- Oh dear, SOL has taken a nosedive of 35.5% over the past months. What a rollercoaster!

- With daily Active Addresses dwindling, Solana’s on-chain activity is waving a white flag. 🏳️

Once upon a time, just three weeks ago, Solana [SOL] basked in the glory of a local high of $195. But alas, the winds of fortune have shifted, and now it finds itself at a three-month low, like a sad puppy left out in the rain.

So, what’s behind this dramatic decline? Analysts are scratching their heads, suggesting that Solana is grappling with a fundamental crisis of low on-chain activity. It’s like trying to run a marathon with one shoe! 🥴

Solana’s On-chain Activity Decline

As the months have rolled by, Solana’s chain activity has been on a steady decline, like a slow leak in a tire. The number of daily active addresses has plummeted to a three-month low of 3.5 million. Talk about a ghost town!

When active users start to vanish, it’s a clear sign that market interest is taking a vacation. Fewer active users often lead to less on-chain activity, which could mean prices are heading south faster than a bird in winter.

Historically, fewer users mean lower prices, as demand takes a nosedive. It’s a sad, sad song. 🎶

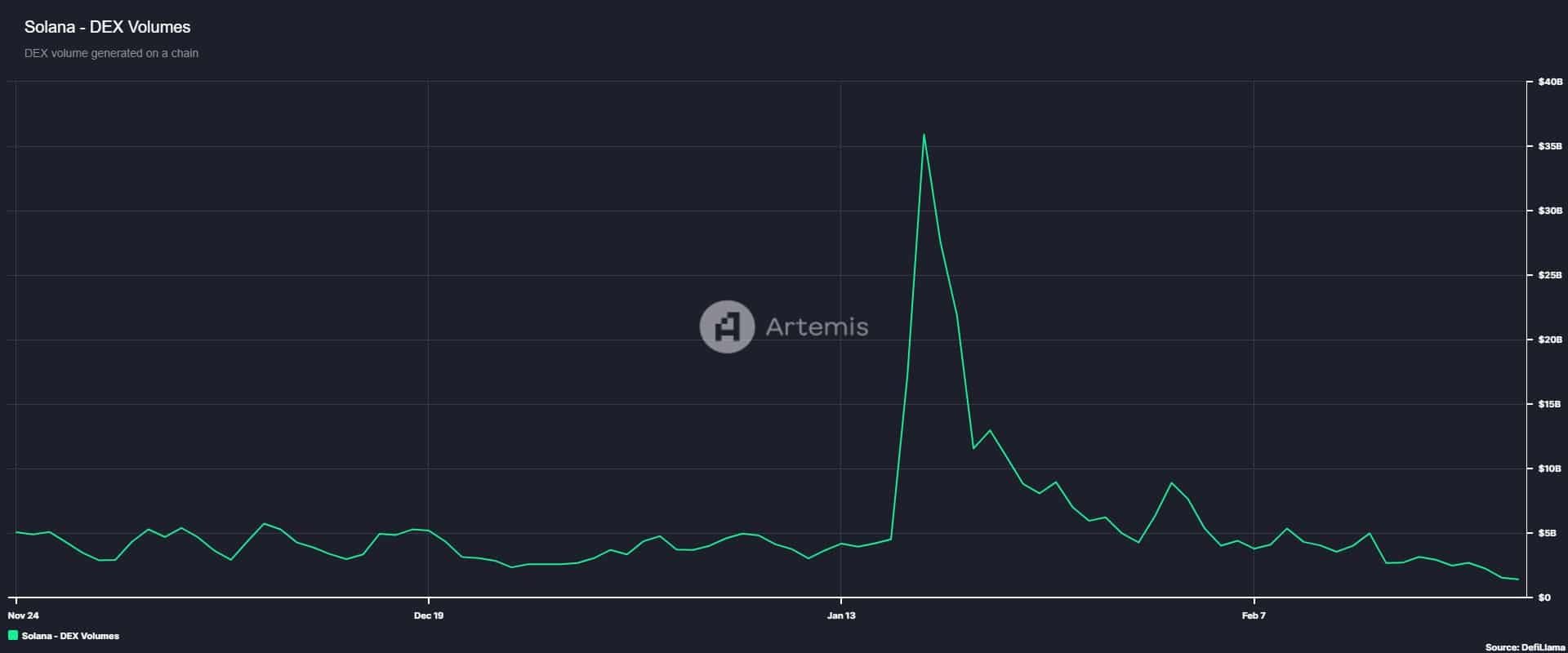

The decline in on-chain activity is further highlighted by the dwindling Decentralized Exchange (DEX) trading volume. According to Artemis data, it has dropped to a four-month low of $1.5 billion. Ouch!

This drop suggests that trust in the network is waning, as investors are opting for Centralized Exchanges (CEX) like they’re the last slice of pizza at a party. 🍕

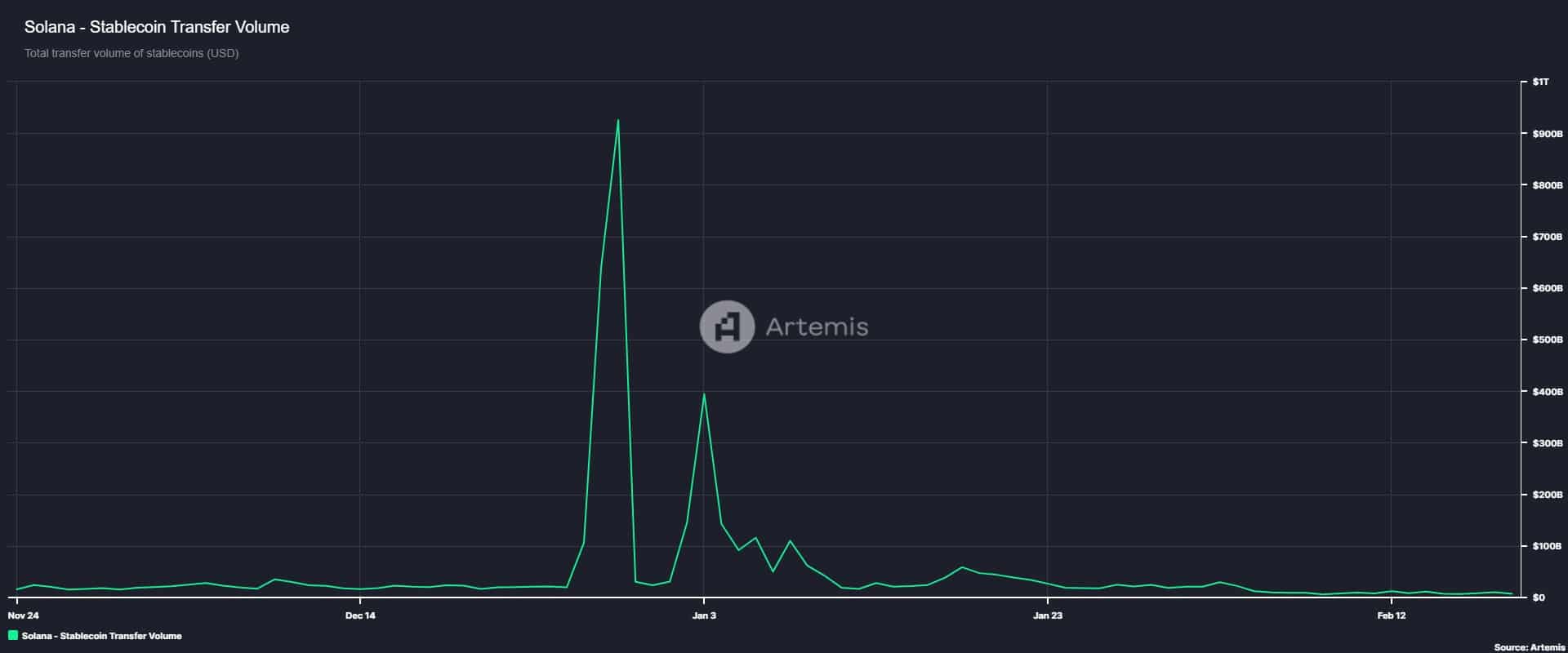

Moreover, Solana’s stablecoin transfer volume has nosedived to $7.1 billion, a far cry from the $394 billion it was just a month ago. It’s like watching a balloon deflate in slow motion.

This significant drop indicates that investors, especially the big fish, are eyeing other chains like Ethereum’s [ETH]. It’s a classic case of “the grass is greener on the other side.” 🌱

It also reflects a risk-off sentiment among SOL investors, who are probably clutching their pearls right now.

Impact on SOL?

As expected, the reduced on-chain activity has cast a shadow over Sol’s price movements. This has put a damper on SOL’s demand side. Low demand usually leads to less buying pressure, leaving sellers to dance alone at the market party.

As of now, Solana is trading at a three-month low of $158, marking a 7.09% decline on daily charts. It’s like watching your favorite team lose in the finals. Solana has also dropped by 35.52% over the past month. Yikes!

With such strong downward pressure and low demand, SOL could very well continue its downward spiral. If this trend keeps up, SOL risks dipping to $154. But hey, if buyers decide to swoop in and buy the dip, we might just see SOL bounce back to $175. Fingers crossed! 🤞

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-24 18:22