- Stacks has surged by 11.63% over the past 24 hours.

- With a potential bullish crossover on DMI and RSI, STX could see more gains.

As a seasoned analyst with years of experience navigating the crypto markets, I can confidently say that the recent surge in Stacks [STX] is quite intriguing. After witnessing a market correction that felt like a rollercoaster ride, it’s refreshing to see an altcoin like STX making such a strong comeback.

Following a market adjustment where Stacks [STX] dipped to $1.89, this altcoin has shown significant growth in the last 24 hours, reaching a peak of $2.62 after surging by approximately 19.63%.

After that point, there was a minor decline. At the moment of this writing, Stacks was being traded at $2.53. During the last day, it showed a rise of approximately 11.63%.

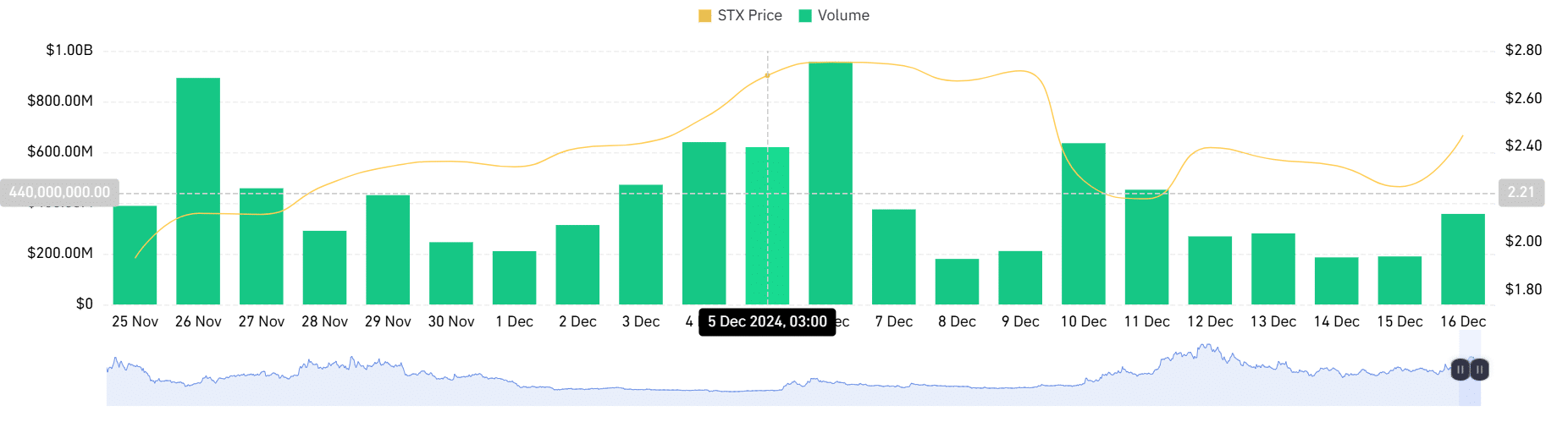

Over the same period, STX’s trading volume has spiked by 202.25% to $534.69 million, according to Coinglass.

Before this daily increase, STX experienced a decrease on weekly charts, dropping by 1.79%. Yet, over the past month, the cryptocurrency has significantly risen by 29.42%.

Despite the recent gains, STX remains approximately 34.3% below its ATH of $384.

As a researcher observing the surge in popularity, I find myself pondering if the altcoin’s momentum might be indicative of a prolonged upward trend.

What STX charts says

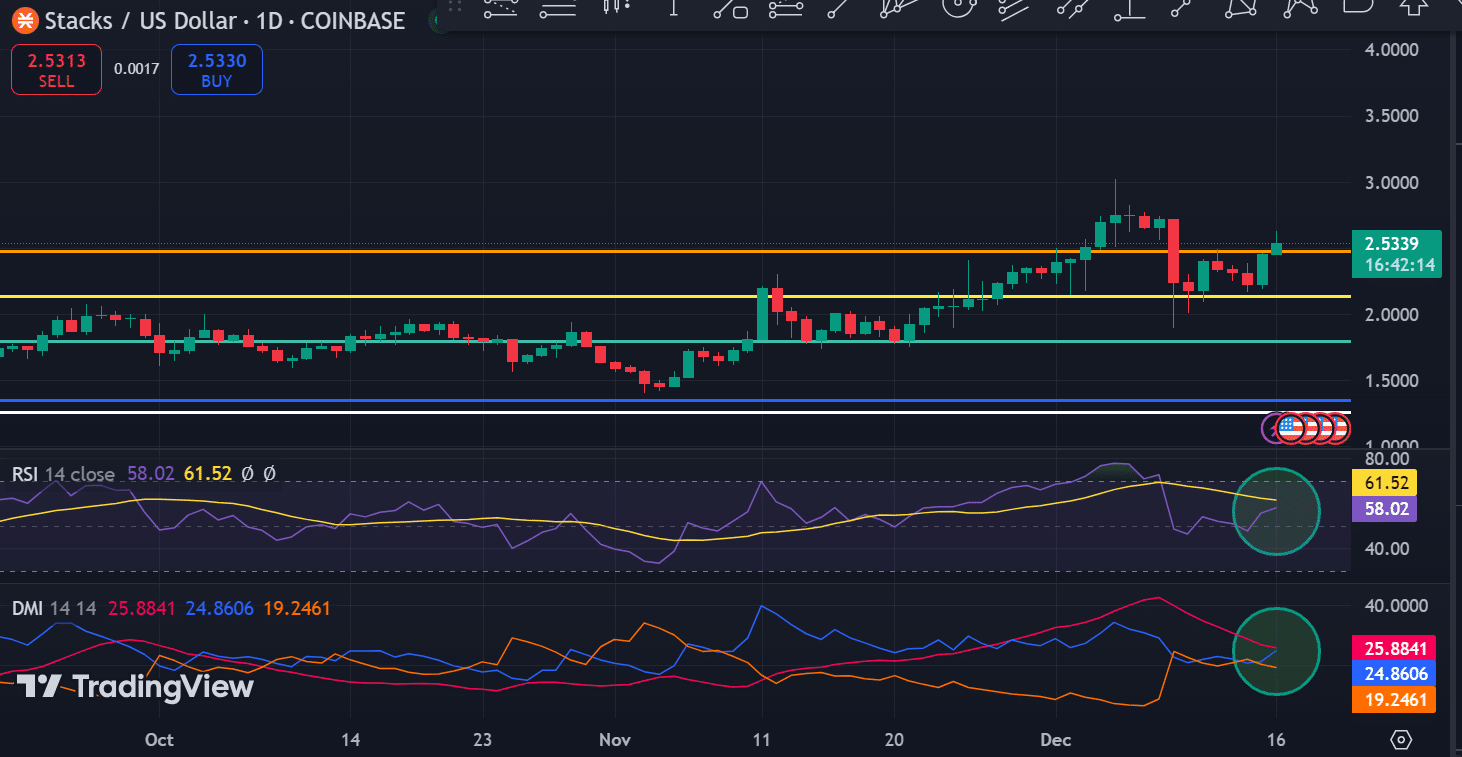

Based on AMBCrypto’s assessment, Stacks is currently seeing robust upward movement due to increased buying activity.

The strong growth trend for STX is reinforced by its approach to a bullish crossover between the two lines. Consequently, the strength of this altcoin, as indicated by its Relative Strength Index, has risen significantly from 47 to 56, while its Moving Average has decreased slightly from 64 to 61.

This rise suggests that buyers are entering the market while seller’s dominance is dwindling.

This trend is reinforced by the fact that the Positive Directional Index (DI+) on the Directional Movement Index keeps increasing, whereas the Negative Directional Index (DI-) has decreased. Currently, the DI+ for STX stands at 24.86, while the DI- has fallen to 25.

This trend indicates that STX might be about to experience a bullish breakthrough. A breakthrough at this point would reinforce the underlying upward momentum.

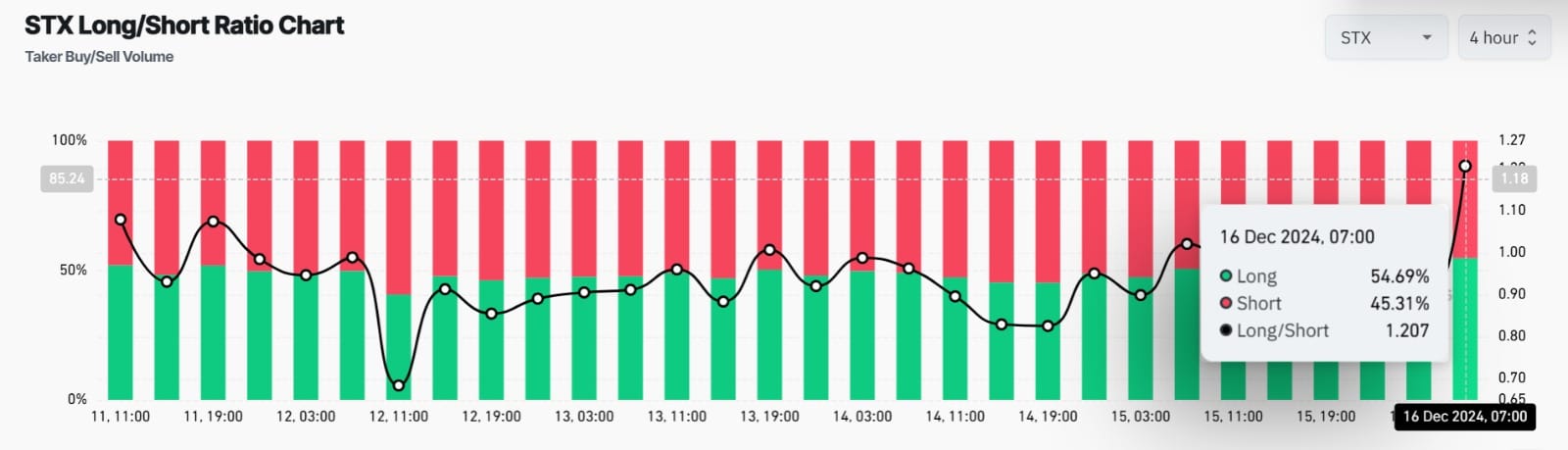

Glancing ahead, we observe a similar optimism among investors holding long positions. As reported by Coinglass, these long investors seem to be in control of the current market dynamics.

Significantly, it’s evident from the Long/Short Ratio that long positions account for approximately 54.69% of the total within a 4-hour period. This suggests that the majority of investors are anticipating an increase in prices.

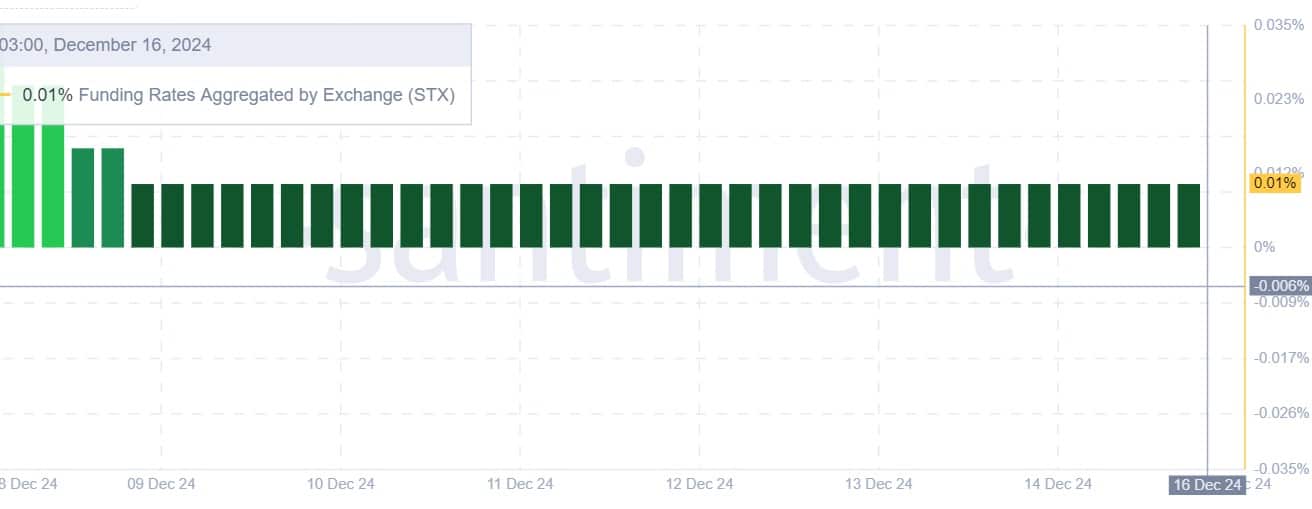

To rephrase, let me express it like this: Lastly, the preference for long positions is also backed up by a favorable overall Funding Rate calculated across the trading platform.

This implies that investors are buying into these positions, even if the altcoin’s value decreases slightly, they’re prepared to pay an extra fee for doing so.

In simpler terms, there’s a significant increase in buying activity for Stacks right now, as investors are showing interest.

Read Stacks’ [STX] Price Prediction 2024–2025

As I closely monitor the market trends, I’m optimistic about the potential growth of STX, given the bullish crossover signal that’s surfaced. If these favorable conditions persist and a bullish crossover is indeed confirmed, I believe Stacks will regain its $2.7 resistance level, marking a promising upward movement in its price charts.

Leaving this stage might push the value of this altcoin up to approximately $3.04. However, should sellers re-enter the market, Stax (STX) may slide back down to around $2.4.

Read More

2024-12-17 06:15