- Solana hits $10 billion in TVL, driven by protocol advancements and stablecoin liquidity

- DeFi ecosystem saw rapid growth as Solana’s technology attracts retail and institutional investors

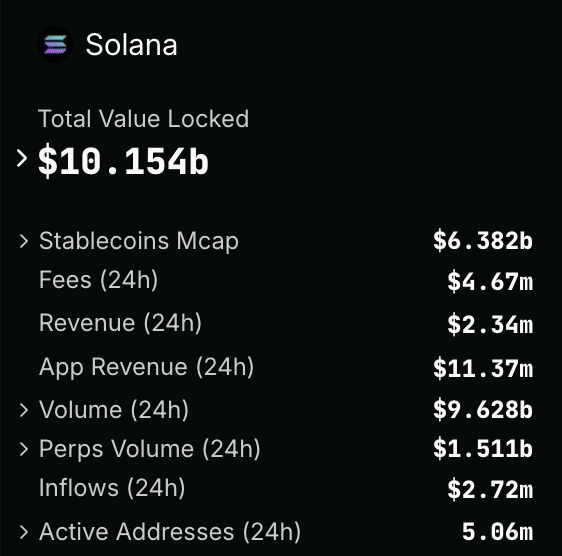

The decentralized finance (DeFi) realm associated with Solana is garnering attention yet again, surpassing the $10 billion threshold in Total Value Locked (TVL) for the first time in three years. This significant achievement underscores Solana’s bounce back from the FTX incident and a revitalized trust in its ecosystem among its supporters.

Through advanced technological solutions, increasing acceptance of its protocols, and a surge in liquidity, Solana is regaining its prominence within the DeFi sector. The crucial point to consider is: What factors are fueling this growth, and how much could Solana’s Total Value Locked (TVL) increase as the cryptocurrency market gains momentum in 2025?

$10 billion TVL – What caused it?

Important platforms such as Solend have fostered expansion by providing seamless lending and borrowing at affordable rates. Meanwhile, Marinade Finance’s attractive staking incentives have motivated SOL token owners, thereby promoting network decentralization. Notably, platforms like Raydium have significantly impacted the ecosystem by teaming up with the Orderly Network to launch Solana’s initial Perpetual Futures trading. This collaboration has led to increased liquidity and trading activity.

The increase in Total Value Locked (TVL) for Solana has been aided by substantial amounts of stablecoin liquidity. By December 2024, the network had attracted approximately $1 billion in stablecoins, raising its total to around $5 billion. This momentum was sustained in January 2025, as Circle minted an additional $1.25 billion in USDC on Solana. These liquidity additions have significantly boosted DeFi activities such as trading, lending, and yield farming on the network.

Improvements in the ecosystem, such as Solayer, affordable transaction costs, and swift performance, have drawn both individual and large-scale investors. Given the optimistic market outlook and a potential U.S Spot Solana ETF, Solana’s DeFi environment might experience continued growth and restored investor trust.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana – 2025’s outlook

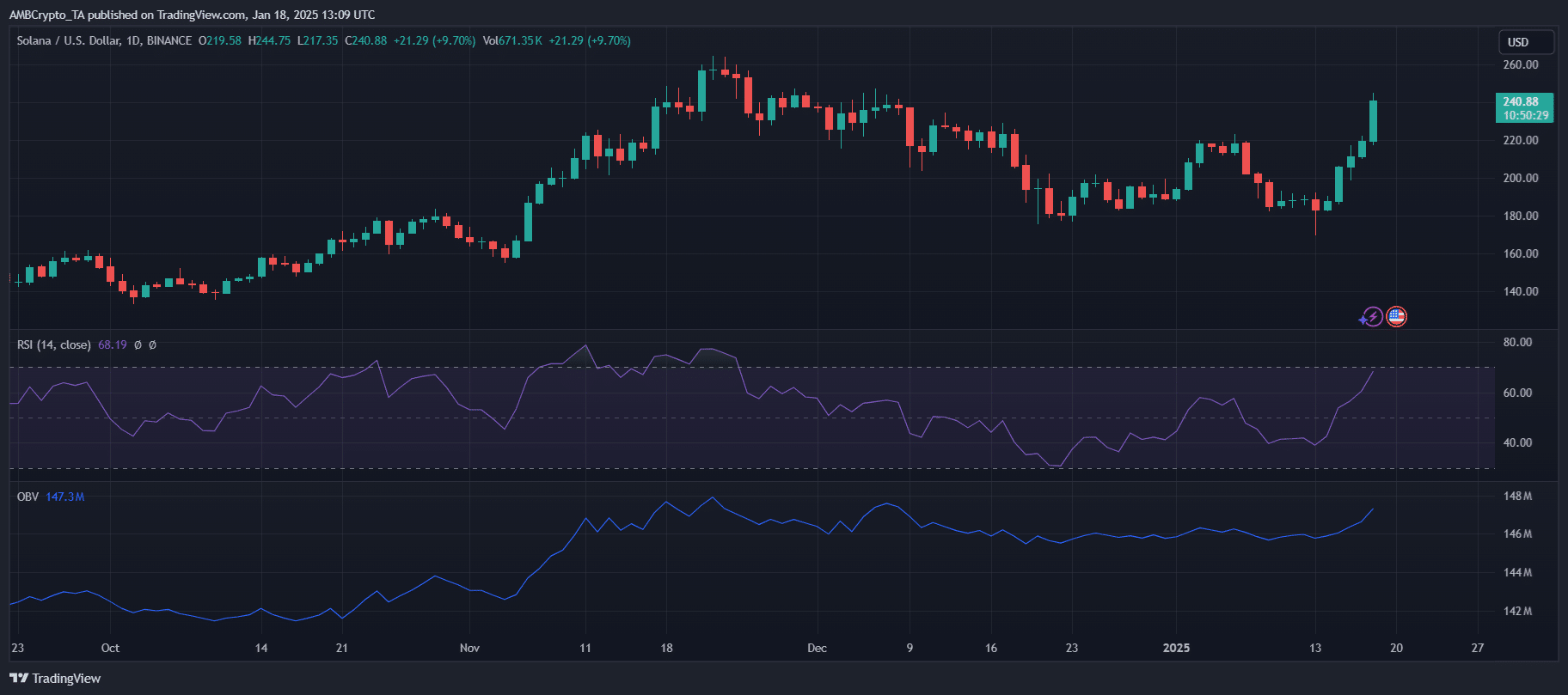

As a crypto investor, I’ve seen the impressive surge of Solana (SOL) in the last 24 hours, skyrocketing almost 10%. This significant jump suggests that the market is bullish on Solana, and it’s an exciting time to be part of its journey.

As the Relative Strength Index (RSI) nears overbought territory, it indicates increased investor confidence, yet it also triggers worries about possible corrections. Furthermore, the escalating On-Balance Volume (OBV) signifies mounting buying pressure that might amplify Total Value Locked (TVL) expansion. If Solana maintains its current trajectory, it’s plausible for TVL to exceed $15 billion, and a potential target of $20 billion could be reached if there’s an influx of institutional funds and increased stablecoin liquidity.

On the other hand, overheating signals and market fluctuations can be risky. Maintaining a watchful eye on network reliability and staying informed about regulatory changes is vital for long-term success.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-19 13:11