- Consistent stablecoin inflows into exchanges are fueling Bitcoin’s price stability above $96,000.

- Bitcoin’s MVRV ratio at 2.69 and rising open interest suggest a bullish trend with minimal risks.

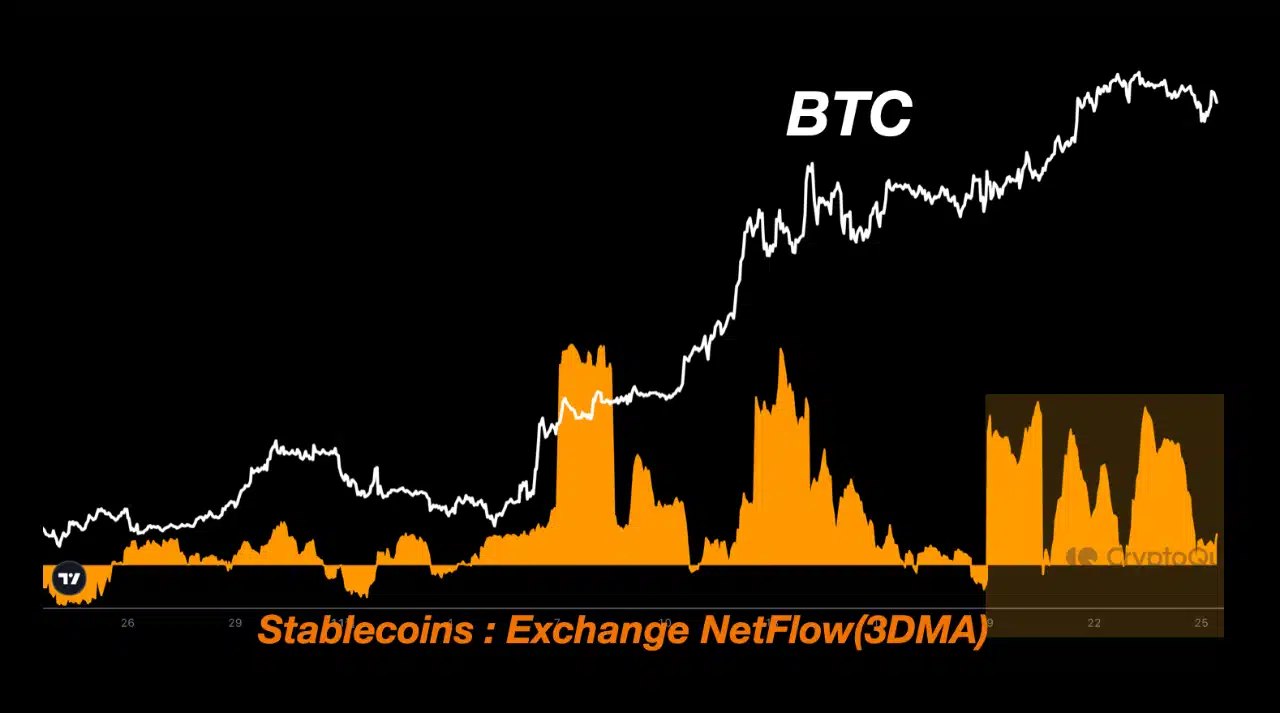

As a seasoned crypto investor who’s weathered the stormy seas of the digital asset market for years, I can confidently say that the current price stability of Bitcoin above $96,000 is nothing short of impressive. The consistent inflow of stablecoins into exchanges, as observed by SignalQuant, has undeniably played a significant role in Bitcoin’s ability to sustain higher lows and maintain its resilience against corrections.

As an analyst, I’m keeping a close eye on Bitcoin’s [BTC] progression towards the significant milestone of $100,000. Currently, it’s holding steady above $96,000, demonstrating a level of price resilience that’s piquing the interest of many in the crypto community.

In contrast to dipping after reaching a record-breaking price of $99,645 on November 22nd, Bitcoin has shown remarkable strength and continues to trade at $98,083 as we speak. This resilience implies a solid base beneath it, as investors eagerly watch for its next strategic move.

As a crypto investor, I’ve noticed that a consistent flow of stablecoins into exchanges seems to be a significant factor behind the current price stability. According to SignalQuant, an analyst at CryptoQuant, this trend of net inflows of stablecoins has significantly strengthened Bitcoin’s capacity to maintain higher lows.

SignalQuant noted,

The ongoing pattern suggests that the price will keep reaching new highs at troughs. Given the current trend of net inflows, it’s likely to surpass the $100,000 milestone soon, absent any substantial correction.

As the analyst explains, this continuous flow of funds has reduced the possibility of significant market drops, thereby strengthening the optimistic trend observed in Bitcoin’s recent trading activity.

Market fundamentals and Bitcoin’s future path

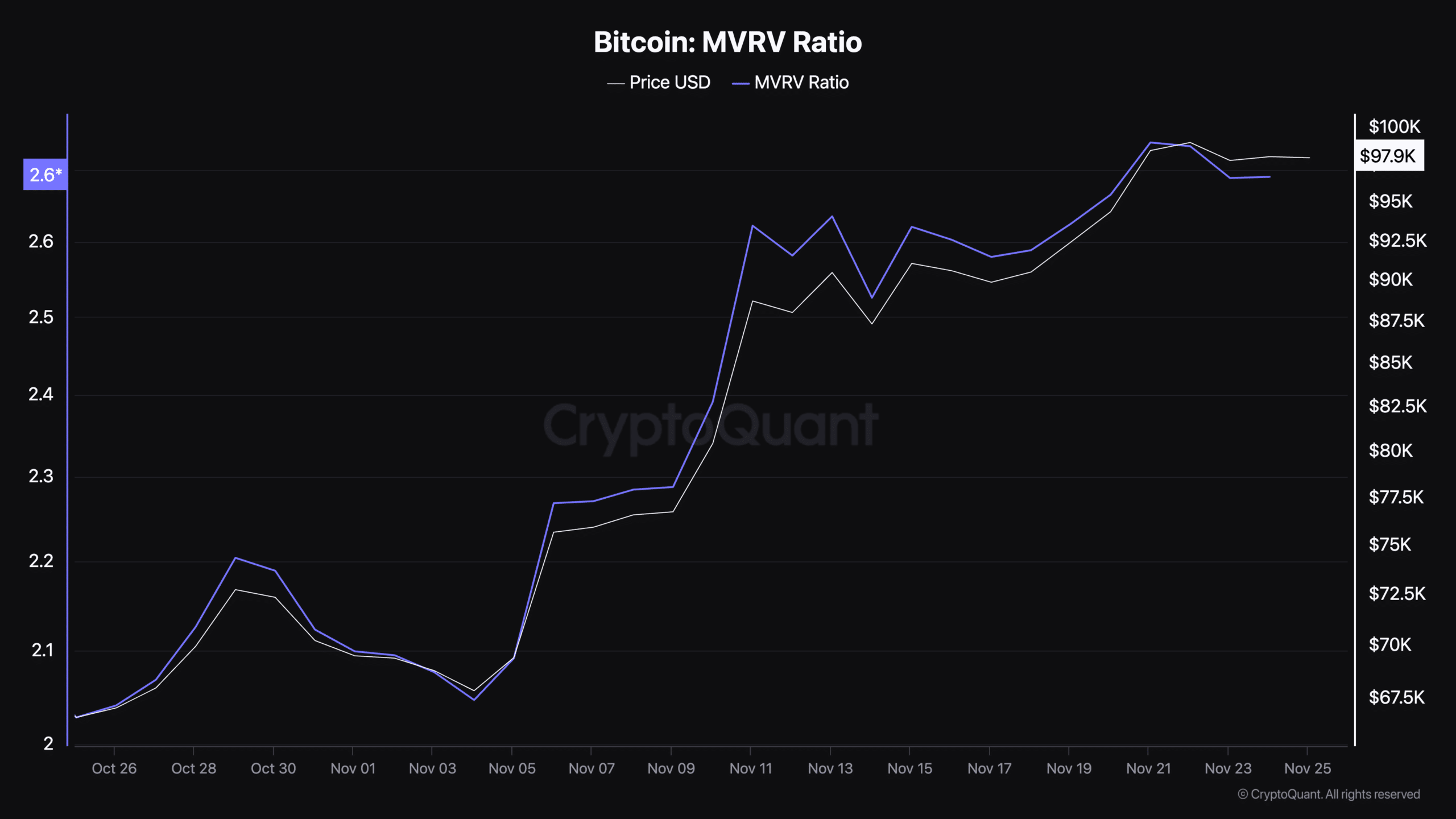

To gain a clearer perspective on Bitcoin’s possible future path, it’s crucial to scrutinize essential market factors. One useful tool for this is the Market Value to Realized Value (MVRV) ratio, which offers significant insights from on-chain analysis.

In simpler terms, the MVRV (Market Value to Realized Value) ratio is obtained by dividing the total value of Bitcoins in circulation by the worth of Bitcoins that were previously sold or transferred. This ratio indicates if Bitcoin’s current price is considered overvalued or undervalued compared to its historical value.

Historically speaking, an MVRV ratio less than 1 usually signals a possible market bottom, whereas a value greater than 3.7 might suggest a potential market top. As for Bitcoin’s current MVRV ratio of 2.69, this suggests that the market is tending toward optimism but has not yet reached critical overvaluation levels.

This suggests room for further price growth while maintaining a cautious stance on overextension.

Read Bitcoin’s [BTC] Price Prediction 2024-25

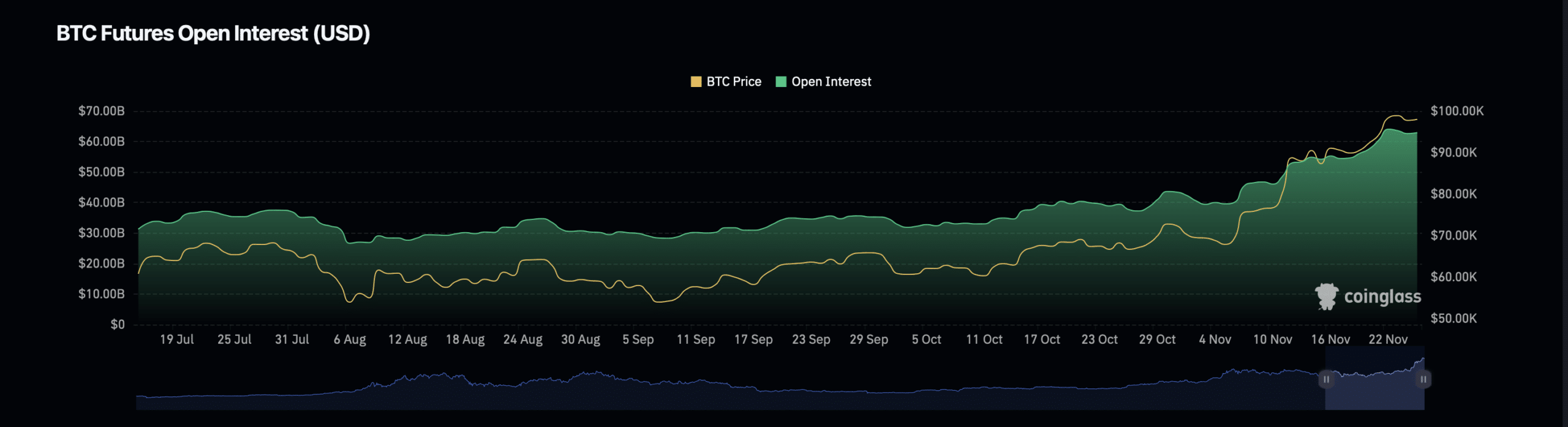

Alongside the MVRV ratio, Bitcoin’s open interest and trading volume also offer insights into trader behavior. According to Coinglass, Bitcoin’s open interest has risen by 0.86%, reaching a total of approximately $63.16 billion.

In much the same way, the open interest volume has grown dramatically by 47.13%, amounting to a whopping $81.33 billion. This significant increase underscores a robust demand for Bitcoin from investors, as they strategically position themselves in expectation of future price movements.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-25 19:35