- Stacks tested the $1.75 support amid a 26% weekly drop

- Ascending channel pointed to bullish potential, with the resistance at $2.40 and target at $10

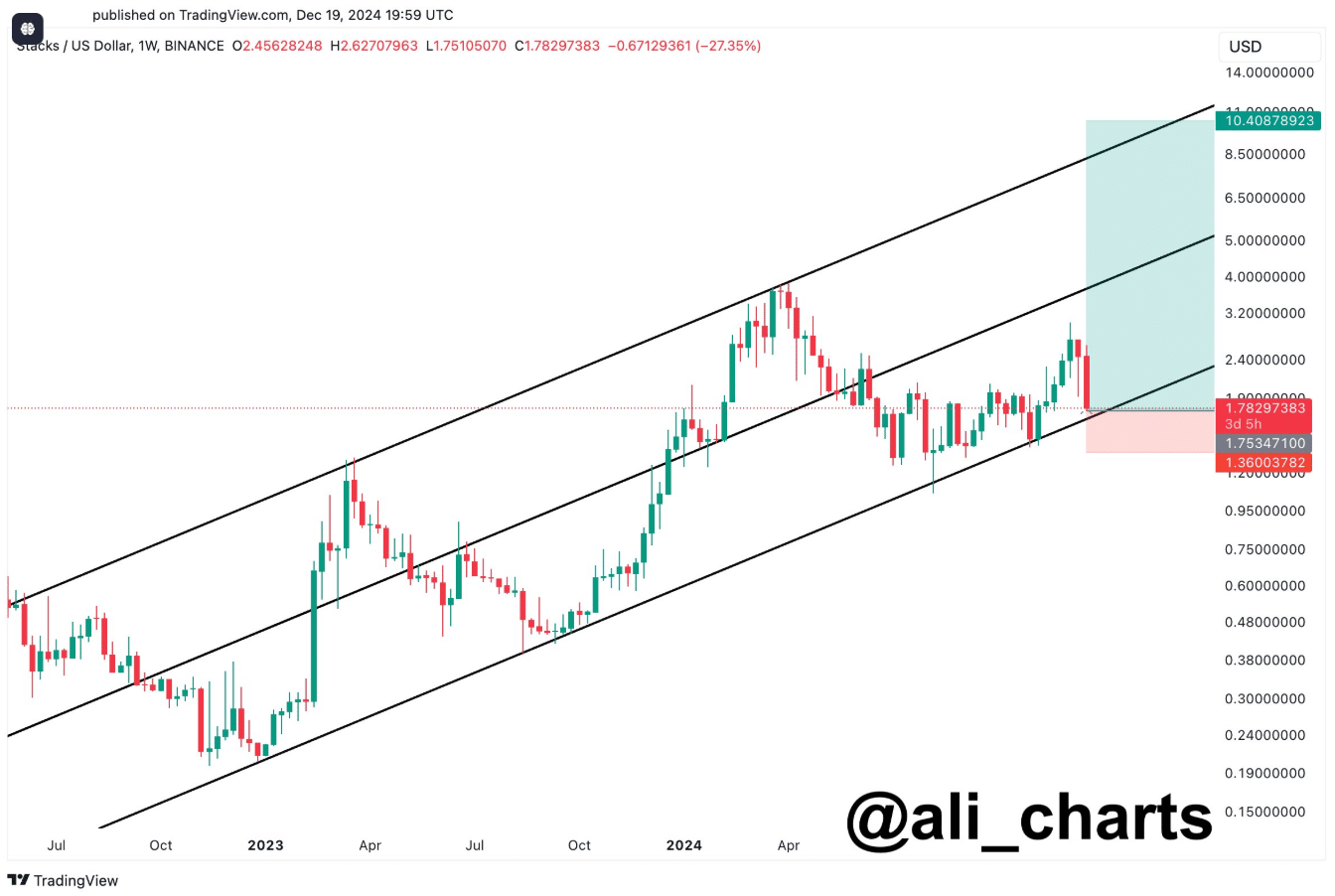

As an analyst with over two decades of experience under my belt, I’ve seen markets ebb and flow like the tides. The current state of Stacks (STX) is intriguing, to say the least. After a 26% weekly drop, it seems this cryptocurrency has tested its support at $1.75 amidst a broader market decline, which looks quite familiar in my book.

At this moment, Stack (STX) is being traded at $1.71, having experienced a 11.73% decrease over the past day and a more substantial drop of 26.06% within the last week. With a circulating supply of approximately 1.5 billion STX coins in circulation, the cryptocurrency currently holds a market capitalization of around $2.57 billion.

In the past 24 hours, trading volume reached approximately $439 million, suggesting a significant level of activity coinciding with the recent price decline.

It appears that the drop in STX’s value aligns with a general market slump, and this fall has been strong enough to approach the crucial support point within an extended uptrend pattern (ascending channel).

Ascending channel indicates long-term bullish trend

Based on AMBCrypto’s examination, Stacks appeared to be moving within an upwardly sloping trading channel, indicating a wider bullish trend even with recent drops. At the current moment, its price was nearing the lower limit of this channel, hovering around $1.70 and $1.80 – An area that has historically shown robust support.

The top limit of the channel hints at a possible goal ahead of roughly $10, implying there may be scope for further price improvement should the underlying support remain intact.

As an analyst myself, I’d concur with the widely recognized viewpoint of Ali Martinez, who identified this phase as a potential buying opportunity. He underscored the significance of these levels for long-term investors like myself, suggesting that they could capitalize on the situation to expand their portfolios.

Recent correction and key levels

The stacks retreated sharply from around the $4.50 resistance point in the mid-channel, plummeting by a significant 27.35% as part of this correction. Despite this drop pushing the price towards its support level, such swift declines are often seen in prolonged uptrends and could potentially present opportunities for accumulation.

In order to understand STX’s next direction, the support between $1.75 and $1.78 will play a crucial role. Should this range be maintained, it might trigger a recovery, with an initial aim for resistance at around $2.40 – $2.50, while stronger resistance could be expected near $2.80 – $3.00.

If the price falls below $1.75, it might lead to additional drops. Key support levels that could potentially halt this trend are found at $1.50 and $1.40.

Momentum indicators signal mixed trends

Currently, the Awesome Oscillator (AO) is showing red bars, signifying downward momentum, which could suggest a bearish trend. However, it’s worth noting that the histogram is decreasing, possibly indicating less selling pressure. For a potential bullish reversal, we would look for green bars on the AO and a price breakout above the resistance levels established by previous low-high points.

Keep a close eye on the $1.75 region, as it might indicate either a resurgence or continued decline. If the price holds and climbs above this point, it could potentially surge toward $2.00 – $2.40 in the upcoming period.

Outlook and key metrics to watch

Investors are closely monitoring STX’s trading as it nears its underlying support. They are looking at crucial points to forecast the market direction. The immediate support can be found at $1.75, while potential resistance areas lie at $2.40 and $2.80. If the lower limit of the rising trend line is broken, there might be a shift towards bearish targets such as $1.50 or even lower prices.

Despite being quite significant, this adjustment aligns with Stacks’ broader trend of expansion, implying a possibility for recuperation as long as the support thresholds remain intact.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-21 11:03