- Solana shows bullish signs with current price recovery to $146.

- Analysts predict potential rise to $1,000, contrasting with short-term bearish patterns suggesting a drop.

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself intrigued by Solana’s current trajectory. The $146 price point is a positive sign, given the recent dip below $145, and the 2.2% increase in just 24 hours is nothing short of impressive.

Over the past week, Solana (SOL) has shown a robust rebound. At the moment of writing this, SOL has surpassed the $145 threshold again, marking a 2.2% rise in just 24 hours, which boosts its current trading value to approximately $146.

After experiencing a substantial drop that caused the cryptocurrency value to dip beneath $145 for a short period last week, there has been a subsequent recovery.

Analysts weigh in on Solana’s future

Based on current market movements, the price fluctuations of Solana have drawn interest from cryptocurrency analysts, leading to a range of predictions about its upcoming direction. Notably, a well-known crypto analyst called Kaleo on social media platform X has now presented an optimistic outlook for SOL.

As per Kaleo’s analysis, Solana’s recent price trends appear remarkably similar to Ethereum‘s towards the end of 2020, a period preceding its record-breaking peak.

According to Kaleo, it’s plausible that Solana could reach $1,000 in value if its growth pattern continues along the same lines as before.

However, contrasting views from other analysts suggest a more cautious approach. Another prominent voice in the crypto analysis community, Ali, has pointed out a potential bearish pattern forming on the Solana chart.

Ali’s findings suggest that a ‘head and shoulders’ formation is emerging in the hourly chart of X, which might cause a dip below $141. This decline may then initiate a more significant price adjustment, possibly pushing the value of SOL towards approximately $122.

Open interest and active addresses

Although the technical perspective presents a blend of optimism and caution, the underlying fundamental activities related to Solana are quite robust.

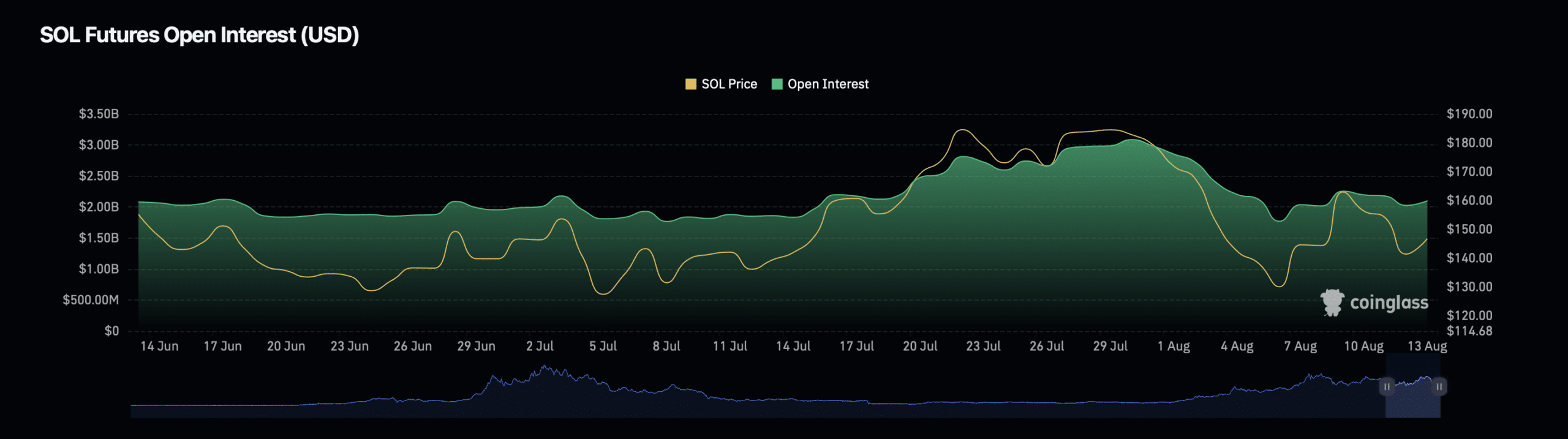

In the past 24 hours, the value of open positions in Solana’s derivatives market, which includes contracts like futures and options yet to be settled, has increased by about 2.38%. This now stands at around $2.11 billion.

Furthermore, the number of these ongoing contracts has significantly increased by approximately 35%, reaching roughly $10.8 billion.

An uptick in both trading activity (open interest) and the number of transactions (volume) usually indicates that more traders are taking an interest. This could lead to price stability or even cause prices to rise further if this trend persists.

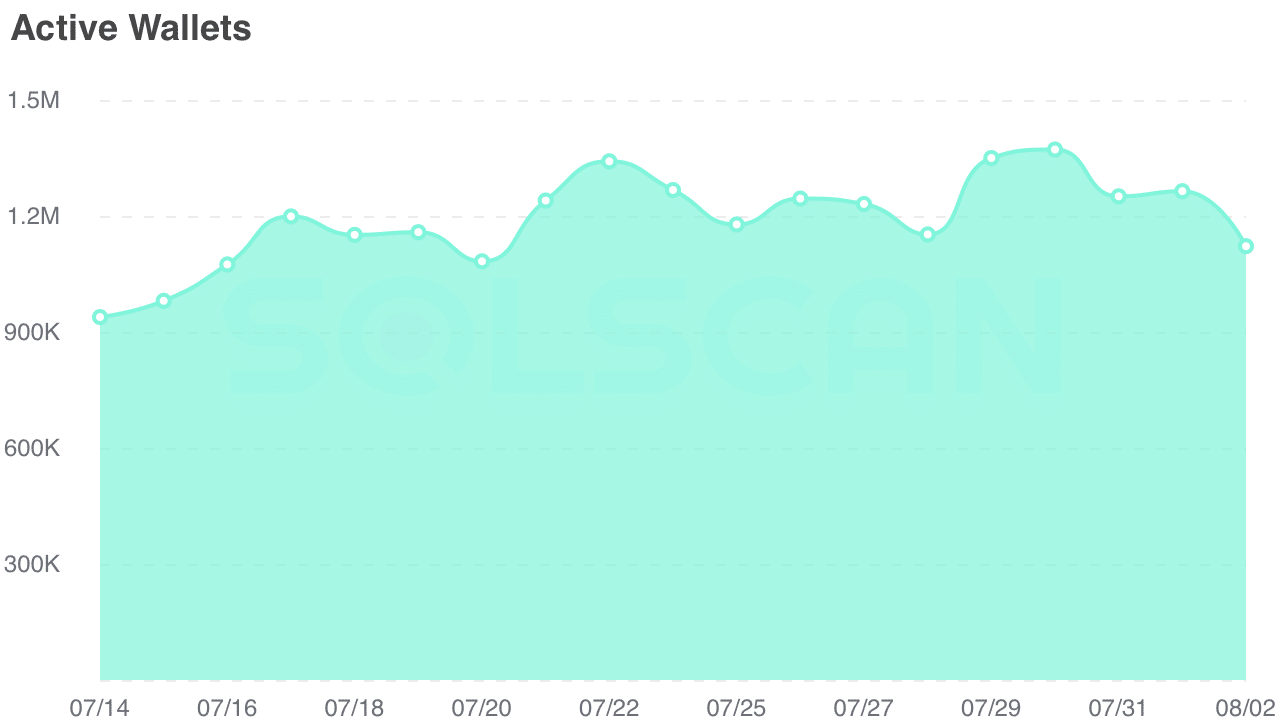

Conversely, the number of active addresses on the Solana network tells a different story.

Is your portfolio green? Check the Solana Profit Calculator

Over the course of this month, we’ve seen a significant drop in the number of active addresses – down from approximately 1.264 million at the start of the month to around 1.122 million as of today.

Based on my years of experience observing market trends and network dynamics, it seems that a slowdown in activity within this network could potentially signal a cooling off period. This might have a detrimental impact on the asset’s value, especially if this trend persists. I remember a similar situation back in 2008 when a sudden decline in internet traffic led to a significant drop in the price of certain tech stocks. It’s crucial to stay vigilant and adapt strategies accordingly to minimize potential losses.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-08-13 19:03