-

Per Nate Geraci, the U.S. SEC may approve spot Solana ETFs next month.

WIF, BONK, JUP, and MEW are Solana-based tokens that might see significant gains if the SEC approves a Solana ETF.

As a seasoned crypto investor with over five years of experience in the industry, I’ve witnessed numerous market swings and regulatory developments that have significantly impacted various projects and their associated tokens. The recent news regarding potential Solana ETF approval by the U.S. SEC, as hinted by Nate Geraci, has piqued my interest.

The positive outlook in the financial markets is attributed to Joe Biden’s announcement that he will not seek re-election as the US President.

Nate Geraci speaks on Solana ETFs

Following Biden’s declaration, Nate Geraci, who is the head of The ETF Store, indicated on X, previously known as Twitter, a possible approval for a Spot Solana [SOL] Exchange-Traded Fund (ETF) in the near future.

Experts like Geraci anticipate that major ETF providers including BlackRock, Fidelity, VanEck, among others, will likely apply for a collective Bitcoin (BTC), Ethereum (ETH), and Solana ETF in the upcoming months.

Currently, ETF investors are focusing on Bitcoin ETFs. It’s likely that the SEC will give its approval for an Ethereum ETF in the coming month.

Among the 11 ETF issuers, just two – VanEck and 21Shares – have so far filed 19b-4 applications with the Securities and Exchange Commission. Additional filings from other issuers are anticipated in the near future.

However, Geraci’s post signaled potential approval of Solana ETF in the next month.

Should the SEC in the United States give their approval for a Solana spot ETF based on this prediction, we could witness a significant surge in Solana’s price and the value of memecoins connected to its ecosystem.

This includes dogwifhat [WIF], Bonk [BONK], Jupiter [JUP], and cat in a dogs world [MEW].

What’s next for Solana?

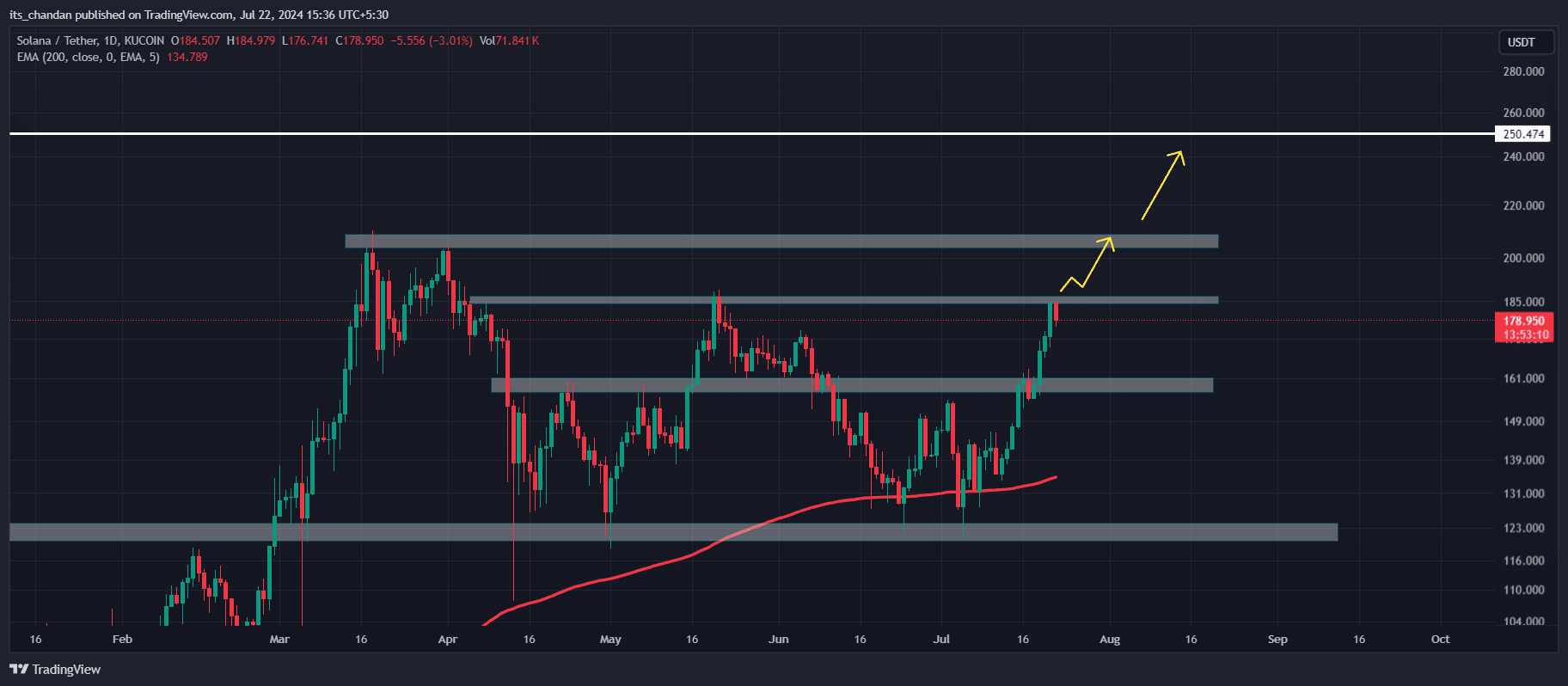

Based on technical analysis conducted by experts, Solana’s price trend appeared optimistic at the current moment. This was indicated by Solana’s (SOL) rise above the 200-day Exponential Moving Average (EMA) on the daily chart.

Despite this bullish trend, it faced strong resistance near the $186 level.

Based on the prevailing market mood and investor attention, it’s plausible that Solana (SOL) could surpass its current resistance threshold. Should this occur, there is a strong possibility for a bullish trend, potentially pushing SOL prices upwards toward the $200 mark or possibly beyond.

Solana’s major liquidation level

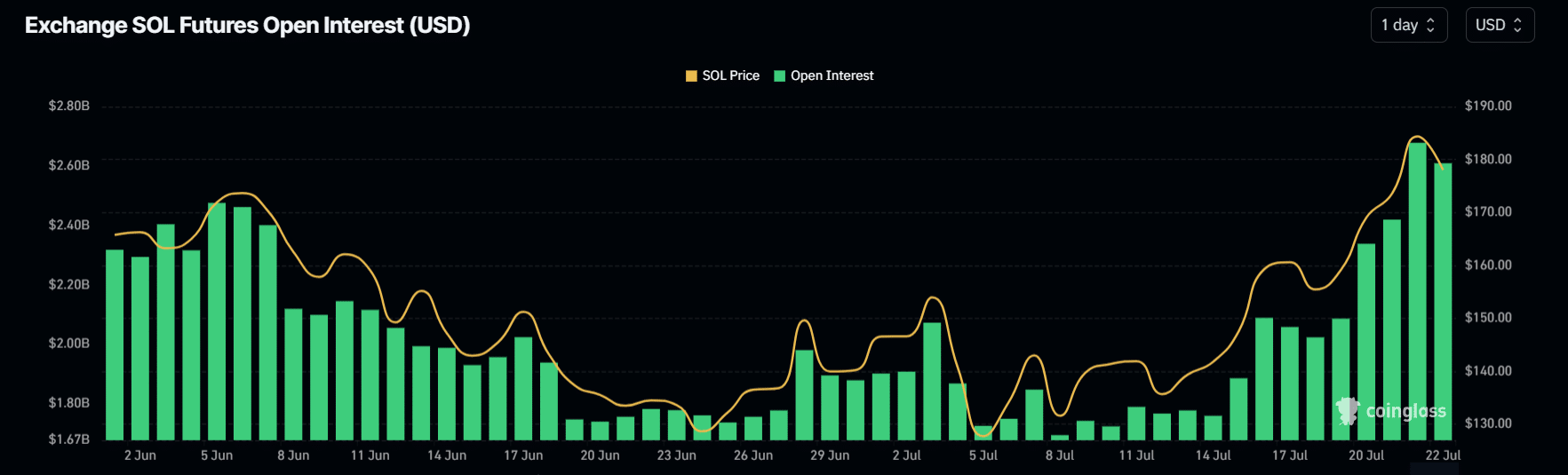

Additionally, investors’ and traders’ interest and confidence are continuously increasing.

As a researcher examining data from CoinGlass, I’ve observed a noteworthy development in Solana (SOL) Open Interest. Within the past 24 hours, this metric has surged by more than 9%, reaching its peak since late June 2024.

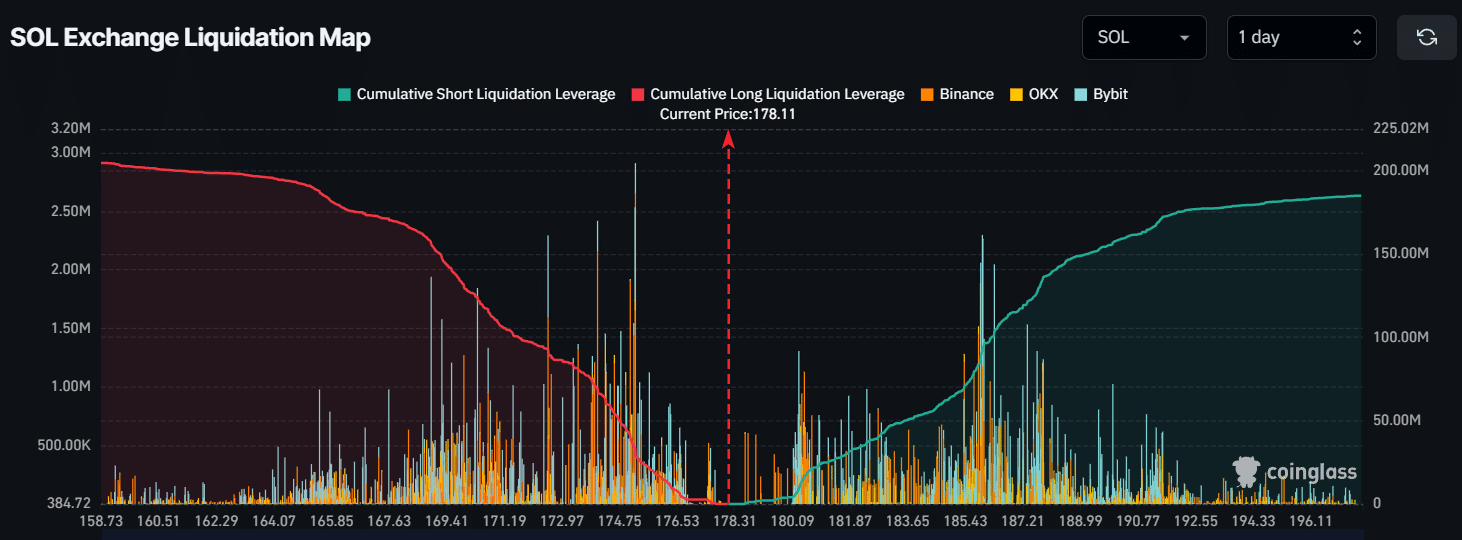

As a crypto investor, I’ve noticed from the liquidation data that long positions held by bulls outweigh the short positions of bearish investors in Solana (SOL). This suggests that more investors are betting on SOL’s price to rise than those who believe it will decline. However, I should mention that the short sellers remain convinced that the SOL price won’t exceed the $186.5 resistance level.

According to Coinglass, $108 million in short positions have been built at the $186.5 level.

At the point of composition, SOL was approximately priced at $179 on the market, marking a noteworthy increase of more than 4% within the past 24 hours. Furthermore, its highest price point during this trading session peaked at $185.

In the past week, SOL has experienced significant growth, surpassing 18% and surpassing the performance of leading cryptocurrencies such as Bitcoin and Ethereum over the longer term.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-07-23 01:12