- Popcat saw an uptick in volatility that could be good news for lower timeframe traders.

- The technical indicators showed upward momentum is likely to win soon.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I’ve witnessed the volatility that Popcat [POPCAT] has experienced over the past few weeks. The price action and technical indicators suggest an uptick in volatility that could be good news for lower timeframe traders.

POPCAT, with the nickname [Popcat], was poised for a potential breakthrough beyond the nearby resistance level and value gap. The intrinsic data indicated that investor sentiment leaned towards negativity. However, traders could potentially reap rewards if POPCAT‘s upward trend persisted.

Recent market turbulence resulted in numerous sell-offs, primarily affecting long positions held in July. Despite encountering obstacles around the $60,000 mark, the near-term perspective for Bitcoin remains optimistic.

Late buyers can wait for this to happen before bidding

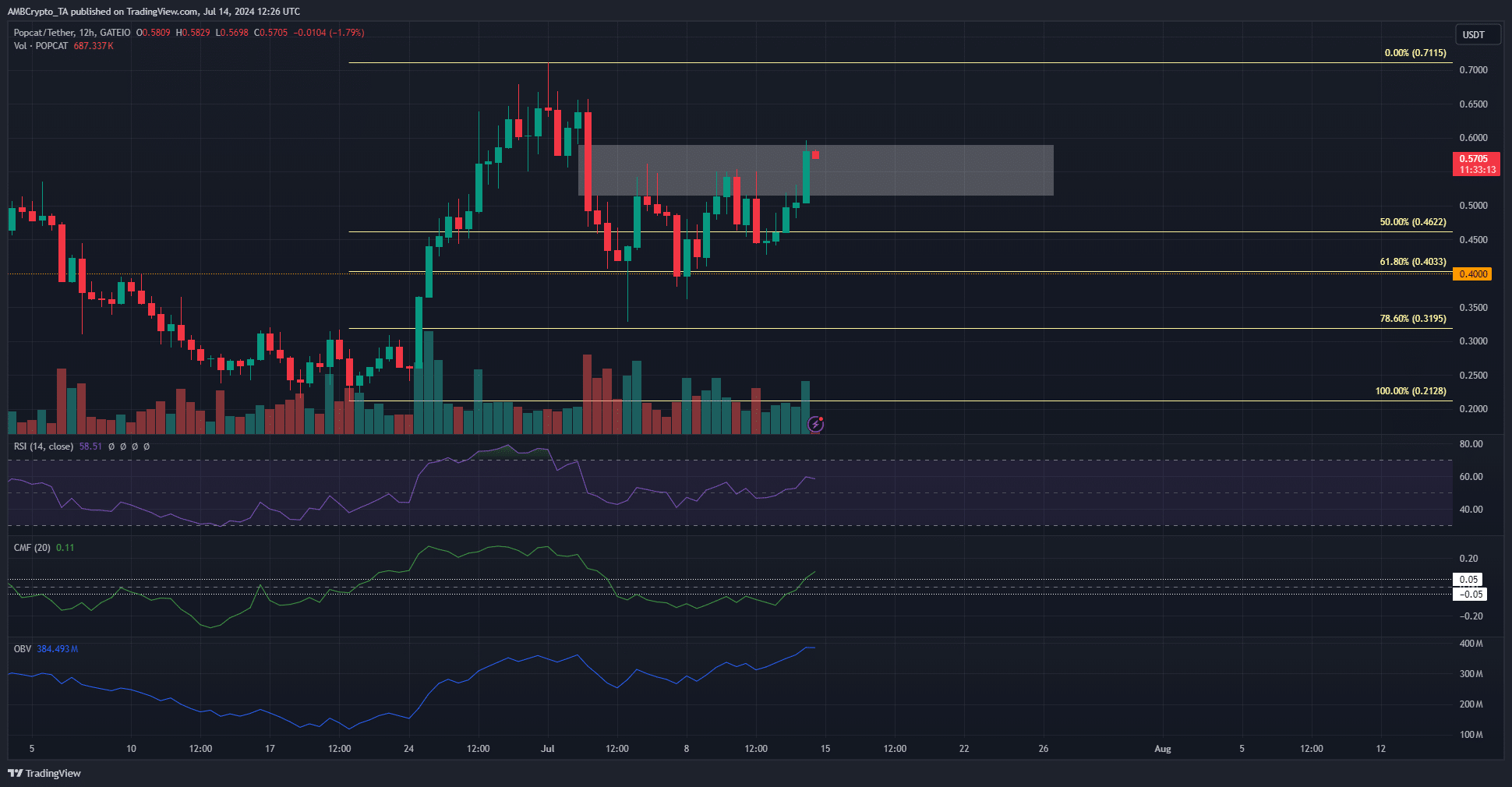

Based on the strong surge in late June, a series of Fibonacci retracement levels were determined. The market’s volatility over the past two weeks caused POPCAT to revisit the 61.8% level at $0.403 and come close to challenging the 78.6% level at $0.319.

As an analyst, I’ve noticed that the significant price drop on the 12-hour chart, which occurred on the 3rd of July, created a noticeable value gap (represented by the white box). This area could potentially function as resistance and impede any potential bullish momentum.

Despite a recent pullback in prices, the On-Balance Volume (OBV) continued to climb upward, signaling a net buying trend. Additionally, the Chaikin Money Flow (CMF) surpassed the +0.05 threshold, demonstrating robust capital influxes.

With a RSI score of 58 indicating positive momentum, there were signs that the meme coin was poised to surpass the $0.59 resistance level.

Exchange flow trends and sentiment at odds

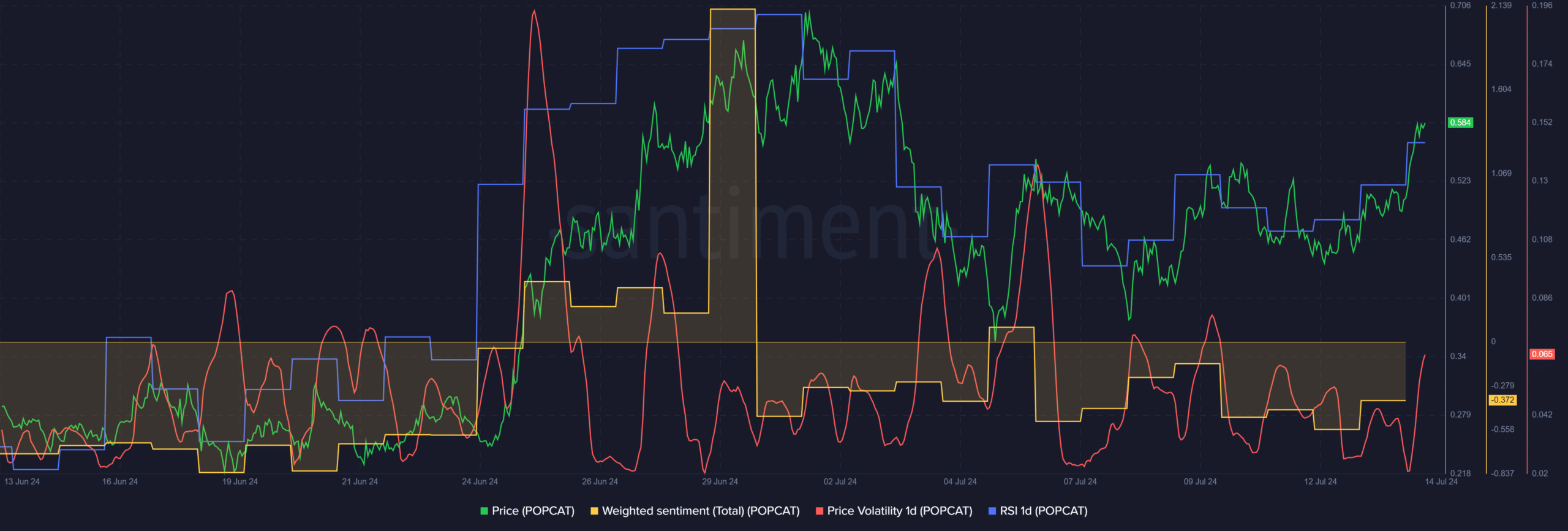

Over the last fortnight, the overall feeling, taking into account both positive and negative opinions, has remained unfavorable. Within the previous day, market instability emerged as prices significantly increased.

As a crypto investor, I would interpret a daily Relative Strength Index (RSI) of 62 as a potential buying signal. This indicator suggests that the asset has been gaining in value over the past several periods but isn’t yet overbought. Consequently, scalp traders might consider entering long positions to capitalize on the ongoing upward trend.

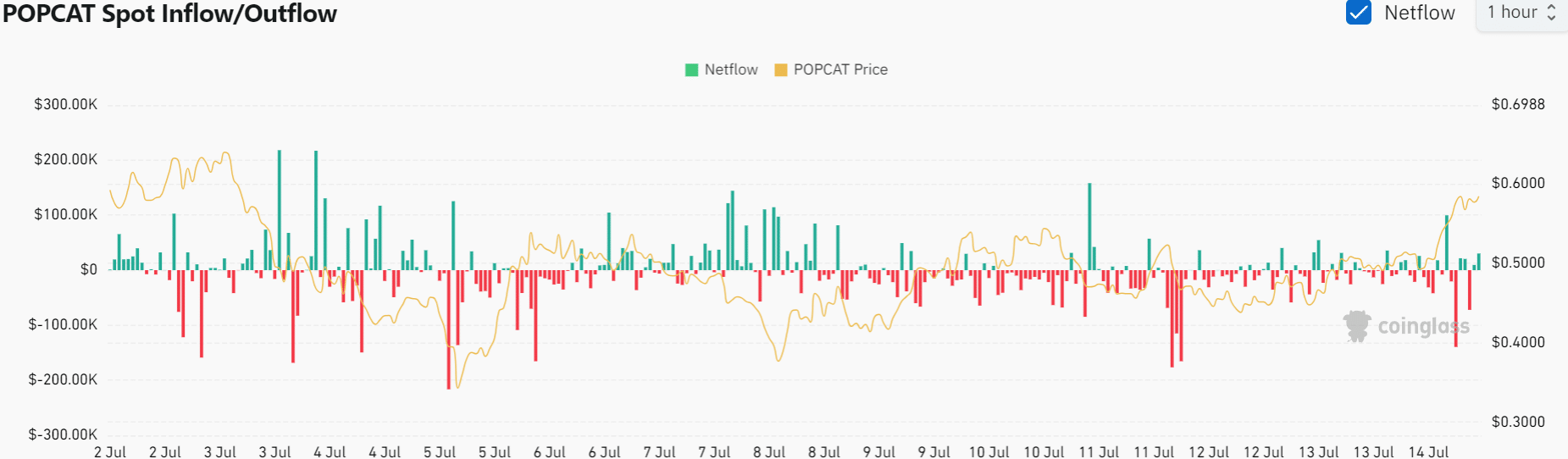

Over the last two days, despite a gradual increase in POPCAT‘s price, there was no significant surge in deposits of this cryptocurrency onto exchanges as indicated by the netflow chart I analyzed.

There was a possibility that prices would keep climbing, as selling forces didn’t present a significant obstacle.

Read Popcat’s [POPCAT] Price Prediction 2024-25

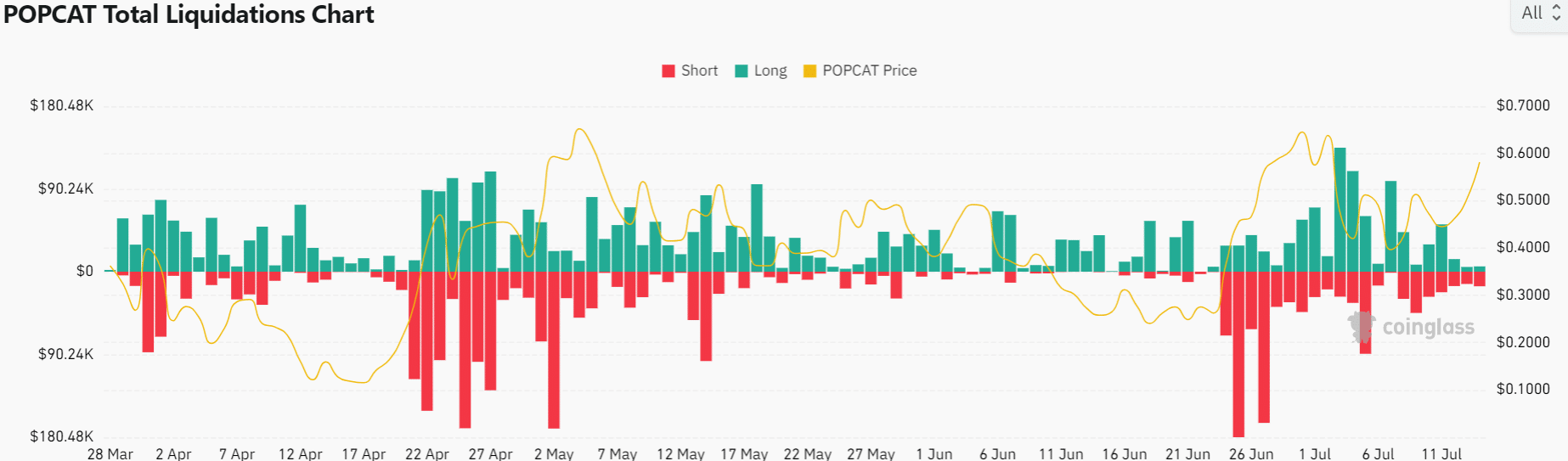

Since the 26th of June, the market’s volatile nature led to significant losses for both long and short position holders. Traders should monitor this chart closely once the token price surpasses the $0.6 threshold.

As a researcher studying market dynamics, I have observed that a rapid succession of small sell orders can lead to a sudden increase in asset prices. Swift traders, also known as scalpers, seize this opportunity to make a profit by buying and selling these assets within a short time frame before the price reverts back to its previous level.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-07-15 06:15