-

Solana has seen an increase in network and trading volume.

SOL price has declined in the last 24 hours.

As a seasoned analyst with years of experience observing the crypto markets, I find myself intrigued by Solana’s [SOL] recent developments. While it’s always exciting to see increased trading volume and Total Value Locked (TVL)—particularly when they reach levels not seen since October 2022—the current price trend is a bit concerning.

For the past several days, Solana’s [SOL] trading activity has remained steady within a certain bandwidth, and its Total Value Locked (TVL) has shown encouraging growth.

Over the past day, I’ve noticed a substantial surge in the trading volume of SOL. Interestingly, this spike seems to align with Solana’s efforts to steady its price following recent market fluctuations.

Solana volume and TVL surges

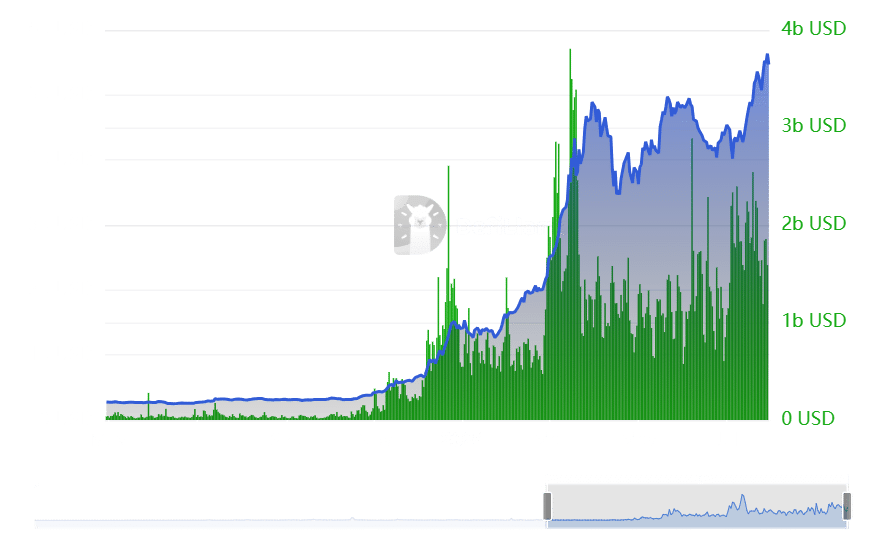

Over the past few days, an examination of Solana’s volume on DeFiLlama shows it has frequently remained around the $2 billion mark.

Significantly, Solana’s trading volume has been regularly exceeding the $1 billion mark this month, with instances where it peaked at over $2 billion. As of now, the volume hovers around $1.6 billion.

One reason for this increase in activity is the growing popularity of meme-based cryptocurrencies on the Solana network, which have drawn a substantial amount of investor focus and action.

This increase in volume has paralleled a boost in Total Value Locked (TVL).

On July 29th, the value locked (TVL) on the platform reached more than $5.6 billion, which was the highest point since the platform’s dip in October 2022.

According to recent figures, the Total Value Locked (TVL) stands approximately at $5.5 billion. The consistent high TVL figure, combined with the substantial trading volume, suggests a strong level of user interaction and liquidity within this system.

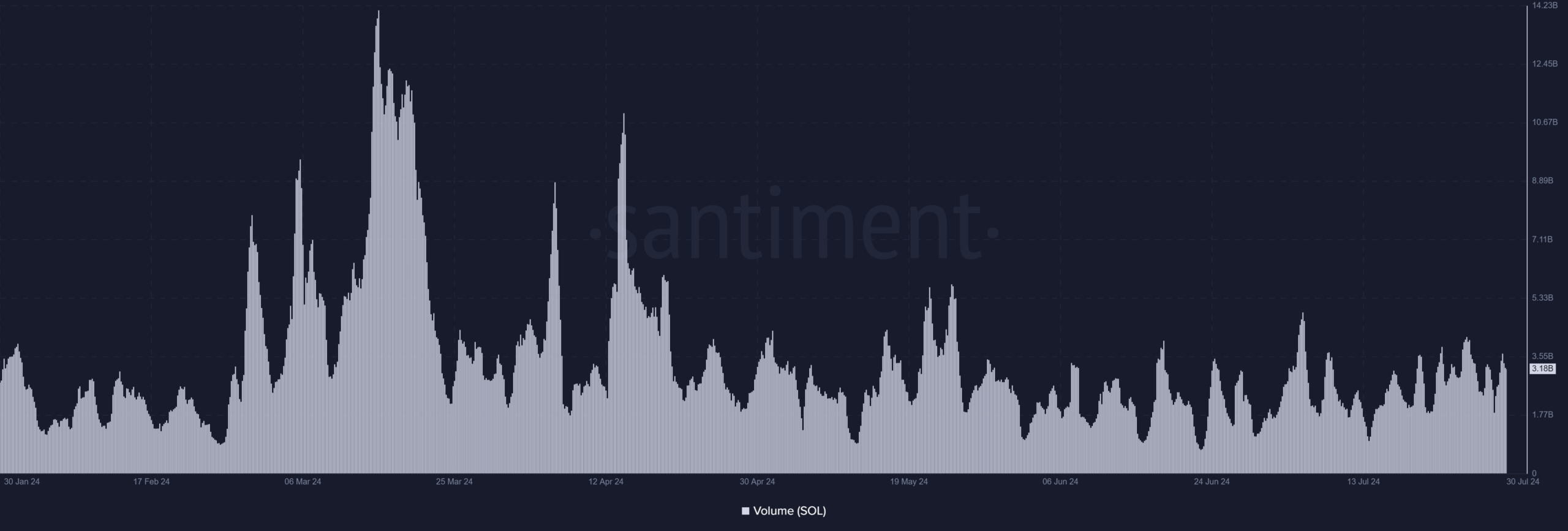

SOL volume shows mixed signals

Over the past day, there’s been a substantial surge in Solana’s trading activity, as observed in a recent study by Santiment. At present, the daily trading volume for SOL stands at approximately $3.2 billion.

Furthermore, data from CoinMarketCap supported this growth trajectory, indicating a 18% surge in trading activity within the same timeframe.

Although there’s been a surge in trading, the pattern of price movements indicates that sellers are in control of the market at this time.

As a seasoned trader with years of experience under my belt, I can confidently say that the surge in volume we’re seeing is likely due to selling pressure. Traders may be taking profits or reacting to specific market conditions that have instilled a bearish sentiment among them. Throughout my career, I’ve learned that such trends often signal potential downturns in the market and should not be ignored. It’s crucial for investors like myself to stay vigilant and adapt our strategies accordingly to navigate these challenging times.

Solana trends downward

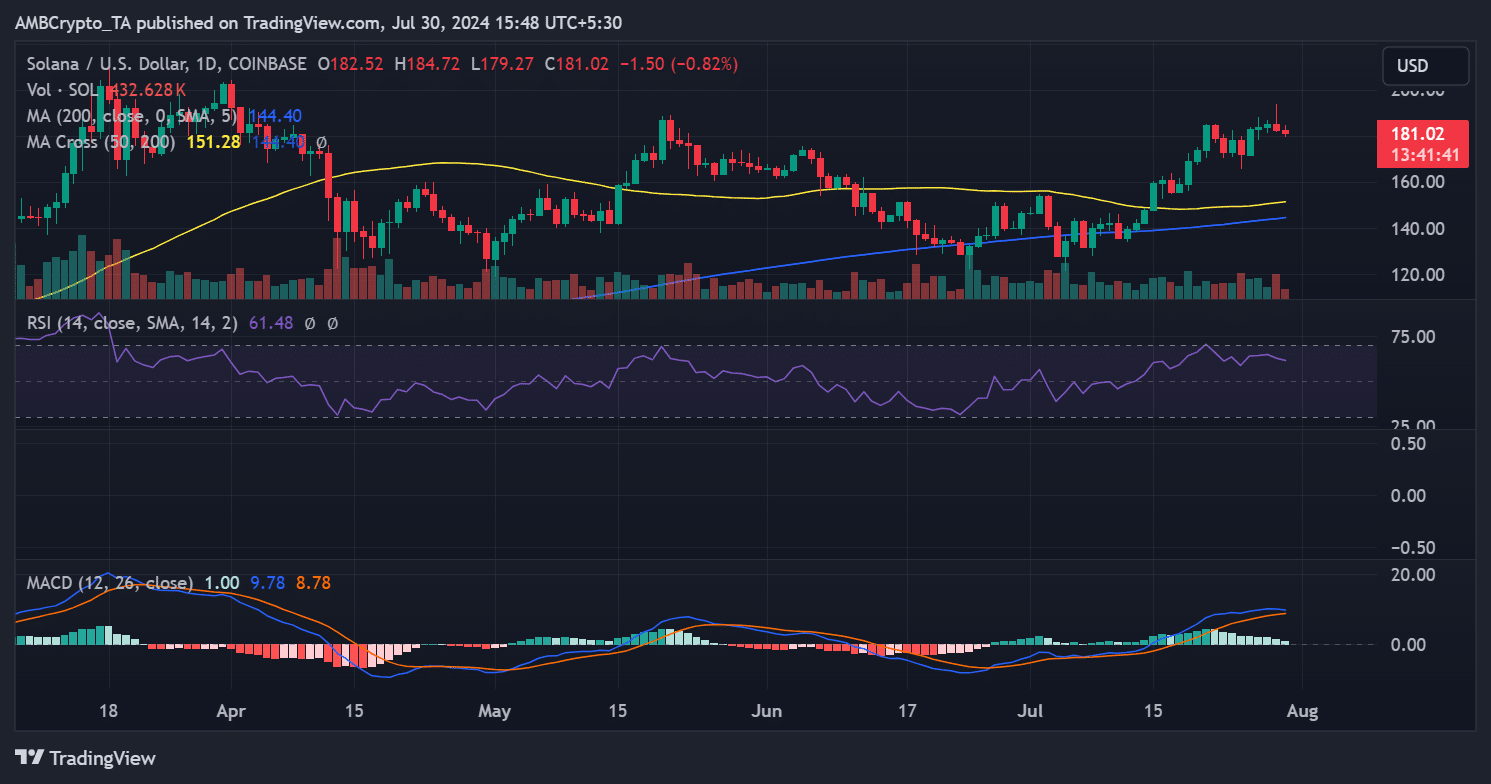

Over the past few days, a possible shift in Solana’s price trend seems to be emerging based on current analysis. Until now, the value of SOL had been consistently rising, nearing the $186 mark, which was last touched in May.

On the 29th of July, there was a change – the price dropped more than 1% and fell from approximately $185 down to about $182.

According to recent information, it has been experiencing a drop, currently trading at 1% lower, approximately around $180.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-07-31 03:04