Stablecoin Showdown: Korea Takes on the World 🌎💸

Oh, the drama unfolding in the land of kimchi and K-pop! 🍜🎤 The largest South Korean political party, the Democratic Party, is on a mission to fast-track the rollout of KRW stablecoins. And why, you ask? Well, they’re taking a cue from the Trump Administration’s recent moves to establish a stablecoin bill. Because, you know, if the Americans are doing it, the Koreans want in on the action too! 😏

According to a report from local media Edaily, lawmakers from the South Korean Democratic party are pushing for the government to start institutionalizing Korean won-pegged stablecoins. And who’s leading the charge? None other than Chairman Min Byeong-deok, the head honcho of the party’s Digital Asset Committee. This guy’s got big dreams, folks! He thinks the global stablecoin market is going to be “bigger than artificial intelligence or semiconductors” in the near future. 🤯

Min’s all about the urgency of institutionalizing stablecoins pegged to the Korean won. He sees it as a way to not only strengthen the national fiat currency through crypto, but also to boost global demand for won-backed assets. And let’s be real, who doesn’t love a good underdog story? 🐕

“We need to take the lead in institutionalizing stablecoins before U.S. dollar-based stablecoins become firmly established. That is the only way we can secure a sure position in the global battle for stablecoin hegemony,” said Min in his statement. Translation: Korea wants to be the cool kid on the block, and they’re willing to fight for it! 💪

Meanwhile, the South Korean Democratic Party presidential candidate, Lee Jae-myung, is a frontrunner in the lead-up to the South Korean presidential elections. And guess what? He’s all about accelerating the roll-out of KRW stablecoins, aiming to establish them quickly before the U.S. gets a chance to establish stablecoin bills. Talk about a stablecoin showdown! 🤔

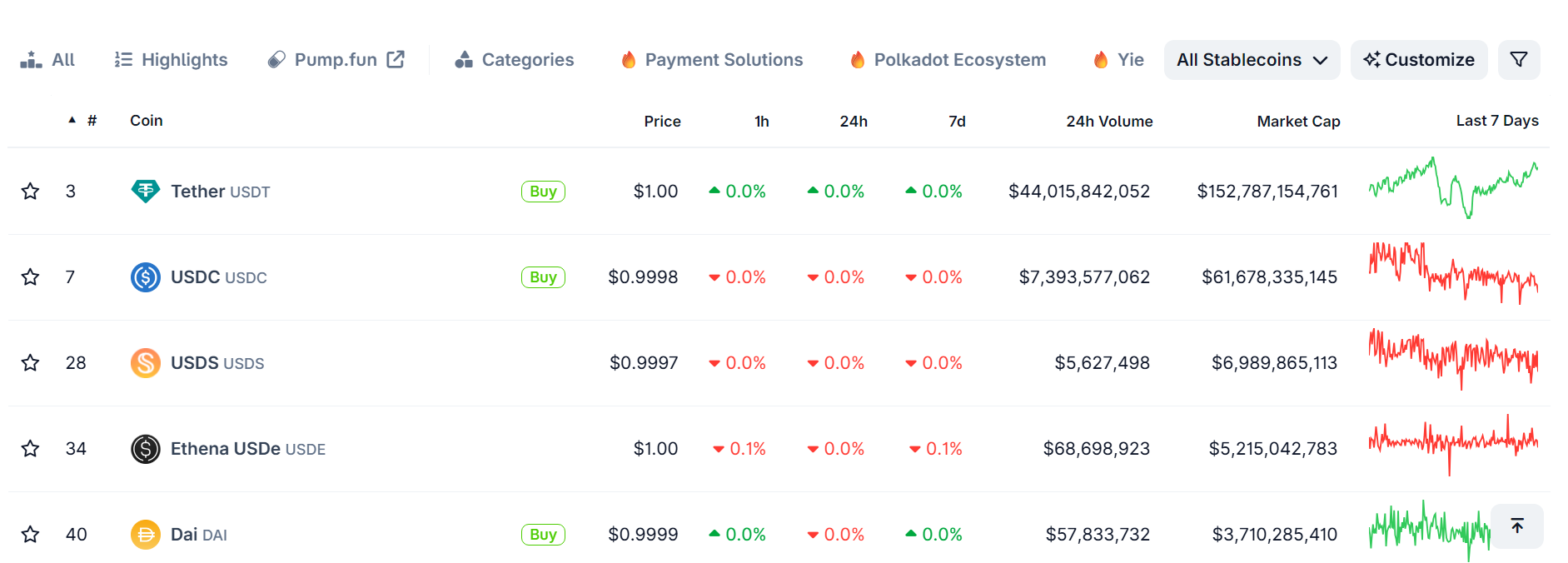

These regulations could potentially boost the domination of strongholds like Circle (USDC) and Tether’s (USDT) U.S. dollar-backed stablecoins on the market. But hey, a little competition never hurt anyone, right? 😏

“These two [stable]coins account for 90% of the stablecoin market in the United States, and are also used in some areas of Korea, such as Dongdaemun, where many foreign payments are made,” continued Min. Yeah, because who doesn’t love a good game of stablecoin monopoly? 🎲

Min’s currently urging South Korean lawmakers to pass a stablecoin bill, with a working draft titled “Basic Act on Digital Assets.” He’s conducted a second review process with industry experts and the media, and plans to submit the bill after the third review. Fingers crossed, folks! 🤞

And in other news, the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, or the GENIUS Act, passed the U.S. Senate vote with 66 votes in favor. It’s currently headed to a full floor vote, bringing it closer to becoming formalized as the first U.S. stablecoin bill. Because, you know, the Americans are always one step ahead! 😜

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

- Masters Toronto 2025: Everything You Need to Know

2025-05-26 11:31