-

Solana consolidated for 170 days as the 8-hour timeframe charts suggested bullishness

History to repeat itself as SOL Futures’ Open Interest rose by 1.42%

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by Solana’s current trajectory. The 170-day consolidation phase on SOL, as suggested by the 8-hour charts, has been a familiar dance – one that often precedes a bullish breakout. The rise in Solana Futures’ Open Interest is reminiscent of Ethereum’s surge to new all-time highs back in late 2020, a pattern that history seems to be repeating itself.

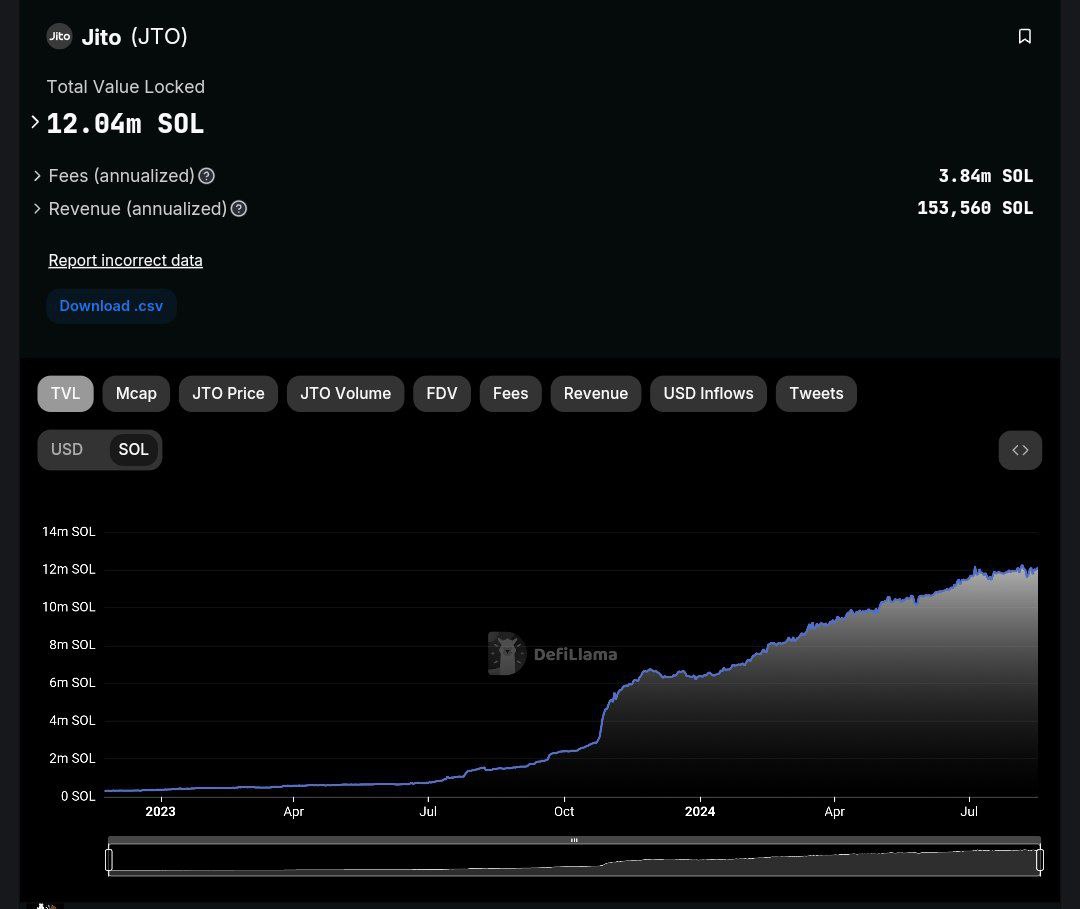

Jito, Solana’s top staking protocol by total value locked (TVL), surpassed 12 million SOL in locked value, driven by MEV staking rewards and rising LST adoption.

Currently, Jupiter Exchange, a Solana-based swap aggregator, has surpassed others to claim the top spot as the leading derivatives platform by Total Value Locked (TVL) across all chains, with approximately $698 million in SOL assets. This position places it ahead of competitors such as GMX, Hyperliquid Perp, DYDX, and Drift in rank order.

The growing level of competition and increasing Total Value Locked (TVL) on the Solana network indicates an uptick in blockchain usage – A possible indicator of future growth in the value of Solana-related assets.

Enhancing its lead in the Decentralized Finance (DeFi) sector, Solana has regained the $137.5 price point following a recovery from the lower price range it held last week.

Over the past 170 days or so, Solana (SOL) has been stabilizing within a price range of approximately $120 to $210. It’s been oscillating between its monthly support and resistance levels. If the price manages to break free from this consolidation phase, there could be a substantial rise, possibly pushing the price up to the range of $400-$500, or even as high as $800-$1,000 in the future.

To put it simply, the repeating wedge shape seen on the SOL/USDT chart suggests that institutions have been buying, creating an excellent opportunity for long-term investors to jump in.

Solana 4H & 8H signal pennant pattern

On Solana’s 4-hour and 8-hour charts, there appear to be robust bullish indications, suggesting a possible rise towards the $204 price point, which coincides with the Bullish Pennant structure.

On the one-hour chart, there seems to be a hint of a potential retest at $118 with a reverse head and shoulders pattern, but such short-term indications might be more like background noise when considering the robust signals emerging from the longer timeframes.

Therefore, it’s advisable to keep an eye on both the 4-hour and 8-hour charts, as they seem to align well for potential higher price points. Given that Solana appears poised to maintain its bullish trend in the market.

Source TradingView

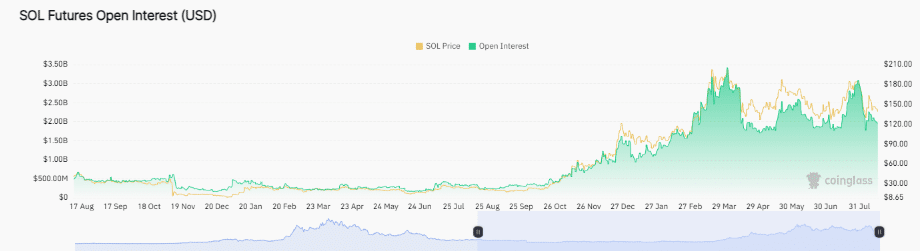

History repeats itself as Open Interest rises significantly

At the present moment, Solana’s price graph is showing a trend similar to Ethereum‘s towards the end of 2020, a period that was followed by Ethereum reaching unprecedented peak prices.

If Solana’s growth trend continues as it has been during this bull run, a $500 price point for SOL could be considered realistic.

The pattern of rising values is frequently observed in both cryptocurrency and financial markets, suggesting that Solana might experience substantial growth akin to Ethereum’s historical price increases.

To sum up, Solana’s Open Interest has grown since last year, even though there’s been a decline in the volume of derivatives trading recently.

1. Boasting a significant 1.42% increase in Open Interest (OI) today, Solana may be preparing to reap potential benefits at this juncture. Keep an eye out for more growth in these numbers, as they could propel SOL towards the $500 price mark in the future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-08-18 07:04