-

SOL has surged by 7.01% over the past week as market sentiment shift.

Spot CVD is the main driver as buyers dominant the market.

After years of navigating the volatile and unpredictable waters of the cryptocurrency market, I can confidently say that the recent surge in Solana (SOL) has caught my attention. With a 7.01% increase over the past week, SOL is trading at $146.88 as I write this, which is certainly something to take note of.

For the last seven days, Solana (SOL) has been on an upward trajectory. At present, it is being traded at approximately $146.88. This represents a 7.01% rise compared to its price a week ago.

Before this upward trend, SOL had been on a continuous decline, reaching a low point of $120. But since that time, the cryptocurrency has climbed to a recent peak of $152.

Despite these gains, Solana remains 43% below its ATH of $259.96. Therefore, the current market conditions raise questions about whether Solana is on the verge of a more sustained recovery and what’s driving the recovery.

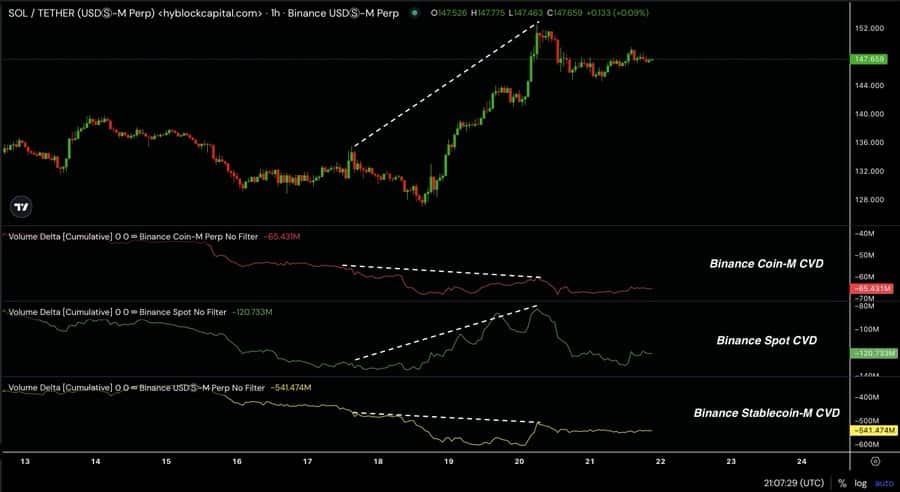

According to HyblockCapital analysts, the primary cause fueling the recent market surge is heightened demand for purchasing, which they attribute to significant interest in both current (spot) CDV and perpetual (Perp) CVD.

Prevailing market sentiment

According to Hyblockcapital’s assessment, the rise was fueled significantly by increased demand from both spot buyers and those showing keen interest in purchasing.

Based on this assessment, it’s the increased demand for genuine SOL tokens that seems to be driving up prices significantly. This indicates that active traders, or spot buyers, are in control of the market, and their continuous demand for the altcoin is causing the prices to rise steadily.

On the other hand, analysts have noted that Perp CVD displays some discrepancies. In other words, it seems that those trading perpetual futures might be exhibiting a distinct pattern in their trades.

When the cost increases due to immediate purchases (spot buying) as opposed to the perpetual contract funding rate (CVD) decreasing or staying constant, this suggests that the futures market may not be as bullish as those trading in the spot market.

Given that the primary factor influencing it is the increased demand for SOL, the price of Spot CVD is consequently rising. Such a trend often suggests the possibility of a longer-term, more stable increase in value.

What SOL charts suggest

As a researcher, I find the indicators presented by Hyblockcapital to be quite encouraging for a possible surge in Sol’s value. Given the current market climate, these indicators may well contribute to further price increases for Solana, making it an interesting prospect for potential investors.

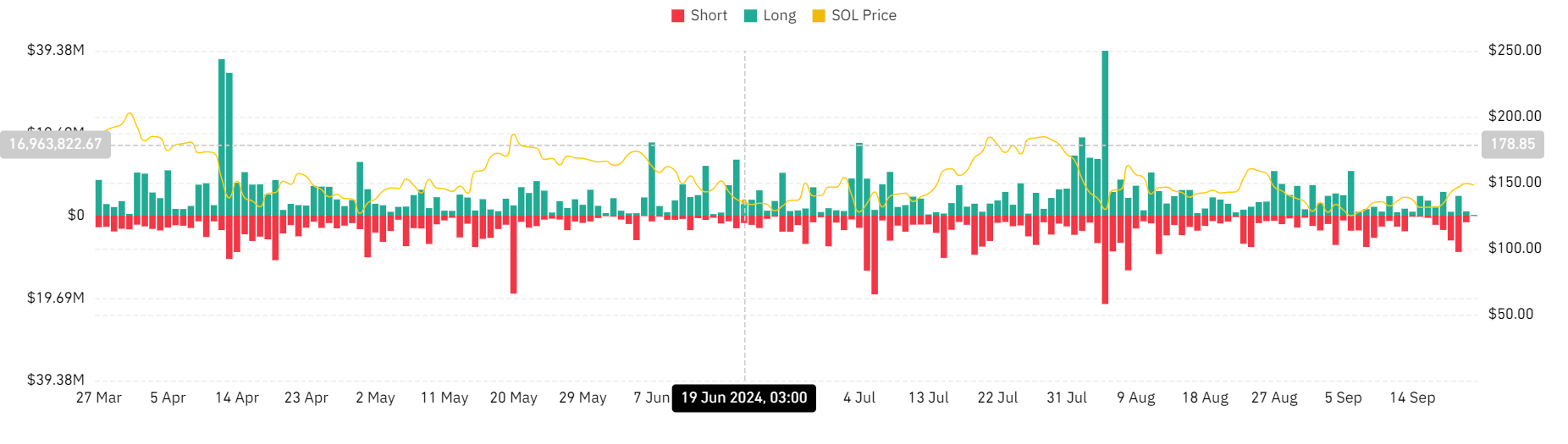

In the last four consecutive days, long position holders on Solana’s Dydx exchange have been making payments to short position holders, suggesting that this trend has been favorable for the short positions.

This suggests that the market sentiment is bullish as there is a higher demand for long positions.

Furthermore, the preference for long positions is reinforced by a favorable funding rate across exchanges. This indicates that those holding long positions are prepared to pay extra to maintain their positions.

To wrap up, during the past four days, there’s been an unprecedented increase in the closure of short positions, while long positions have experienced a decrease. The maximum liquidation for short positions reached a staggering $8.65 million, whereas long position liquidations dropped to a minimum of $185.7k during this timeframe.

This shows investors betting against the markets are forced out of their positions.

Read Solana’s [SOL] Price Prediction 2024–2025

From my perspective as a researcher, I’m observing an evolving trend in the market attitude towards Solana. According to Hyblockcapital, there seems to be a growing appetite for Solana, particularly for long-term investment opportunities.

With optimistic feelings about the market, altcoins are poised for additional price increases. Consequently, under current circumstances, Solana (SOL) may try to surpass the $160 resistance in the near future. If it manages to break through this level, SOL’s strength could increase, allowing it to aim for the $185 resistance next.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-09-22 16:08