Well, would you look at that? The stablecoin market cap in 2025 decided to flex its muscles, sprouting up to a record-breaking $228 billion. Who knew fake internet dollars could be worth more than most small nations? Let’s take a nosedive into the magical land of digital IOUs and see what’s fueling this circus. 🥳💸

Stablecoin Market: Up 17%—That’s Right, We’re Printing More Than The Fed!

So, the big brains over at CryptoQuant posted on X (that’s Twitter’s evil twin, in case you’re behind the times) about stablecoins. If you don’t know what a “stablecoin” is, congratulations, you still have a life. For everyone else: it’s monopoly money pretending to be real money, usually pegged to the US dollar. Like cosplay for finance nerds.

People use them for all sorts of things—payments, hiding from Bitcoin’s mood swings, or just because they love to party with things that end in “coin.”

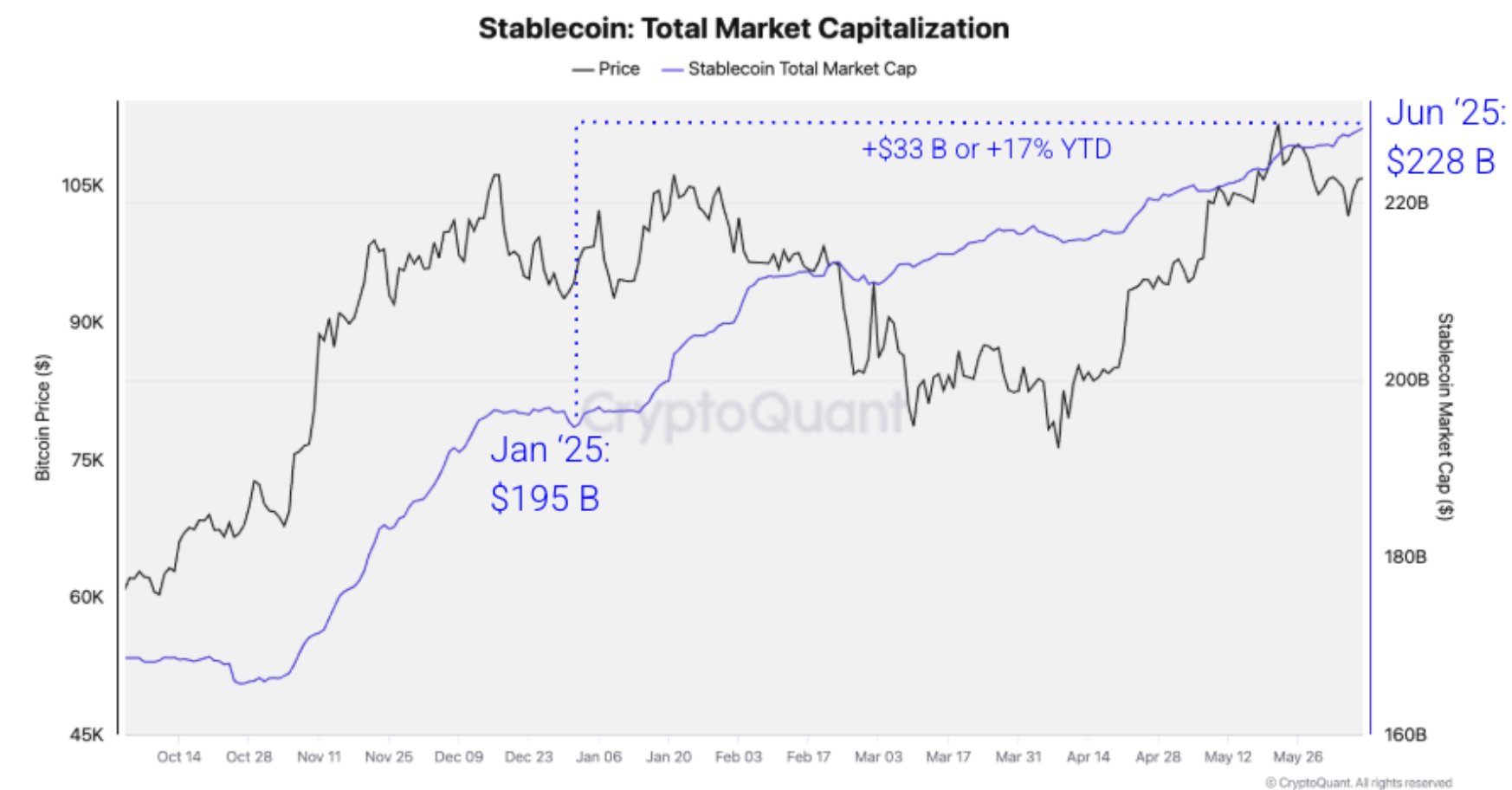

Take a gander at this beauty—they even brought a chart to the show-and-tell:

Look at those numbers! Back in January, stablecoins sat at $195 billion. Now they’re up to a jaw-dropping $228 billion. That’s a $33 billion jump—or as Elon calls it, pocket change. 🚀

What’s pushing these digits higher than my cholesterol? According to our friends at CryptoQuant, it’s “rising trading activity, growing payment use, and clearer U.S. regulation under Trump.” Yes, you read that right—the guy who once suggested we drink bleach might finally make crypto regulations boring instead of terrifying.

Apparently, there’s a bipartisan bill rolling through the Senate, and it might actually pass. The politicians are either on the same page—or just playing a really elaborate prank on all of us.

Naturally, people keep parking their dough in these “safer” digital dollars to avoid the heartbreak of watching Bitcoin crash faster than my WiFi during a Zoom call.

And here’s the kicker: all this parked cash (aka “dry powder”) is just waiting for a dramatic comeback. At some point, someone’s gonna yell “BUY THE DIP!” and we’ll see more action than a Marvel reboot. Hold onto your butts, folks.

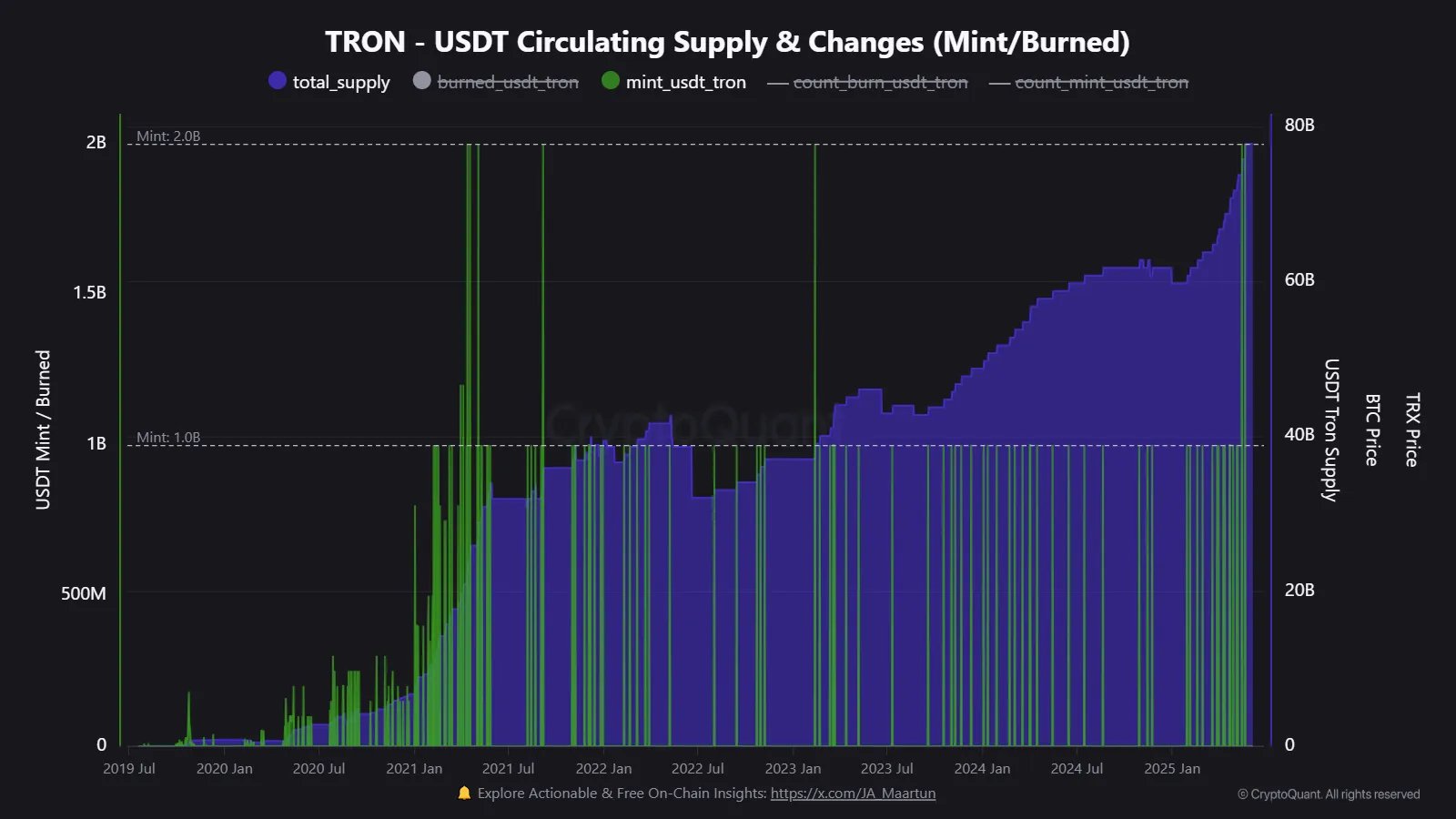

Oh, and if you thought Ethereum was the big kid on the block—plot twist! The Tron network has been hosting stablecoins like it’s spring break in Miami.

Tron’s holding $75.7 billion worth of USDT, while Ethereum is sitting on a modest $71.4 billion. It’s like watching two rich guys argue over who has the bigger yacht.

And if billion-dollar mints are your thing (and hey, who doesn’t love a good money fountain?), Tron’s been on a roll. In 2025, they’ve done 17 mints over a billion each. Someone out there is walking around with diamond hands… or maybe just a really big printer. ✨🖨️

BTC Price

Meanwhile, in “Actual Bitcoin News,” the old king is trading around $108,300—up 5% this week. Not too shabby. At this rate, it might even afford New York rent someday.

Read More

2025-06-13 15:14