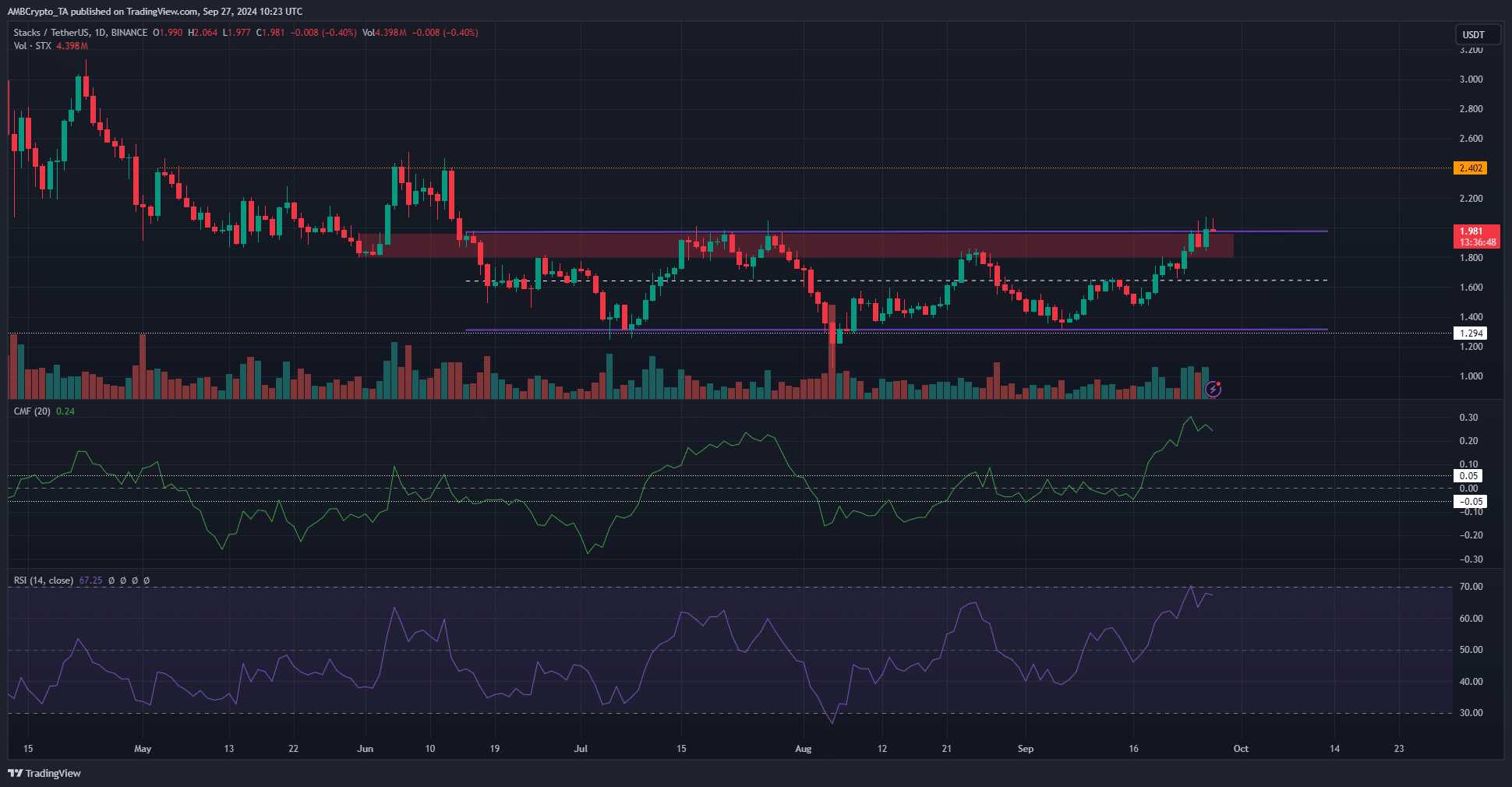

- Volume indicators highlighted bullish conviction.

- An intermediate resistance before the May highs was identified.

As a seasoned crypto investor with a knack for spotting trends and interpreting technical indicators, I find myself quite optimistic about Stacks [STX] at this moment. The volume indicators have been consistently pointing towards a bullish conviction, and it’s always a sight to behold when these signals align so perfectly.

In simpler terms, just like Bitcoin, the cryptocurrency known as Stacks had a downward trend since April when viewed from longer timeframes. However, it managed to break free from a pattern that had persisted for three months.

The recent bullish sentiment and demand were driving steady gains.

According to the latest findings, it appeared that STX might challenge its peak levels again. However, a significant leap beyond these levels would depend on the On-Balance Volume (OBV) establishing a fresh high. Indeed, the predicted retest and the OBV’s subsequent new high have materialized.

Inspiring performance from the bulls

Regarding the amount of trading, the optimistic side seems to be taking strong steps. Additionally, the On-Balance Volume (OBV) has hit a new local peak, and the Chaikin Money Flow (CMF) stands at +0.24. This level on the CMF hasn’t been seen since early January 2023.

A CMF value greater than 0.05 indicates a significant flow of capital entering the market. Moreover, the volume indicators suggest a high probability of a price breakout in the range for Stacks.

The daily RSI was also firmly bullish, and the bearish breaker block at the psychological $2 level was on the verge of being beaten.

The market trends and signals were robustly optimistic, suggesting a potential increase towards $2.4, which serves as a historical resistance level from May and June.

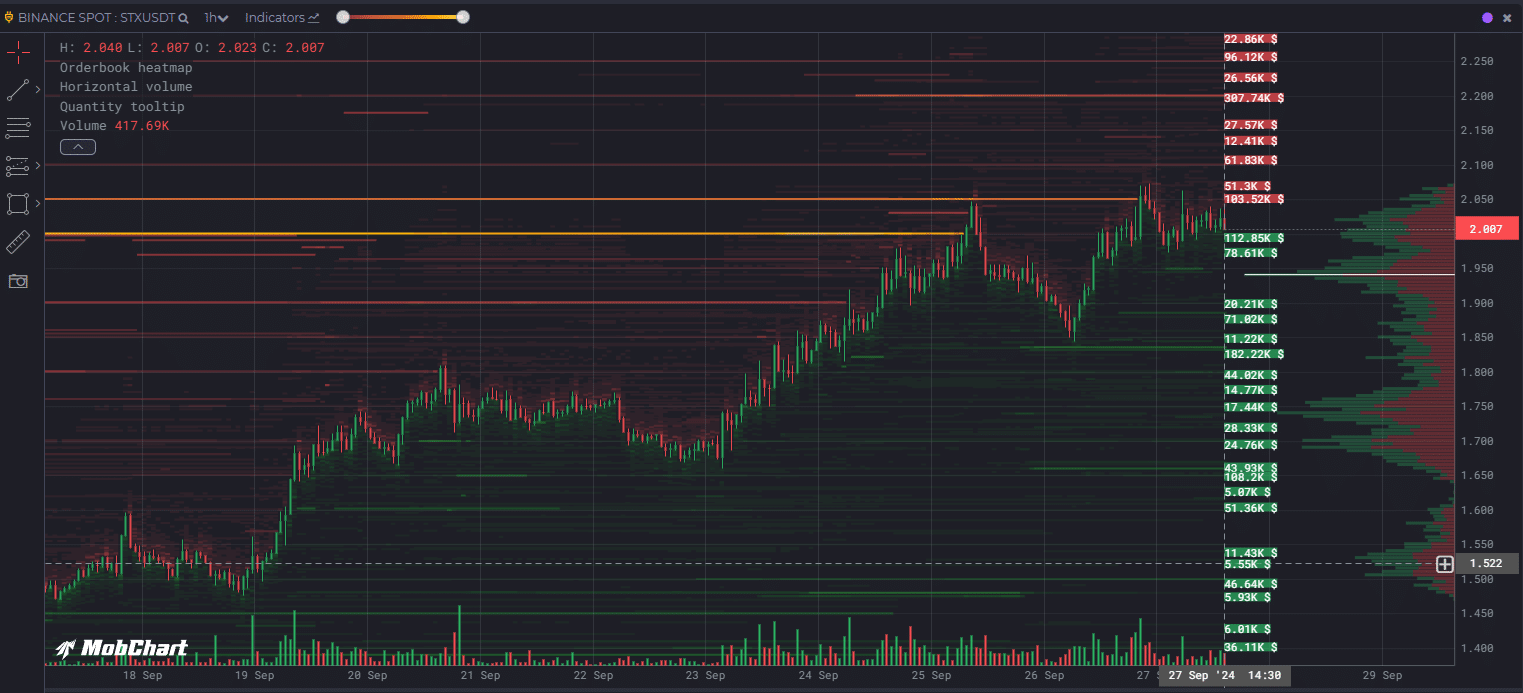

Orderbook heatmap gives clues on support/resistance

In simple terms, the Order Book Heatmap provided by MobChart highlights the most significant points where price action tends to pause or reverse due to strong support or resistance. Furthermore, the concentration of pending orders at specific levels can cause prices to approach those areas.

Approximately a week past, the $2 mark held nearly a million dollars worth of pending orders. These orders were filled, leading to a brief drop in price to around $1.84 within a few hours that followed.

In a similar fashion, an accumulation of orders at $2.2 might draw Stacks’ pricing towards this point prior to a brief pullback.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-28 04:07