- Stablecoin market reaches a historic $169 billion in market cap, setting the stage for a potential Bitcoin price boost.

- Regulatory challenges in Europe contribute to a decline in stablecoin trading volumes despite market growth.

As a seasoned analyst with over two decades of experience in the financial markets, I must say that the current state of the stablecoin market is nothing short of remarkable. The $169 billion market cap is an impressive milestone, underscoring the increasing acceptance and adoption of these digital assets.

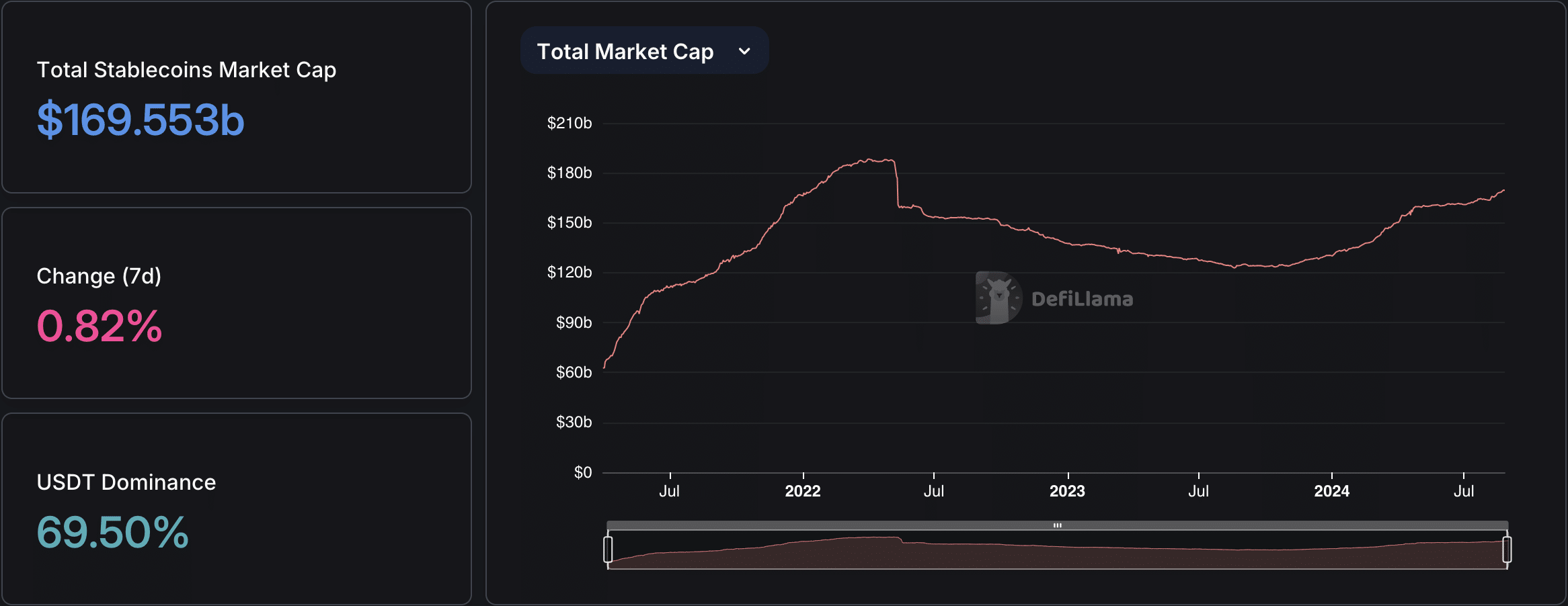

The stablecoin market has reached an unprecedented milestone, with its market capitalization soaring to $169.553 billion. This figure represents the highest point in history, marking 11 consecutive months of growth.

Based on information from DefiLlama, this recent high value exceeds the prior maximum of $167 billion, achieved in March 2022, before a substantial drop occurred later that same year.

In simpler terms, the current market value doesn’t consider stablecoins that are maintained by algorithms instead of traditional assets.

Stablecoin surge boosts Bitcoin potential

As a researcher delving into the world of stablecoins, it’s clear that Tether [USDT] has been a significant catalyst fueling the recent expansion in this market. Kicking off 2024 with a market capitalization of $91.69 billion, USDT has consistently grown month over month, reaching a market cap surpassing $117.844 billion in August.

The digital currency Circle’s USD Coin (USDC) has seen expansion as well, surpassing a market value of more than 34.338 billion USD. This is the peak for USDC in the year 2024; however, it still falls short of its all-time record of $55.8 billion that was set in June 2022.

The surge in stablecoin issuance has brought renewed attention to its potential effects on Bitcoin’s [BTC] price. The increase in liquidity from dollar-pegged tokens has been viewed as a potential opportunity for Bitcoin to rise.

Currently, at the moment this information is being shared, one Bitcoin is being exchanged for approximately 63,645 US dollars, which is a slight drop from its peak of 64,879 USD the previous day. The surge in available funds might not immediately impact Bitcoin’s price movements, as the market works to adapt to the influx of fresh stablecoin capital, adjusting its dynamics accordingly.

Europe’s crypto rules slow trading

Although the market value of stablecoins continues to expand, it’s worth noting that the trading volume has experienced a drop. As per CCData’s latest report, this decline reached 8.35%, amounting to $795 billion in July. This decrease is primarily attributed to reduced transactions on centralized exchanges.

The decline is linked to the implementation of the MiCA Regulation for Cryptocurrencies in Europe, causing apprehension regarding the longevity of stablecoins such as USDT within that continent.

The trading volume has been decreasing, and it persisted through August, currently hovering slightly above 50 billion dollars, according to CoinMarketCap’s latest report.

With an expanding stablecoin market, major players such as Tether and Circle are progressively opting for U.S. Treasury bills as their preferred reserve assets, as indicated in a recent analysis by AMBCrypto.

As a seasoned crypto investor, I can attest to the importance of these assets, which are renowned for their robust safety measures and high liquidity. They serve as the foundation, providing a reliable 1:1 backing for the stability of my digital coins.

The development of this trend has firmly established Tether and Circle as significant forces in the market, as they strive to ensure the consistency and dependability of their digital currencies.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-08-27 11:35