- USDT mints have totalled $16 billion since Bitcoin’s $74k peak

- Whale activity increases as Bitcoin and USD liquidities move in correlation

As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-evolving digital asset landscape, I find myself intrigued by these recent developments. The surge in USDT minting, coupled with the increased whale activity on centralized exchanges, is reminiscent of a well-choreographed ballet – albeit one with significant financial implications.

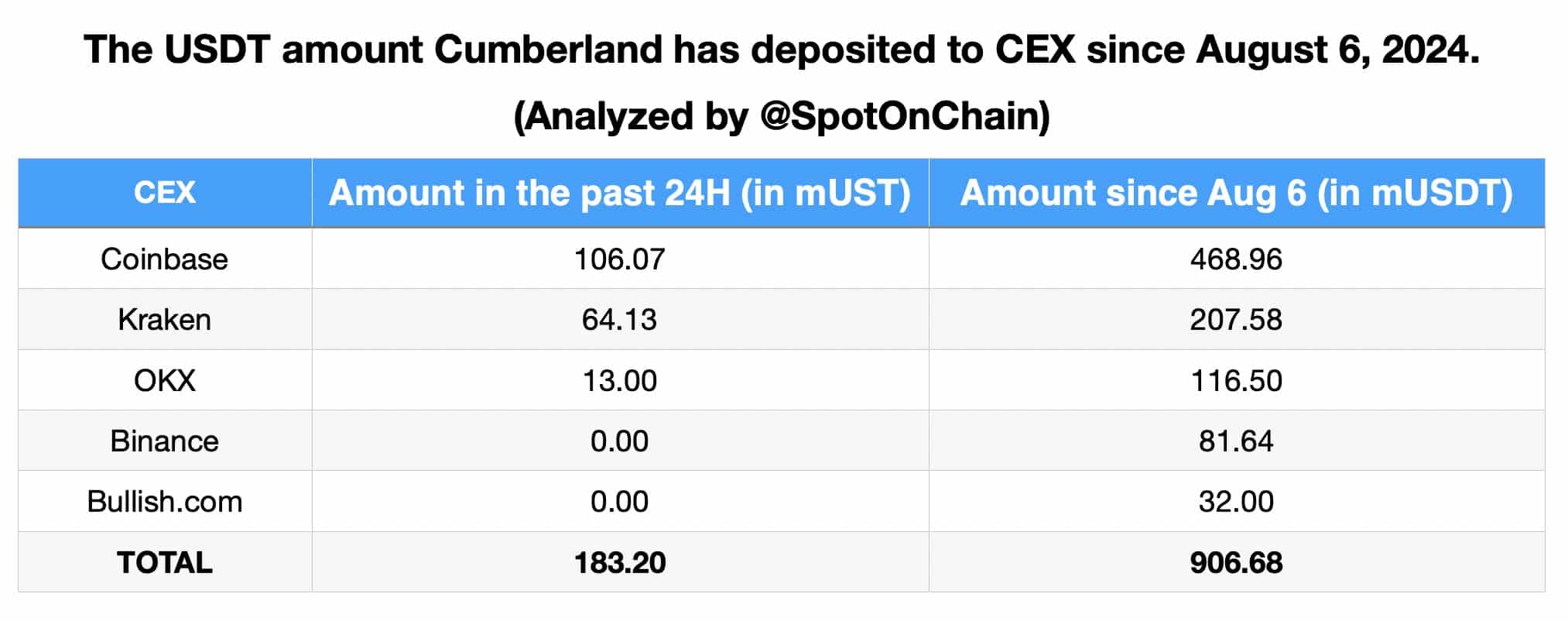

Over the past 13 hours, as an analyst observing the blockchain, I’ve noticed that the Tether Treasury has minted a billion USDT on Ethereum. Interestingly, they transferred approximately 183.2 million USDT to Cumberland for exchange deposits. This insight is based on my analysis using SpotOnChain’s data point X.

After the crypto market’s dip on August 5th, Cumberland has received approximately 953 million USDT from Tether and has injected around 906.7 million USDT into several different exchanges. These exchanges include popular platforms such as Coinbase, Kraken, OKX, Binance, and Bullish.com.

Moreover, Tether (USDt) has now been added to the TON blockchain, which has propelled USDT’s total market capitalization to a record-breaking $115.6 billion.

In simple terms, when you include today’s additional $1 billion from Tether, this brings the total amount minted since Bitcoin reached its peak of $74,000 up to a staggering $16 billion.

With major financial entities gearing up for market entry, their influx of funds might potentially escalate prices, given the liquidity at hand. The recent Tether update serves as an indicator of heightened “whale” presence on centralized exchanges, facilitated by swift transactions.

Continuous coin production aligns with the latest market uptrends, bolstered by robust and streamlined systems such as Multi-Party Computation (MPC) wallet providers, custodians, and Remote Procedure Call (RPC) solutions. In simpler terms, this results in increased transactions on centralized exchange platforms.

Therefore, it’s likely that these minting activities and transactions will continue to influence the pace of the cryptocurrency market.

A hike in whale activities

After engaging in minting and transactions, Whale “0xbe6” subsequently withdrew approximately 935.1 Wrapped Bitcoin (WBTC), valued at around $55.6 million, from Binance, with an average withdrawal price of about $59,451 per WBTC.

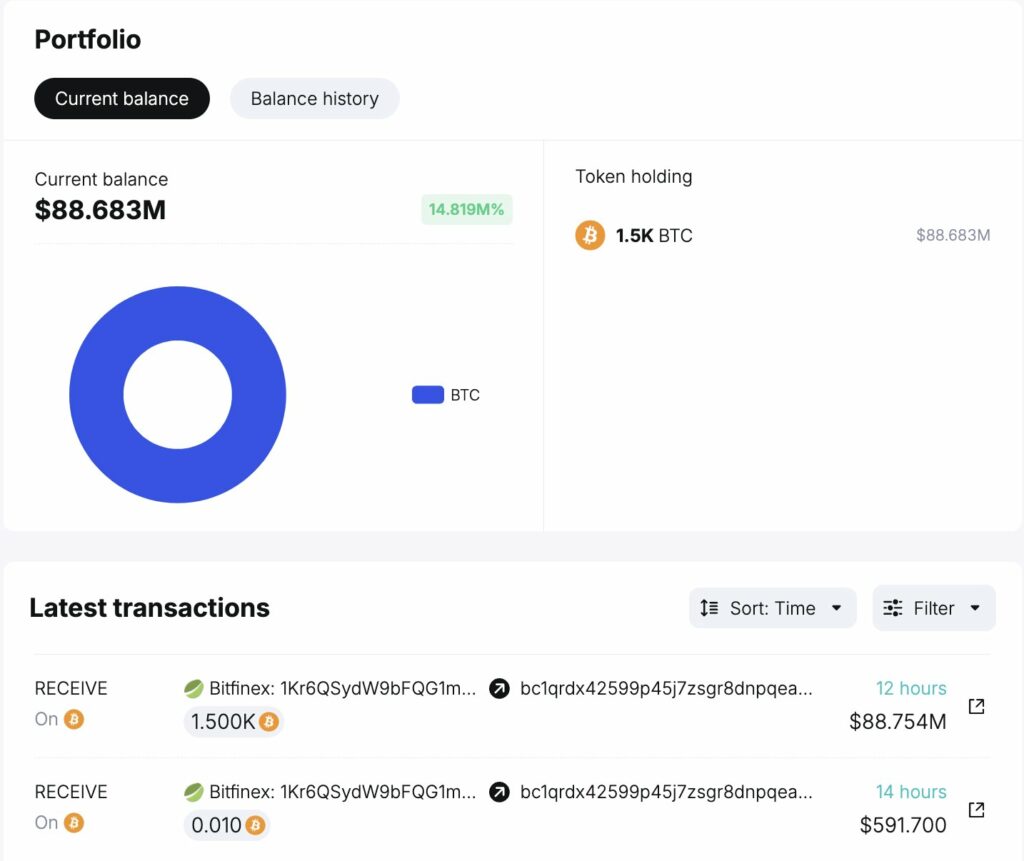

Approximately three hours past, another whale, identified as “bc1qr”, also removed approximately 1,500 BTC (equivalent to around $89.1 million USD) from Bitfinex at a price of $59,393 per coin.

These notable financial transactions, carried out by these influential ‘whales’, were recognized using data from SpotOnChain.

Bitcoin and USD liquidity rhymes

As a researcher, I’ve observed an intriguing pattern: Bitcoin (BTC) and U.S. Dollar (USD) liquidity tend to align in the market. However, unlike the usual correlation, Exchange-Traded Funds (ETFs) inflows have boosted BTC prices this year, even when USD liquidity was relatively low. This suggests a decoupling of traditional market dynamics, which is worth further exploration.

On the contrary, now, USD liquidity is increasing on the charts. This could boost risky assets as the trend continues due to USDT’s minting.

The recent change in the balance between Bitcoin (BTC) and U.S. Dollar (USD) liquidity could significantly affect Tether (USDT), particularly given its recent increased issuance on centralized trading platforms.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-08-15 08:10