- Hopes of Solana ETFs deferred to 2025 following reports that recent applications could be turned down.

- A recap of SOL price action and Solana on-chain activity as TVL soars to new highs.

As a seasoned researcher with years of experience tracking cryptocurrency markets, I must admit that the delay in Solana ETF approval has left me feeling somewhat like a kid waiting for Christmas morning to arrive – full of excitement and anticipation, but with a lingering sense of uncertainty.

It appears that the Solana (SOL) enthusiasts have been anxiously anticipating the opportunity to hop aboard the ETF bandwagon, as several entities have submitted applications to the Securities and Exchange Commission (SEC). Nevertheless, recent news indicates that Solana ETFs might not see the light of day this year.

After the successful debut of Bitcoin and Ethereum exchange-traded funds (ETFs), Solana was a natural contender next in line. A host of companies such as VanEck, Bitwise, Grayscale Investments, 21Shares, and Canary Capital were among the pioneers who submitted applications for Solana ETFs.

According to a newly released report, the U.S. Securities and Exchange Commission (SEC) informed at least two applicants that they plan to deny their applications. The reason for this proposed denial appears to stem from uncertainty about how Solana assets should be categorized, specifically due to fears that they might be classified as securities.

What are the implications on SOL price action?

Historically, there’s been a lot of anticipation surrounding Bitcoin and Ethereum ETF launches, often causing excitement about their price movements in the days leading up to launch. Yet, once these ETFs were actually launched, prices tended to drop. This suggests that the approval of these ETFs tends to be more about buying the hype (or rumors) and selling once they become a reality (selling the news).

Rejected ETF applications are unlikely to affect the current price. But, if approved, it could bring a surge of institutional investment, which might increase Solana’s (SOL) price over several months.

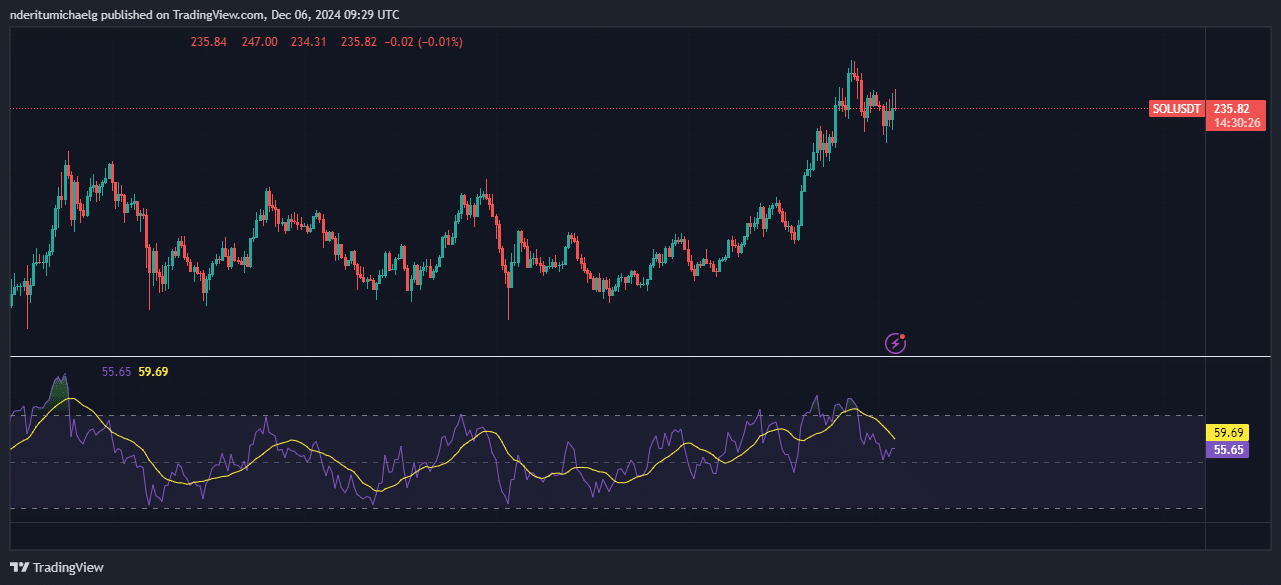

This year, SOL has demonstrated significant growth, with its price consistently staying over the $200 mark. A recent dip, following its climb to a new peak, suggests that some investors may have taken profits. At the moment of reporting, it was trading at $235.88.

It’s quite possible that Solana (SOL) might rise again above $200, assuming the market stays optimistic through December. Furthermore, if there’s a significant surge in demand, we might even witness SOL going beyond that price point.

Alternatively, giving in might trigger strong selling activity. If that happens, the price could drop down to around $157 before it tests the next significant support level again.

Solana maintains robust on-chain performance

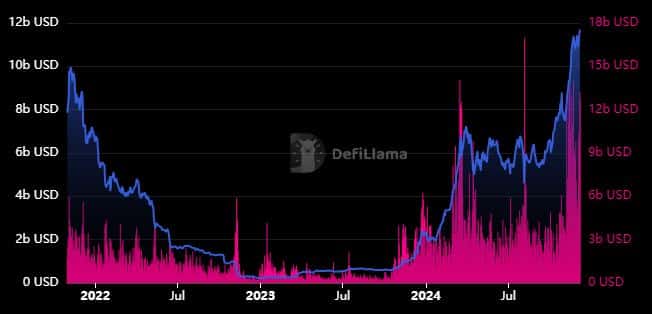

As an analyst, I’ve noticed a pause in the price momentum, but the network has continued to thrive in other significant aspects. For instance, its Total Value Locked (TVL) has hit a new all-time high of $11.69 billion.

Read Solana’s [SOL] Price Prediction 2024–2025

In the past day, trading volume on the Solana blockchain reached an impressive $5.88 billion, showcasing robust network activity which Solana has been nurturing steadily.

Concerning network activity, it’s worth noting that the number of transactions on our network has been increasing noticeably during the fourth quarter. To give you a sense of the scale, we were averaging around 40 million daily transactions before this surge, but now we’re consistently exceeding 50 million transactions each day.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-07 04:07