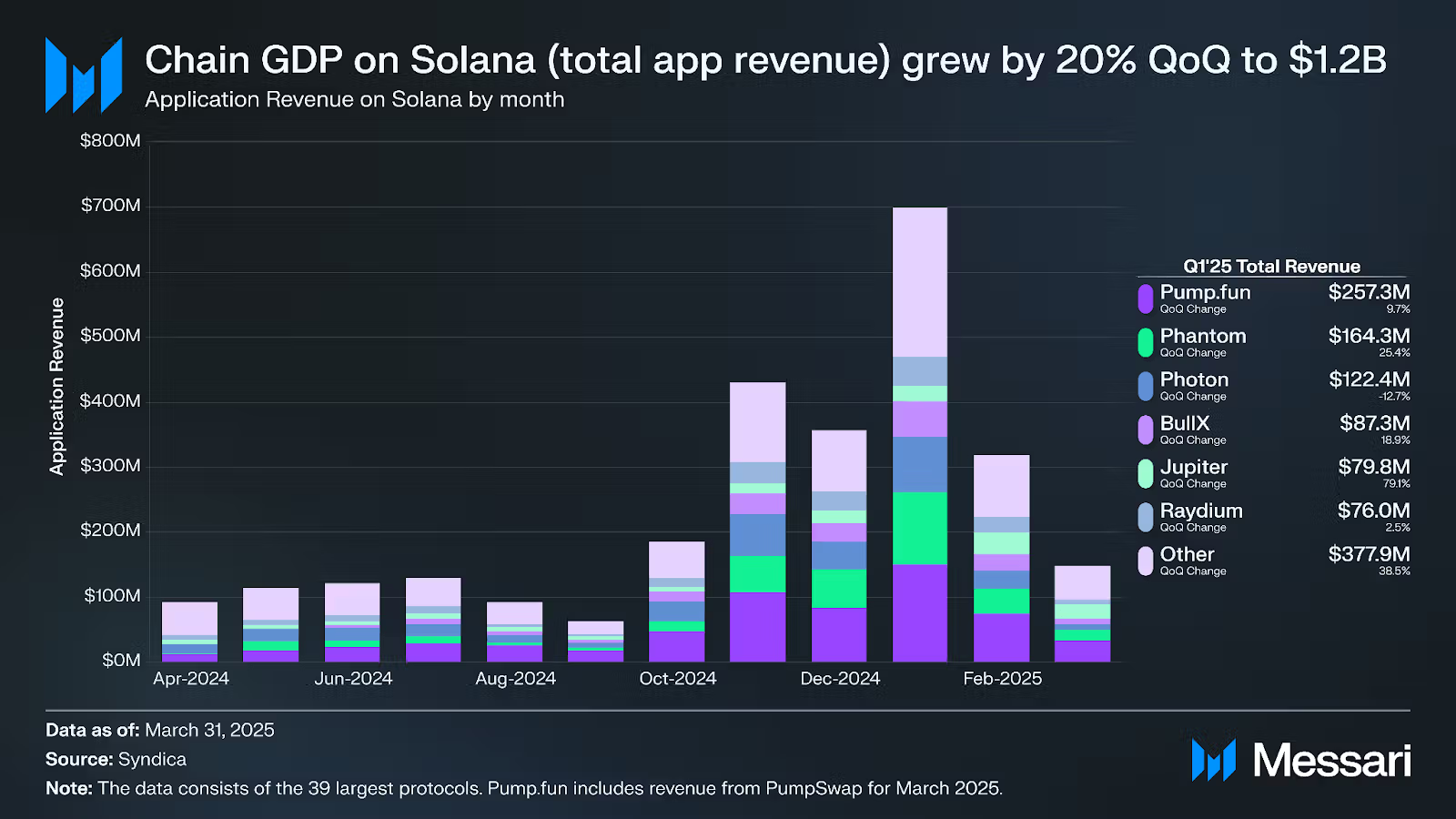

In the mystical realm of Q1 2025, Solana’s app revenue jumped a daring 20%, while its TVL decided to take a leap off the financial cliff with a 64% plunge, and transaction fees slid down by 24%. It’s like watching a superhero trying to juggle flaming torches while riding a unicycle—impressive, but definitely dangerous.

Solana continues to stand tall in the crypto circus, but whether it can keep its balance amidst the chaos of market challenges and fickle fortunes remains to be seen. One thing’s for sure: it’s a show worth watching—preferably with popcorn.

Q1 Revenue Hits $1.2 Billion: January Star of the Show

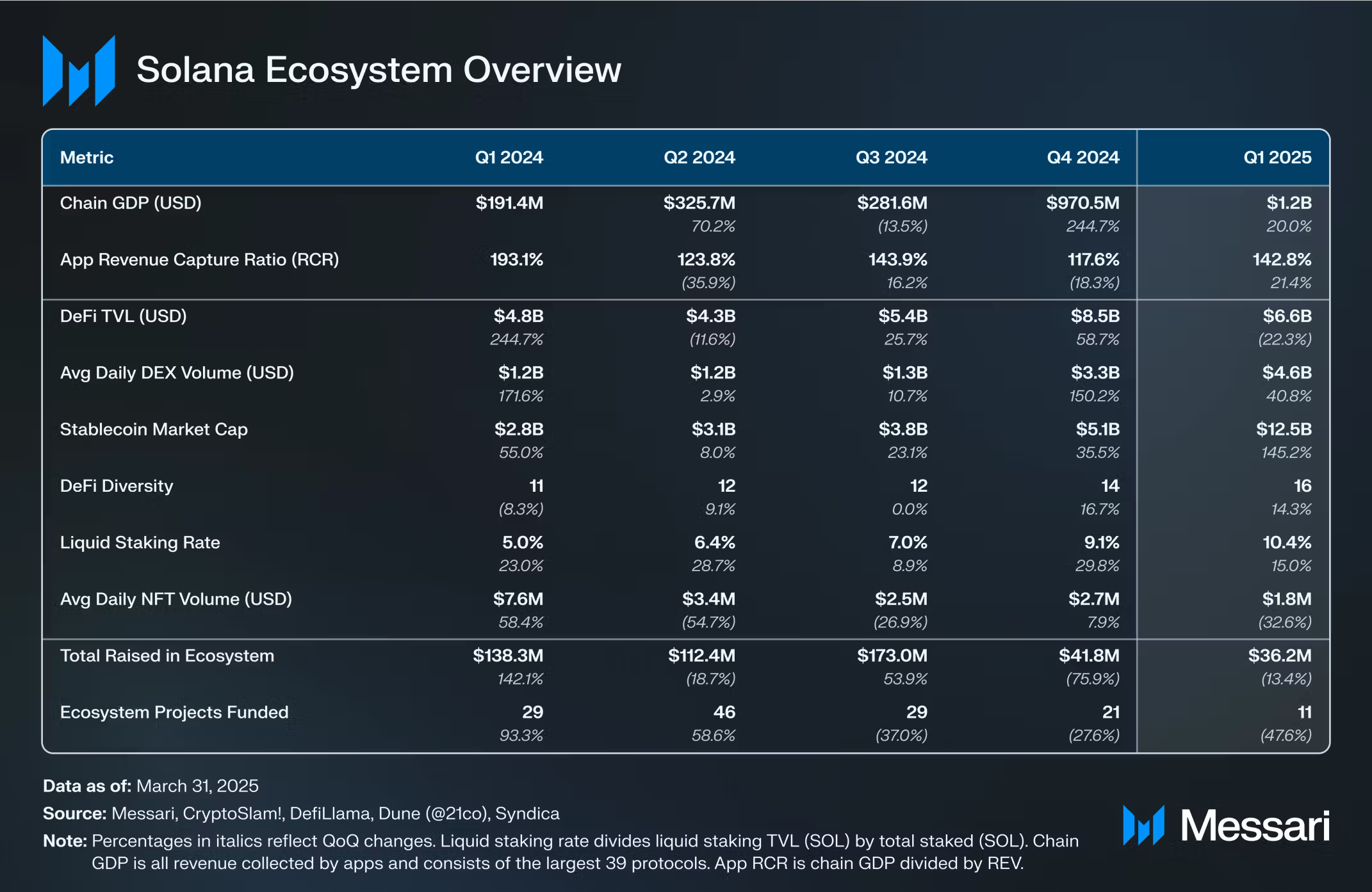

According to some wise folks at Messari, Solana (SOL) raked in a staggering $1.2 billion in Q1 2025. That’s a 20% bump from the previous quarter, with $970.5 million earned during the month of January alone—a figure so shiny and bright it probably blinded some investors. This quarter was Solana’s best in a year, a true comeback story after a rollercoaster ride through volatility-ville.

“Solana’s economy is booming,” Crypto Banter proudly proclaimed on the social media echo chamber known as X.

January’s contribution was nearly 60% of the total quarterly income—because why have a balance when you can have a fireworks display of revenue? This growth is all about applications flourishing on Solana, especially meme coins, DEXs, and wallets—because who doesn’t love a good meme? 🐸

Solana’s secret sauce? Low fees and speedy processing—like a cheetah on roller skates—giving it a competitive edge over big, lumbering rivals like Ethereum.

Pump.fun: The Meme Machine That Made It Rain 💸

Among the crowd of Dapps, Pump.fun stole the show with a whopping $257 million, earning it a big fat slice of the Total Ecosystem Revenue Pie. It’s all about meme coins, baby, especially after the Trump meme coin launched on January 17, turning the trading floor into a meme-filled frenzy. But beware—the more fireworks, the more smoke, and the market’s been coughing a lot lately.

Following Pump.fun was Phantom, the wallet that’s as popular as free pizza in a college dorm, bringing in $164 million. Its secret? Friendly interface and smooth integration—because who wants stress when managing your digital gold?

Photon, the third wheel in the trio, pulled in $122 million—a steady 13% growth showing it’s in no mood to slumber, not while there are memes to be made.

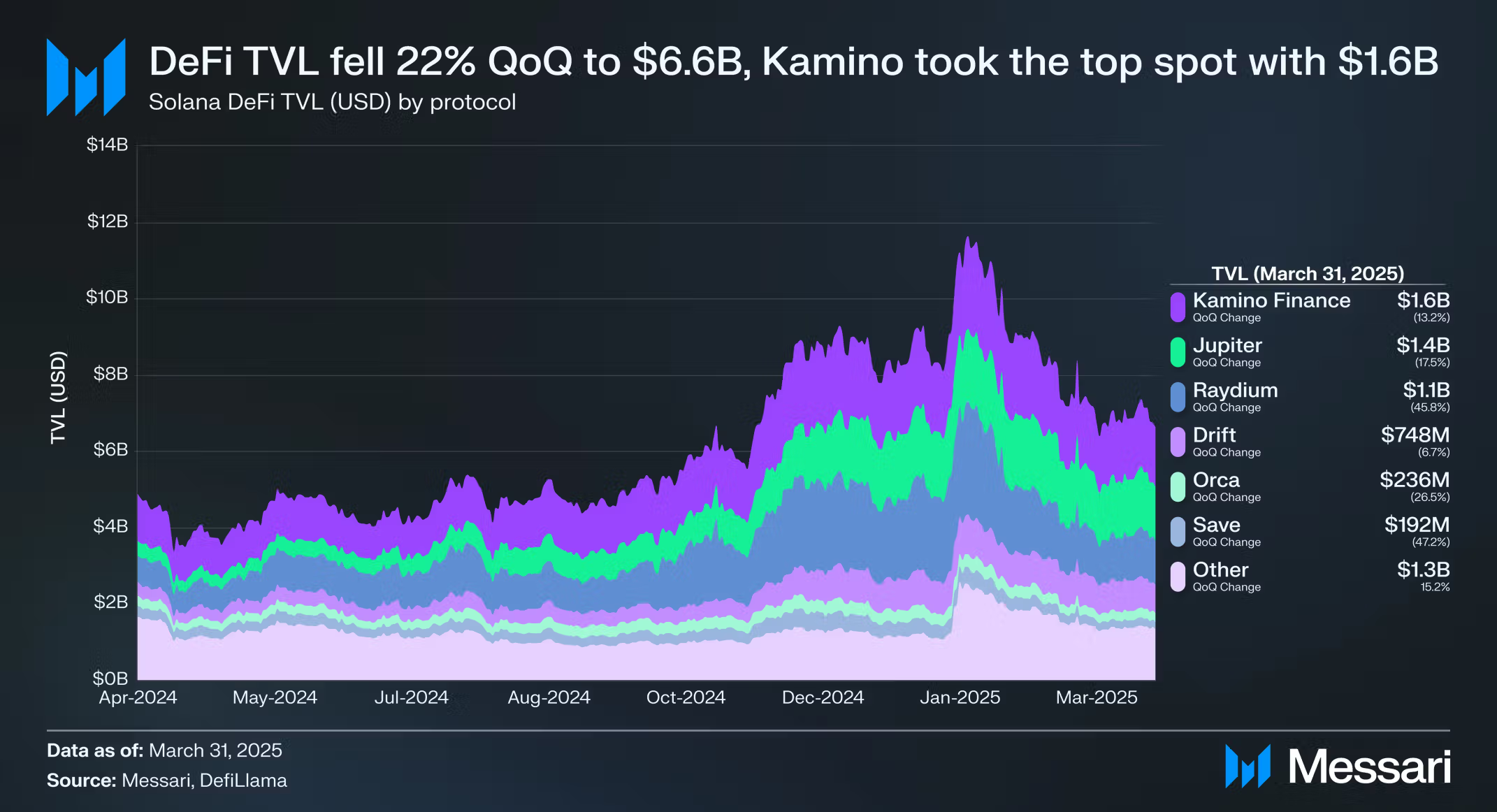

DeFi TVL: The Great Disappearing Act 🎩✨

Despite the shiny new revenues, the total value locked in DeFi on Solana took a nosedive of 64%, landing at a modest $6.6 billion. Looks like investors got spooked and ran for the safer haven of stablecoins, because who doesn’t love a good safety blanket in volatile times?

In contrast, stablecoins on Solana had a smashing breakthrough, soaring 145% to hit $12.5 billion. USDC led the charge, ballooning by 148% to a cool $9.7 billion—about four times more than its arch-rival USDT, which also grew by 154% to $2.3 billion. Because if you can’t beat volatility, just buy more stablecoins and call it a day.

Fees? What Fees? 🚀

One tiny silver lining—transaction fees on Solana in Q1 dropped by 24%, now sitting at a bargain price of 0.000189 SOL ($0.04). It’s like getting a fancy latte but paying with Monopoly money—win-win for users clamoring for cheaper trades in meme coins, DeFi, and NFTs.

While app revenues hit the billion-dollar mark and the ecosystem tries to hold on, the 64% TVL crash sends a message: the road ahead is bumpy, and Solana’s ecosystem is more like a trampoline—fun, but with a risk of bouncing too high or landing on a cactus.

As of now, SOL’s trading at $161.22—perhaps resting before its next ascent. The charts look like a giant ascending triangle—meaning, if the pattern holds, we’re about to see Solana rocket into the stratosphere (or at least a rooftop). Or so the prophets of technical analysis hope.

“$SOL – Solana’s monthly chart shows a huge ascending triangle. Breakout will send it soaring,” slurred the analyst, probably after too much coffee.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-05-19 12:09