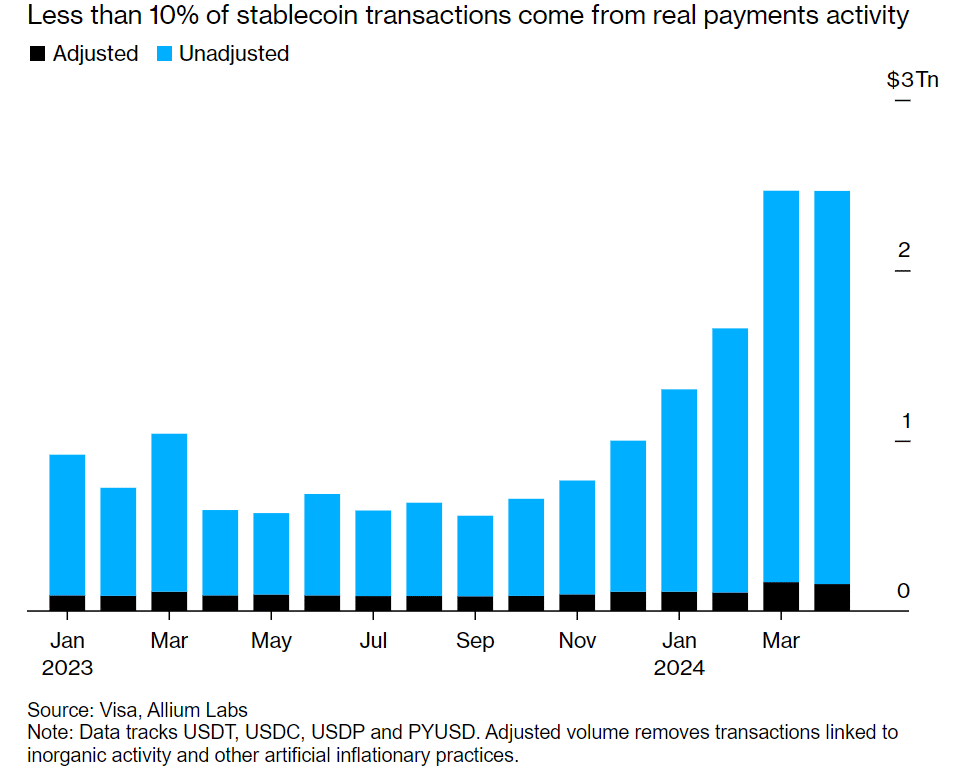

- Over 90% of stablecoin volumes are linked to bots and large traders.

- The findings suggest that stablecoin payments haven’t hit mainstream adoption yet.

As a crypto investor with some experience in the market, I find the recent report on stablecoin transactions intriguing. The fact that over 90% of the volume is linked to bots and large traders is concerning, as it suggests that genuine user adoption has yet to reach significant levels.

Only less than 10% of the April stablecoin transaction volume was linked to genuine users.

Based on recent data from Visa Inc., I have discovered that approximately 90% of trading volume can be attributed to automated bots and large-scale traders.

Part of the report highlighted that,

As a researcher examining transaction data, I discovered that out of the approximately $2.2 trillion worth of transactions recorded in April, only around $149 billion came from organic payment activities.

In contrast to the vast payments industry valued at $150 trillion, the report indicated that stablecoins had yet to gain significant popularity as a preferred payment method.

Stablecoin have a long way to hit mainstream adoption

As a financial analyst, I can tell you that PayPal and Stripe are two well-established names in the payments industry who have recently expanded their reach into the world of stablecoins.

Last year, Visa processed an impressive volume of $12 trillion in transactions. However, this industry titan may face significant competition with the increasing acceptance of stablecoins for payments on a global scale. Many experts consider this trend a potential challenge to Visa’s current business model.

As a researcher exploring the current state of this market, I’ve come across varying perspectives. Some observers hold the view that we’re still in the market’s infancy and widespread adoption might take place further down the line. However, in the near or medium term, it seems prudent to focus our efforts on the underlying payment infrastructure.

One analyst, Pranav Sood, general manager at the payment platform Airwallex, commented,

In the short term and mid term, it’s essential to improve the performance of our current systems.

During this period, the stablecoin market experienced a significant growth spurt as the broader market recovered from the substantial declines in March and April.

Its market cap hit $160B, with DAI dominating notable growth from blue-chip stablecoins.

In terms of monthly development, the USDe of Ethena and the FDUSD of First Digital experienced substantial growth of over 10%, according to DeFiLlama’s latest data. Meanwhile, DAI, USDT, and USDC reported growth figures of around 1-9% respectively.

An increase in the ownership of stablecoins, particularly among large investors, might indicate that major market participants are preparing to take advantage of potential discounts, thereby influencing the markets.

As a researcher studying the cryptocurrency market at present, I’ve observed that Bitcoin [BTC] has retreated to the price range of around $60,000 to $71,000. An additional surge in stablecoins could potentially fuel further gains for the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-07 10:15