- StanChart’s Geoffrey Kendrick argues Base has “borrowed” $50B from Ethereum‘s market cap. 🤑

- Amberdata hints Ethereum could continue as the market’s favorite short-selling candidate. 📉

Standard Chartered has lobbed a grenade at Ethereum [ETH] enthusiasts, all but halving its 2025 price projection—from $10K to a modest $4K. One might call this the financial equivalent of being ghosted on a date after promising eternal love.

In an eyebrow-raising report, StanChart’s Head of Digital Assets, Geoffrey Kendrick—who perhaps misses the irony of profiting from chaos—shared that Coinbase’s Base network has wreaked havoc on Ethereum’s fortunes.

“Layer 2s, and Base in particular, now extract super-profits from the Ethereum ecosystem… We estimate that Base (the dominant Layer 2) has sapped $50 billion of market cap from Ethereum, like a sneaky roommate ‘borrowing’ your leftovers while calling it a favor.”

Mr. Kendrick, with the zeal of someone determined to fix a leaky faucet by flooding the house, proposed Ethereum slap a ‘super tax’ on Layer 2 networks—because nothing says “We’re innovative!” quite like bureaucracy. He even warned that without this existential Band-Aid™️, ETH’s ratio to BTC could tank further. 🚨

Market reaction: Can ETH charm its way out? 💔

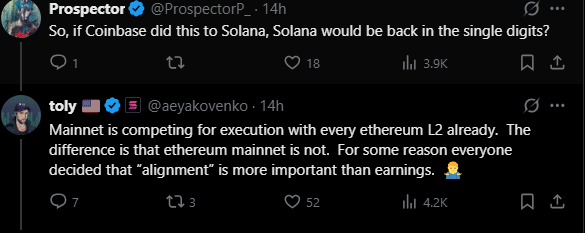

Kendrick’s analysis hasn’t gone unnoticed. Solana Co-Founder Anatoly Yakavenko chimed in, labeling the report “spicy”—as if Ethereum drama is the secret ingredient to his next recipe. When pressed on whether a similar crisis could reduce Solana to a sad shadow of itself, Yakavenko smiled and threw subtle shade at Ethereum’s lack of “alignment,” which might as well be code for, “At least we know where our toothbrushes are.” 🪥

Not to be left out, Ceteris (alias Head of Research at Delphi) weighed in, making sure everyone knows that StanChart’s $4K prediction is wildly optimistic. His critique was tinged with humor so biting you could spread it on toast:

“Standard Chartered’s pricing models are like horoscopes—they’re cute but seldom accurate. 🌌”

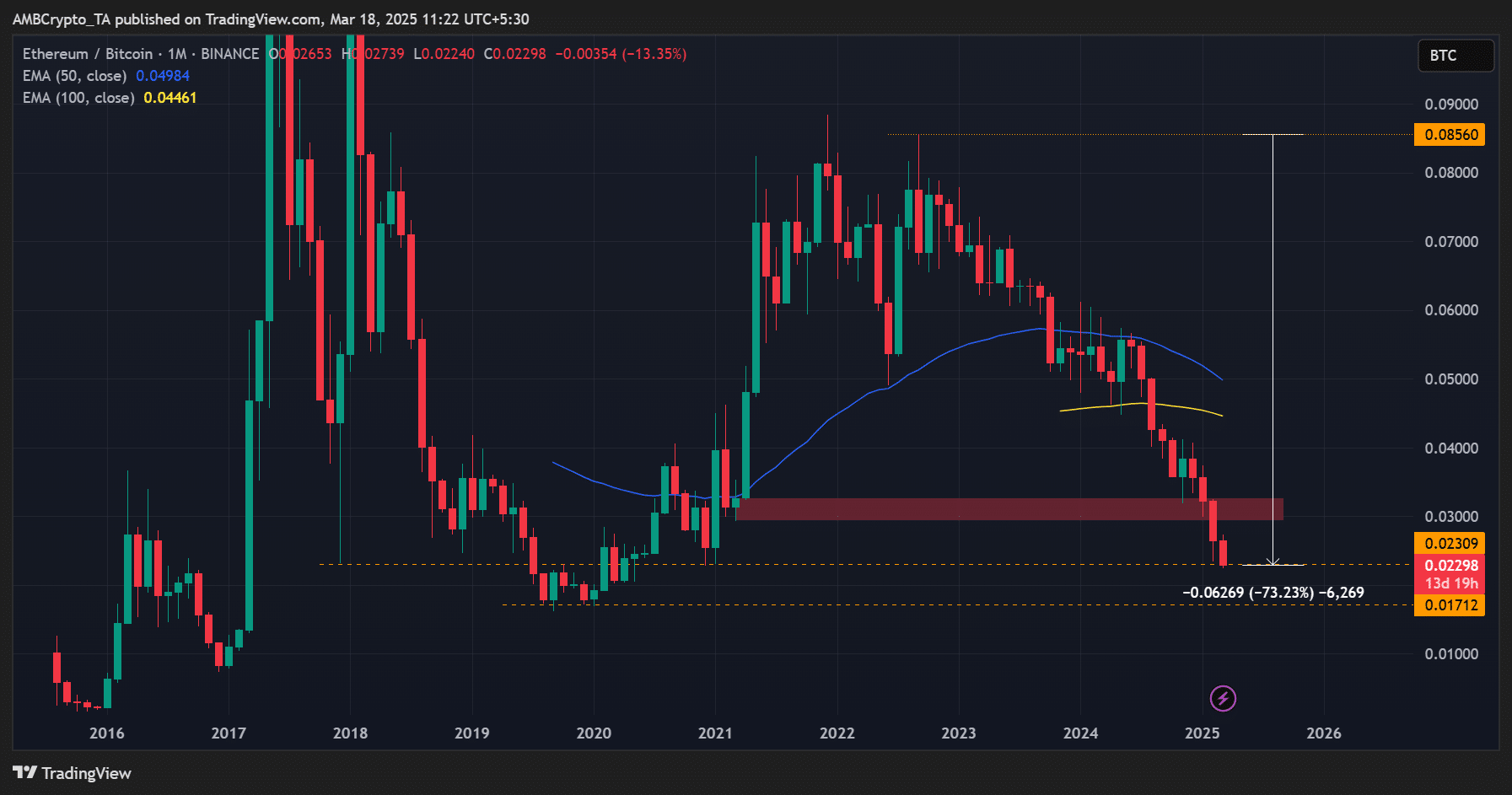

As of writing, Ethereum continues its five-year losing streak against Bitcoin with a fresh low ETH/BTC ratio of 0.22—a figure so sad it could serve as inspiration for a Russian existential play. “Have they considered watering it with tears? Might sprout something,” one imagines Chekhov might quip.

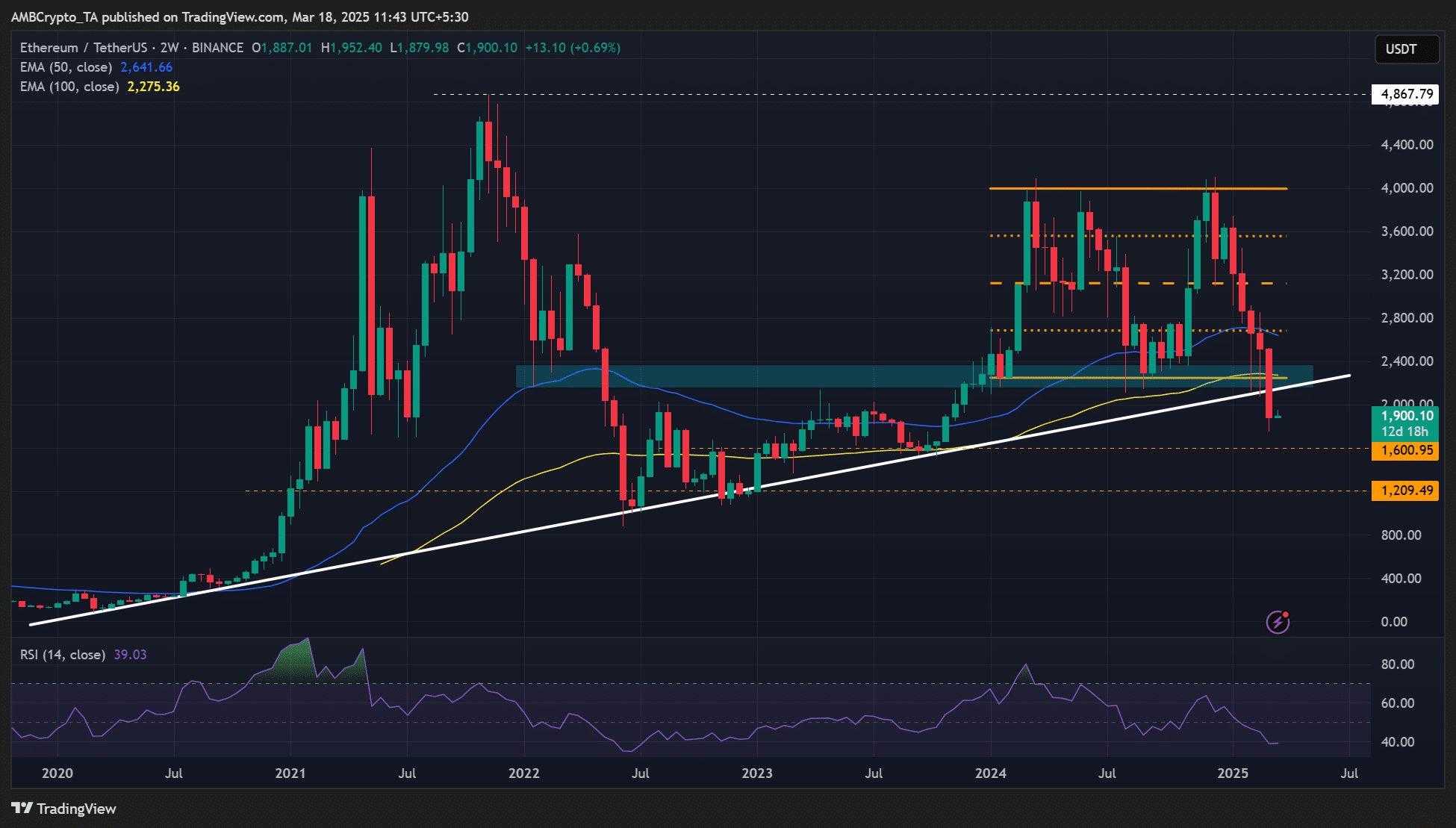

Adding insult to injury, compared with U.S. equities like the S&P 500, Ethereum has fared worse than a summer intern tasked with solving quantum physics. Regardless, Ethereum’s brief rally in late 2023 to early 2024—jumping 167% from $1600 to $4K—feels like a distant memory as the asset hovers nervously near $1.9K, casting anxious glances at $1.6K or even $1.2K like guests eyeing the dessert they can’t afford. 🍰

Amberdata’s Greg Magadini further stirred the pot, describing ETH as “the most interesting short-trade,” like a magician betting his audience keeps their eyes on the coin while he burns their wallet. His remarks:

“The ETH/BTC ratio—yikes. The rest of the altcoin sell-off? Double yikes. Ethereum is the gift that keeps on shorting.” 🎁

Breaking through its 5-year trendline support, Ethereum is now defying gravity—downward, that is. Magadini’s bleak forecast leaves us pondering: Will short sellers courageously drag ETH to rock bottom at $1.6K or pioneer a dive to $1.2K? As the old saying goes, “Ethereum users, put on your goggles. It’s going to be a splashy descent.” 🌊

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-18 13:15