- Stablecoins are redefining their role, moving beyond their traditional ‘safe-haven’ status.

- A major shift is underway that could transform the entire financial landscape.

In times when Bitcoin (BTC) experiences a downturn, stablecoins tend to garner attention as the crypto market’s “refuge.” However, their significance extends well beyond simply shielding investors. Instead, they have evolved to play a much broader role in the digital currency landscape.

Currently, stablecoins are carving out a significant role in the practical economy. For instance, they’re increasingly being chosen over the U.S. dollar in international trade, facilitating transactions for key commodities such as oil and agricultural products. Yet, their impact goes beyond monetary affairs; they also play a notable role in other domains.

Stablecoins are now doubling down on tech giants

As a crypto investor, I’ve noticed that stablecoins have been increasingly popular when it comes to global money transfers. The reason behind this trend is quite apparent: they offer the convenience of instant fund transfers, which far surpasses the speed of traditional banking systems.

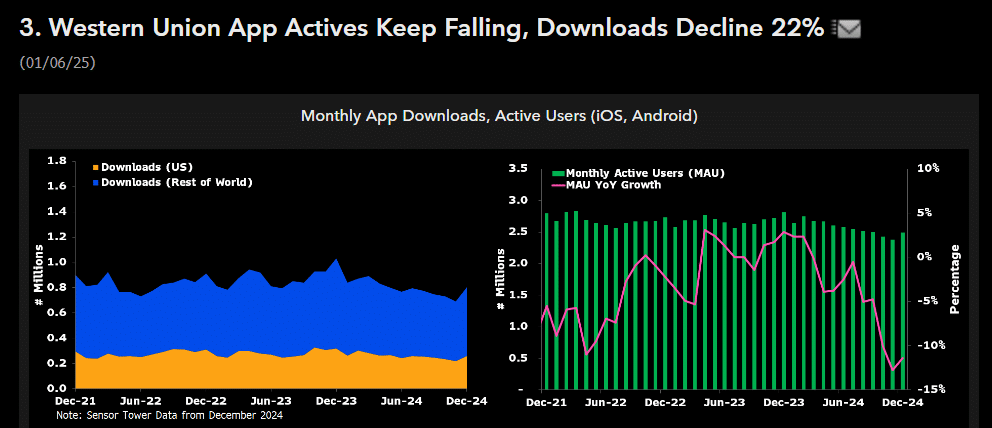

Matthew Sigel, representing VanEck, has pointed out an important transformation. Companies such as Western Union and MoneyGram are experiencing difficulties, as Western Union reports a 22% decrease in mobile app utilization, while MoneyGram grapples with a 27% decrease.

It’s particularly noteworthy that the number of their monthly active users has remained below 3 million since 2021, suggesting a decline in the number of individuals utilizing their services.

This aspect is definitely worth paying attention to. These companies have a significant presence in the remittance sector, boasting market values of approximately $302 billion and $92 billion each.

On the other hand, as stablecoins exceed $200 billion in market value, they’re increasingly proving themselves as formidable competitors. It’s a transformation that’s difficult to overlook.

But what is driving this shift?

Stablecoins may be pegged to the U.S. dollar, but they’re far from a typical currency.

By utilizing blockchain technology, transactions can be completed quicker, at a lower cost, and in a more streamlined manner compared to conventional money transfer services that frequently involve steep charges and lengthy waiting periods.

With increasing interest rates causing turbulence for the U.S. dollar, stablecoins are gaining popularity as a reliable choice for cross-border transactions.

Because the instability of the US dollar can cause import prices to rise and trigger inflation, stablecoins provide a steady alternative that ensures more consistent business, personal, and national transactions.

Read Bitcoin’s [BTC] Price Prediction 2025-26

This transition has only just started, as the usefulness of stablecoins extends far beyond finance and technology, demonstrating their versatility.

As the Federal Reserve contemplates raising interest rates and the dollar’s value surges, traditional risky assets such as Bitcoin and stocks are experiencing stress. However, amidst this volatile market, stablecoins have been gaining traction as a highly sought-after secure investment option for 2021.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-01-09 01:11