Ah, the fickle dance of the markets! Solana, once the darling of August’s frenzied optimism, now lies prostrate, its price cooled like yesterday’s borscht. In the past week, it has traded flat-a stagnant pond in the vast ocean of crypto volatility. And in the last 24 hours? A slip of 1.1%, a mere whisper of its former vigor. Yet, let us not forget the monthly gains, still puffed up at 26%, and the three-month rally of 35.8%. But for those dreaming of August’s glory days, the on-chain data sings a dirge, not a hymn.

Profit-taking, that voracious beast, has sunk its teeth into Solana’s flesh. Another metric, lurking in the shadows, has turned as bearish as a Siberian winter. Together, they cast doubt on Solana’s ability to ascend further, at least not without shedding a few more tears-and tokens.

Two Metrics Whisper of Greed and Fear

Behold, the on-chain data reveals a grim truth: nearly 95% of Solana holders were in profit as of September 3, a figure rivaling the six-month peak of 96.59% on August 8. Even now, the reading hovers around 87%, a feverish level that screams, “Sell! Sell! Sell!” 🤑 For when the masses sit on gains, the temptation to flee grows as irresistible as a warm stove in a cold gulag.

History, that relentless teacher, confirms this. Recall August 2, when the profit supply plummeted below 54%, and Solana’s price languished at $158.53. From that nadir, it soared to $214.51 by August 28-a 35% gain. The lesson? Solana thrives when fewer hands clutch their profits. Otherwise, every ascent is met with a barrage of sell orders, a testament to humanity’s unquenchable thirst for quick gains.

Craving more of this crypto wisdom? 🧠✨ Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

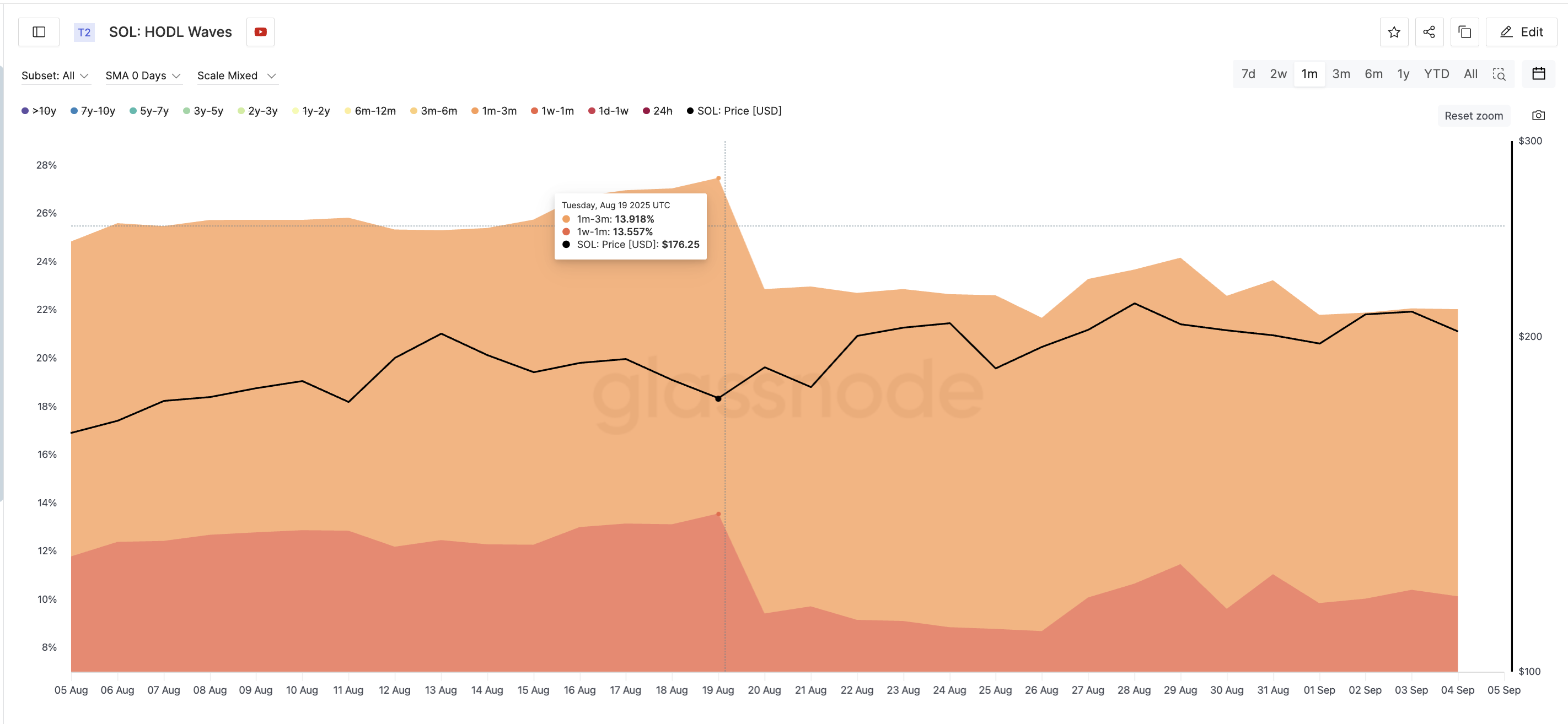

The HODL Waves metric, that silent observer of human folly, tells a similar tale. Short-term holders-those who clung to their tokens for a mere week to three months-peaked on August 19, when Solana traded near $176. Together, they controlled 27% of the supply. Since then, their share has shriveled to 22%. These fickle souls are selling into strength, a real-time symphony of profit-taking.

Weak Money Inflows: The Canary in the Coal Mine

On the price chart, Solana faces resistance at $218, a fortress as impenetrable as the Kremlin walls. A clean close above this level would signal a breakout, but hope is as scarce as a kind word in a Soviet labor camp. The Chaikin Money Flow (CMF), that harbinger of buying or selling pressure, has weakened like a dissident’s resolve under interrogation. On July 22, when Solana hit a local high, CMF stood at 0.31, a sign of robust inflows. Since then, the price has climbed, but CMF has plummeted to -0.01.

This divergence is a silent scream: whales and institutions are not pouring fresh money into SOL. Without their support, profit-takers face little resistance, leaving rallies as fragile as a snowflake in spring. The absence of offsetting demand makes a deeper pullback more likely than a respite, should key supports falter.

On the downside, support levels await at $194, $186, and $173, like lifeboats on a sinking ship. For now, Solana holds steady, but unless CMF improves, any hope of recovery remains as distant as a fair trial in a totalitarian regime.

Read More

- Darkwood Trunk Location in Hytale

- Best Controller Settings for ARC Raiders

- Hytale: Upgrade All Workbenches to Max Level, Materials Guide

- How To Watch A Knight Of The Seven Kingdoms Online And Stream The Game Of Thrones Spinoff From Anywhere

- Ashes of Creation Rogue Guide for Beginners

- Donkey Kong Country Returns HD version 1.1.0 update now available, adds Dixie Kong and Switch 2 enhancements

- PS5’s Biggest Game Has Not Released Yet, PlayStation Boss Teases

- Nicole Richie Reveals Her Daughter, 18, Now Goes By Different Name

- When to Expect One Piece Chapter 1172 Spoilers & Manga Leaks

- Olympian Katie Ledecky Details Her Gold Medal-Winning Training Regimen

2025-09-05 18:33