Ah, Solana, that tempestuous prima donna of the crypto stage, once again pirouetting into the spotlight! Her chart, my dear reader, is a veritable sonnet of bullish whimsy, echoing the grand overtures of past breakouts. After weeks of languishing in the shadows of key resistance levels, she now teases us with a performance reminiscent of her October 2023 triumph, a rally so sublime it left the audience (and their wallets) breathless. 🌟

A Fractal Farce: The Breakout Ballet

Solana’s weekly structure, a mirror to her October 2023 consolidation fractal, is nothing short of a dramatic monologue. Compressed like a corseted diva, she prepares for a vertical breakout that would make even the most stoic investor blush. Galaxy’s rising structure, supported by three delicate touches on the ascending trendline, whispers of accumulation-a secret only the most astute whales know. 🕵️♂️💰

Should this fractal play its part, a breakout above $210 to $220 would be the crescendo, heralding Solana’s next grand leg towards fresh all-time highs. Momentum, that fickle muse, aligns across higher timeframes, and historical symmetry suggests Q4 as the season of her expansion phase. 🎭

Whales in the Wings: A Bullish Overture

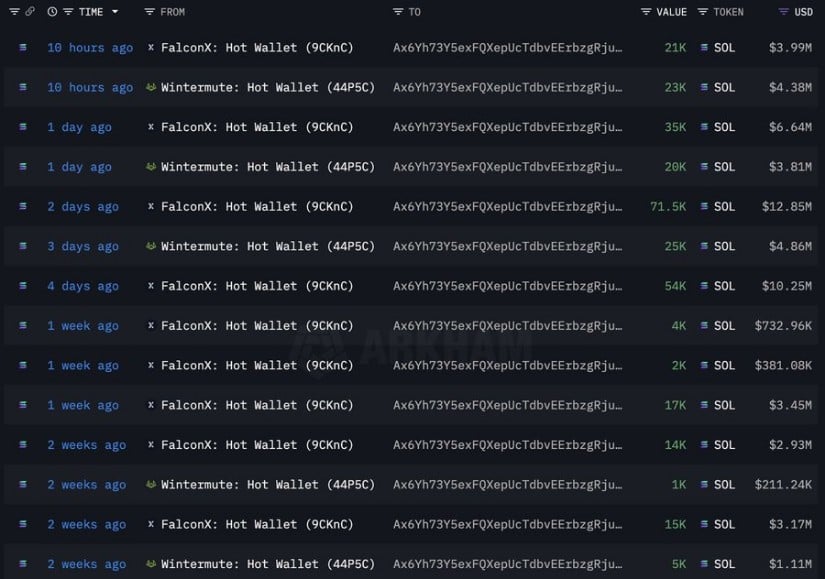

Ah, the whales-those corpulent patrons of the crypto arts! The Solana Post reports a recent acquisition of 44,000 SOL, swelling one whale’s holdings to a staggering 844,000 SOL ($149M). Such conviction, my dear, is no mere speculation but a standing ovation for the bullish case. 🎩🐳

With spot demand swelling like a Wagnerian opera and on-chain metrics singing of consistent exchange outflows, Solana appears to be entering another accumulation wave. History, that wily narrator, tells us such whale activity often precedes upside swings as grand as a Verdi finale. 🎶

Short-Term SOL: A Comedy of Recovery

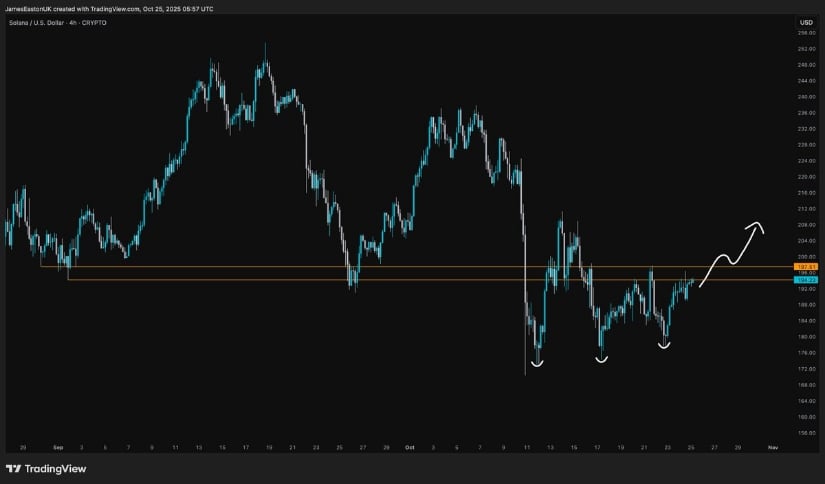

James, that astute critic of charts, notes SOL forming an inverse head-and-shoulders pattern near $190-a short-term recovery so clean it could grace the walls of the Louvre. Price, having reclaimed its mid-range level, now eyes the $200 resistance with the determination of a starlet chasing her Oscar. 🏆

Should SOL buyers maintain their grip above $192 to $195, the path to $210 opens like a red carpet. Momentum indicators on the 4H chart, those fickle critics, suggest sentiment is finally turning in favor of the bulls. 🦬

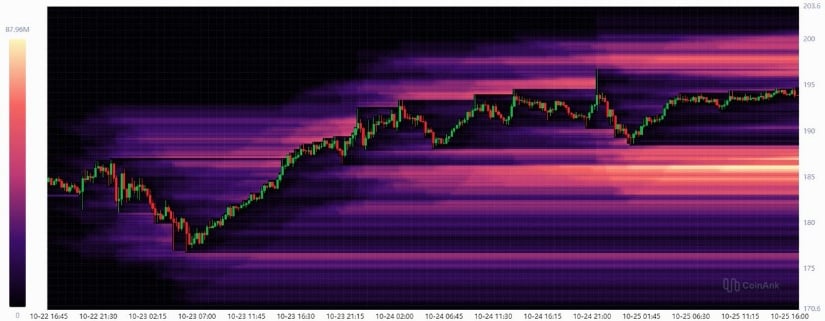

Liquidity Map: A Tragic Liquidation Zone

The order book, that grand ledger of fate, reveals a liquidation zone at $200-a level where short positions face a dramatic demise. This aligns perfectly with the current range high, amplifying the probability of a breakout as sharp as a Shakespearean dagger. ⚔️

Below, liquidity is as thin as a ballet dancer’s waist around $180 to $185, meaning any dip could be as fleeting as a summer romance. The setup favors an upward squeeze, where momentum and positioning conspire to fuel volatility towards the next resistance band. 🎢

Technical Levels: A Drama in Three Acts

Solana, having reclaimed her 20-day EMA near $196, now stands at a crossroads. To confirm her trend continuation, she must close decisively above this moving average, opening targets towards $238 to $260. Failure to sustain above $190, however, could trigger a brief correction to $170 to $175-a plot twist no one saw coming. 🌀

RSI, that indecisive critic, remains mid-range, giving both bulls and bears room to maneuver. But with volatility rising, the odds tilt toward another breakout attempt as Solana’s bullish rhythm returns. 🎲

Final Curtain Call: Solana’s Next Grand Move

Solana’s market structure, a symphony of whale accumulation, liquidation data, and historical fractals, aligns across all timeframes. The confluence of technical compression near $200, strong on-chain buying, and renewed investor interest suggests volatility may soon expand in the bulls’ favor. 🌪️

Should Solana reclaim and close above $210 to $220, momentum could accelerate towards $250 to $260, validating the breakout thesis. A rejection, however, could trigger a short-term reset to $180, where demand has repeatedly stepped in. 🛡️

Overall, the market tone remains as constructive as a Wildean wit. The consistency in both technical and fundamental signals points to a potentially explosive Q4, provided key resistance levels give way and volume continues to support the move. 🌠

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

2025-10-25 23:12