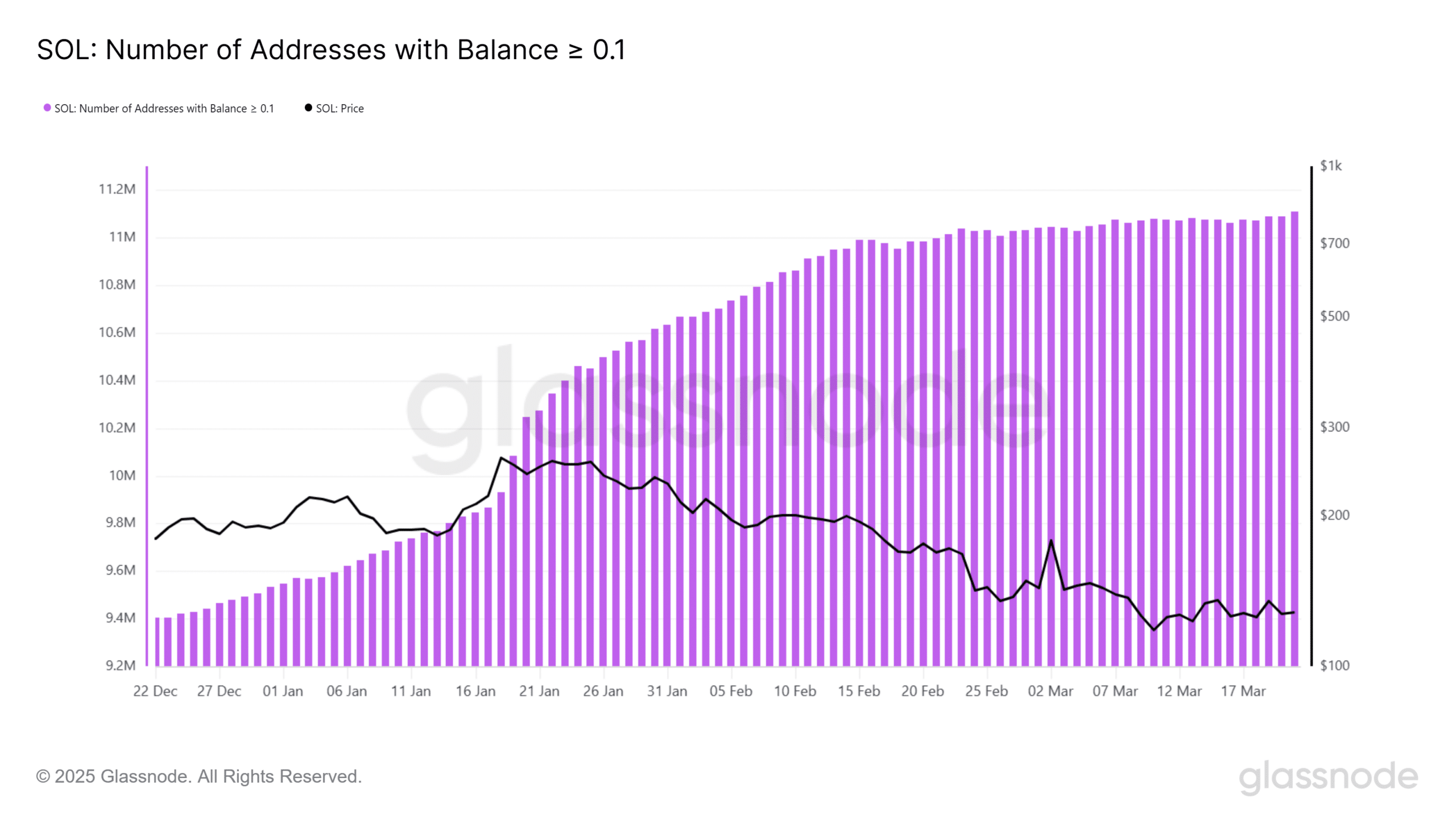

- SOL network addresses with ≥0.1 balance have surged past 11.1M – Its highest level in months

- Despite rising network activity, Solana’s TVL has dropped from $11.7 billion to $6.2 billion since January

In the labyrinth of Solana’s network, a peculiar phenomenon unfolds. The number of addresses clutching at least 0.1 SOL has soared to a new zenith, a testament to the growing throng of users. This metric, a beacon of adoption, has been ascending since the twilight of December 2024. Yet, the price of SOL, like a weary traveler, has stumbled from its previous heights. 🧗♂️💸

Amid this curious decoupling of network growth and price action, one must ponder: Is the market blind to Solana’s robust fundamentals? Or is it merely biding its time, waiting for the opportune moment to strike? 🤔

Solana’s user adoption soars amid price correction

Glassnode’s data reveals a tale of resilience. The number of addresses with 0.1 SOL or more has swelled from 9.2 million in late December to over 11 million by 21 March. 📈

This burgeoning user base, a harbinger of sustained interest in the Solana ecosystem, persists even as the asset’s price has slipped from above $180 in January to around $129.54 at press time. This divergence suggests that smaller retail participants, undeterred by the price correction, continue to accumulate SOL, perhaps in anticipation of future gains. 🛒💎

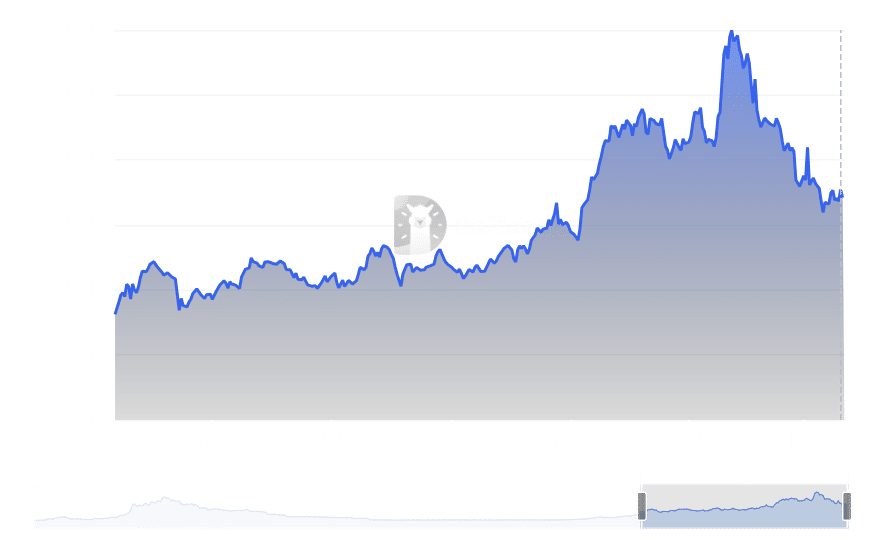

Solana’s TVL faces pressure, but holds key levels

On the flip side, Total Value Locked [TVL] on Solana has experienced a notable pullback. 📉

DeFiLlama’s data paints a stark picture: the TVL has plummeted from its yearly peak above $11 billion in January to just under $6.4 billion recently. This decline hints at a contraction in DeFi capital allocation, possibly driven by macro volatility and reduced incentive programs. 🌍💼

Source; DefiLlama

However, it’s worth noting that the press time TVL level remains significantly higher than the pre-bull market base of 2023. This suggests that Solana’s DeFi ecosystem retains meaningful traction across the board. 🚜🌾

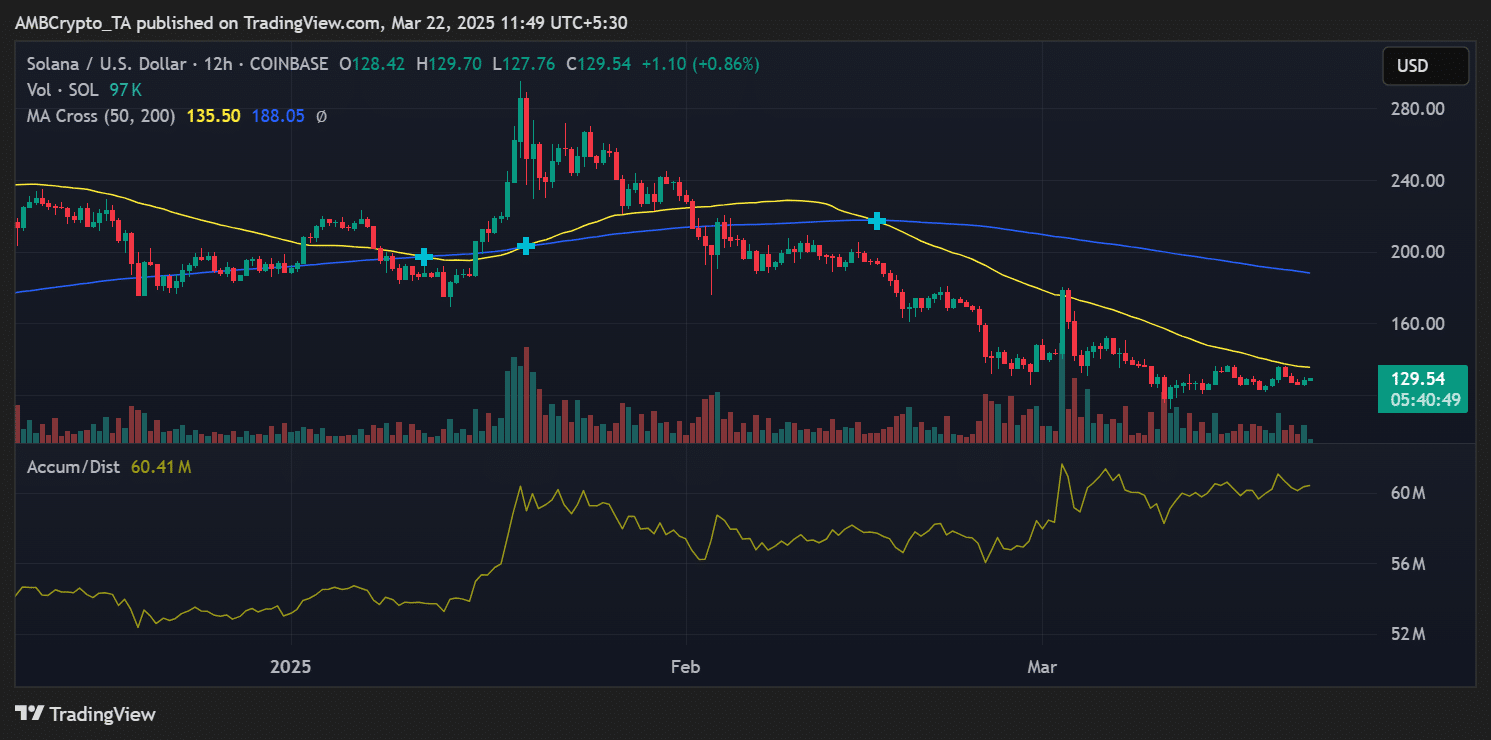

Solana’s price outlook – Rangebound, but supported by accumulation

At the time of writing, SOL was trading below both the 50-day [$135.50] and 200-day [$188.05] moving averages. This hints at a broader bearish structure. However, the Accumulation/Distribution Line highlights consistent upward movement – a sign that smart money might be entering at press time levels. 🧠💹

With relatively low volume and resistance around $135, price action could remain rangebound in the short term. However, sustained on-chain growth could act as a tailwind for future rallies. 🌬️📊

Solana has been exhibiting strong foundational demand, despite speculative capital pulling back. If the price eventually aligns with network strength, SOL may gear up for another rally on the charts. 🚀📈

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2025-03-23 06:19