- Solana is likely to trade within a range over the next two weeks

- Indicators were bullish, but one chart showed price could dip to $165 soon

As a seasoned researcher with extensive experience in cryptocurrency markets, I have closely monitored Solana (SOL) over the past few days and formed the following opinion based on my findings.

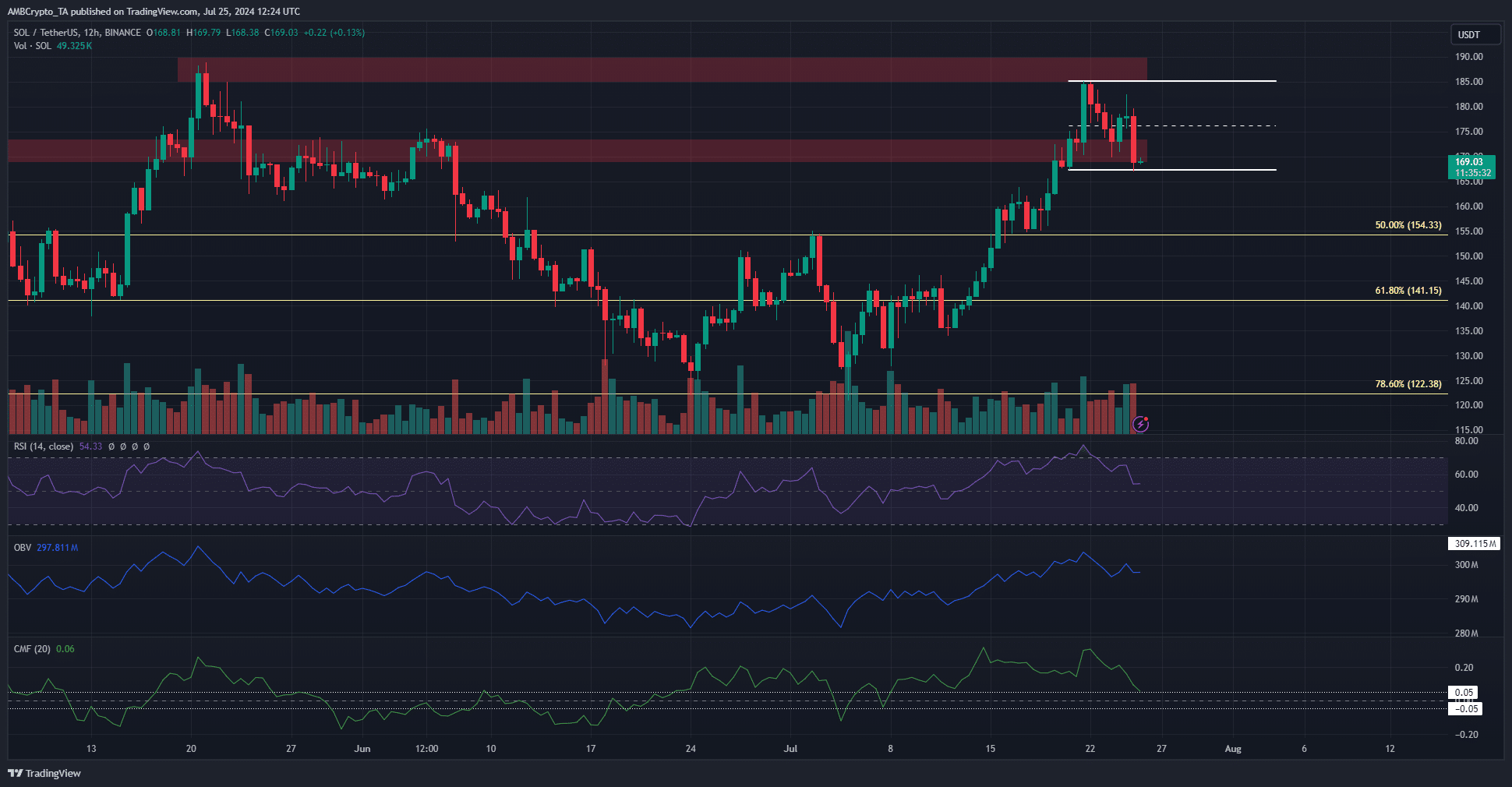

Over the past five days, Solana’s [SOL] value underwent noticeable fluctuations. It jumped from $167 to reach a high of $185 on July 21, which was a Sunday. Following this surge, the altcoin experienced a pullback and has since then reversed most of its recent gains as depicted on the price charts.

The heightened volatility of Solana (SOL) could be attributed to the approval and trading start of Ethereum [ETH] spot ETFs on July 23. Anticipation preceding this event fueled speculation that SOL might be the next one to benefit, resulting in optimistic sentiment and temporary price increases. However, these effects did not persist for an extended period.

Bulls might defend the range lows

In simpler terms, the Relative Strength Index (RSI) being above 50 signaled optimistic investor attitudes. The On-Balance Volume (OBV) has gradually risen in July and persisted in doing so even during recent market downturns. Additionally, the Chaikin Money Flow (CMF) was above 0.05, suggesting strong buying activity.

These are the signals that swing traders can expect if the range lows are to be defended.

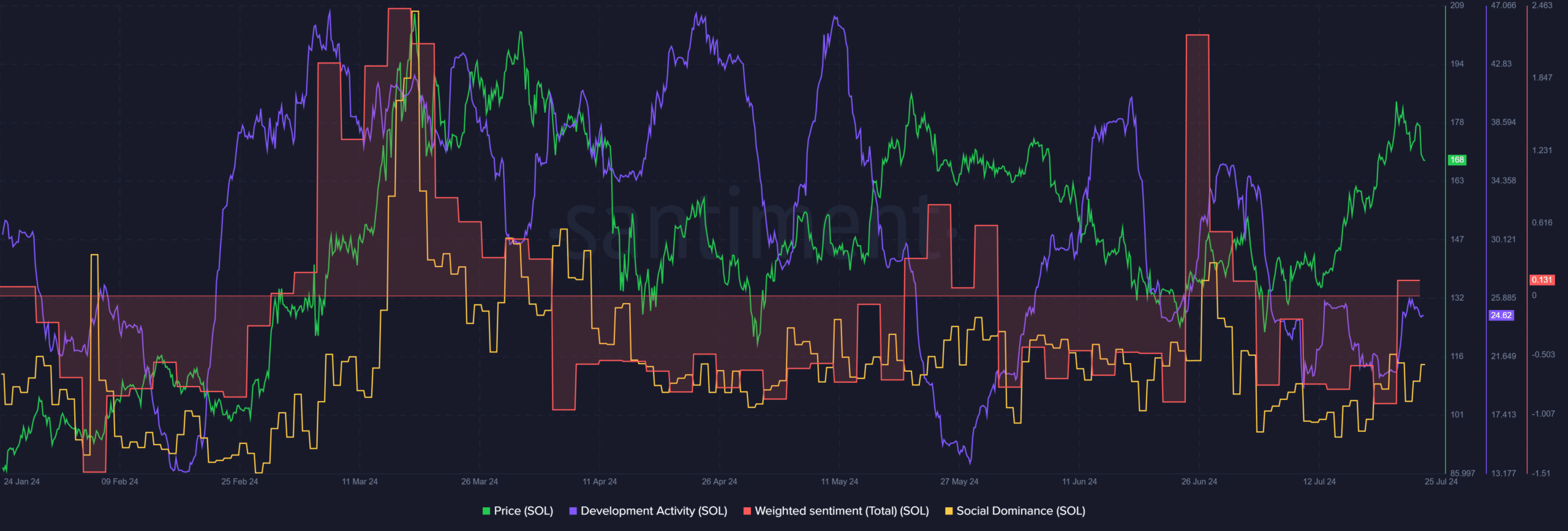

Since June, there has been a decrease in development activity for this project. The metric’s value of 24.62 was lower than both Ethereum’s value of 44.95 and Cardano‘s ADA value of 77.83. However, the weighted sentiment shifted into positive territory instead.

Based on the technical data, the metrics indicated a noticeable improvement in sentiment. An increase in Social Volume (SOL) prominence could strengthen the bullish perspective, but currently, it appears to have minimal impact.

Possibility of a Solana short-squeeze

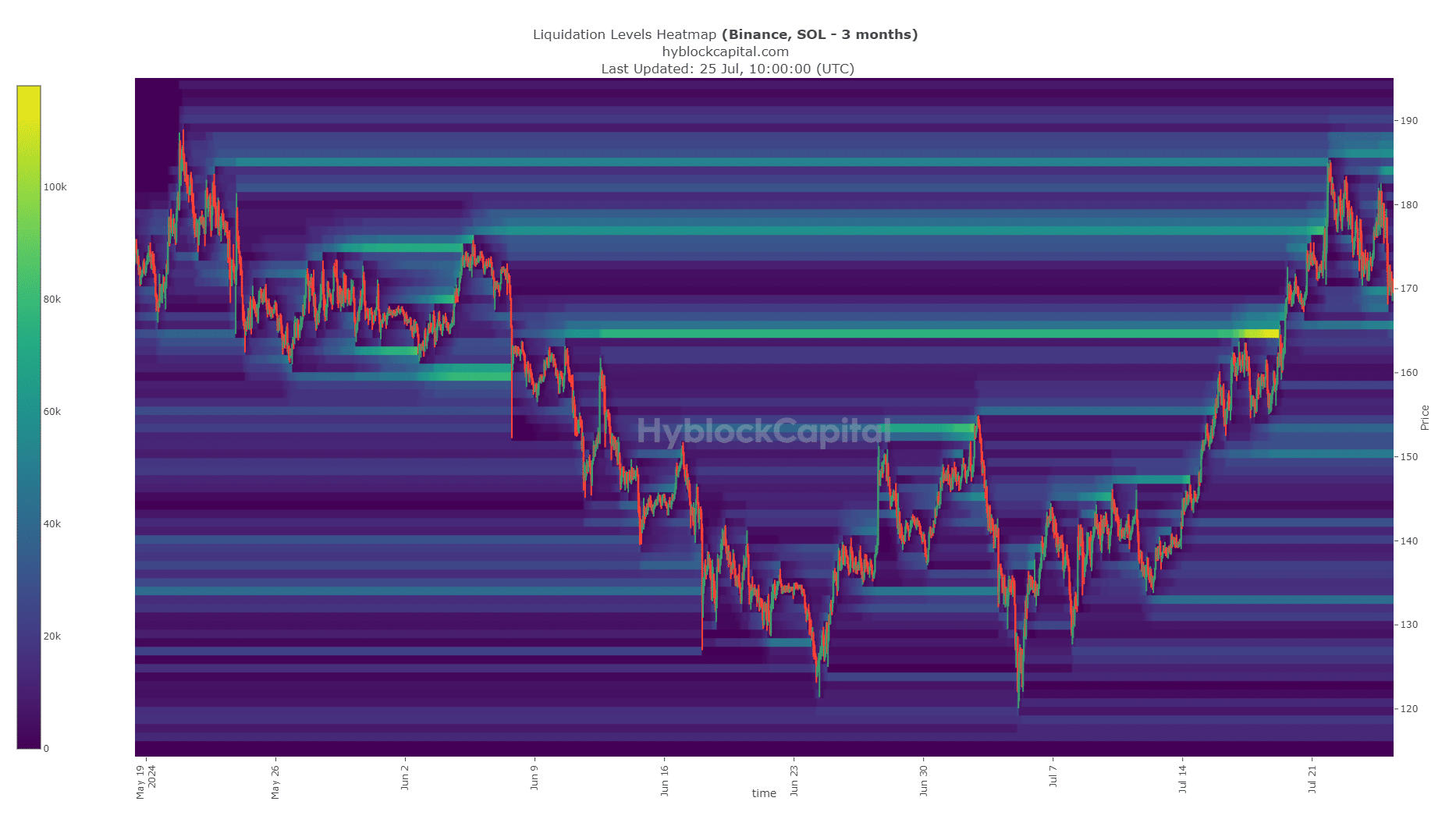

During the past three months, the Solana liquidation heatmap has identified $170 and $185 as significant levels to monitor for potential price movements. Additionally, $165 and the range between $150 and $155 are possible areas where a downtrend could potentially reverse.

The technical support levels are merging with their current position. The price range may persist as the significant $170 area for liquidity was breached, yet the signals from indicators and market sentiment remain favorable.

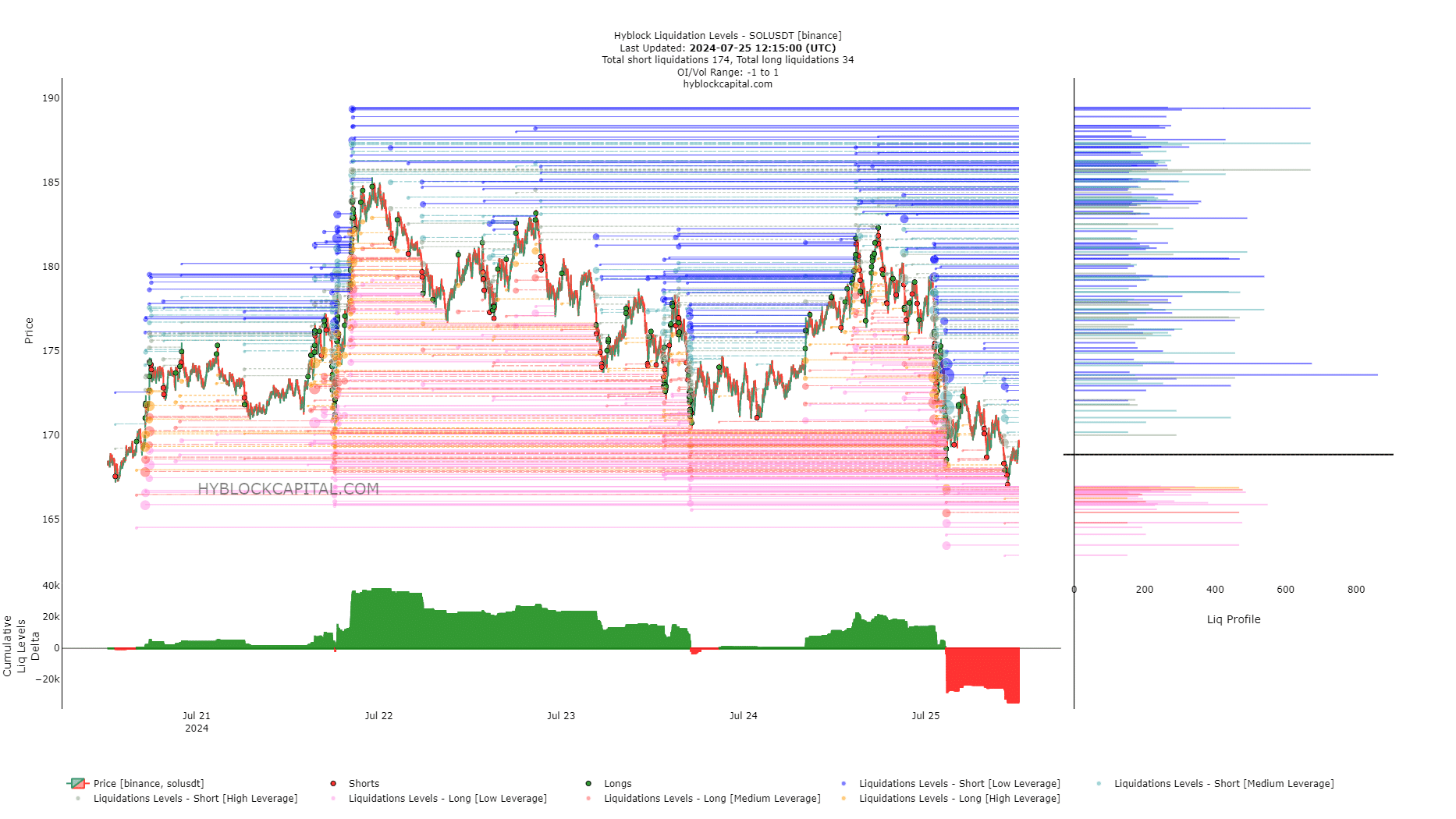

As a researcher studying market trends, I noticed an intriguing development while examining the liquidation levels. The cumulative data indicated a progressively more negative trend, suggesting that short positions were gaining ground.

Realistic or not, here’s SOL’s market cap in BTC’s terms

As an analyst, I would interpret that if prices stabilize between $165 and $167, drawing in additional short sellers, it sets the stage for significant short liquidations. In turn, this could lead to a bullish reversal, effectively defending the lower range boundaries.

Traders should expect Bitcoin [BTC] to rebound near the $165 mark, but they need to remain cautious as the price range could potentially break down. If Bitcoin fails to maintain its position above $64,000, this outcome becomes more likely.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-26 08:07