-

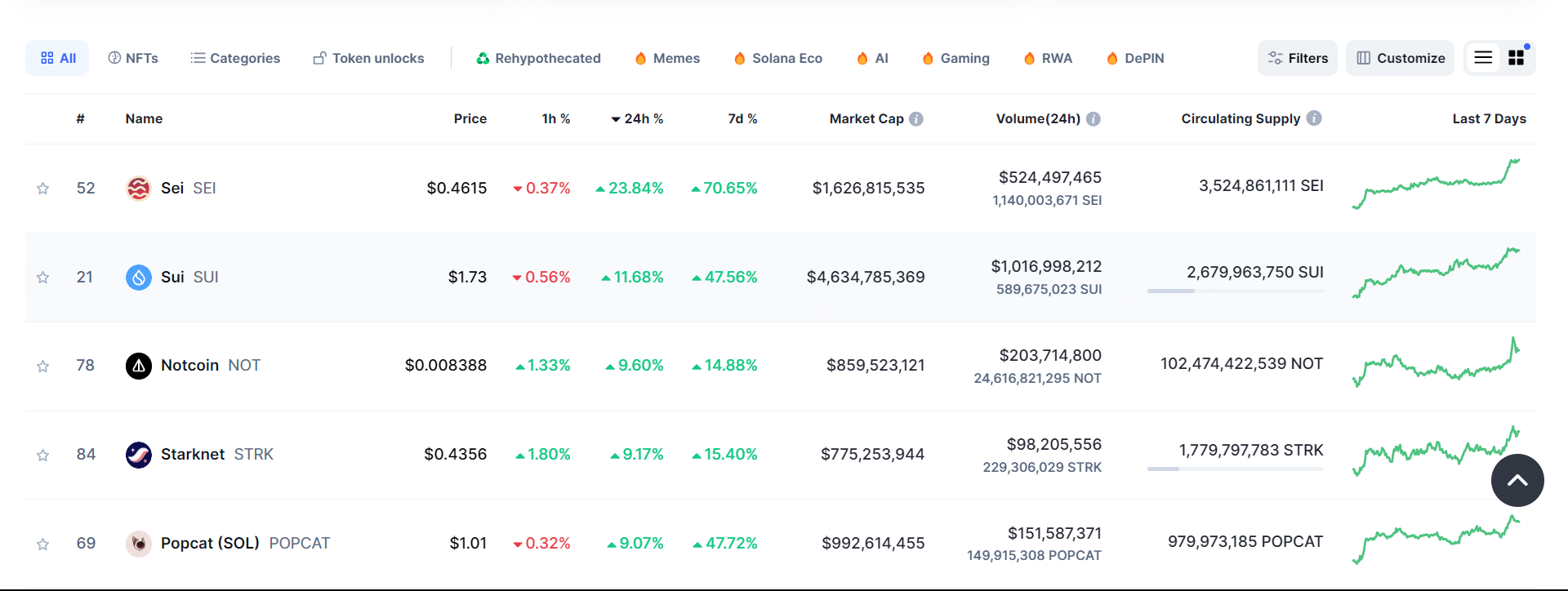

As at press time, Starknet appear in gainers’ leaderboard for the last 24 hours.

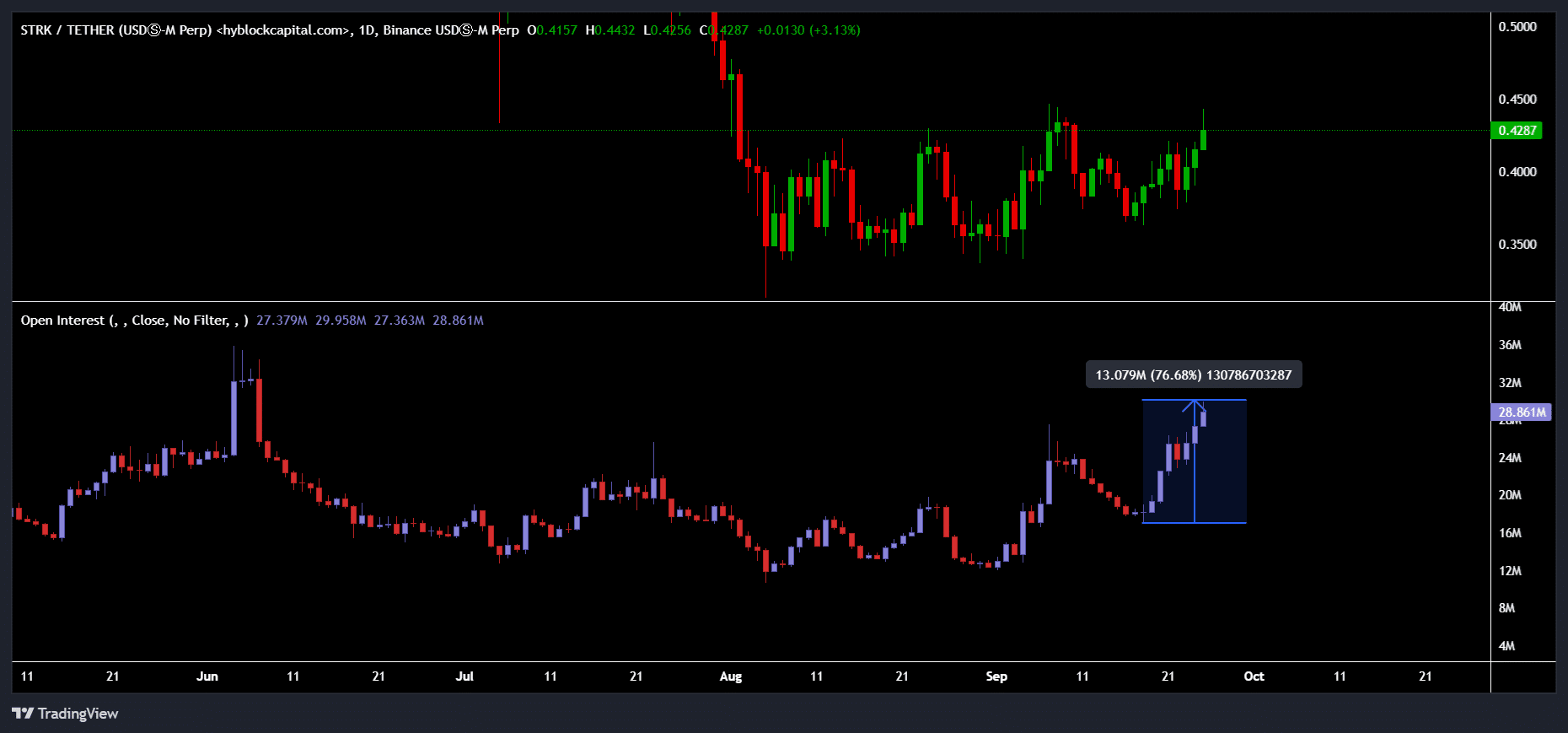

STRK stuck in a range but open interests are rising for the last 7 days.

As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I must admit that Starknet [STRK] has caught my attention recently. With its unique fee-paying mechanism and consensus-enabling staking, this Layer 2 solution seems to be making waves in the blockchain space.

In the realm of cryptocurrencies, Starknet [STRK] is consistently drawing interest due to its distinctive approach to transaction fees, network security, and consensus-based staking capabilities.

In the past day, trading volume for STRK has surged by 39% and the cryptocurrency itself has experienced a rise of over 9%, pushing its market capitalization beyond $775 million, according to CoinMarketCap data.

Placing Starknet in the 4th spot among the leading 100 cryptocurrencies based on market capitalization implies that if market circumstances get better, the potential for STRK to achieve additional growth is quite high.

Price action of Starknet in a range

Looking at STRK‘s price movement, it seems optimistic. But here’s the key point: can STRK/USDT continue its upward trend and manage to surpass the current threshold?

The prolonged consolidation period of Starknet, which has extended beyond 50 days, seems to be hinting at an approaching breakout. This pattern is reminiscent of other cryptocurrencies, as the price of STRK has faced rejections at its lower range boundaries, suggesting that a potential floor might be taking shape.

As a researcher, I’ve noticed an intriguing trend after three consecutive rejections: each time, the market has moved higher subsequently. Despite instances where prices briefly surged beyond the resistance level only to close within it, the third rejection was followed by a robust closing at the upper range boundary.

If Starknet’s price consistently surpasses and remains above the $0.45 mark, it suggests a potentially optimistic trend. Moreover, the Moving Average Convergence Divergence (MACD) indicator aligns with this bullish projection.

The histogram indicates an upward trend may be approaching for Starknet, as suggested by its graph, and the Bollinger Bands are expanding, which could lead to a rise in prices.

In other words, if STRK does not manage to rise beyond its present range as set by the sideways motion of the Bollinger Bands, this might suggest that a continuing descent is in store. Keep in mind that traders should remain vigilant and prepared for any possible scenarios.

Open interest rises

A study with Hyblock Capital’s tool shows a substantial surge (approximately 76%) in the open interest of Starknet, suggesting it could be next in line among altcoins gaining popularity as others start to pick up momentum.

With growing participation from traders, investors, and significant players in Starknet’s futures market, there’s a higher likelihood that the price might surpass its current range highs. If Starknet (STRK) succeeds in reaching the $0.55 mark, potential gains could soar by approximately 23%.

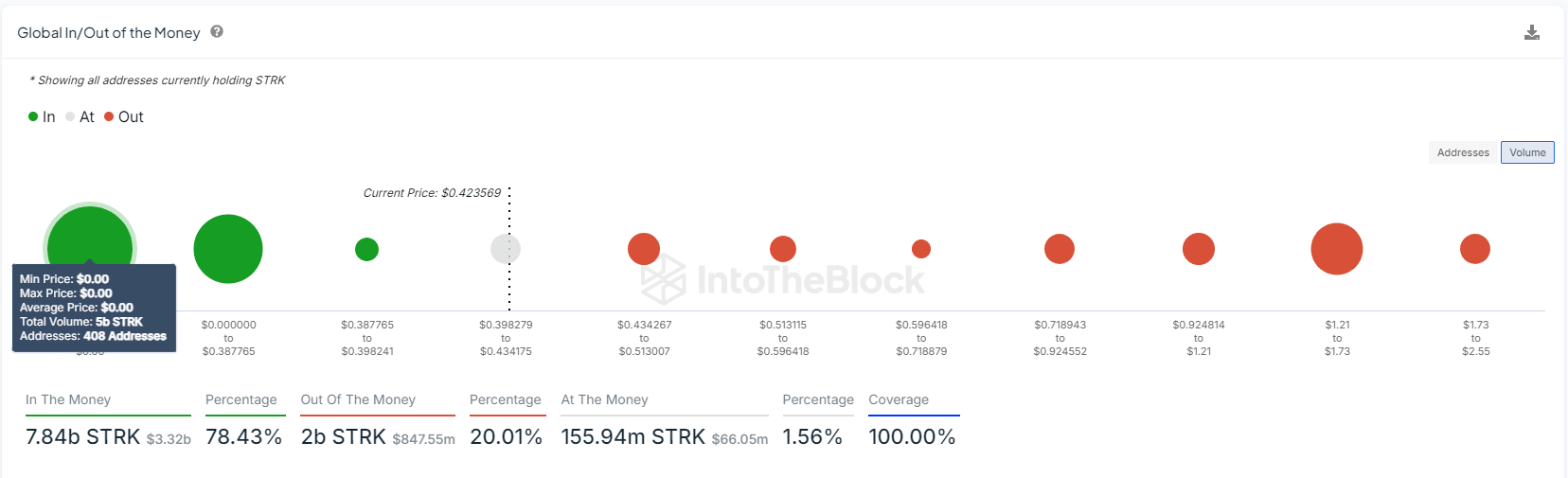

In/out of the money

To conclude, analyzing whether STRK tokens are in-the-money or out-of-the-money provides insight into their profitability.

About 7.84 billion STRK, worth over 3.3 billion dollars, are currently generating a profit, meaning that more than 78% of these tokens have surpassed their purchase price. On the other hand, roughly 2 billion STRK, valued at $847.5 million, are not profitable, which equates to approximately 20% of the total.

Approximately 98.44% of STRK tokens have already been distributed and are in circulation prior to STRK’s market debut, while only a small percentage (1.56%) remain at their initial value.

Realistic or not, here’s STRK’s market cap in ETH terms

Starknet appears to be a promising contender within the cryptocurrency market, with increasing interest from traders. As market dynamics strengthen and more participants join, there’s a strong possibility that the value of STRK could increase.

Keeping a close eye on Starknet could be beneficial in the upcoming weeks, given its robust technical signals and expanding user base.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Here’s What the Dance Moms Cast Is Up to Now

2024-09-26 09:12