- Solana’s Open Interest has hit a new ATH.

- SOL has surged by 45.18% over the past month to hit an 8-month high.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed numerous bull runs and bear markets. However, the recent surge in Solana (SOL) has caught my attention, particularly due to its impressive 45% growth over the past month. The fact that it is trading above an ascending trendline for the first time since July is a significant development.

For the first time in about four months, Solana (SOL) is trading above its upward slope. As Bitcoin (BTC) soared to reach a fresh all-time high of $79,000, many altcoins have mirrored this trend.

In the past month, Solana has shown a robust increase in value, reaching its highest point in eight months.

Currently, Solana is being exchanged at $205, representing a significant increase of 25.42% in the past week. Additionally, it has seen a notable rise of 45.18% over the past month when considering its performance on monthly charts.

Currently, the market situation indicates that power lies with the buyers as they gain more influence, while the sellers (bears) seem to be gradually weakening. This trend can be observed through the significant increase in the Open Interest for Solana’s futures contracts.

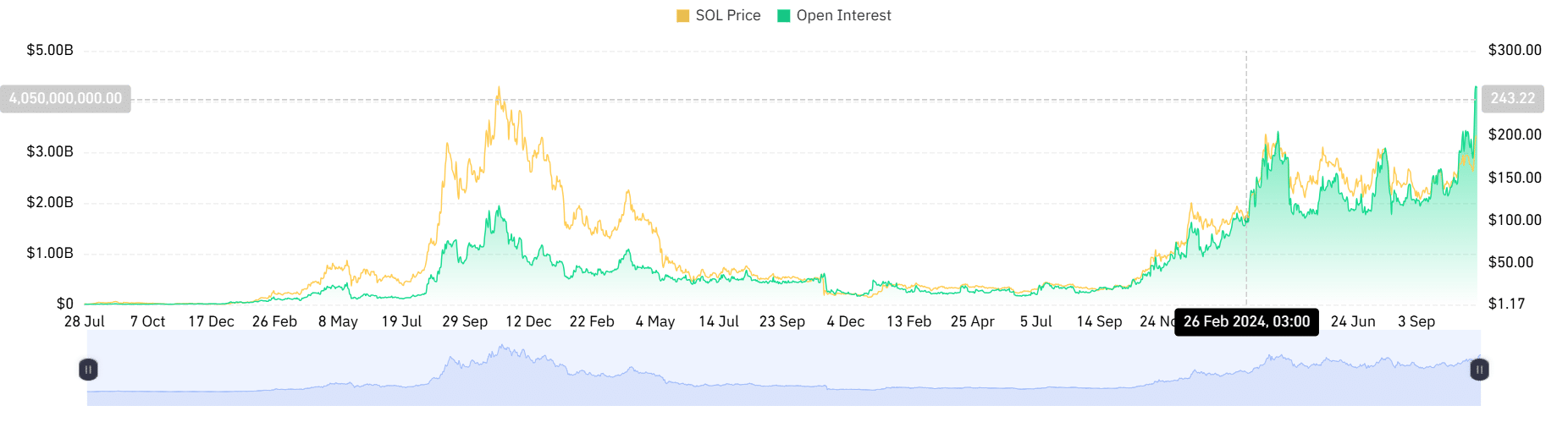

Solana Open Interest hits new ATH

As a crypto investor, I’ve just noticed that according to Coinglass data, Solana’s Open Interest has hit an all-time high of $4.28 billion at this moment. That’s a significant jump of 42.19% over the last seven days.

An increase in Open Interest suggests that traders and investors are becoming increasingly confident, as they’re entering into more contract agreements. This trend significantly contributes to drawing additional buyers, which can further escalate the price upward.

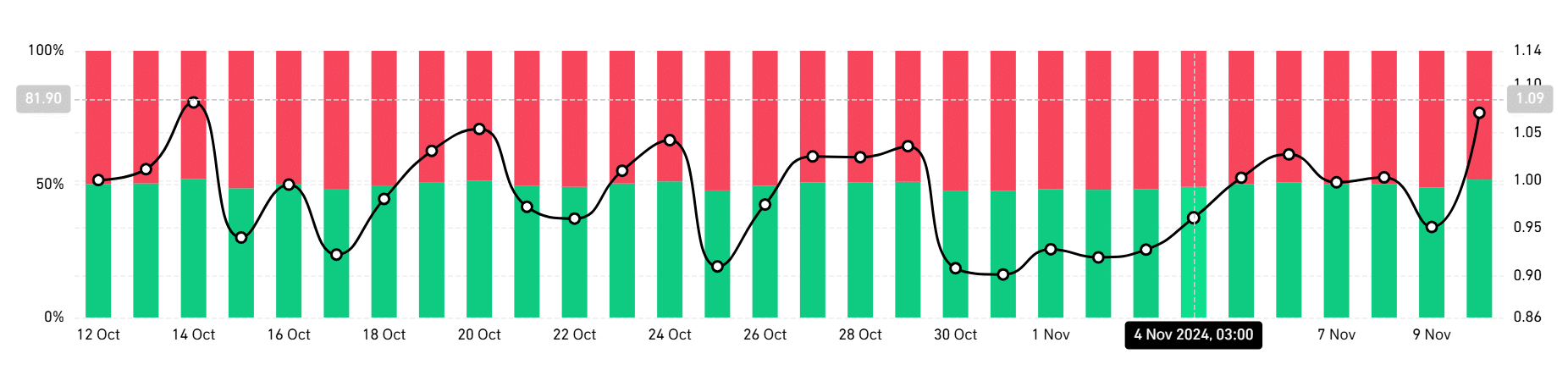

Such confidence among investors can also be observed as the majority of them are opting for buying (taking long positions) rather than selling.

Based on data from Coinglass, the Long/Short Ratio suggests that a majority of market participants are currently holding long positions, implying they expect the prices to rise since they’re primarily betting on an upward trend.

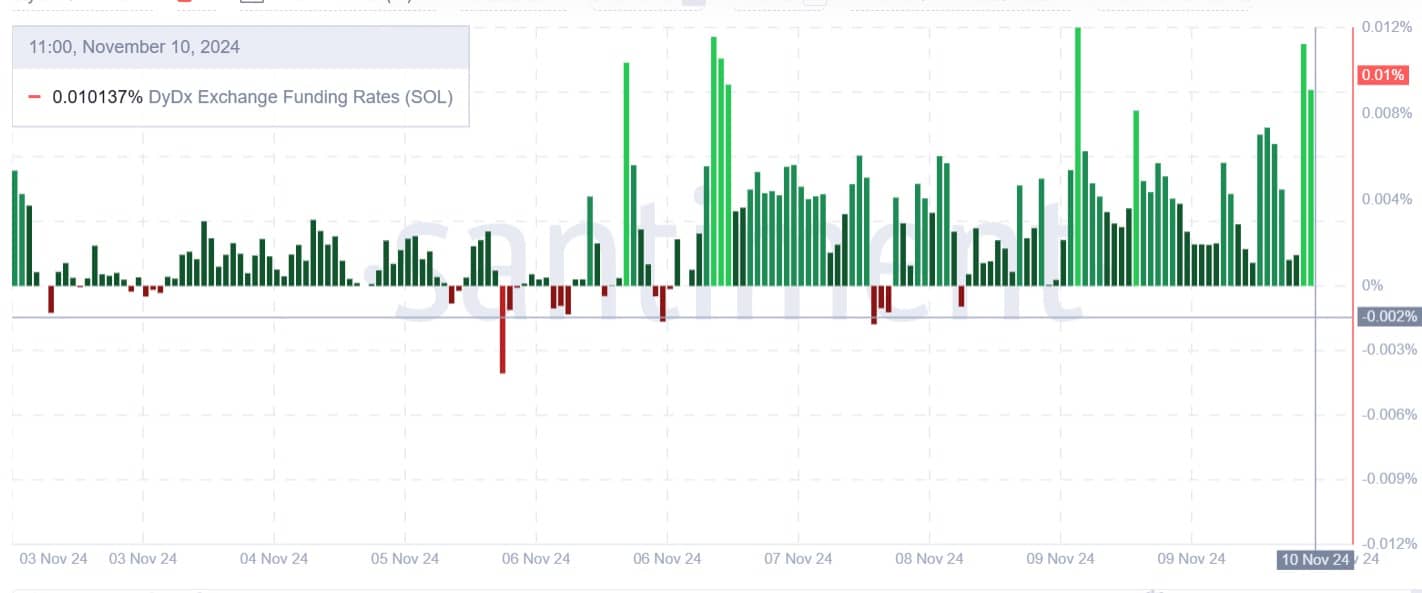

This demand for long positions is further supported by a positive DyDx exchange Funding Rate.

This implies that long position holders are prepared to compensate short sellers for maintaining their positions during market declines.

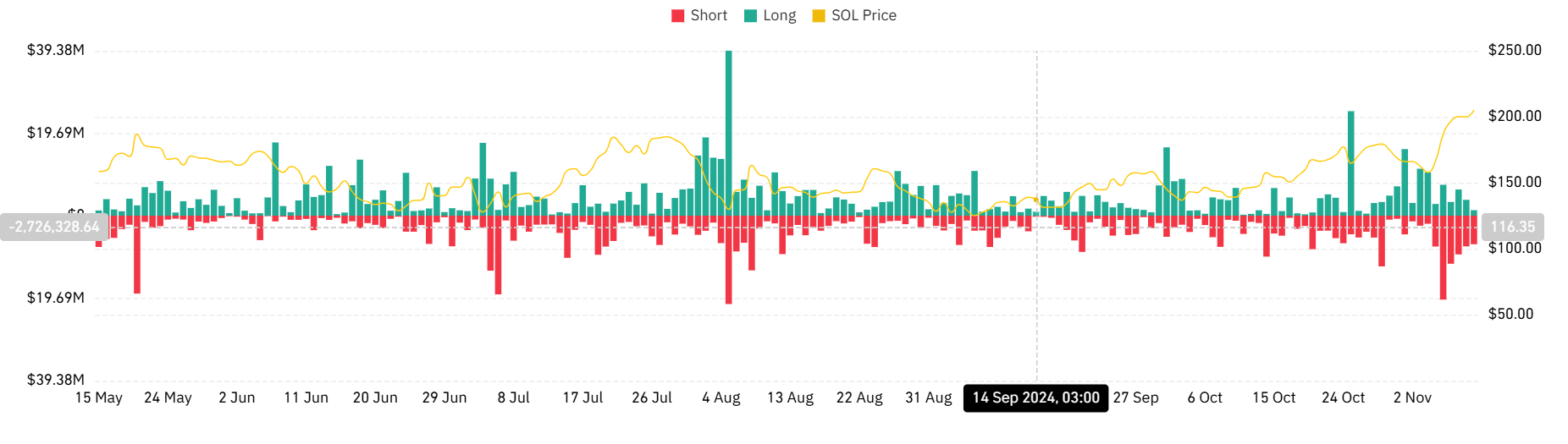

In this scenario, it’s more common to observe larger sell-offs (liquidations) among those who have taken a short position, as opposed to those with a long position. This suggests that traders tend to hold onto their optimistic outlooks (long positions), while the pessimistic bets (short positions) are often forcibly closed out.

Impact on SOL?

Over the past week, heightened purchasing and amassing actions have contributed significantly to an uptrend in Solana’s price. Remarkably, this surge in value can be seen even when compared to the Open Interest of other cryptocurrencies.

Read Solana’s [SOL] Price Prediction 2024–2025

To break it down simply, these extraordinary levels of Open Interest are significantly contributing to the current surge in prices.

Consequently, should the desire for long positions and optimistic attitudes persist, Solana (SOL) could witness additional growth, potentially reaching $246. Breaking past this point would likely result in SOL achieving a brand-new all-time high (ATH).

Read More

2024-11-11 01:11