- Solana’s price increased by over 5% in the last 24 hours.

- Several metrics and indicators hinted at a price correction.

As a seasoned crypto analyst with years of experience in studying market trends and price movements, I have seen my fair share of bull runs and subsequent corrections. While Solana’s [SOL] recent price surge is impressive, there are several indicators that suggest a correction may be on the horizon.

Solana (SOL) has kept a firm grip on the crypto market for an extended period, much like many other cryptocurrencies.

Despite the indication of further price growth for SOL, potential obstacles may arise for the cryptocurrency in the near future, regardless of the bulls’ control over the market. Let’s explore the current developments.

Solana remains bullish, but…

As a market analyst, I’ve reviewed the latest data from CoinMarketCap and discovered that Solana’s (SOL) price experienced an impressive surge of over 12% during the last week. Furthermore, within just the previous 24 hours, the token’s value has significantly jumped by more than 5%.

Currently, Solana’s price is at $161.26 during this composition, while its market value exceeds $74.8 billion, positioning it as the fifth most valuable cryptocurrency.

According to an earlier report by AMBCrypto, Captain Faibik, a well-known cryptocurrency analyst, shared his prediction on Twitter that the price of Solana (SOL) could reach $1,000 during this current bull market.

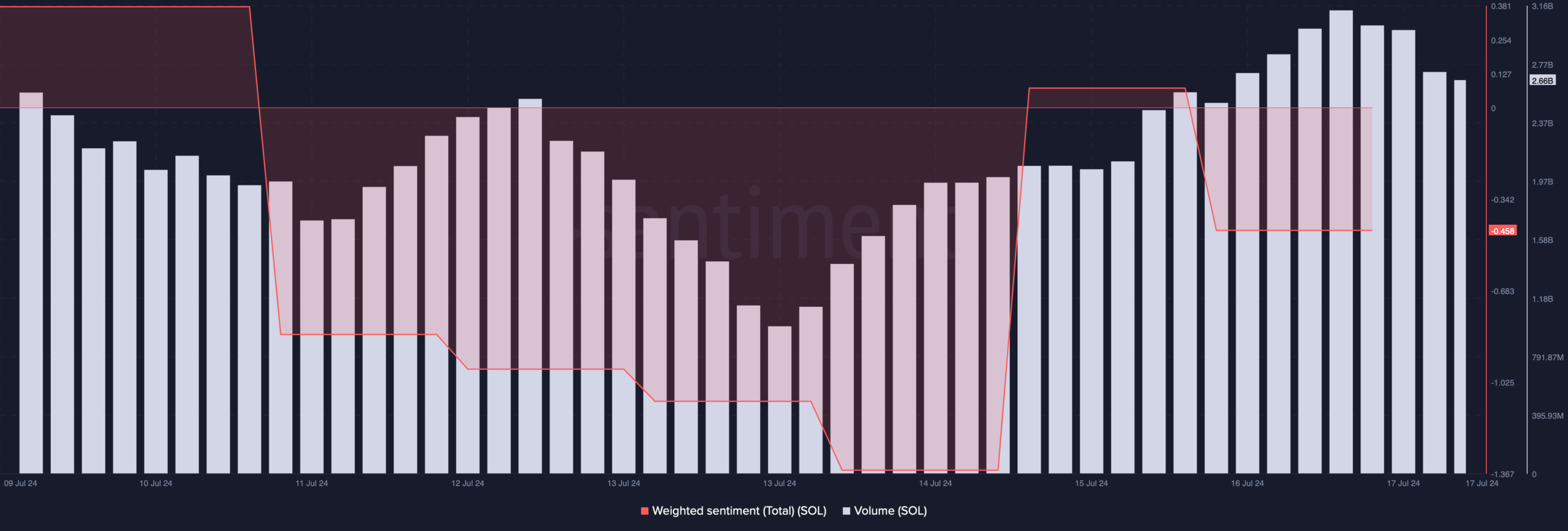

According to our examination of Santiment’s statistics, Solana (SOL) experienced a surge in trading activity coinciding with its price rise during the previous week. This observation indicates a bullish trend, as heightened trading volume typically reinforces a persistent price upward trend.

Although the Weighted Sentiment decreased, indicative of a growing negative outlook towards the token among investors in the market.

As a crypto analyst, I’ve come across some intriguing news regarding Solana (SOL). A notable figure in the community, Ali, has drawn attention to an upcoming event that could potentially cause more challenges for SOL. Specifically, there are approximately $2.98 billion worth of short positions that will be liquidated if the price of SOL jumps to $176.

As a crypto investor, I’ve noticed that when liquidation levels rise during a bull market, it often leads to a short-term price correction. For Solana to continue its bull run and potentially reach $1,000 in the future, it needs to convincingly surpass this resistance level first.

SOL’s road ahead

After examining AMBCrypto’s initial analysis, we decided to explore additional datasets for deeper insight into the token’s behavior. Notably, we observed a significant surge in Solana’s (SOL) Funding Rate within the recent timeframe.

In simpler terms, the price of SOL usually goes against the trend set by the Funding Rate. This implies that a possible price adjustment for SOL may occur before it hits $176, resulting in approximately $2 billion worth of liquidations.

An analysis of Coingeasus’ data indicated a decrease in Solana’s Long-Short Ratio. This signifies an increasing negative outlook among traders, likely resulting from an uptick in new short position contracts being executed in the market.

Additionally, the Fear and Greed Index of SOL, as measured by Crypto Fear & Greed Index, indicated an “extreme greed” condition at the current moment. Historically, such readings have signaled impending price corrections in the market.

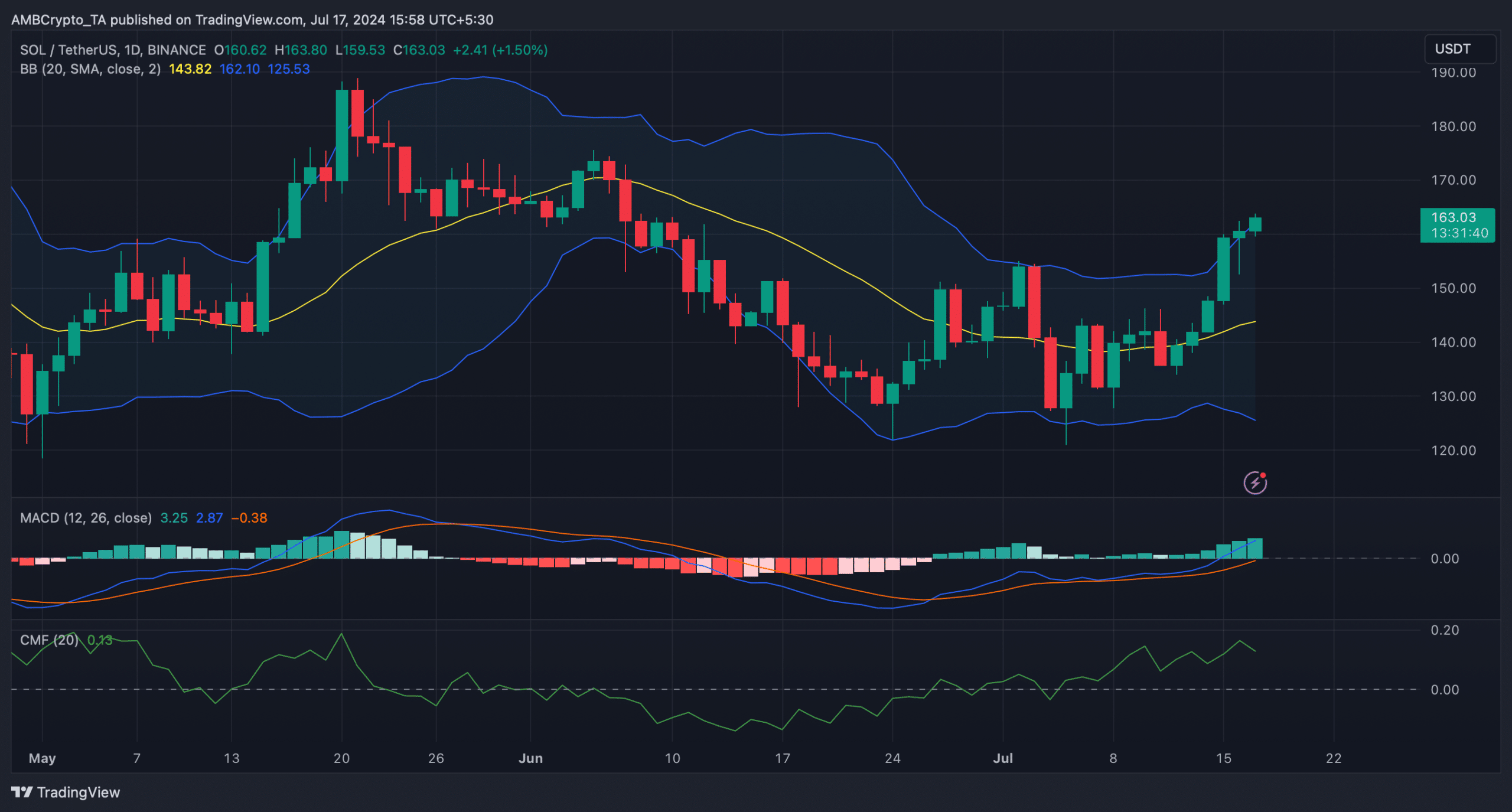

We then analyzed SOL’s daily chart to see what indicators had to say regarding SOL reaching $176.

The price of SOL had reached the maximum level within the Bollinger Bands once more. The Chaikin Money Flow indicator showed a decrease, signaling potential downward price movement. However, the Moving Average Convergence Divergence (MACD) still indicated bullish tendencies.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-07-18 04:07