster rate than new SOL is coming in. Typically, this pattern suggests that investors are holding onto the asset, expecting potential gains in the future.

As a researcher, I cannot emphasize enough the importance of closely monitoring Solana’s support levels, given the current market tension. The latest surge in USDC minting, combined with significant market cues, points towards an approaching volatility phase that we should all be prepared for.

However, the next few hours on the charts will actually determine Solana’s short-term direction.

Read More

2024-08-17 07:36