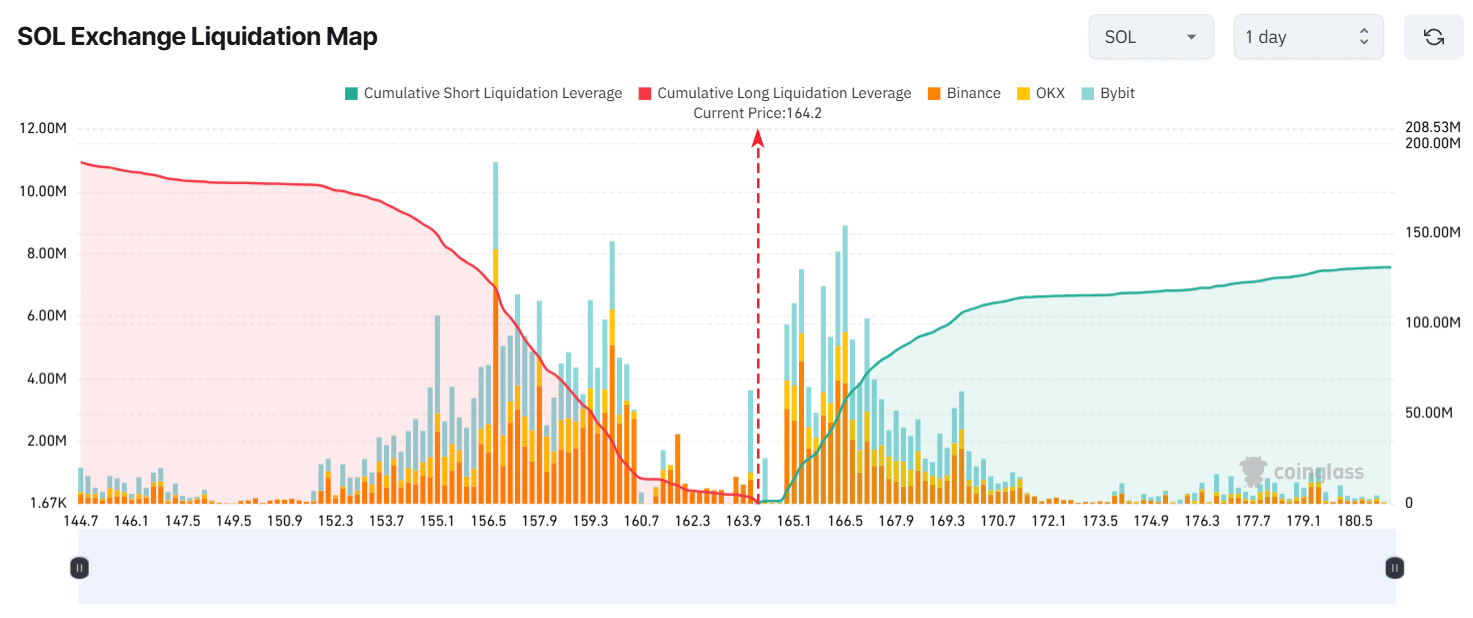

- Traders seemed to be over-leveraged at $156.7 on the lower side and $166.5 on the upper side

- SOL’s on-chain metrics with technical analysis suggested that bulls have been dominating the asset

As a seasoned crypto investor with battle-tested nerves and a portfolio that’s seen more ups and downs than a rollercoaster, I’ve learned to read between the lines when it comes to market analysis. The current Solana (SOL) situation presents an interesting conundrum: on one hand, the broader market’s downturn has pushed SOL to its breakout level, but on the other, the general sentiment seems uncertain and clouded by various factors such as elections, geopolitical tensions, and more.

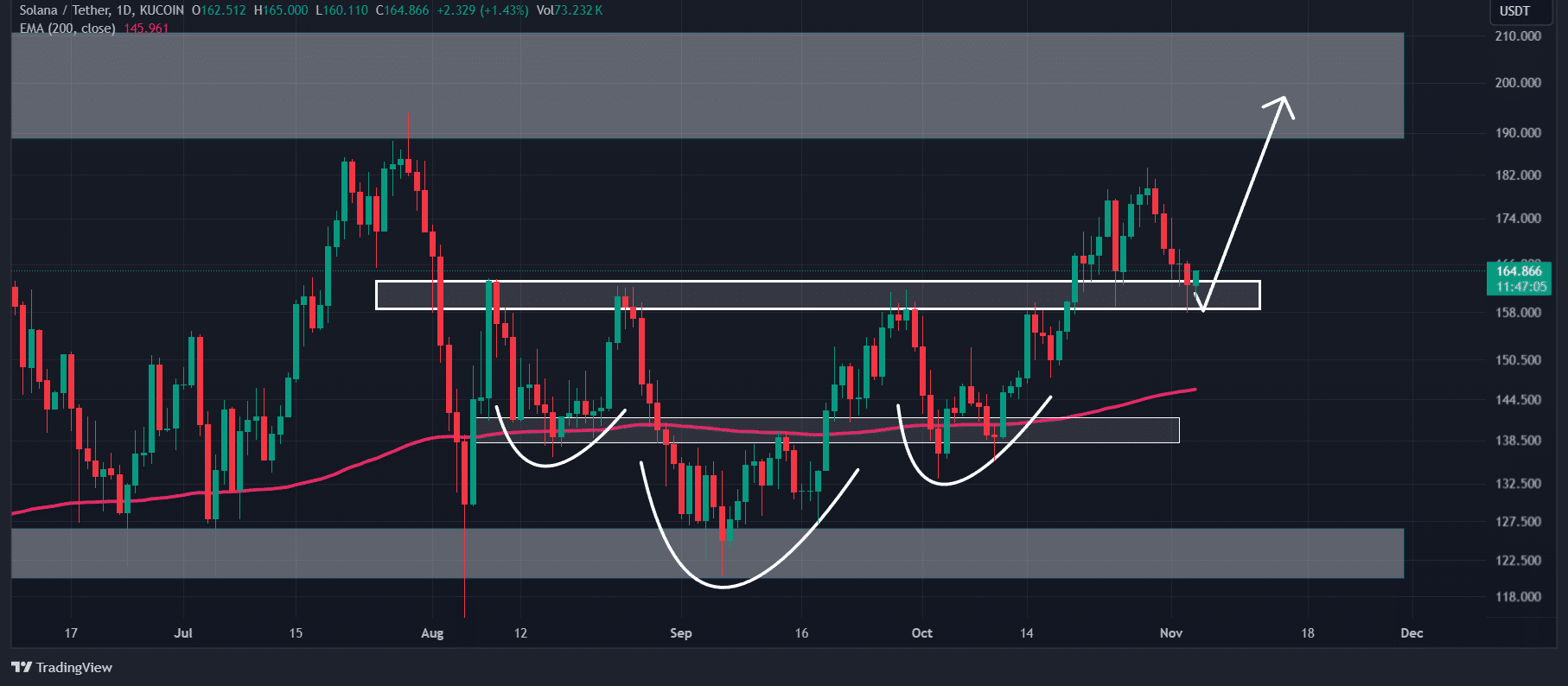

In simpler terms, due to the recent fall in the broader market, Solana (SOL) has reached the critical point where it could potentially break away from its Head and Shoulders pattern on the price chart. At present, SOL seems to be re-evaluating this crucial level after having previously broken out from it.

Market sentiment

Despite this, there was a sense of hesitancy in the current market atmosphere. Notably, it showed hints of revival following a substantial drop.

Indeed, certain individuals think that period of depreciation was actually a corrective phase. However, others attribute the market’s drop to the overall uncertainties surrounding the forthcoming U.S. elections, geopolitical issues, and various other factors.

Solana price analysis and key levels

Although taking these aspects into account, SOL’s technical evaluation indicated a positive trend and pointed towards a possible increase in the near future.

Based on AMBCrypto’s price assessment, Solana (SOL) currently stands at a pivotal point of resistance around $161. On the four-hour chart, there seems to be a shift in the price trend.

If Solana (SOL) finishes its daily trading at a price above $167, it’s quite likely that the value of this altcoin might surge to around $195, and potentially even beyond that level, given its recent market behavior and past momentum.

Currently, Solana (SOL) is showing a positive trend since it’s being traded above the 200 Exponential Moving Average (EMA) on both the 4-hour and daily charts, suggesting a bullish outlook.

As I analyze the market trends, it appears that the Relative Strength Index (RSI), which I’m closely monitoring, suggests an upcoming bullish trend might be on the horizon. Currently, the RSI indicates we are in oversold territory, offering a potential buying opportunity.

Bullish on-chain metrics

In terms of on-chain data, Solana (SOL) appears optimistic as indicated by recent analysis from Coinglass. Specifically, SOL’s Long/Short ratio stood at 1.02 at the present moment, which is the highest since the market downturn started. A Long/Short ratio above 1 suggests that traders are generally bullish on Solana.

On the other hand, Open Interest for SOL declined by 7% during the past day, suggesting that some traders closed their positions in response to the recent drop in prices. Meanwhile, there seems to be a reluctance among traders to establish fresh positions at present.

Key liquidation levels

Currently, the key selling points stand at approximately $156.7 (on the lower end) and $166.5 (on the higher end). Traders are found to be excessively leveraged at these price points.

If the market maintains a positive outlook and the price hits around $166.5, it would result in roughly $57.6 million being cleared from short positions. On the flip side, if the market sentiment changes negatively and the price drops to about $156.7, an estimated $120 million could be liquidated from long positions.

As an analyst, I’ve found that by integrating on-chain metrics with traditional technical analysis, the pattern suggests that bullish sentiment has been predominant in the SOL market. In simpler terms, it seems there might be an upcoming price surge for Solana in the short term.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-11-05 07:03