- The longer-term structure was bearish and $2 is a key psychological resistance.

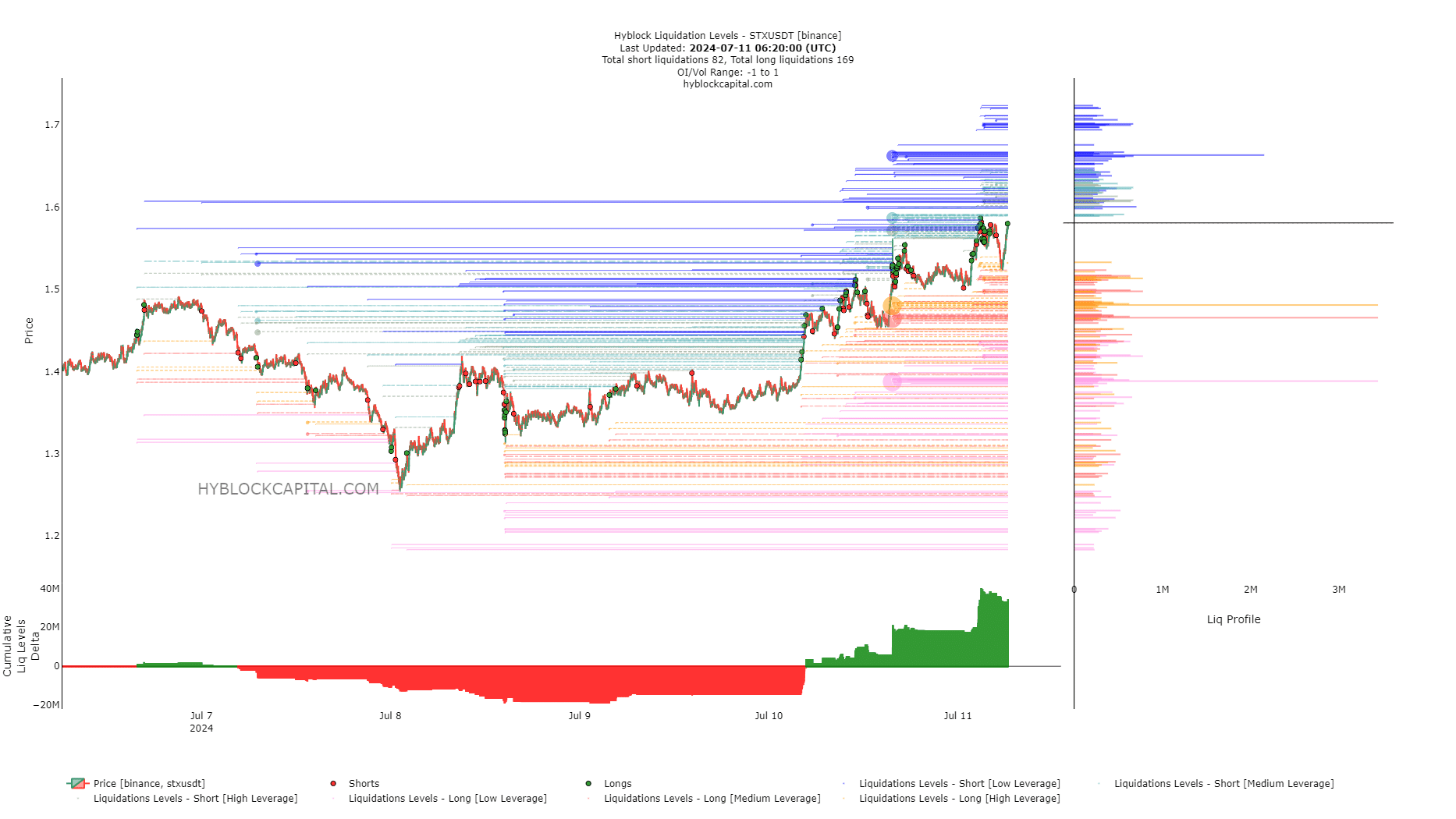

- Traders should be prepared for a price move below a short-term support level due to the liquidation levels there.

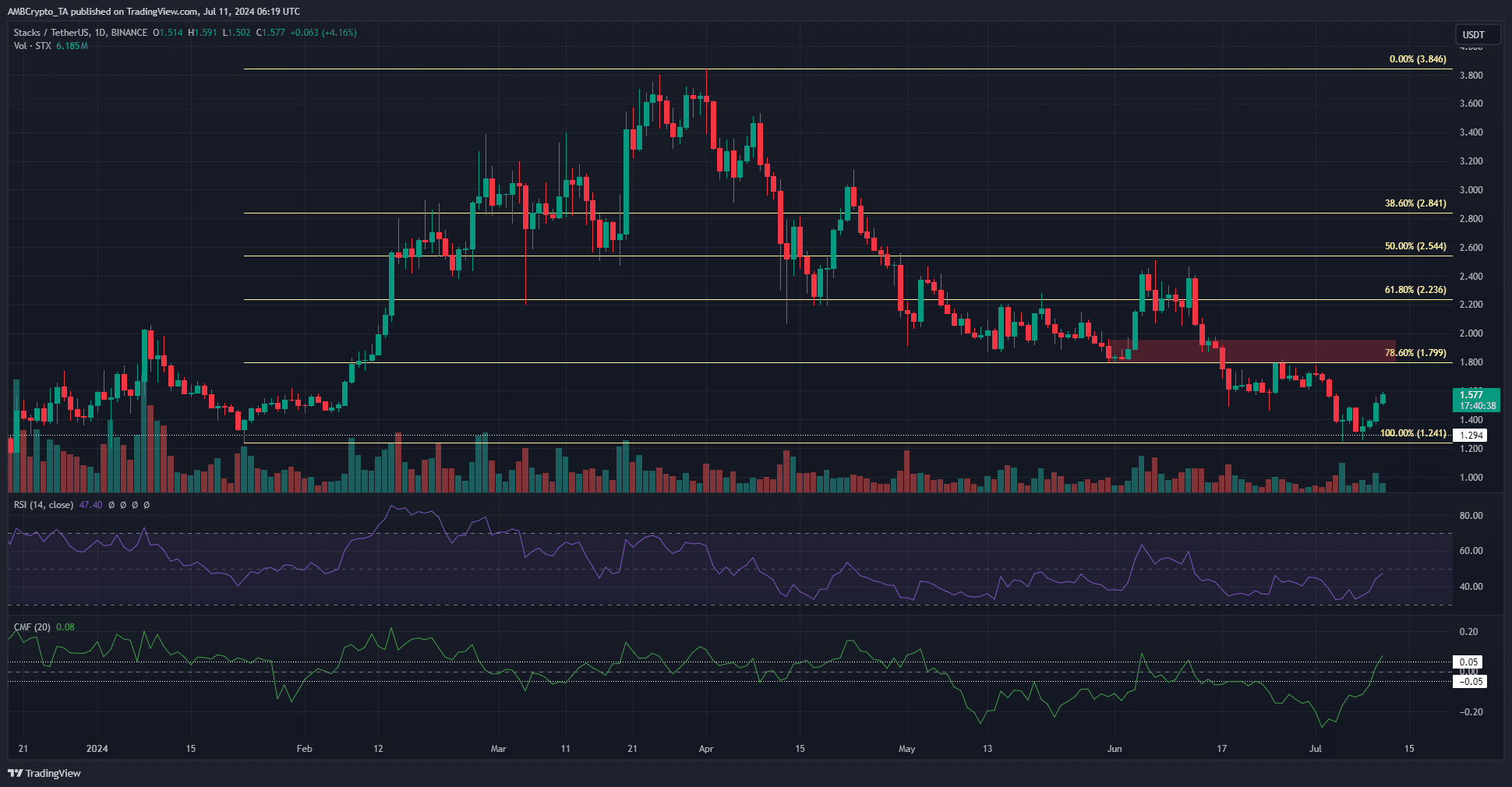

As a seasoned crypto investor with a keen eye for market trends and technical analysis, I’m cautiously optimistic about Stacks (STX) following its recent price surge. While the bullish momentum is encouraging, the longer-term structure remains bearish, and $2 is a key psychological resistance level that must be broken to confirm a sustainable uptrend.

The price of Stacks (STX) surged by 25.8% over the last three days. It experienced a notable gain of 13.25% within the previous 24 hours, whereas Bitcoin (BTC) exhibited a slight decrease of 1.75% during the same timeframe. Early Thursday saw heightened volatility in the price movements of Bitcoin.

The price of it rose from $57,000 to $58,300 before completely reversing and returning to $58,000. Supporters of Stacks (STX) managed to profit from the brief surge in value, but can they defy the longer-term trendline?

The $1.8 is the next target but traders must temper their enthusiasm

As an analyst, I’ve observed that the lower timeframes presented a favorable scenario for the bulls recently. A key support level from early 2024, around $1.3, was revisited and successfully defended, contributing to the price increase. Additionally, we managed to surmount the resistance level on the lower timeframes, which was located at approximately $1.5.

As a researcher studying market trends, I’ve observed that the Daily Chart Movement Index (CMF) has recently surpassed the +0.05 threshold, suggesting robust capital inflows into the market. Despite the Relative Strength Index (RSI) currently hovering around 47 and maintaining a bearish stance, there’s an expectation for it to breach the 50 mark soon. This potential shift could serve as an early indicator of an emerging trend reversal.

As a crypto investor, I’m optimistic about the potential price increase and believe we may see a surge towards $1.8 starting from this point. However, it’s important to note that the overall market trend on higher timeframes, like daily charts, remains bearish. The area around $1.8-$2 is significant as it’s filled with sellers, making it a challenging zone to break through.

Should traders expect high volatility from STX soon?

As a researcher studying market trends, I’ve observed an intriguing development: on the 10th of July, when the price surpassed $1.5, it incited a wave of bullish sentiment. However, this surge could potentially pave the way for a downward trend driven by liquidity withdrawals. The delta of cumulative liquidity levels indicated a strong positive shift, meaning that long positions were more frequently closed than short ones.

This could see prices squeezed downward to force long liquidations.

Realistic or not, here’s STX’s market cap in BTC’s terms

There were two clusters of medium and high leverage at $1.46 and $1.48.

As an analyst, I would interpret the current price level of $1.51 as a potential support point. However, given the relatively low liquidity in this range, there’s a risk that prices could dip slightly lower before bouncing back up. Specifically, we might see the price testing the $1.45 level before attempting to break through the resistance at $1.8-$2 in the days ahead.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-11 17:11