-

GSOL surged towards it all-time high at press time.

Increased anticipation around SOL ETFs drove GSOL’s prices.

As a seasoned crypto investor with a few years under my belt, I’ve witnessed the ups and downs of the digital asset market. However, recent developments surrounding Solana (SOL) and Grayscale Solana Trust (GSOL) have piqued my interest and left me optimistic about their future potential.

The trust holding Solana assets in grayscale format experienced gains during the crypto market rebound, with heightened institutional investment fueling the upswing.

Over the last two months, there’s been intense debate about SOL ETFs, revealing significant institutional attention towards them. Despite a price drop for Solana following the May rally.

GSOL trades near ATH

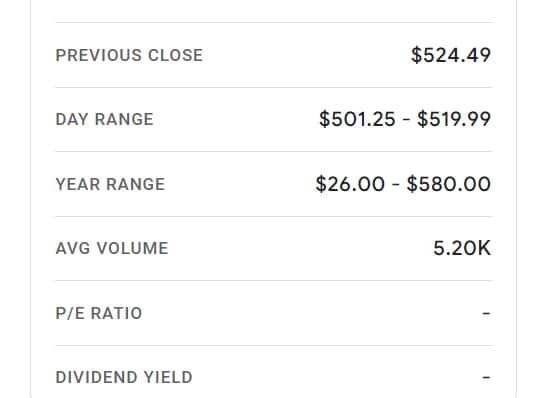

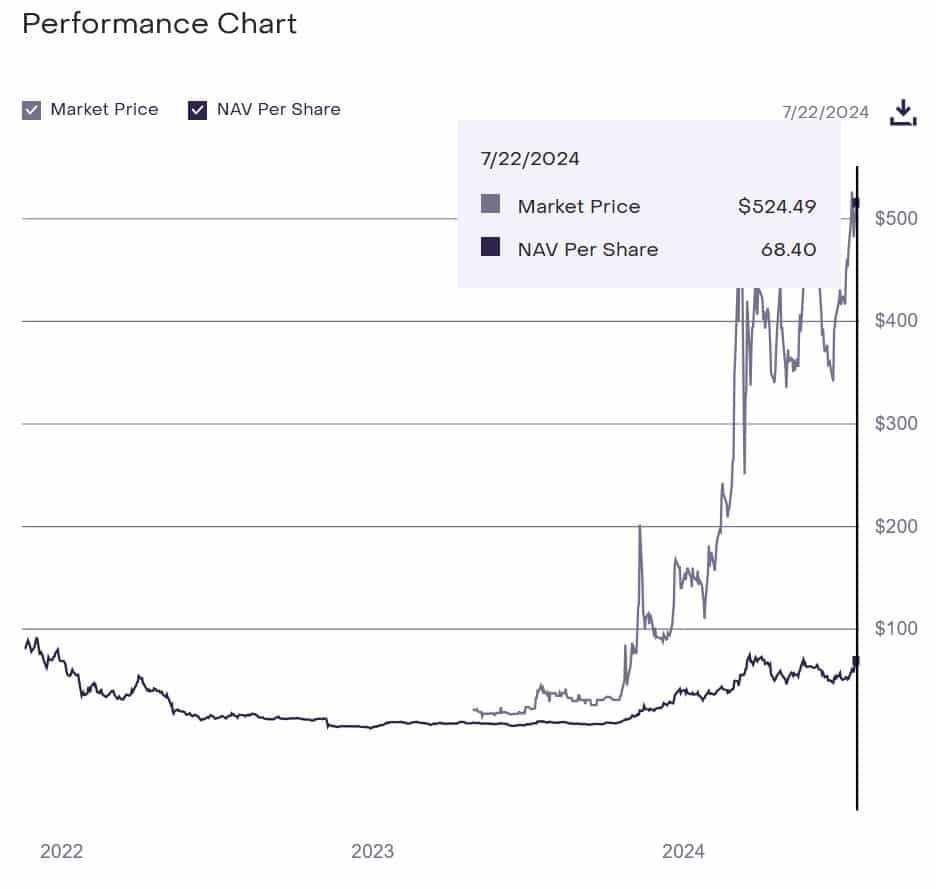

In recent market circumstances favorable to Solana (SOL), GlobalSol Holdings (GSOL) has experienced substantial gains. As of the latest update from Google Finance, GSOL ended its trading session at approximately $524, just shy of reaching an all-time price record.

In the last thirty days, GSOL experienced a significant increase of 48.45%, reaching a price of $507 as of now. Moreover, over the past six months, there was an impressive growth of 298.99% for this asset.

Significantly, the latest development has sparked intrigue and enthusiasm among analysts regarding GSOL’s prospective growth. To illustrate, crypto expert Nic expressed this viewpoint:

“The Grayscale GSOL trust for Solana is close to reaching its highest point ever in trading, and it currently trades at a price seven times greater than its net asset value (NAV). Institutional investors are eagerly purchasing Solana exposure through this trust, implying a price tag of over $1,300 per unit.”

His analysis predicted that institutional investment in SOL would persist, leading investors to seek higher prices to secure a position in this asset.

Eyes on SOL ETFs

Over the past two months, I’ve noticed a surge in conversations among the crypto community regarding the possibility of Solana-backed exchange-traded funds (ETFs) entering the market.

Last month, there was a notable surge in optimism regarding Solana (SOL), as multiple companies submitted applications for related investment funds in the US. VanEck was the pioneer in this movement by filing for Solana Exchange-Traded Funds (ETFs) in the United States.

After the submission of an application by 21Shares to the SEC, they put forward a proposal. Simultaneously, the Canadian firm initiated the filing process for a Solana ETF named QSOL, specifically designed for institutional investments.

The actions taken caused GSOL’s share price to reach $408. Consequently, the excitement surrounding potential Solana ETFs has fueled GSOL’s recent growth and robustness, as investors remain hopeful following the approval of Ethereum ETFs.

What Solana’s price charts indicate

At the current moment, the price of SOL stood at $176.39. This came after a weekly decrease of 8.21%, leading up to this point. Notably, there was a boost in trading volume by approximately 4.24% within the last 24 hours, reaching a total of $3 billion.

Based on AMBCrypto’s assessment, the surge in Solana (SOL) prices has been consistent with the persistent growth of Gravity Bridge’s wrapped SOL (GSOL), indicating favorable market circumstances for the Solana ecosystem.

At the moment of reporting, Solana’s market mood was favorable based on the Chaikin Money Flow (CMF) indicator reading. The CMF value for SOL stood at 0.31, signifying a rise in purchasing demand.

At a volume of $73.4 million, the On Balance Volume (OBV) indicated growing buying activity, potentially leading to an upward price trend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-07-25 03:03