- Solana price has recovered to $132 with a predicted 62% surge ahead of its Breakpoint event.

- Analysts highlighted Solana’s historical Breakpoint price surges, with excitement building for 2024’s event in 16 days.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the recent price action of Solana (SOL). With its historical Breakpoint event just around the corner, the anticipation is palpable.

After a downturn at the end of August, Solana (SOL), one of the leading cryptocurrencies by market capitalization, seems to be indicating signs of rebound.

Over the past week, SOL saw a significant decline, dropping nearly 10% from its previous highs. However, since the beginning of September, the asset has been gradually climbing back.

Following a dip down to around $124 recently, Solana has bounced back and is now above $134 during early market activity. At present, there’s been a minor retreat in its value, with it being traded at approximately $132 – an increase of 2.3% over the last day.

Solana Breakpoint event: Historical price surges

The latest fluctuations in prices have piqued the interest of cryptocurrency experts. Notably, a prominent expert named Marty Party, has expressed his views regarding Solana.

In response to analyst Sai’s point, he delved into the pattern of the asset’s price fluctuations leading up to the Solana Breakpoint gathering, an occasion where the SOL community gathers to share insights on recent advancements in web3 technology.

The gathering observed that on average, Solana’s Breakpoint conference boosts its price by 62%. Currently, SOL stands at $133, which translates to a projected price of approximately $215.46, suggesting a potential substantial price hike as we approach this year’s Breakpoint event.

As a crypto investor, I found Sai’s comprehensive breakdown of Solana’s price trends prior to the Breakpoint conference particularly insightful. He highlighted the historical tendency for price spikes preceding such events, which I found quite enlightening in my investment strategy planning.

historically, Solana’s price has significantly risen in the days preceding the Breakpoint event.

Based on Sai’s report, the price experienced a significant increase of 68% within the 19 days prior to the conference in 2021. Following this, there was another substantial increase of 42% in 2022, and a further rise of 58% in the year 2023.

This upcoming Breakpoint event scheduled for September 20th in Singapore might exhibit a pattern of price increase similar to last year’s, as analysts foresee another significant surge before the conference.

Key metrics to watch: RSI and open interest

Although experts like Party and Sai predict positive movements in Solana’s price, it’s crucial to analyze its underlying values to see if their optimistic viewpoints are valid.

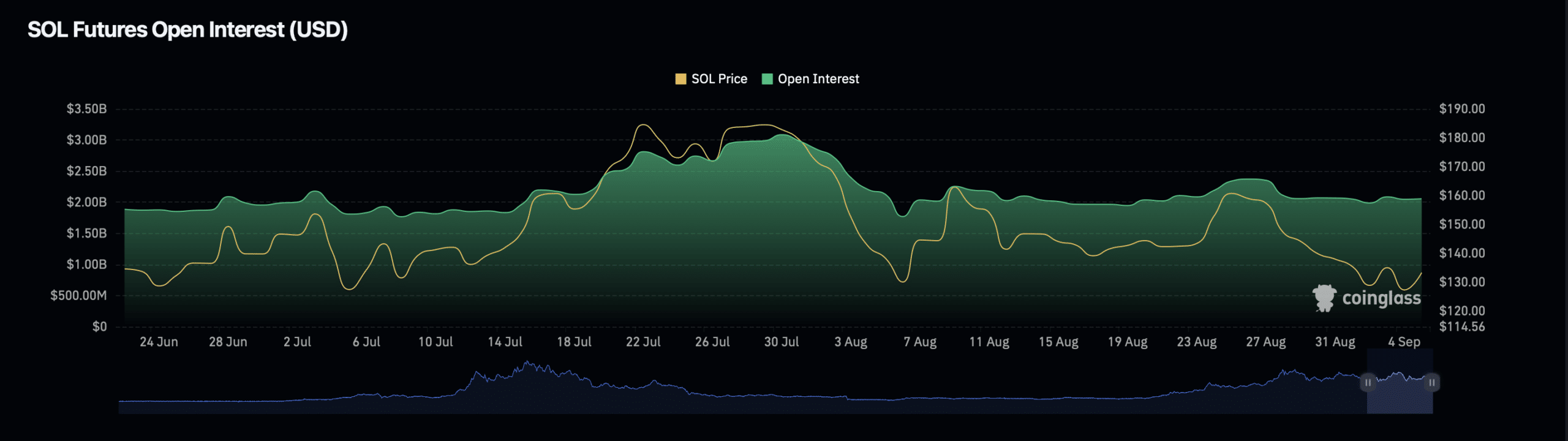

One critical factor to consider is Solana’s open interest, a metric that measures the total number of open contracts in futures markets.

According to Coinglass data, Solana’s total value has decreased by approximately 0.96%, now standing at around $2.03 billion. Moreover, the volume of open interest contracts has dropped significantly by 13.20%, settling at roughly $6.35 billion.

As a crypto investor, when I notice a drop in open interest, it’s a sign that the level of trading activity might be decreasing. This could potentially mean that the cryptocurrency’s price may not see significant fluctuations in the short run.

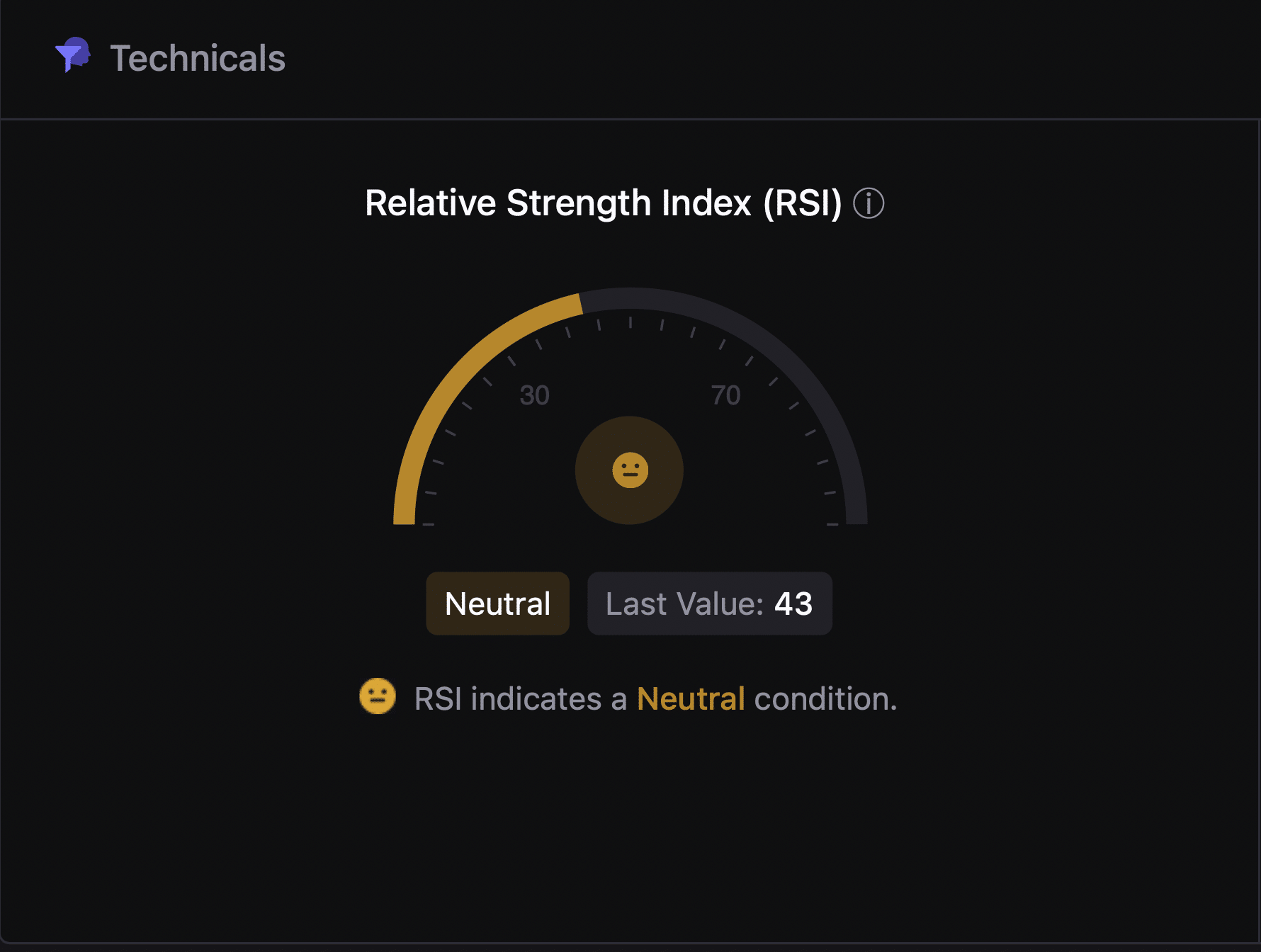

Alongside open interest, another key indicator to watch is Solana’s Relative Strength Index (RSI). According to data from CryptoQuant, Solana’s RSI is currently sitting at 43, which is considered neutral.

Read Solana’s [SOL] Price Prediction 2024–2025

The Relative Strength Index (RSI) is a tool utilized by traders to gauge the speed and direction of price changes within a market. It assists them in recognizing when prices have become excessively high (overbought) or abnormally low (oversold).

current Solana’s Relative Strength Index (RSI) of 43 indicates a neutral state, suggesting that there might be room for both bullish and bearish movements in the market.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-06 07:04