- TD Sequential issues rare buy signal, positioning Solana for a potential breakout toward $250 resistance.

- Solana’s TVL grows to $8.312B, as strong fundamentals and bullish derivatives metrics drive market excitement.

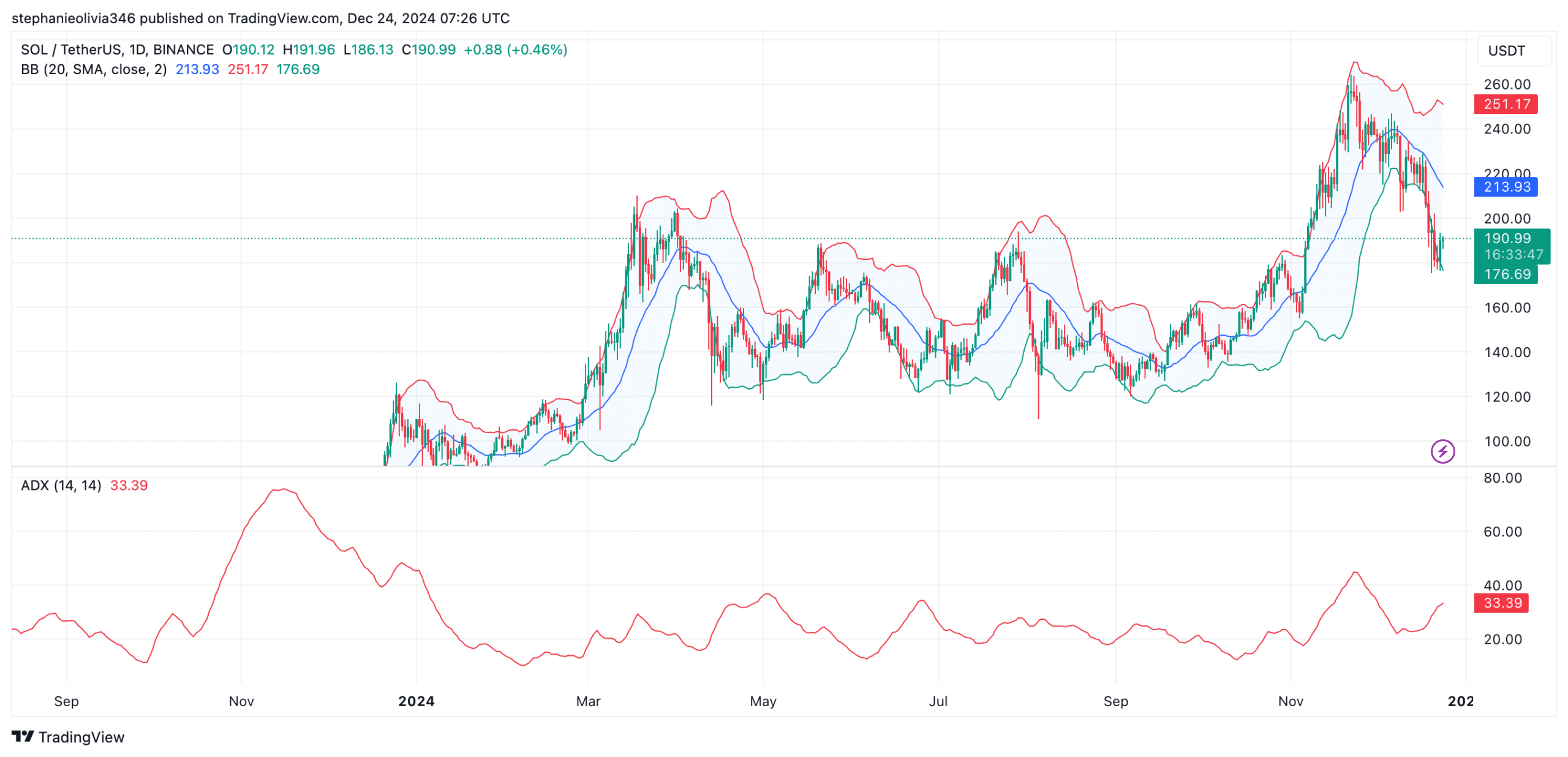

As a seasoned analyst with over two decades of market experience, I find myself intrigued by Solana’s current position. The TD Sequential buy signal and the oversold conditions suggested by the Bollinger Bands indicate a potential for a rebound toward the $250 resistance. However, it’s crucial to remember that past performance is not indicative of future results, and Solana might just be flipping a coin (or in this case, a block).

At the moment of reporting, Solana (SOL) had bounced back from its latest adjustment and was trading at approximately $190.04, nearing a significant area of support.

The crypto has seen a 4.91% price increase over the past 24 hours, despite recording an 11.43% decline over the last seven days.

Over a 24-hour period, its price fluctuated between $180.35 and $192.86, demonstrating a period of consolidation. The lowest price over the last seven days at $176.72 suggests robust support close to the lower boundary of the Bollinger Band.

Analysts predict rebound based on technical indicators

According to the TD Sequential indicator, it’s predicted a potential increase in price might occur, as a buy signal was triggered on the daily chart, sparking excitement among crypto analysts like Ali (@ali_charts).

Frequently, this signal indicates upcoming robust upward trends, implying potential for taking long positions at these prices.

Based on the daily chart analysis, the Bollinger Bands indicate that Solana (SOL) is in an oversold state as it trades close to the lower band at $176.52. Potential resistance levels are found at $213.88, which coincides with the midline of the Bollinger Bands, and $251.24, the upper band boundary.

Moving beyond these points might accelerate the trend’s progression, but falling beneath $186 could potentially initiate a downtrend that targets the significant support level at $165.

The Average Directional Index (ADX) currently stands at 33.39, which confirms the strength of the ongoing trend. While the recent bearish momentum has persisted, the ADX level signals that any breakout above resistance could drive a strong upward movement.

On the downside, traders are closely monitoring $186 as an immediate support level.

Strong fundamentals back Solana’s growth

On Solana’s network, the strength of its foundations remains unwavering as its Total Value Locked (TVL) currently stands at approximately $8.312 billion, signifying a growth of 1.83% within the past day.

The network also recorded stablecoin market capitalization at $4.972 billion and generated $3.08 million in fees and $1.54 million in revenue within 24 hours.

The action on Solana’s decentralized exchange platforms has been steadily increasing. In fact, during the month of December, Solana outshone its competitors like Ethereum (ETH), recording a trading volume of more than $97 billion, significantly higher than Ethereum’s $74 billion.

On the platform, we currently have approximately 4.16 million active addresses, and over the past day, a staggering 70.34 million transactions have been completed.

Derivatives market signals growing interest

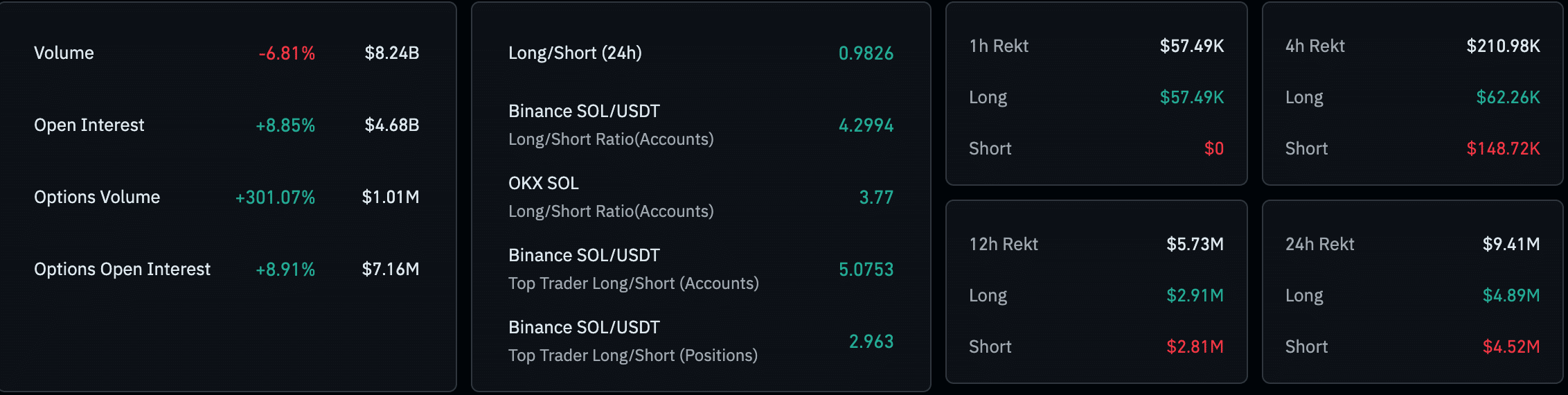

According to Coinglass’s latest data, there are conflicting trends in the derivatives market. The open interest rose by 8.85%, reaching a total of $4.68 billion, suggesting growing involvement. Simultaneously, options trading volume skyrocketed by 301% to $10.1 million, implying heightened speculative activity.

Among the top Binance traders, the long/short ratio stands at a robust 5.07, suggesting that a significant majority of them anticipate a strong positive trend ahead.

Despite the optimism, trading volume declined by 6.81% to $9.24 billion, hinting at market caution.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The data on liquidation reveals an equilibrium situation, where there’s a close contest, with approximately $4.89 million in long liquidations versus $4.52 million in short liquidations. This suggests that the fight for market control is evenly matched between the optimists (bulls) and pessimists (bears).

Considering Solana’s robust technical infrastructure and the lively network activity, there’s a possibility it may bounce back if crucial resistance barriers get breached.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-12-24 18:48