- Data suggest that stablecoin adoption has risen exponentially in the past four years.

- Circle CEO predicts stablecoins will become widely recognized as legal electronic money globally by 2025.

As an experienced financial analyst, I’m excited about the growing trend and impact of stablecoins within the cryptocurrency market. The data we see from Circle CEO Jeremy Allaire and various analytics platforms suggest a significant surge in stablecoin adoption over the past few years. This growth is not only evident in terms of transfer volumes but also in the number of active users and transactions.

As a market analyst, I’ve noticed an intriguing development amidst the ongoing bull run. The once-controversial stablecoins have gained significant traction and are now the center of attention. Even traditionally skeptical jurisdictions, such as the United States, seem to be warming up to them.

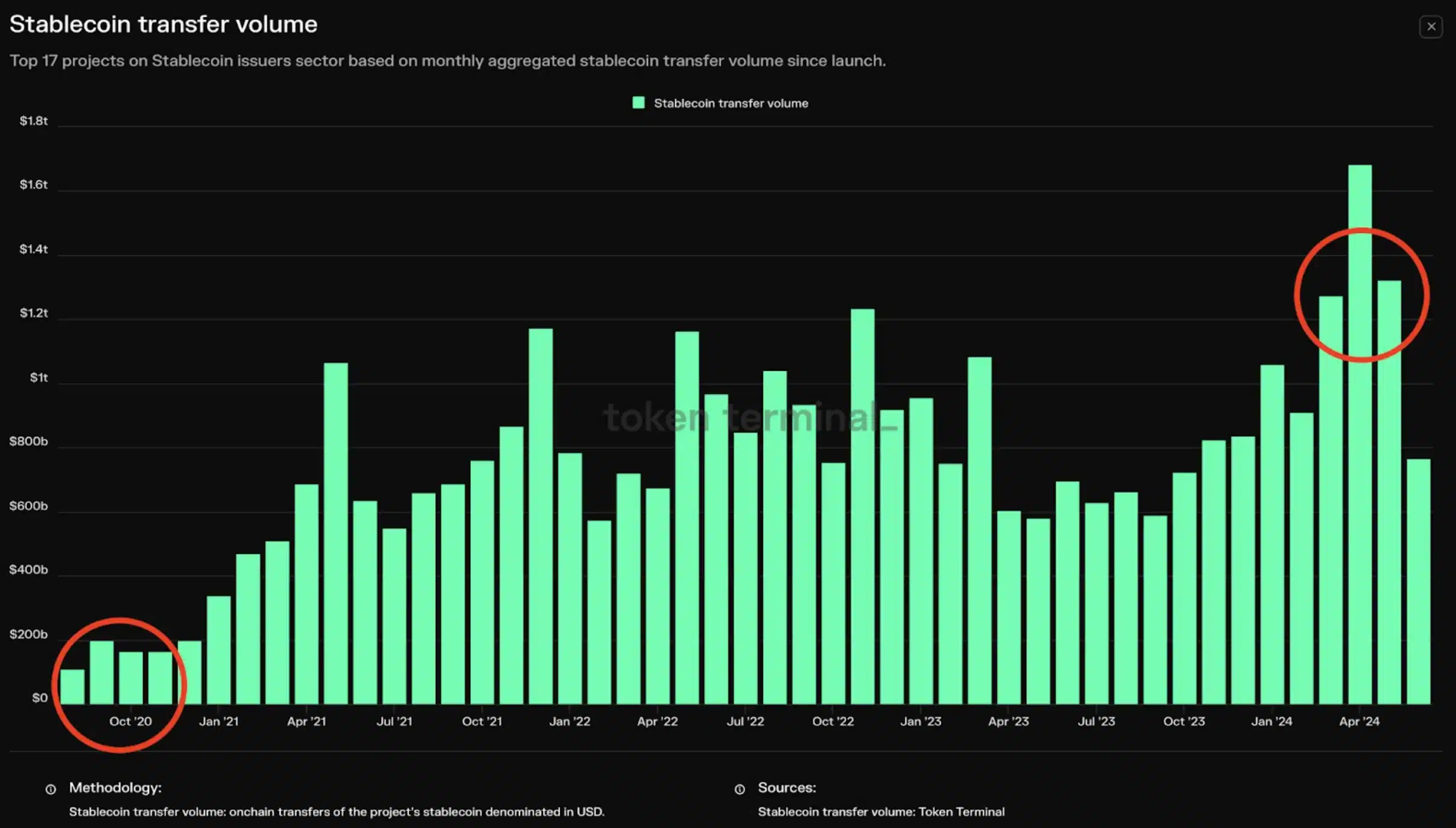

According to reports, the value of stablecoin transactions has experienced a remarkable surge, representing a significant 1,600% growth over the last four years.

As a crypto investor keeping a close eye on market trends, I’ve noticed some intriguing data from Token Terminal regarding stablecoin transfers. In October 2020, these volumes hovered around the $100 billion mark. However, by April 2024, they had skyrocketed to an unprecedented high of $1.68 trillion.

The significant increase highlights the impressive expansion and impact of stablecoins in the realm of cryptocurrencies.

Allaire’s positive outlook on stablecoins

Expanding on the topic, Circle CEO Jeremy Allaire took to X and highlighted,

In most significant legal systems globally, stablecoins are progressing towards being recognized and regulated as digital currency equivalents. By the year 2025, it is anticipated that stablecoins will hold the status of “legal electronic money” in nearly every jurisdiction, expanding their influence within the over $100 trillion market for electronic funds.

The increasing popularity of stablecoins is highlighted by their role as a connecting link between conventional financial systems and cryptocurrencies.

Data sets show…

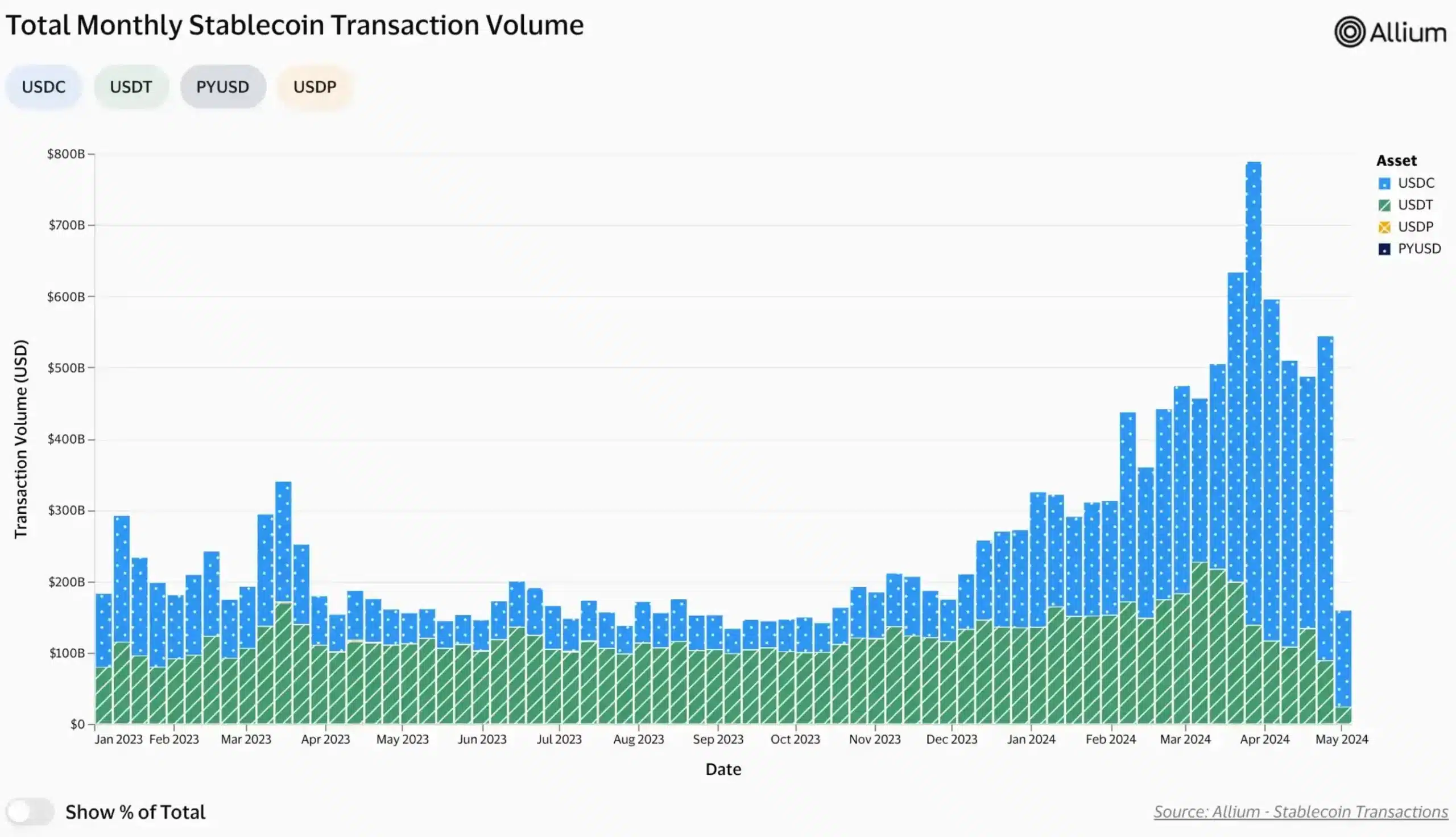

Over the past month, data from Visa’s on-chain analytics shows that an impressive 31.2 million users have carried out approximately 353 million transactions involving stablecoins.

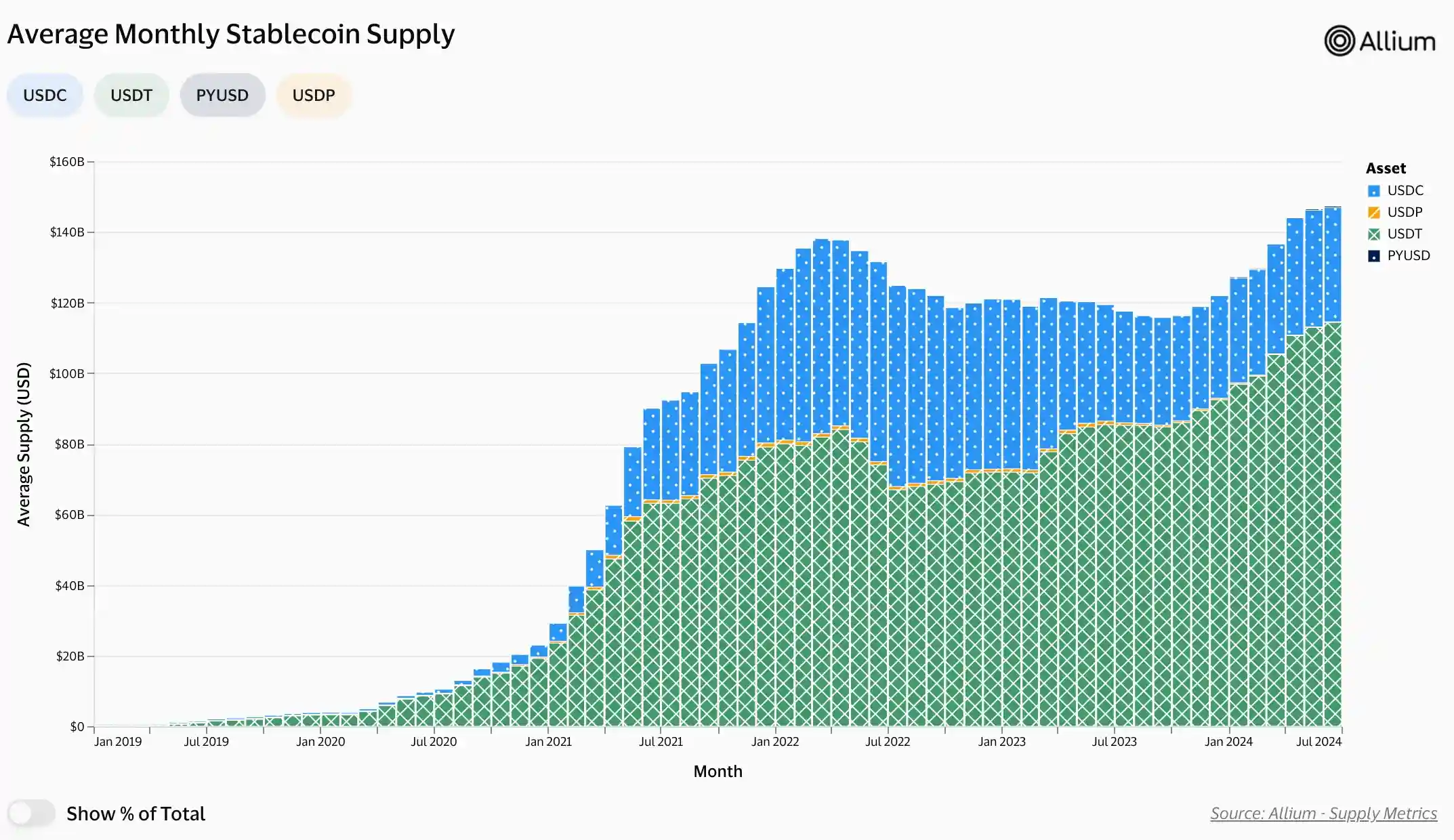

As a analyst, I’ve compared the two leading stablecoins, USDC from Circle and USDT from Tether.

In April, USDC processed more stablecoin transactions than any other, amounting to a total of 166.6 million. This figure exceeded the 163.6 million transactions recorded for Tether (USDT) during the same period.

However, as of the latest update, USDT is topping the charts with USDC following the trail.

Allaire further added,

As a researcher studying the cryptocurrency market, I’ve observed an incredible surge in the adoption and usage of stablecoins. These digital currencies are becoming the most evident application of crypto, acting as a bridge between traditional finance and the decentralized world. By releasing digitized versions of fiat currencies, they’re attracting more individuals to join the onchain economy. Moreover, stablecoins are starting to deliver on their potential by providing affordable banking services for the unbanked, reducing remittance costs, and enabling smoother cross-border commerce transactions.

Stablecoins: A savior for crypto?

The value of cryptocurrencies like Bitcoin can change dramatically in a short time due to their volatility. In response to this price instability, stablecoins have gained popularity as a more consistent choice for digital currency users.

Major industry leaders like Stripe and PayPal have adopted stablecoins such as USDC for this very reason. They’ve seamlessly incorporated these digital currencies into their payment structures.

As an analyst, I would express it this way: This particular step significantly expands the accessibility of digital payments while simultaneously underpinning the significance of stablecoins in international transactions.

As events progress, the increasing backing for stablecoins indicates a significant rise in their usage and that of the entire cryptocurrency sector. To quote Allaire, this trend signifies a substantial growth.

“We’re still in the VERY EARLY STAGES in the adoption of crypto. That’s insanely bullish.”

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-06-21 09:11