Ah, USDT and USDC — the enigmatic twins of stablecoins, siblings of digital finance, both lurking in the murky alleys of crypto bazaars. Here begins our tormenting quest to unveil their secrets, their deceptions, and their virtues, so weary souls like you might decide whence to place your trust.

The Grim Anatomy of Stablecoins

Imagine, if you will, a creature born not of nature’s whim but of man’s yearning for order amidst chaos—a digital chimera bound to earthly currencies like the U.S. dollar, the euro, or that inscrutable yen. Some even claim gold as their tether, a glittering promise amidst the digital tundra.

These stablecoins — they offer a tantalizing mirage: all the swiftness and transparency of cryptos, yet shorn of their monstrous whims, avoiding the dizzying spins of Bitcoin’s lunacy. They are the bridge over the chasm between the mundane world of fiat and the dazzling fever dream of blockchain.

The trader’s restless hand, the business’s eager ledger, the dreamers of DeFi — all cling to these tokens for swift passage, for shelter from tempestuous market storms. Stablecoins whisper, “Trust in me, for I am steady.” But is that truly so?

In the cryptic edifices of decentralized finance, these coins are pillars—lending, borrowing, growing yields—yet always under the shadow of that maddening question: whose feet truly brace the ground?

USDT: The Old Soldier of 2014

Tether Limited conjured USDT in 2014 — the grandfather of stablecoins, stalking across Ethereum, Tron, EOS, Algorand, and beyond. A titan with a market worth about $150 billion, its liquidity flows like a restless river, fueling exchanges both centralized and wild.

Yet behind this giant stands Paolo Ardoino, the figure of command since 2023, steering Tether and Bitfinex through murky waters. Tether wears transparency as a badge, yet critics whisper of shadows in reserve vaults—of tales less overt, less credible.

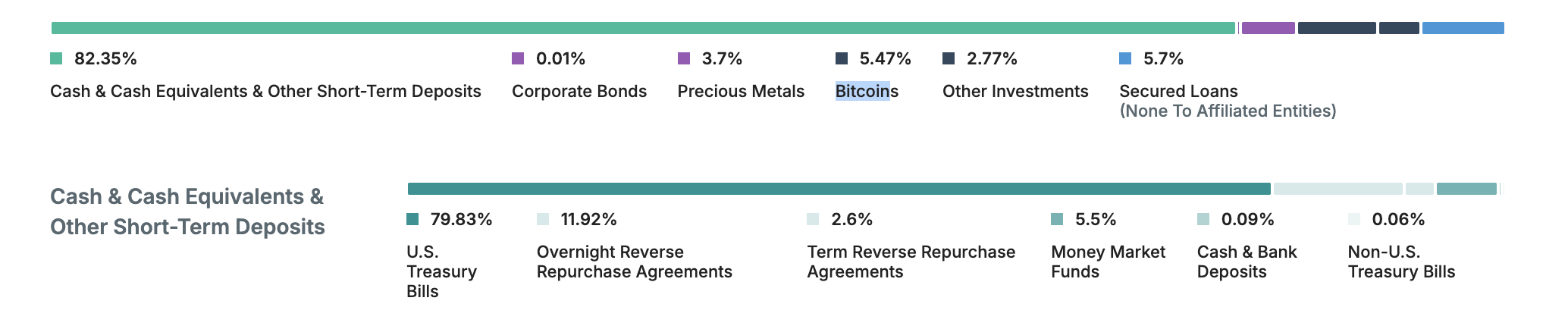

The reserves, once a cocktail of treasury bills, commercial papers, and mysterious loans, have been pruned by regulatory scythes down to mostly safe U.S. Treasury bills. Reports come quarterly, but attestations rather than full audits—leaving ever so sly gaps for suspicion’s embrace. Nevertheless, USDT holds its place, a stubborn colossus refusing to fade.

USDC: The Pristine Newcomer of 2018

In strolls USDC, born under the watchful eyes of Circle and Coinbase—fintech giants wielding the tools of regulation and transparency like fine-crafted armor. Launched in 2018, USDC prides itself on clarity and law-abiding virtue, lighting its path across blockchains Ethereum, Solana, Algorand, Stellar, and others.

With a shiny market cap near $30 billion, its reserves are as pure as a saint’s prayer: cold, hard U.S. dollars or their faithful Treasury proxies, meticulously attested monthly by the immaculate scribes Deloitte and friends. Regulators nod approvingly, especially under Europe’s MiCA regime, where USDC stands the herald of compliance.

Circle’s Jeremy Allaire champions trust and the rule of law, carving a sanctified niche amidst crypto’s often wild frontier. USDC is not just a stablecoin; it is a promise of order, the dime-store messiah for institutions.

The Tale of Two Reserve Strategies

Tether’s Shadowed Reserves

Once upon a time, Tether’s coffers brimmed merely with cash. Then ambition and demand drove it into commercial paper and corporate bonds, risking liquidity in turbulent storms. But when the regulators growled, Tether retreated, now hoarding near 80% in sober Treasury bills, forsaking the risky ventures.

Those quarterly glimpses into their holdings come as attestations — shades on the wall, not the full light of audits. Suspicion lingers, as does the persistent satire of skeptics.

USDC’s Sanctified Vault

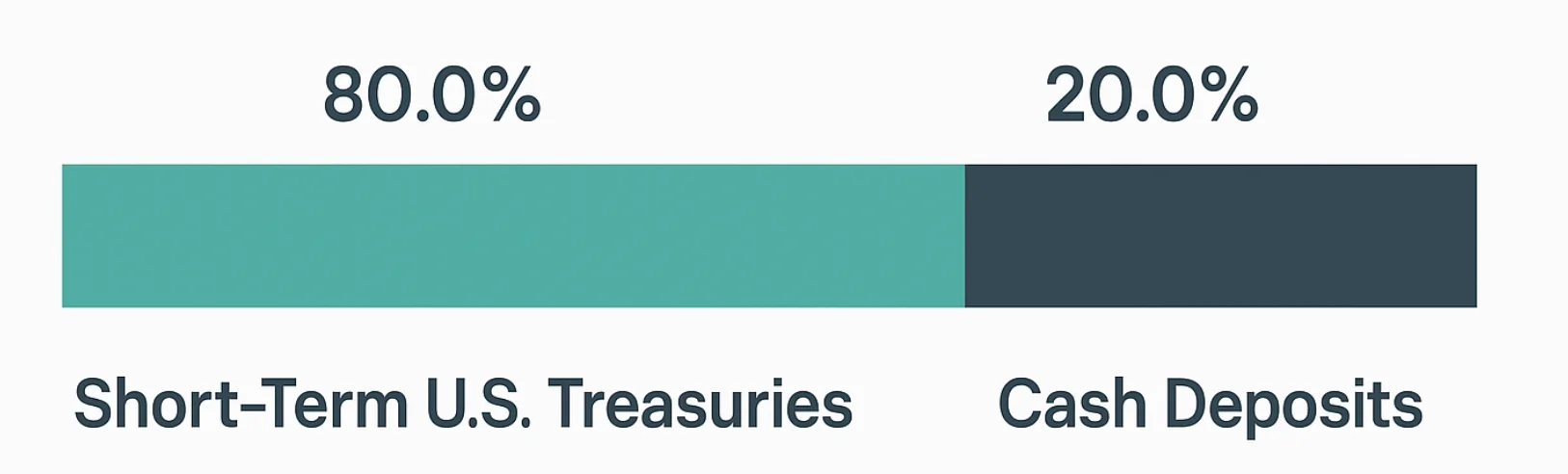

USDC’s reserves are the very picture of caution. No corporate bonds shall taint them; only U.S. cash or Treasury bills cradle each token. Monthly attestations verified by giants like Deloitte confirm the 1:1 holy backing.

Here, transparency breathes fully, comforting the risk-averse like a warm shawl on a cold Siberian night.

Regulatory Duels: Battles Won and Lost

Tether’s Legal Scars

In 2021, Tether was smacked with an $18.5 million fine by New York’s Attorney General—its sins of reserve misrepresentation laid bare. Though promising better disclosures since, skepticism shadows each step.

Without global licenses, Tether’s reach may shrink like a disappointed novelist at the EU’s stern MiCA readership, while European platforms prepare to exile USDT altogether.

Circle’s Lawful March

Circle dances nimbly with regulators, registered as a U.S. money services business, and clutching the coveted MiCA license in Europe, allowing its USDC to roam freely across the continent—unlike its troubled sibling.

The Stark Contrasts: USDT vs. USDC

Transparency Tango

USDT’s moonlit reserve reports fool no one entirely; shadows still slink between the lines. USDC’s monthly attestations shine the benevolent sun on every dollar behind the token.

Compliance Waltz

USDT fumbles with regulatory ghosts, bruised by fines and doubts. USDC marches proudly armed with licenses and laws, the law’s favorite child.

Reserve Composition Duel

USDT drinks from a mixed cup of treasuries, loans, and mystery meat; USDC sips purely from the crystal stream of U.S. treasury and cash, for the faint-hearted and cautious.

Liquidity and Crowd Appeal

USDT is the bustling bazaar’s favorite coin, the king of exchanges everywhere, while USDC, though quieter, grows with the virtue-signaling elite and institutions craving order.

MiCA Compliance: The Final Boss

The EU’s Markets in Crypto-Assets regulation casts its long shadow, demanding full reserves and audits. USDC bows gracefully and is granted passage; USDT skulks in the shadows, barred and unwelcome at many European venues.

Advantages and Woes: The Tale in Two Lists

The Old Warrior: USDT

- Floods markets with liquidity unparalleled.

- Keeps company with many blockchains — a social butterfly of crypto realms.

- Quarterly attestations without the sweet kiss of full audits.

- Haunted by regulators and missing MiCA’s blessing.

- Beloved still by traders, remittance adventurers, and emerging economies.

The Lawful Newcomer: USDC

- Strong liquidity on regulated stages.

- Monthly attestations from respected accounting sages.

- Fully compliant with U.S. and European laws.

- Tightly woven into DeFi, fintech, corporate vaults.

- Winning hearts of institutions requiring clear conscience and clean books.

How the Wise and the Reckless Use Them

USDT: The Liquidity Juggernaut

Traders cherish USDT for its nimbleness, its worldwide embrace. Day traders, arbitrageurs, and DeFi outlaws find comfort in its broad arms. Remittance kings in shaky currencies count on its digital gold-like sheen. The regulators may bark, but the market strolls unbowed.

USDC: The Compliance Darling

Institutions seek USDC’s regulatory sanctuary. Lending platforms, crypto payment businesses, DeFi builders all trust its clarity. USDC powers novel finance schemes far beyond mere transactions — tokenized bonds, blockchain savings, and dreams of a disciplined digital tomorrow.

Choosing Your Champion

Behold, two colossi, each commanding a kingdom of crypto believers. Tether, the battle-worn general, rules vast liquidity with questionable transparency. USDC, the principled warrior, wields regulatory armor and steady clarity.

Choose not blindly. If you thirst for instant moves and wide acceptance, the old general USDT may still lead your charge. But if you favor the quiet surety of law and order, USDC stands ready with a polished shield and open ledger.

As these titans evolve behind clouds of law and innovation, watch closely: the future of stablevalue may well hinge on this perennial rivalry, a Dostoevskian drama where trust, skepticism, and survival intertwine with a twisted grin 🤡.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Elevation – PRIME VIDEO

2025-04-28 23:20