Will Sonic Price Soar or Sink? The Rollercoaster is Real! 🎢

- Sonic traders are advised to sell at a price bounce. Longing for any potential bounces? That’s like trying to catch a greased pig, my friend!

- Trend reversals are as rare as hen’s teeth at this point – Sonic needs to strut past $0.622 for any chance at this shift.

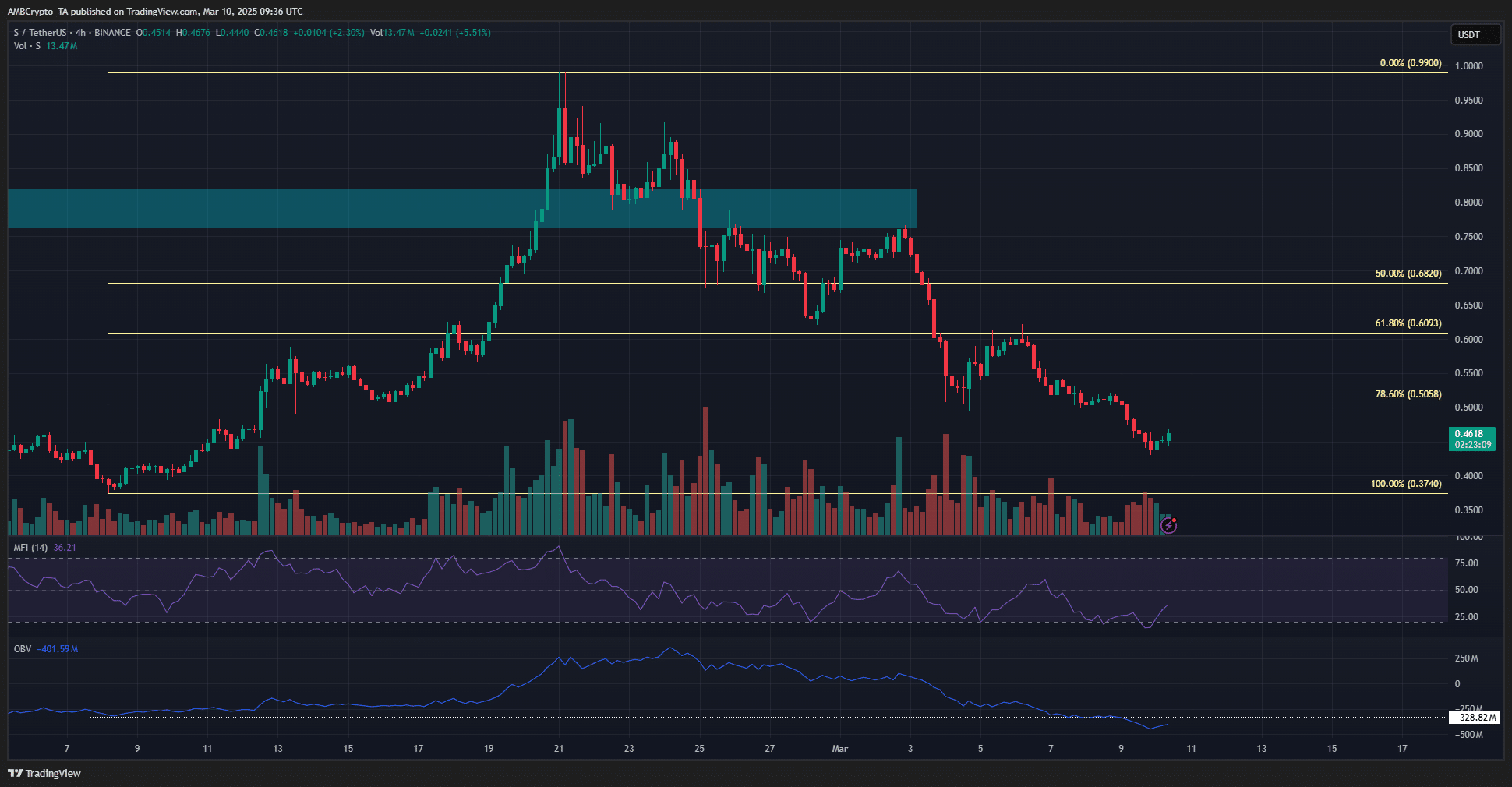

Once upon a time, in the vast landscape of cryptocurrency, Sonic [S] found itself adrift, failing gloriously to protect the fabled 78.6% retracement level—a mystical place sought after following a rally in February. When March dawned, a strange price surge teased the masses, promising glories of yore, but alas, it turned into a painful retest of the former support zone now transformed into a cruel bastion of resistance.

The bearish flag pattern—a lovely little specter introduced in an earlier tale—has danced through the pages of our saga, leading to a testing of the $0.448 level, where the indicators whispered gloomy secrets of prevailing bearish sentiments. 🙁

Sonic set to meander toward the November lows, sounds fun, huh?

Ah, to gaze upon the 4-hour chart is to witness a strong bearish trend, much like watching paint dry in the winter sun. Since the final week of February, the price has been celebrating with lower lows, accompanied by a spiking chaos of trading volume reminiscent of a town besieged by a festival.

This increased selling pressure, a delightful cacophony, only solidifies the waving flag of sellers’ dominance. The OBV, tired and weary, fell below the lows where our February rally began, lamenting heavy selling volume. Who knew meters could mourn?

Meanwhile, the MFI dipped below 20, giving a little bounce as if responding to a cruel joke, but this moment of hope will likely be brief. There is still no sign of a trend reversal, and whispers of a move to $0.374 linger in the air like an unwanted guest at a dinner party.

Open Interest has become more like a distant relative, waning over the past week as prices refused to rise. This dreary situation implies a lack of bullish conviction among derivatives traders; it’s a sad tale about lost hopes and dreams.

Yet in the twilight hours, a sign of life—spot CVD began to climb, and, lo and behold, Open Interest jumped by nearly $4 million in two hours. A small miracle, wouldn’t you say?

Such developments could herald whispers of a minor price bounce, but don’t pop the champagne yet! The liquidation heatmap is waving its flag, showing that the area above $0.5 is the oasis next targeted by thirsty traders.

The $0.522 level aligns rather well with the technical analysis, but one wonders if Sonic is gelling up for this anticipated 13% price bounce. Stay tuned, for this tale is far from over!

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2025-03-11 04:10