-

Solana recorded a massive surge in stablecoin inflows.

A 10% potential gain was at stake as SOL consolidated around 50-day SMA.

As a researcher with experience in cryptocurrency market analysis, I find Solana’s recent surge in stablecoin inflows intriguing. The potential for a 10% gain as SOL consolidates around its 50-day moving average is an opportunity worth exploring.

As a crypto investor, I’ve noticed an impressive surge of stablecoins flowing into the Solana (SOL) ecosystem lately. Historically, such inflows have often been followed by significant price increases for the underlying cryptocurrency. This trend has piqued my interest and left me wondering if SOL could experience a substantial price rise – potentially even reaching new all-time highs.

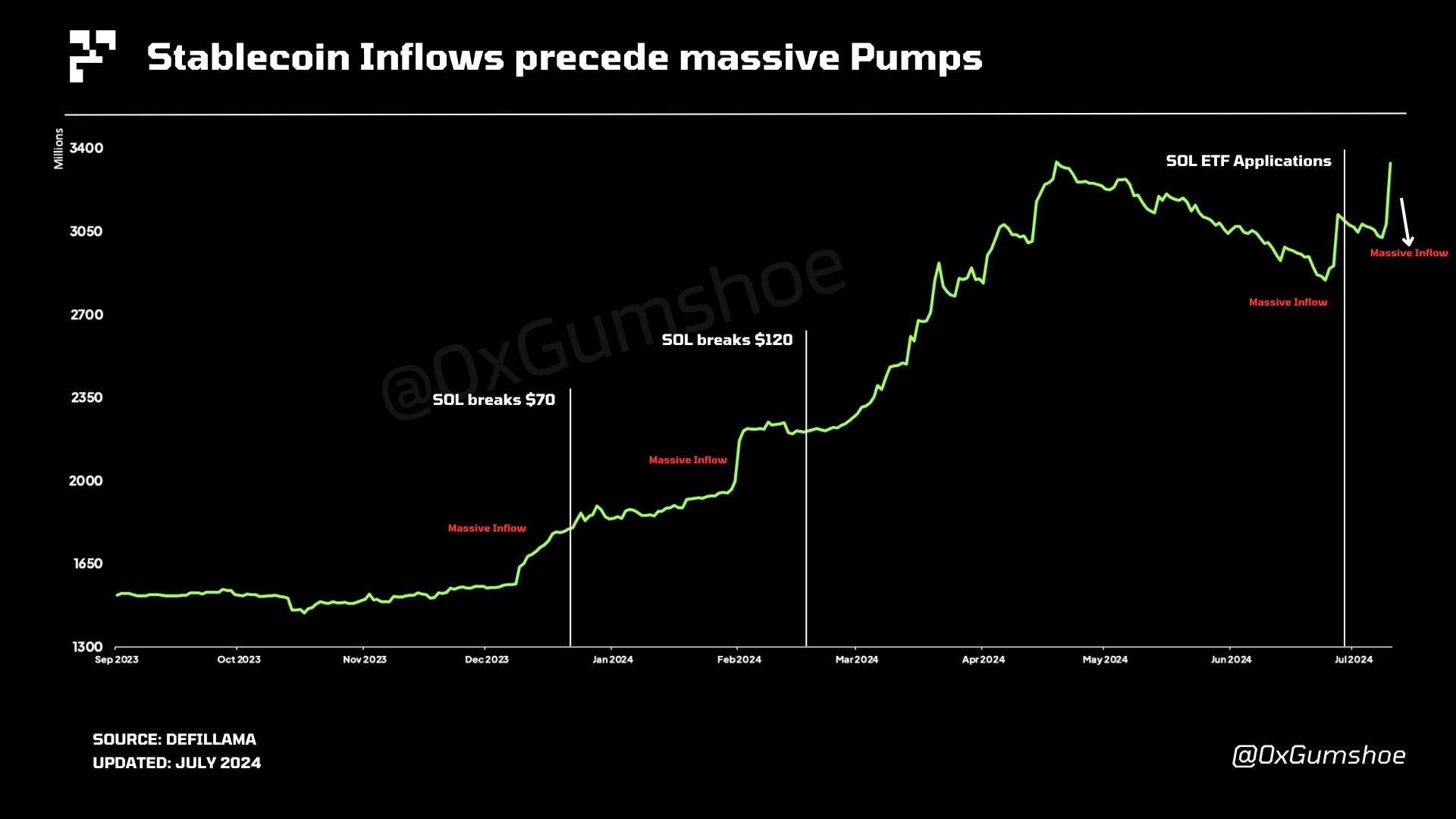

Based on the analysis of an anonymous market commentator known as Gumshoo, the surge in stablecoin investments could have paved the way for a potential price increase in Solana (SOL).

In the past three instances when there was a sudden surge in stablecoin inflows, SOL experienced significant pumping. Not long after the previous such occurrence, an application for an SOL-based ETF was submitted.

An alternative interpretation provided by the analyst is that this information might represent insider knowledge about an imminent SOL update which could potentially influence its market value.

According to Gumshoo’s analysis, SOL experienced significant price increases above the $70 and $120 thresholds following a substantial influx of stablecoins. The most recent surge in value, amounting to over $260 million, occurred on July 9th based on DeFiLlama’s data.

Notingably, the day saw CBOE’s approval of both VanEck and 21Shares Solana ETF proposals being made public.

Beyond the anticipation surrounding the Solana ETF, the network achieved a significant milestone on its testnet with the third-party validator client Firedancer. This new addition is widely regarded as a groundbreaking development for the ecosystem.

The confirmation of the SOL ETF by CBOE and Firedancer’s update may serve as significant triggers for the fear of missing out (FOMO) in the Solana (SOL) market, potentially contributing to the recent rise in the value of stablecoins.

However, was there any change in SOL’s market structure on the price chart?

SOL’s price action

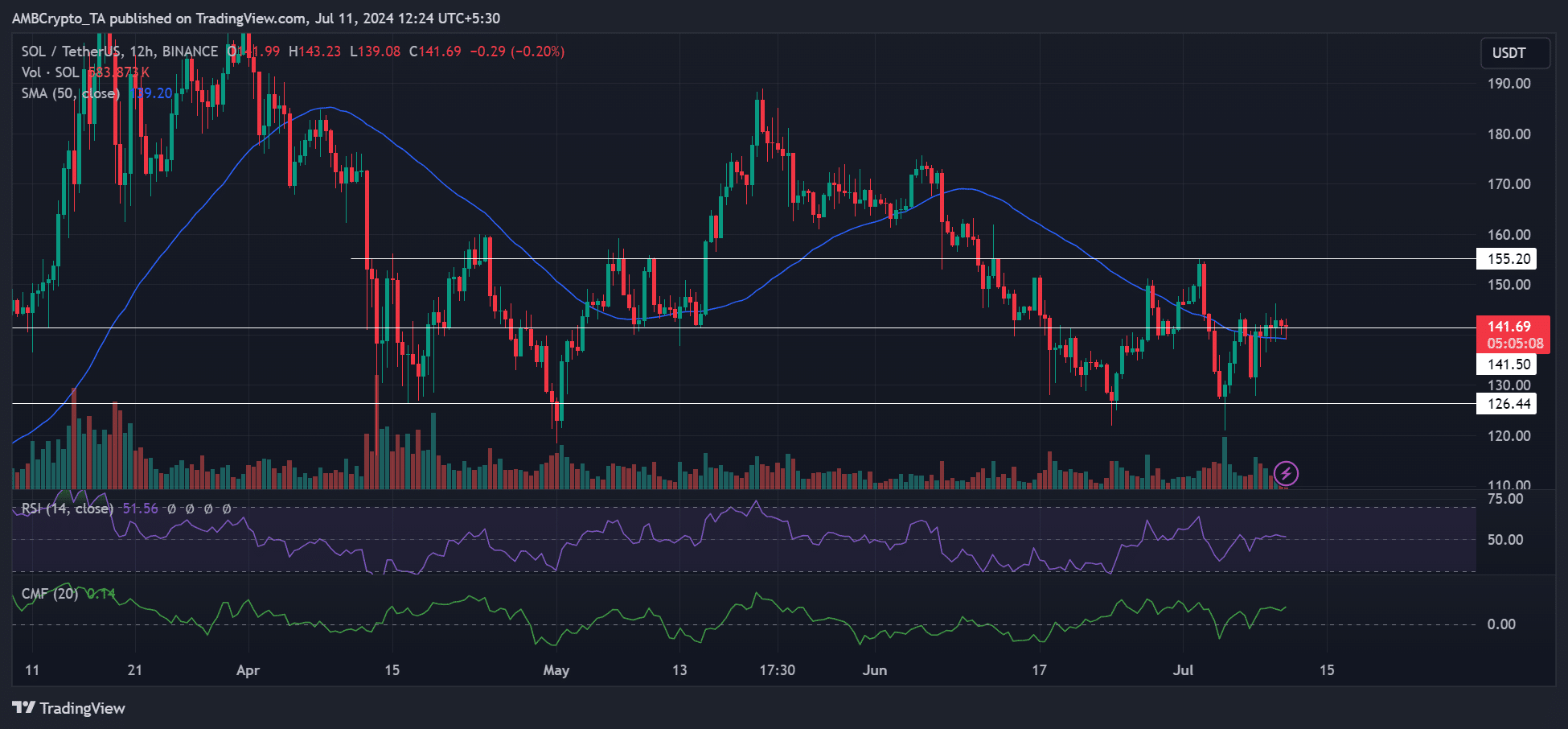

On the ninth of July, SOL experienced modest advancements amounting to roughly 1%, as it stabilized near the significant resistance point of $141. Remarkably, the 50-day Simple Moving Average (SMA) coincided with this resistance level as well.

As an analyst, I’ve noticed a significant increase in Chaikin Money Flow (CMF) indicators for Solana (SOL), suggesting substantial inflows from investors. This could signify a risk-averse stance towards SOL, potentially leading to consolidation around its 50-day Simple Moving Average (SMA). If SOL reaches $155, which is a potential 10% gain from its current price, it would represent an attractive return on investment.

The Relative Strength Index (RSI) remained unchanged at the neutral mark, indicating a lack of significant buying force to propel SOL upwards.

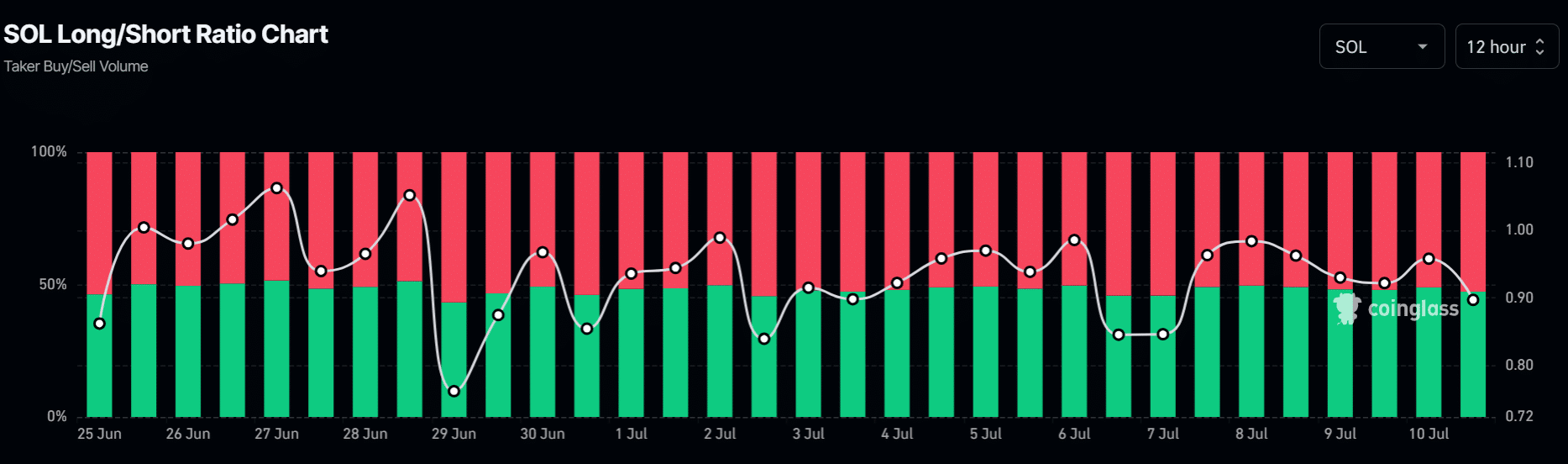

As a researcher studying the cryptocurrency market trends, I’ve noticed an intriguing development regarding Solana (SOL). Specifically, the proportion of traders taking long positions on SOL has decreased from 49.6% to 47% since July 8th. This decline could potentially hinder SOL’s recovery process unless Bitcoin (BTC) experiences a significant reversal of its recent losses.

Based on past trends, a market analyst predicted a potential long-term price of $2800 for SOL.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-07-11 14:16