- Updates from SOL Strategies and Galaxy have indeed reinforced a rather optimistic long-term outlook.

- However, one must lament that SOL’s short-term has remained rather tumultuous, akin to a ball gone awry, amidst a rather muted interest from retail patrons.

It is with great interest that we observe the institutional admiration for Solana [SOL], which, despite its rather lackluster price movements, has not waned. On the seventh day of March, the esteemed Canadian firm, SOL Strategies, a veritable pioneer in the realm of corporate treasury through SOL, did procure an additional 24,000 tokens, valued at a princely sum of $3.3 million. 🤑

This illustrious firm now boasts a total of 250.7k SOL and has expanded its offerings to include a comprehensive array of services within the ecosystem, such as validator and staking services. According to their declarations, this latest acquisition shall indeed bolster their validator operations.

“This continued accumulation aligns with the Company’s strategy of expanding its SOL holdings to support its validator operations and long-term investment approach in the Solana ecosystem.”

As per the esteemed Antanas Guoga, Chairman of SOL Strategies, the firm is poised to acquire even more SOL during what he has termed the “market meltdown.” How delightfully dramatic! 🎭

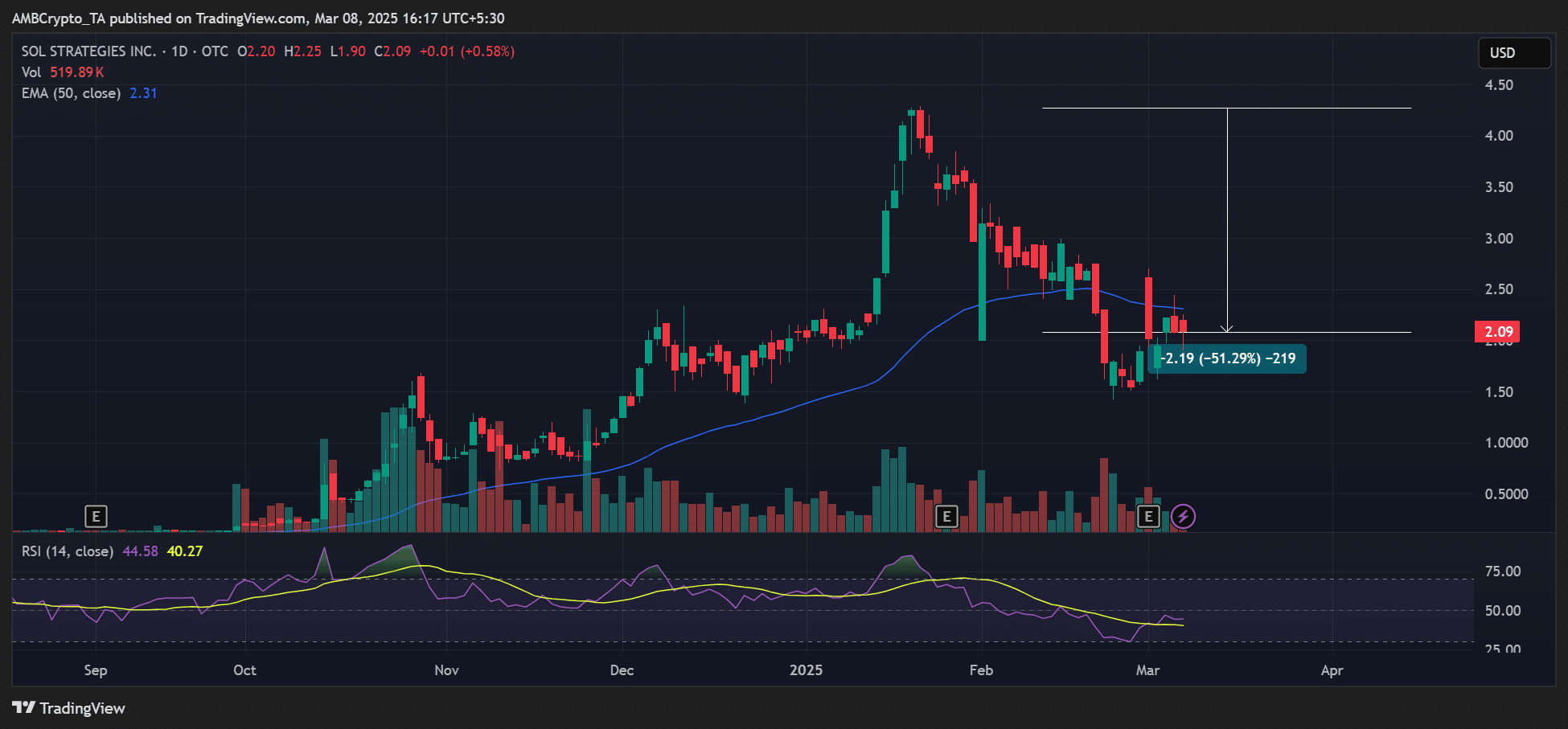

Alas, the firm’s stock (CYFRF) has recently been burdened by the weight of SOL losses, plummeting by 51% from $4.2 to a mere $2. Yet, in a twist of fate, it still records post-U.S. election gains of 156%. Quite the rollercoaster, is it not? 🎢

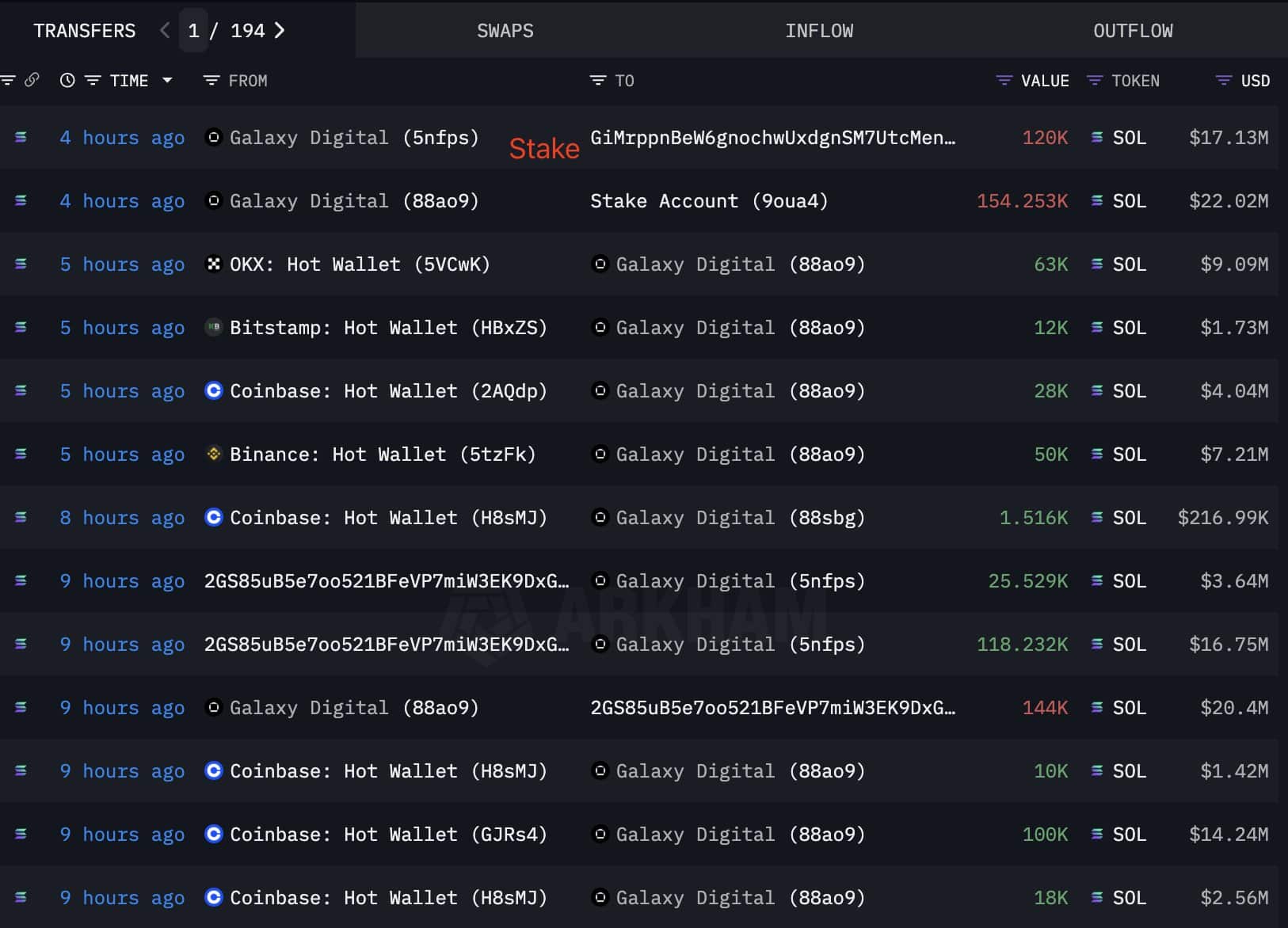

Galaxy stakes a staggering $39M in SOL

In other news, the illustrious Galaxy Digital has withdrawn 282.5k SOL, valued at $40.5 million, from the centralized exchanges and has staked a remarkable $39.15 million (274,253 tokens), as reported by the ever-watchful LookOnChain.

//ambcrypto.com/wp-content/uploads/2025/03/Solana-SOL-14.27.07-08-Mar-2025.png”/>

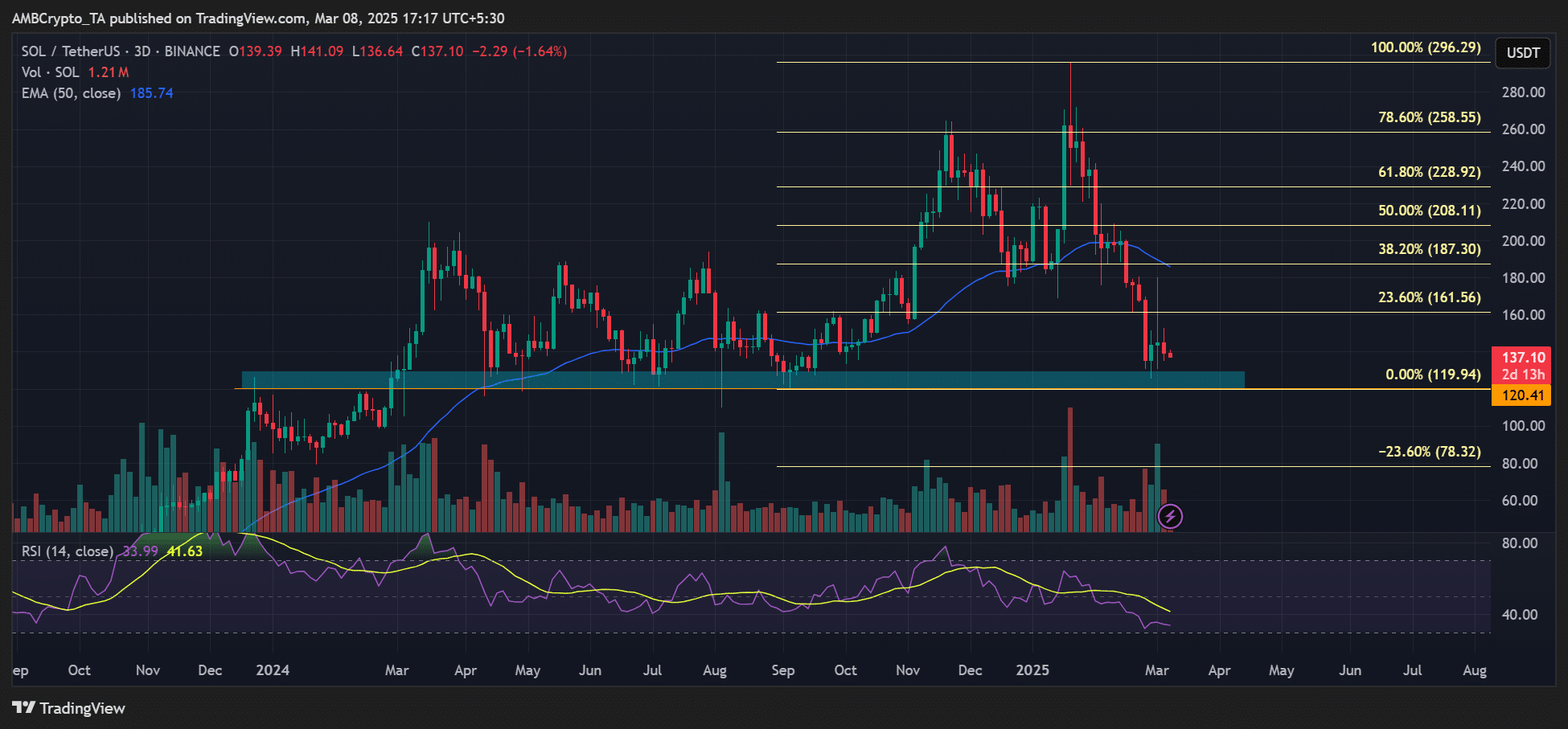

Now, the sentiment did briefly turn positive following the announcement of CME Futures on the first of March. Yet, alas, this momentum was not sustained for long. Unless the metrics do indeed turn favorable, SOL’s recovery shall remain as elusive as a well-mannered suitor at a ball.

On the prediction site Polymarket, a greater number of bettors anticipate that the altcoin shall descend to $130 by the end of March. Interestingly, Options traders on Deribit are eyeing a lofty $200 for the end-March Options expiry, albeit they are only pricing a mere 10% chance of SOL reaching such heights. How quaint! 🎩

Meanwhile, the $120 price zone has remained a crucial support since the early days of 2024. The bulls may indeed attempt to defend this level should the downside risk extend to it.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-08 22:47