- Stablecoin reserves and SSR trends suggested strong buying power and imminent Bitcoin rally potential.

- Technical indicators and liquidations confirmed bullish sentiment, with $110,000 as a realistic target.

As a seasoned market analyst with over two decades of experience in traditional and digital asset markets, I find myself increasingly intrigued by Bitcoin’s latest surge in value. The current state of Binance‘s stablecoin reserves, combined with the bullish trends we are witnessing, suggests that a significant rally could be on the horizon.

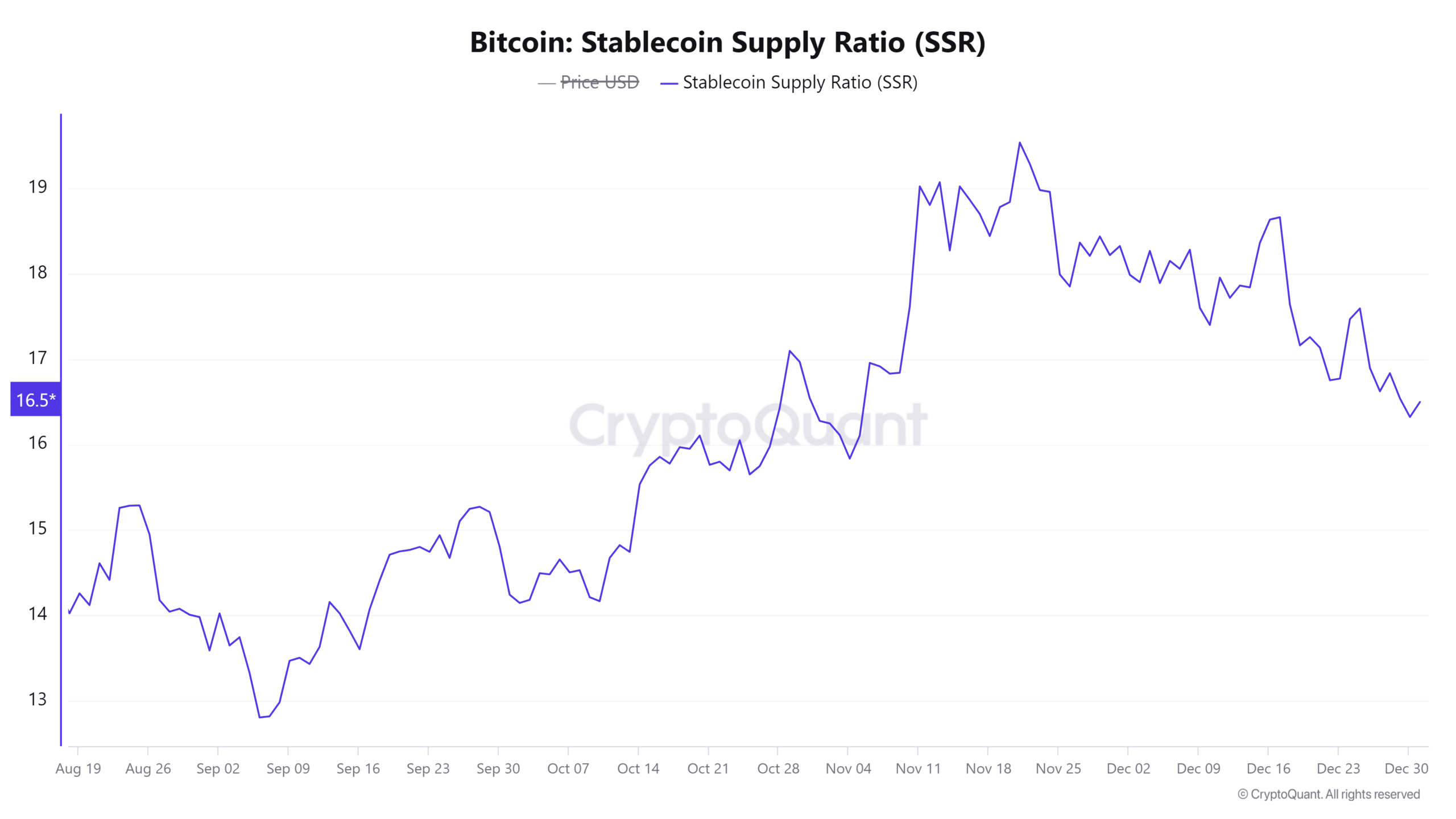

The historical correlation between large stablecoin inflows and BTC price increases is well-established, and the current levels of reserve liquidity hint at another similar rally in the near future. The Stablecoin Supply Ratio (SSR) also points to a favorable environment for Bitcoin’s growth, as there appears to be ample liquidity available to fuel demand.

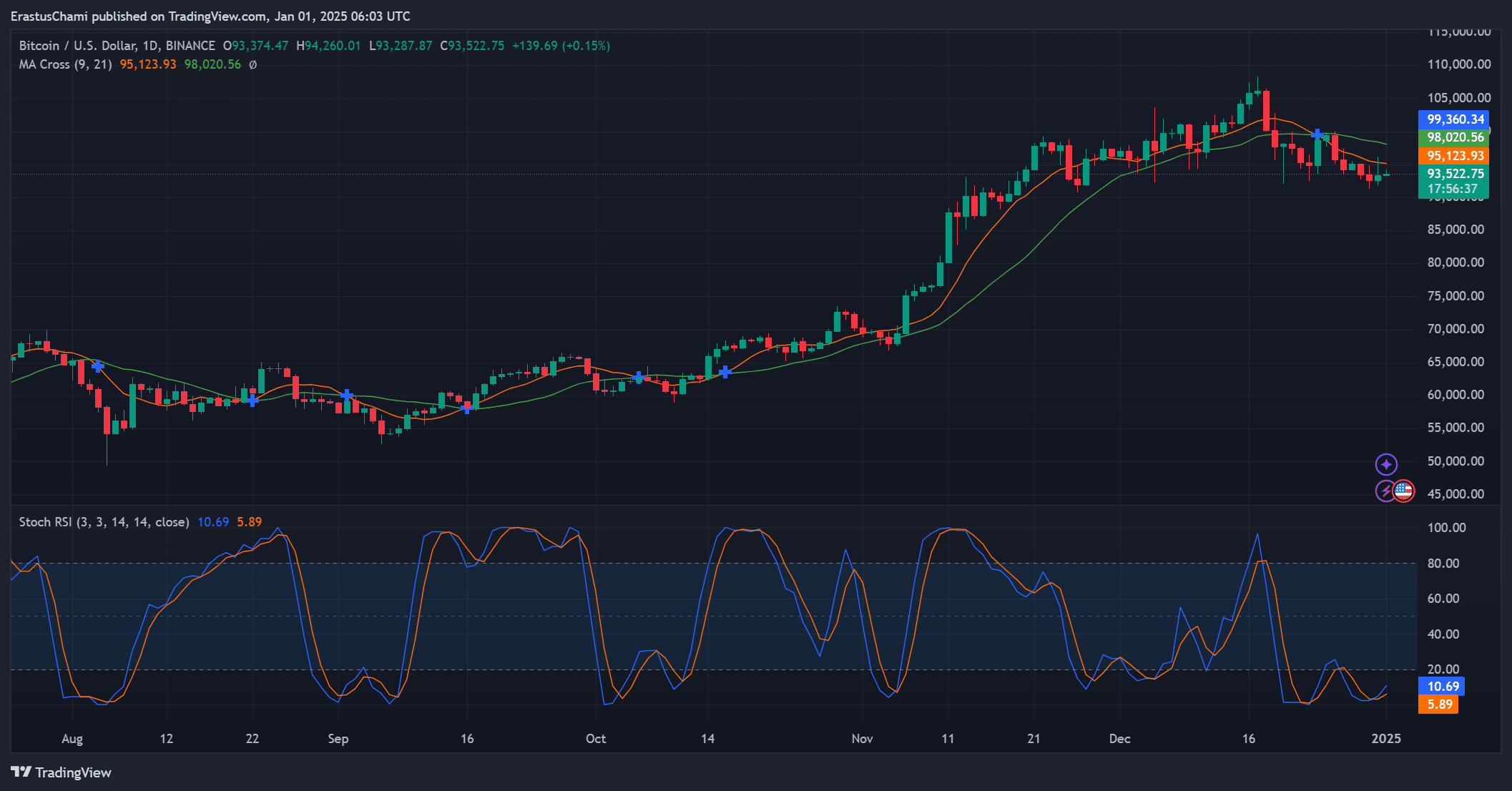

The technical indicators I’ve been observing further support this bullish outlook. The oversold condition of the Stochastic RSI and the strong buying momentum indicated by the 9-day MA above the 21-day MA suggest that a continuation of Bitcoin’s rally is likely.

Moreover, the dominant bullish sentiment reflected in liquidation data underscores significant buying pressure and reinforces investor confidence in BTC’s upward trajectory. It seems we might just be witnessing the early stages of a potential breakout from the descending wedge, with a mid-term target of $110,000 within reach.

In the spirit of transparency and humor, let me remind you that while I’m confident in these predictions, Bitcoin remains an unpredictable and volatile asset. As always, remember to invest wisely and never bet the farm on a single cryptocurrency!

The recent increase in Bitcoin’s [BTC] price has ignited debates, primarily due to Binance’s massive stablecoin holdings and favorable market conditions. These reserves amounted to a staggering $44.5 billion on December 31st, indicating significant purchasing power that could potentially push BTC prices even higher.

Currently, Bitcoin is being exchanged for approximately $93,592.03 per unit (as of the press). Over the last 24 hours, it has experienced a 1.20% increase. This blend of high trading volume and positive trend suggests that the forecast for the cryptocurrency market is becoming more optimistic.

How stablecoin reserves ignite Bitcoin rallies

As a researcher studying the cryptocurrency market, I’ve observed that stablecoins play a crucial role in boosting Bitcoin’s value. These digital assets offer immediate liquidity, frequently serving as a trigger for Bitcoin price surges due to their ability to increase demand. Historically, substantial influxes of stablecoins into exchanges have been followed by BTC rallies.

For example, On December 11th, an increase in stablecoin transactions played a significant role in Bitcoin rising by approximately 4.7% within a single day. Given the current reserves, another surge like this might happen soon, adding to investor confidence.

Does the SSR hint at more upward potential?

The Stablecoin Supply Ratio (SSR), an essential measure, signals the possible expansion of Bitcoin. Right now, it stands at 16.55 and has risen by 1.01% in a day, suggesting a significant amount of liquidity compared to Bitcoin’s total market value.

This implies that Bitcoin’s price might increase due to a more abundant supply of stablecoins, which can boost demand. Moreover, the strong trend of SSR suggests that this upward trend could persist.

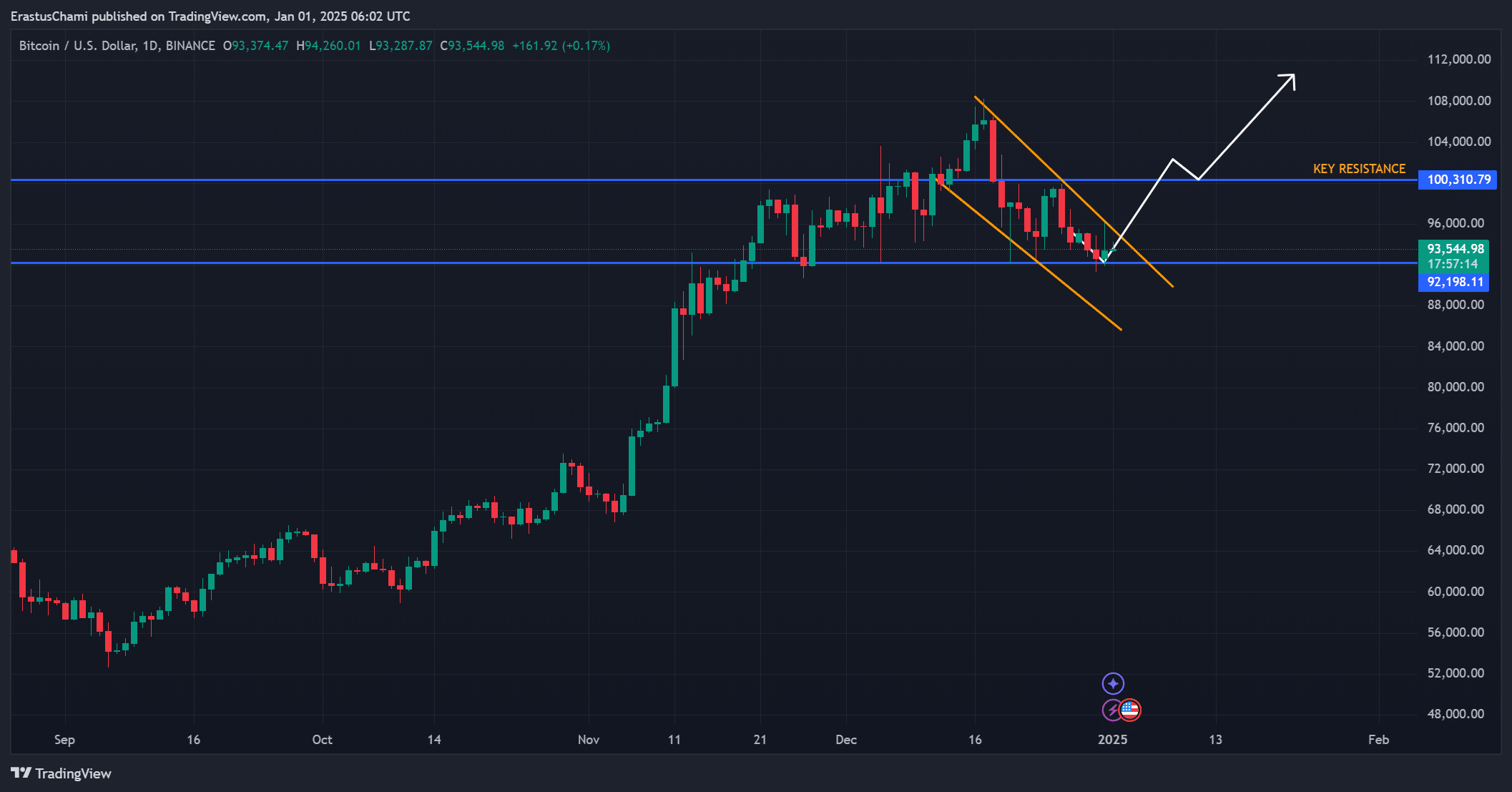

BTC price action: Is a breakout imminent?

The cost of Bitcoin has bounced back after hitting a support level around $92,198.11 and seems to be moving towards a possible breakaway from a falling triangle formation. Typically, these kinds of patterns signal bullish trends, and the current movement of Bitcoin suggests a similar reversal could occur.

The significant barrier at approximately $100,310.79 might open up a potential path toward a medium-term goal of around $110,000. This suggests that Bitcoin’s price movement is suggesting a persistent upward trend.

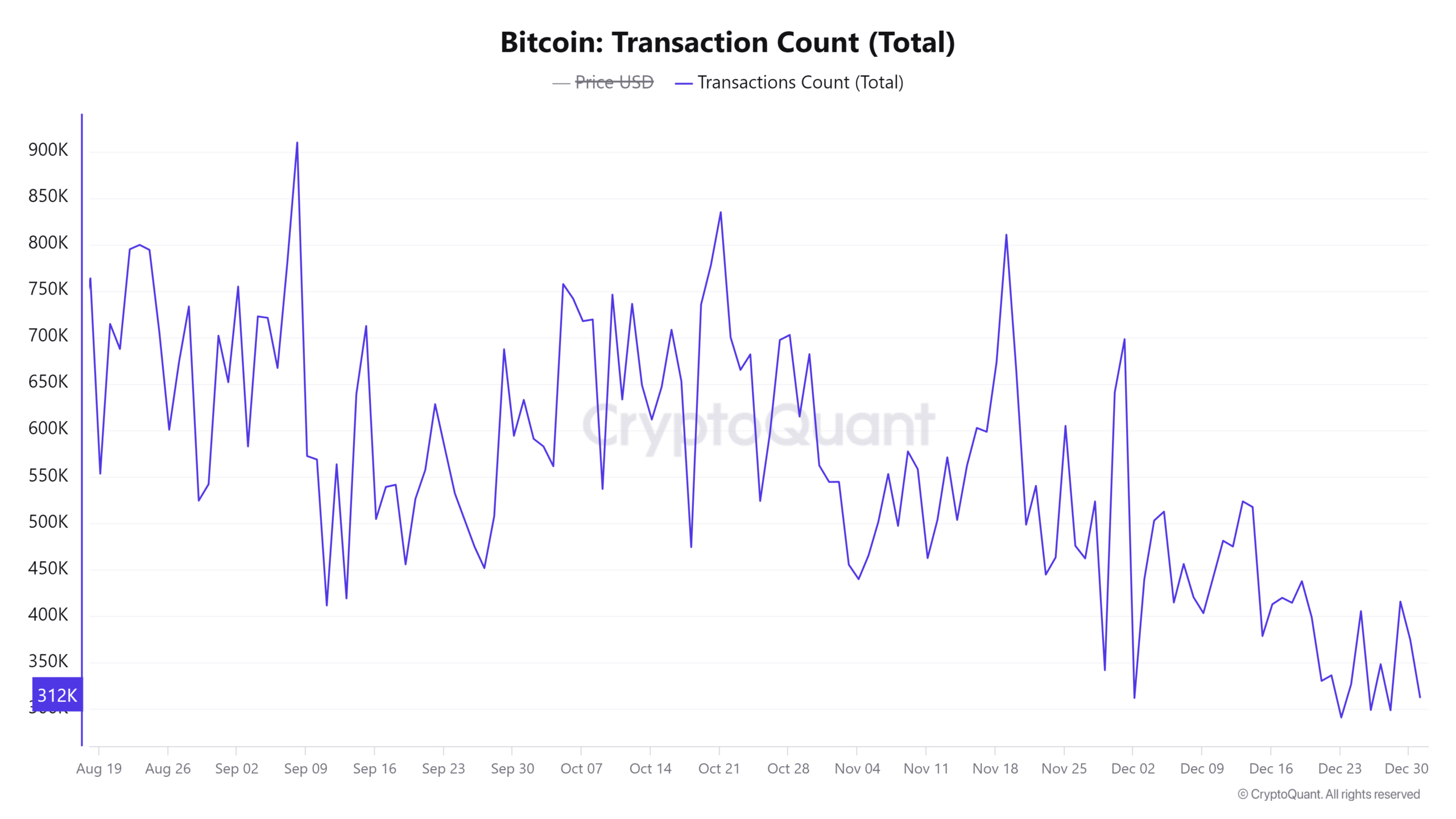

Transaction trends confirm investor confidence

The number of transactions being processed shows regular activity, standing at 312,056 as we speak, which represents a 0.92% rise compared to the previous day. This figure suggests an uptick in involvement within the Bitcoin network, often seen when investors are actively purchasing.

Consequently, consistent transaction activity indicates a strong positive outlook and implies active market participation ahead.

Technical indicators support further gains

Analysis using technical methods indicates a strong possibility for Bitcoin’s price increase. The Stochastic Relative Strength Index (RSI) reads 10.69, hinting at an overbought situation that could lead to a swift price rebound soon.

Additionally, for nine consecutive days, the moving average at approximately $95,124 was higher than the moving average over twenty-one days at around $98,021. This suggests robust buying pressure and implies that Bitcoin’s upward trend may persist based on these technical indicators.

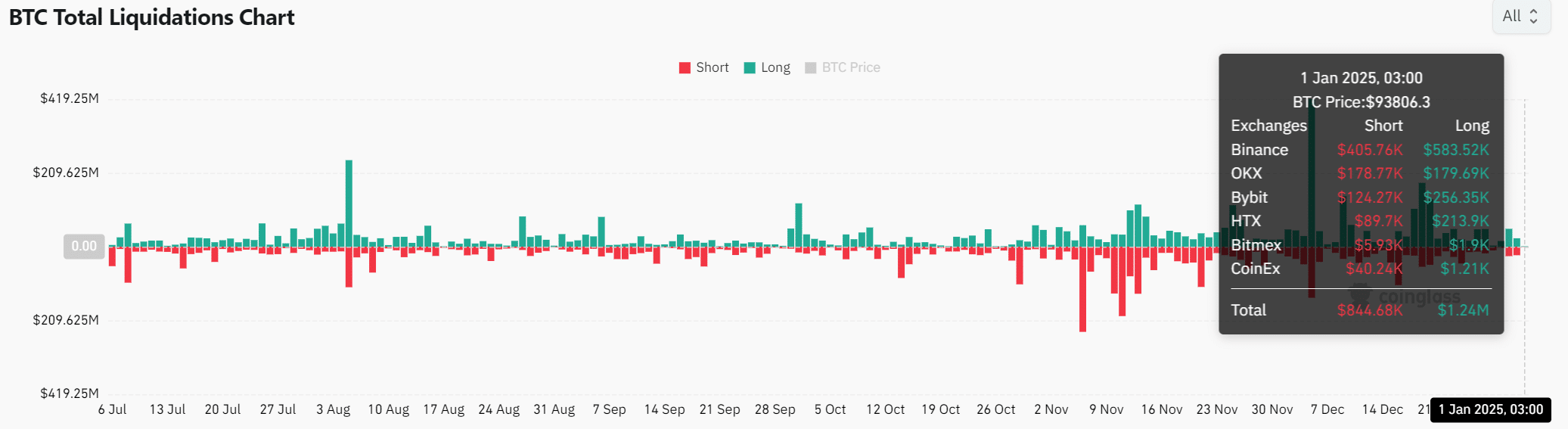

BTC liquidations reveal bullish market sentiment

The information from the liquidation process indicates a strong bullish trend, as there were approximately 1.24 million long contracts settled versus only 844,000 short contracts liquidated.

This imbalance highlights strong demand for Bitcoin, reinforcing the market’s belief in its rising trend. Moreover, it implies that the bullish trend may continue over the short term.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The substantial $44.5 billion worth of stablecoins held by Binance offers a significant amount of liquidity, which is greatly contributing to Bitcoin’s continuing price surge.

With a blend of technological advancements and market transactions, it’s reasonable to expect that Bitcoin might surge up to $110,000 within the short term.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2025-01-01 19:04